The labor market is tight, with about two job openings for every one applicant.

While there are signs that retail, food and energy prices are lowering (slightly), inflation is still an ongoing battle for the Federal Reserve.

In this economy, it pays to be as prepared as possible.

So today, Amber and I want to make sure you know about professional trading tools that can help you take the guesswork out of trading safely and successfully, and help you protect your investments.

I use one in particular across my financial services, like Strategic Fortunes.

This system can alert you to any big drawdowns that are just over the horizon and it could help boost the gains of your stocks (including ones you may already own) by as much as 10X.

We’ll explain all about it…

In Today’s Video:

Amber Lancaster and I are covering:

- Market News: The U.S. economic heat map is “flashing yellow.” What does that mean exactly? [0:35]

- Investing Tips: What’s one of the best ways to protect your investments in this economic environment? With professional trading tools — like TradeSmith’s trade stops. [5:40]

- World of Crypto: BIG news for crypto! Bitcoin reached $30,000 for the first time in 2023. Plus, Ethereum’s new Shapella upgrade is on the way! [7:10]

- Mega Trend: Artificial intelligence is hitting the music industry next — with ChatGPT knocking on Spotify’s door. [13:00]

Start watching below!

(Or read the transcript here.)

And if you have more questions about what’s happening in the market, crypto investing or artificial intelligence let us know!

Send us an email at [email protected].

See you soon,

Ian KingEditor, Strategic Fortunes

As Amber pointed out in her chat with Ian today, we’re seeing warning signs of an economic slowdown.

Data like this is always anecdotal at first. It often takes months to show up in official gross domestic product numbers. But that’s just the point.

By the time the National Bureau of Economic Research “officially” says we’re in a recession, the damage is already done and the recovery has already started!

So let’s take a look at some of those warning signs.

For the past few weeks, I’ve been saying that the banking scare we saw back in March would cause bank lending to dry up.

Well, lo and behold, that is exactly what’s happening!

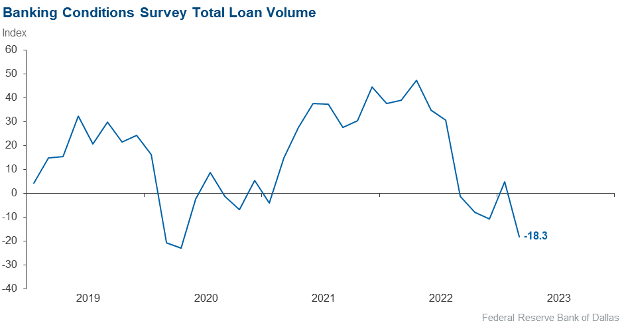

The Federal Reserve Bank of Dallas just published its twice-per-quarter Banking Conditions Survey, and it’s not pretty.

Per the report:

Loan demand declined for the fifth period in a row as bankers in the March survey reported worsening business activity. Loan volumes fell, driven largely by a sharp contraction in consumer loans. Loan nonperformance increased slightly overall…

And as for why loan volumes were falling:

Credit standards and terms continued to tighten sharply, and marked rises in loan pricing were also noted over the reporting period… Some contacts cited waning consumer confidence from recent financial instability as a concern.

In other words, banks aren’t lending because they’re hoarding cash. They’re not comfortable putting their capital at risk, given how skittish depositors are.

But here’s where it gets interesting.

While the crisis brought on by the failure of Silicon Valley Bank and Signature Bank accelerated things, this trend has been in place for a while.

Loan volume started to taper off toward the end of 2021. It then continued to sink throughout 2022 as higher interest rates dissuaded banks (and individuals) from borrowing.

And given that this data only goes through March, we really haven’t seen the post-Silicon Valley drop in the data yet.

Again, a little cooling here isn’t the end of the world. Less bank lending should mean less inflation, which in turn means a less aggressive Fed.

That’s good for the stock market.

But what isn’t is a dip in earnings. Those loans not being made aren’t funding the growth needed to fuel earnings per share.

Again, this doesn’t mean a meltdown is imminent, or that we have a brutal recession on the way. But it does suggest we’ll need to be a little more selective in where we invest for the next several quarters.

That’s why it makes sense to take Ian’s advice when it comes to trading tools like trade stops by TradeSmith. Using stop-losses in your trading allows you to limit losses on your investments. This way, you also maximize your profits on those same investments.

It’s a great tool for this market, where you can still find incredible opportunity in the midst of uncertainty.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge