Updated on July 26th, 2023 by Bob Ciura

Oil refiners have enjoyed an impressive rally since the of the pandemic, thanks to the recovery of global consumption of oil products.

The rally has continued over the past year thanks to the sanctions of western countries on Russia, in response to its invasion in Ukraine. These sanctions have tightened the global supply of oil products, which led to expanding refining margins.

Over the past year, all but one of the top 4 oil refiners generated total returns (including dividends) that beat the major S&P 500 Index ETF:

Marathon Petroleum (MPC) has led the way with a total return above 48%, while HF Sinclair (DINO) was the one oil refiner lagging SPY with a 13.86% total return.

Oil refiners have been among the strongest performers in the energy sector over the past year.

You can see our full list of nearly 250 energy stocks (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Given the rally of the oil refiners, investors should note that refiners are broadly trading at elevated valuations. Their businesses are still highly cyclical and therefore it is prudent to expect their earnings to revert to normal levels in the upcoming years.

In this article, we will compare the expected 5-year returns of the four major refiners. Expected total return data comes from our more than 800 stocks (and growing) Sure Analysis Research Database.

Table Of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

Industry Overview

All the major U.S. oil refiners have generated positive returns over the past 12 months. There are two major reasons behind the impressive rally of the oil refiners.

First, demand for oil is recovering strongly from the pandemic thanks to widespread immunity. In fact, global oil consumption is expected by the Energy Information Administration (EIA) to reach its pre-pandemic high in 2023.

Moreover, global supply of refined products has tightened to the extreme this year due to the sanctions of the U.S. and Europe on Russia in response to its invasion in Ukraine. At the time, Russia produced 10% of global oil output and an even greater amount of refined products. As a result, the sanctions have greatly limited the global supply of gasoline and diesel which has boosted refining margins.

The high EPS reported in recent quarters makes oil refiners’ valuations look cheap. However, we expect refining margins will deflate in the upcoming years due to the cyclical nature of this industry. As a result, our future expected returns are weak.

The major 4 U.S. oil refiner stocks are discussed in greater detail below.

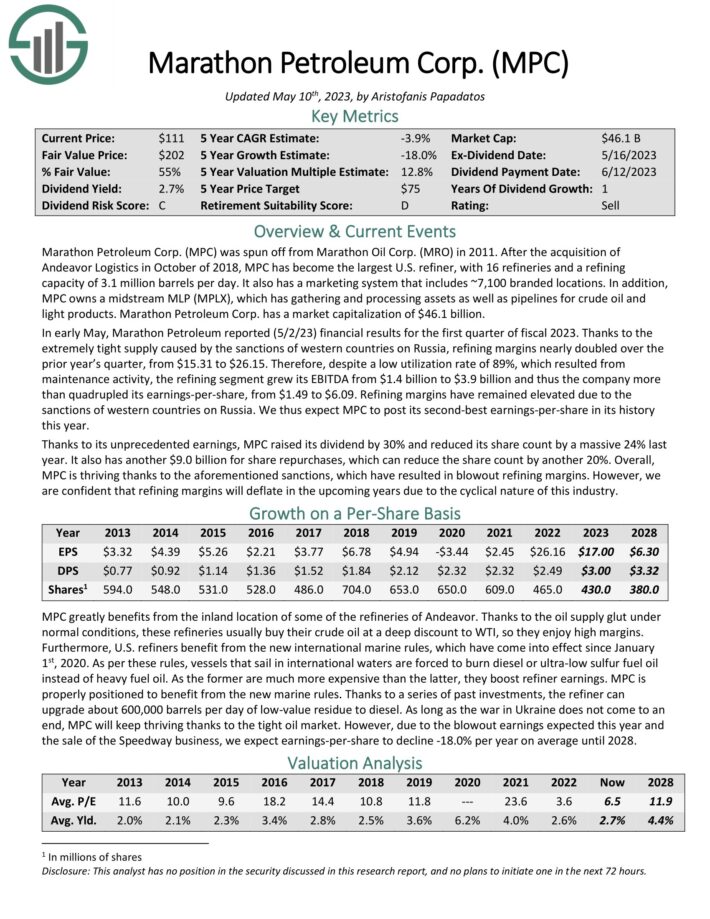

U.S. Oil Refiner Stock #4: Marathon Petroleum (MPC)

After the acquisition of Andeavor Logistics in October 2018, Marathon Petroleum has become the largest U.S. refiner, along with Valero, with 16 refineries and a refining capacity of 3.1 million barrels per day. It also has a marketing system that includes ~7,100 branded locations.

In addition, MPC owns MPLX LP (MPLX), a midstream Master Limited Partnership, which has gathering and processing assets as well as pipelines for crude oil and light products.

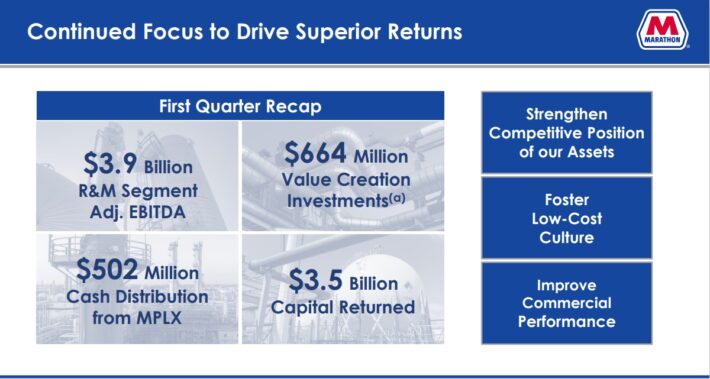

In early May, Marathon Petroleum reported (5/2/23) financial results for the first quarter of fiscal 2023. Thanks to the extremely tight supply caused by the sanctions of western countries on Russia, refining margins nearly doubled over the prior year’s quarter, from $15.31 to $26.15.

Source: Investor Presentation

Therefore, despite a low utilization rate of 89%, which resulted from maintenance activity, the refining segment grew its EBITDA from $1.4 billion to $3.9 billion and thus the company more than quadrupled its earnings-per-share, from $1.49 to $6.09. Refining margins have remained elevated due to the sanctions of western countries on Russia. We thus expect MPC to post its second-best earnings-per-share in its history this year.

Thanks to its unprecedented earnings, MPC raised its dividend by 30% and reduced its share count by a massive 24% last year. It also has another $9.0 billion for share repurchases, which can reduce the share count by another 20%.

Nevertheless, the stock is likely to offer a -6.7% average annual return over the next five years, as the 12.8% valuation tailwind and the 2.3% dividend are likely to be offset by the 18% expected annual EPS decline.

Click here to download our most recent Sure Analysis report on MPC (preview of page 1 of 3 shown below):

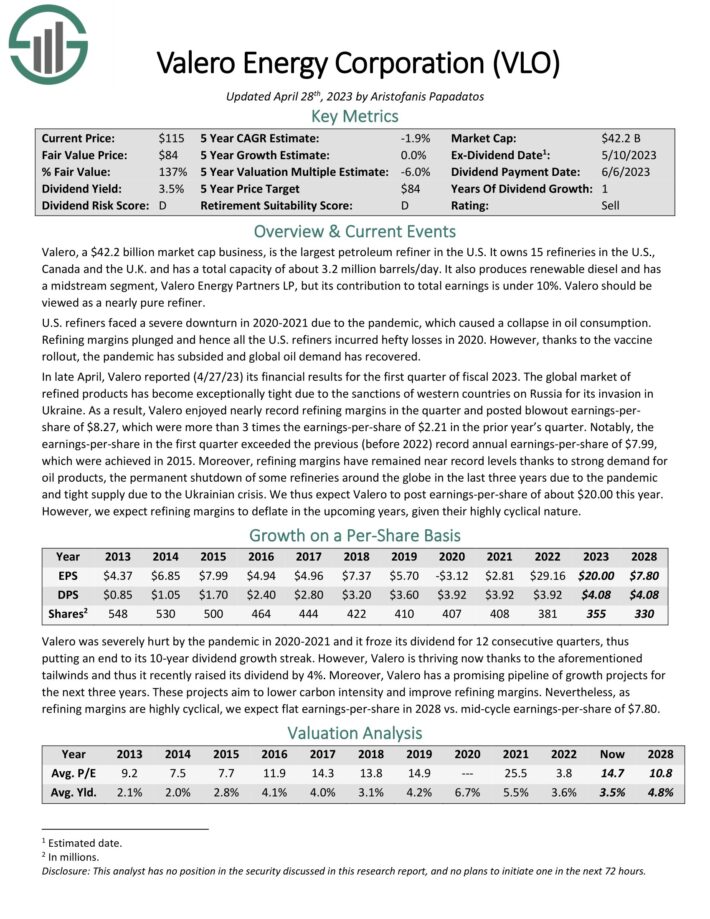

U.S. Oil Refiner Stock #3: Valero Energy (VLO)

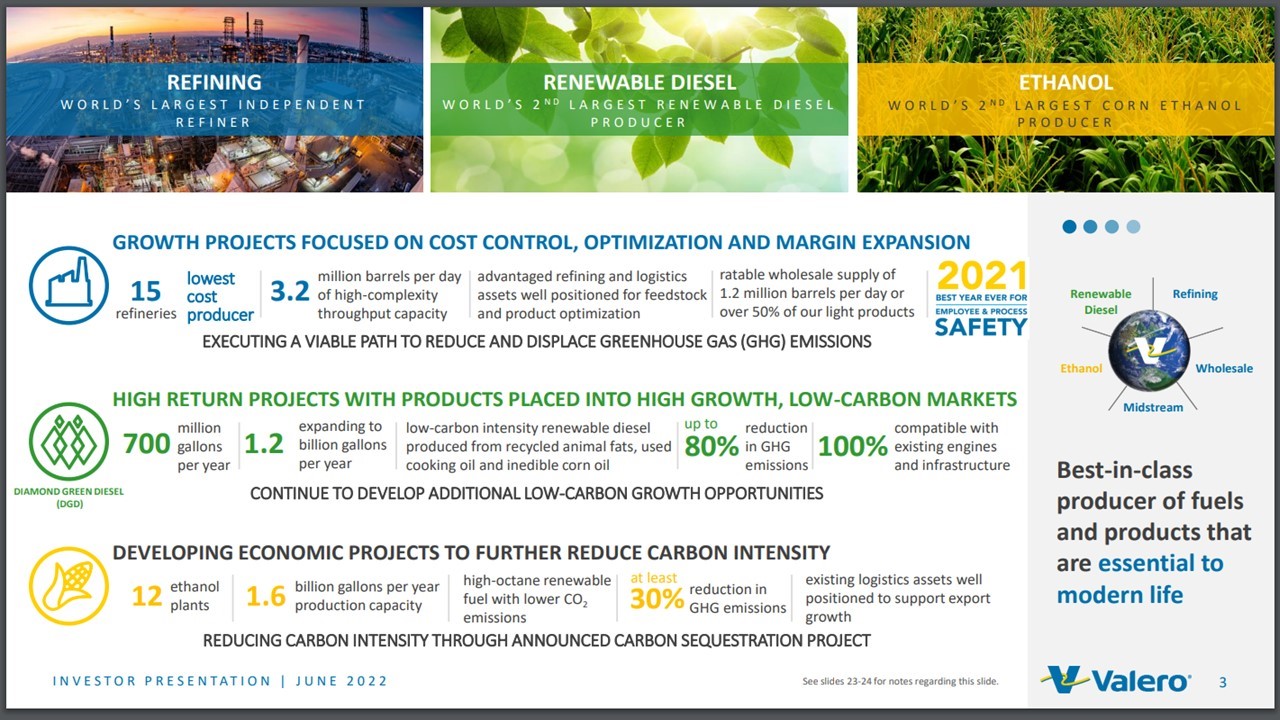

Valero is the largest independent petroleum refiner in the world. It owns 15 refineries in the U.S., Canada and the U.K. and has a total capacity of about 3.2 M barrels/day.

It also produces renewable diesel and has a midstream segment, Valero Energy Partners LP, but its contribution to total earnings is under 10%.

Source: Investor Presentation

In late April, Valero reported (4/27/23) its financial results for the first quarter of fiscal 2023. The company enjoyed nearly record refining margins in the quarter and posted blowout earnings-per-share of $8.27, which were more than 3 times the earnings-per-share of $2.21 in the prior year’s quarter.

Notably, the earnings-per-share in the first quarter exceeded the previous (before 2022) record annual earnings-per share of $7.99, last achieved in 2015.

Click here to download our most recent Sure Analysis report on VLO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #2: HF Sinclair (DINO)

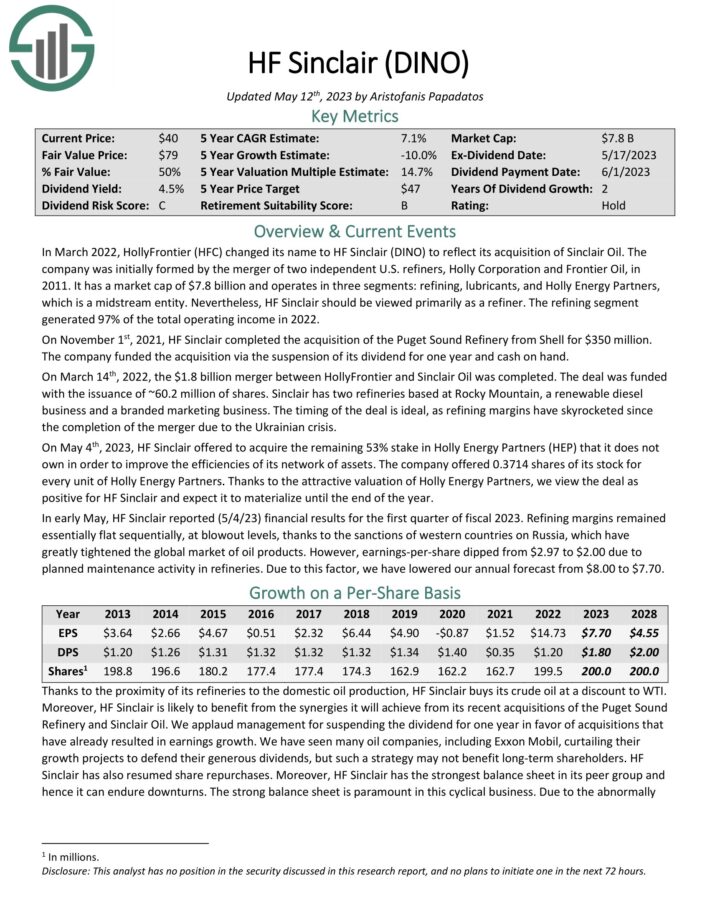

In March 2022, HollyFrontier (HFC) changed its name to HF Sinclair (DINO) to reflect its acquisition of Sinclair Oil. The company was initially formed by the merger of two independent U.S. refiners, Holly Corporation and Frontier Oil, in 2011.

It operates in three segments: refining, lubricants, and Holly Energy Partners, which is a midstream entity. Nevertheless, the refining segment generated 97% of the total operating income in 2022.

On May 4th, 2023, HF Sinclair offered to acquire the remaining 53% stake in Holly Energy Partners (HEP) that it does not own in order to improve the efficiencies of its network of assets. The company offered 0.3714 shares of its stock for every unit of Holly Energy Partners. Thanks to the attractive valuation of Holly Energy Partners, we view the deal as positive for HF Sinclair and expect it to materialize until the end of the year.

In early May, HF Sinclair reported (5/4/23) financial results for the first quarter of fiscal 2023. Refining margins remained essentially flat sequentially, at blowout levels, thanks to the sanctions of western countries on Russia, which have greatly tightened the global market of oil products. However, earnings-per-share dipped from $2.97 to $2.00 due to planned maintenance activity in refineries.

Click here to download our most recent Sure Analysis report on DINO (preview of page 1 of 3 shown below):

U.S. Oil Refiner Stock #1: Phillips 66 (PSX)

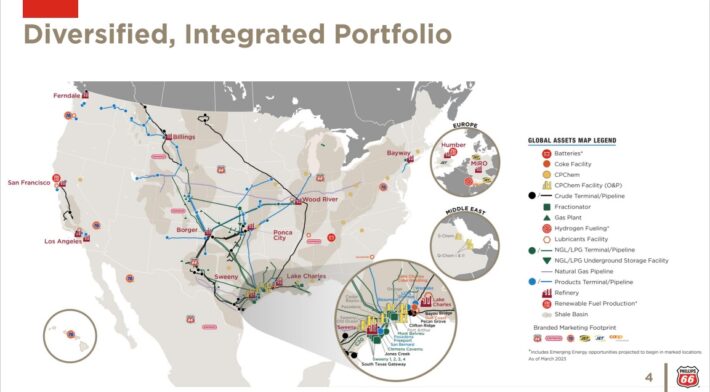

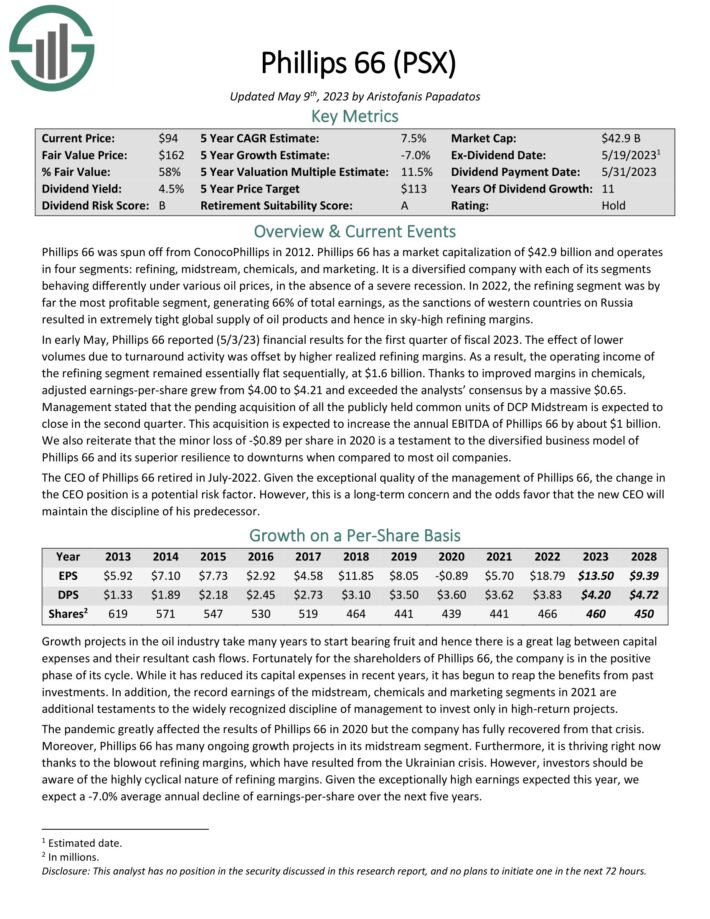

Phillips 66 operates in four segments: refining, midstream, chemicals, and marketing. It is a diversified company with each of its segments behaving differently under various oil prices, in the absence of a severe recession. In 2022, the refining segment was by far the most profitable segment, generating 66% of total earnings.

Source: Investor Presentation

In early May, Phillips 66 reported (5/3/23) financial results for the first quarter of fiscal 2023. The effect of lower volumes due to turnaround activity was offset by higher realized refining margins. As a result, the operating income of the refining segment remained essentially flat sequentially, at $1.6 billion. Thanks to improved margins in chemicals, adjusted earnings-per-share grew from $4.00 to $4.21 and exceeded the analysts’ consensus by a massive $0.65.

Management stated that the pending acquisition of all the publicly held common units of DCP Midstream is expected to close in the second quarter. This acquisition is expected to increase the annual EBITDA of Phillips 66 by about $1 billion.

Click here to download our most recent Sure Analysis report on PSX (preview of page 1 of 3 shown below):

Final Thoughts

Thanks to the tailwind of the economic reopening and their strong business models, the Big 4 major U.S. refiners grown their earnings at a rapid pace. Several refining stocks have outperformed the S&P 500 over the past year, which could make investors hesitant to buy. Indeed, we currently have negative future return estimates for two of the major refiners, VLO and MPC.

Phillips 66 seems to have the most attractive mix of valuation, growth prospects, and dividend yield. As a result, PSX is the stock likely to offer the highest 5-year return. Investors should also note that it is the only refiner that is highly diversified and can keep thriving even in a downturn of the refining margins. Still, PSX remains a hold.

Additional Reading

The following Sure Dividend lists contain many more quality dividend stocks to consider:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].