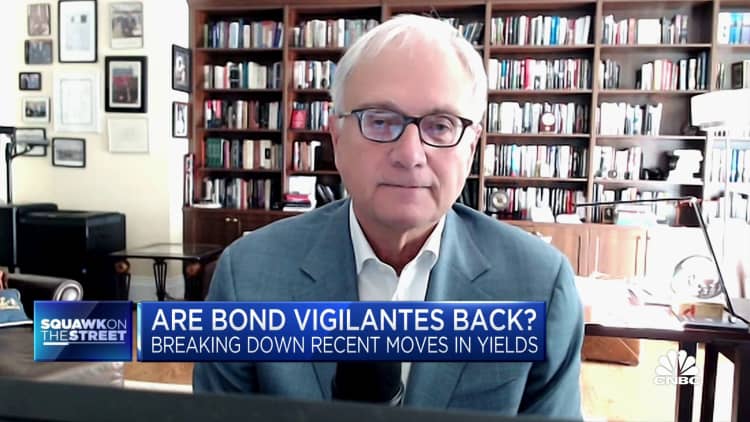

The bond vigilantes are coming back as investors continue to sell amid the prospect of higher-for-longer interest rates and a growing fiscal deficit, according to Kevin Zhao, head of global sovereign and currency at UBS Asset Management.

The yield on the benchmark 10-year U.S. Treasury note rose above 5% once again on Monday, having passed the milestone on Thursday for the first time since 2007. Yields move inversely to prices.

The further selling came after Federal Reserve Chairman Jerome Powell vowed to remain resolute in keeping monetary policy tight as the central bank looks to return inflation sustainably to its 2% target, while investors are also pricing in surprising economic resilience alongside fiscal slippage.

The U.S. federal government ended its fiscal year in September with a budget deficit of almost $1.7 trillion, the Treasury Department announced Friday, adding to a huge national debt totaling $33.6 trillion. The country’s debt has swelled by more than $10 trillion since the onset of the Covid-19 pandemic in the first quarter of 2020, prompting a deluge of fiscal stimulus to help prop up the economy.

Speaking on CNBC’s “Squawk Box Europe” on Friday, Zhao highlighted the historic bond market sell-off that greeted former British Prime Minister Liz Truss’ disastrous “mini-budget” last September — which included a raft of unfunded tax cuts — as an example of bond investors lashing out against what they deem to be irresponsible fiscal policy.

“The bond vigilante is coming back, so this is very important for asset prices in equity, house prices, fiscal policy, monetary policy, so no longer is this a free ride on bond markets anymore — so the government has to be very careful in terms of the future. You saw that last September, you saw that in Treasurys,” Zhao said.

“A few months ago, most people expected the U.S. government deficit would keep going down with growth slowing — it was 3.9% last year and it’s actually going up with growth slowing — that is quite alarming for bond investors.”

The term “bond vigilantes” refers to bond market investors who protest against monetary or fiscal policy they fear is inflationary by selling bonds, thereby increasing yields.

Meanwhile markets are assessing the potential for interest rates to stay higher for longer as the Fed continues to try to rein in sticky inflation. U.S. inflation has retreated significantly from its June 2022 peak of 9.1% year on year, but still came in above expectations in September at 3.7%.

Before holding off on hiking in September, the U.S. Federal Reserve had lifted its main policy rate from a target range of 0.25%-0.5% in March 2022 to 5.25%-5.5% in July 2023.

Fed fund futures pricing reflects a 98% probability that the central bank keeps its main interest rate unchanged at the current target range of 5.25%-5.5% at its next monetary policy meeting.

Zhao’s comments echo the sentiment voiced by several strategists stateside in recent weeks. Yardeni Research President Ed Yardeni told CNBC earlier this month that bond vigilantes had been “asleep for a long time” because inflation was persistently low from the 2008 financial crisis through to the Covid-19 pandemic, but had now awoken again as inflation soared in the aftermath of the pandemic.

“During the pandemic environment we saw basically an experiment in Modern Monetary Theory, helicopter money, money kind of raining down on people’s deposits and that was accommodated by easy monetary policy — well monetary policy has reversed course and has tightened, meanwhile, fiscal policy has gone the other way and has been way too stimulative, and the bond vigilantes are being vigilant again about fiscal policy,” Yardeni said.

“They’re basically saying ‘cut this deficit substantially or we’re going to raise rates to levels that are going to clobber the economy, and then what are you going to do?'”

The 10-year yield is widely seen as a proxy for mortgage rates and a gauge of investor sentiment about the strength of the economy, since a rising yield implies a fall in demand for traditional “safe haven” Treasury bonds, signaling investors are comfortable opting for higher-risk investments.

Don’t miss these CNBC PRO stories: