GMVozd/E+ via Getty Images

Co-authored by Treading Softly

I try to approach life with a long-term mindset. I don’t like to think of the immediate gratification of tomorrow. I’d like to make plans to have enjoyment and success in the future. This doesn’t mean that I don’t accept or enjoy the present, but I also know that what I choose in the present can drive my success and enjoyment of the future, just as much. As such, I choose to buy things that I think are extremely high quality that will last a long time. I’ll spend a little bit of extra to buy a leather boot made with heritage methods, knowing that I can then resole that boot multiple times. I’ll buy a higher-quality vehicle that will stand the test of time. I’ll buy the best of something that I can afford that has proven its value over the long run instead of just buying something because it has a splashy name.

When it comes to the market, I look for similar quality and income investments. I’m not making a purchase today expecting that I will have a benefit from it in a month or two months and then expect to sell it. I buy something to look to hold it for at least 2 to 3 years. Preferably, I’d hold it forever. We’ve previously covered various preferred securities that we view as buy-and-hold forever securities. Picks that we think will do exceptionally well in our portfolio till death do you part. Today, I want to look at a couple of picks that I think are set up to be major successes within the next decade, and as such, I’m looking at them with a 10-year holding period in view.

Let’s dive in!

Pick #1: Realty Income – Yield 5.7%

Realty Income Corporation (O) posted another strong quarter and is on track to meet its 2023 guidance of $4.08-$4.15 normalized FFO/share. Most notable is that O is taking advantage of its scale and the elevated cap-rates available in the market today, boosting acquisition guidance from $7 billion to $9 billion. That is not including the $9.3 billion acquisition of Spirit Realty (SRC).

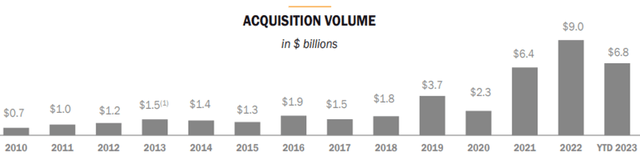

Since COVID, O has been expanding at a rapid rate. Where annual acquisition levels were once $1.5-$2 billion/year, in 2022 and 2023 alone O will have acquired approximately $18 billion in real estate. That is about as much as O acquired from 2010 through the end of 2020. Source

Realty Income Q3 2023 Presentation

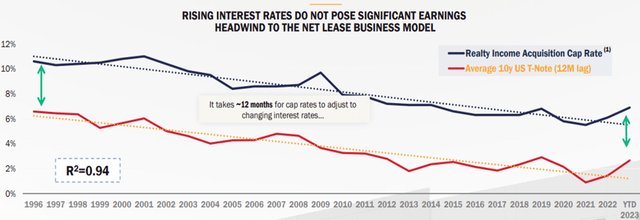

O is sustaining this pace of growth while maintaining an A- credit rating. Why is O backing up the truck? Because real estate is relatively cheap. Properties are selling at the highest cap rates they have in a decade. The cap rate is calculated by the property level net operating income, divided by the price paid. A higher cap rate means a higher return for O.

Realty Income Q3 2023 Presentation

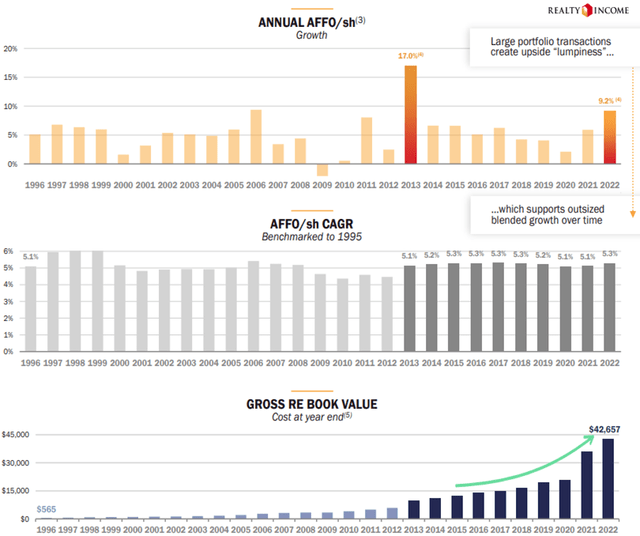

O’s strong balance sheet and high credit rating allow it to be a buyer when others are having difficulty raising capital. Historically, O has grown its earnings per share every year since IPO except for 2009, with AFFO/share growing at an average pace of around 5%/year.

Realty Income Q3 2023 Presentation

Note that large portfolio acquisitions have driven larger-than-average growth for O, and they have another one expected to drive 2024 AFFO with the acquisition of SRC.

O’s scale and conservative business model provide modest but very steady growth. As O grows, this will continue as it can consider larger real estate transactions than peers, has a better cost of capital, and can maintain diversity even with multi-billion dollar acquisitions.

O is trading at only 12x normalized FFO. This is a bargain price, as we would expect an “average” REIT to typically trade around 13-15x FFO. O is clearly a premium REIT. It’s like when you walk into the meat market and they are selling filet mignon at chuck steak prices. There are many cheaper (higher yielding) options, but the price is fantastic for the quality.

Pick #2: GHI – Yield 9.2%

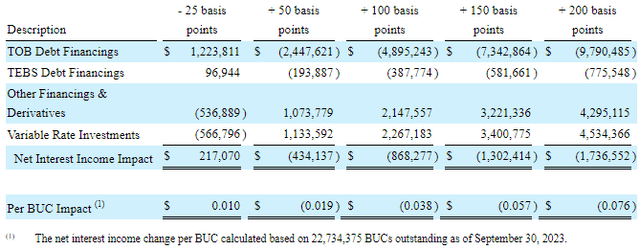

Greystone Housing Impact Investors LP (GHI) is a partnership that invests in residential real estate using two distinct strategies. GHI’s core business is “mortgage revenue bonds” or MRBs. These are bonds issued by state housing agencies for the development of affordable housing. This segment of the business is interest rate sensitive as GHI benefits from the spread between the rate it can borrow and the rate it can lend. Higher interest rates are a negative for this business. The flipside of that coin is that lower short-term interest rates will directly lead to higher net investment income. Currently, every 25 bps change in interest rates will increase or decrease annual earnings by slightly less than $0.01/unit. Source

GHI Q3 2023 10-Q

Yet, even facing these headwinds, GHI has been paying its regular distribution of $0.37/quarter, plus frequent supplemental distributions which was $0.07 last quarter. GHI announced it intends to pay a $0.07 supplemental distribution in Q4 and in Q1 2024.

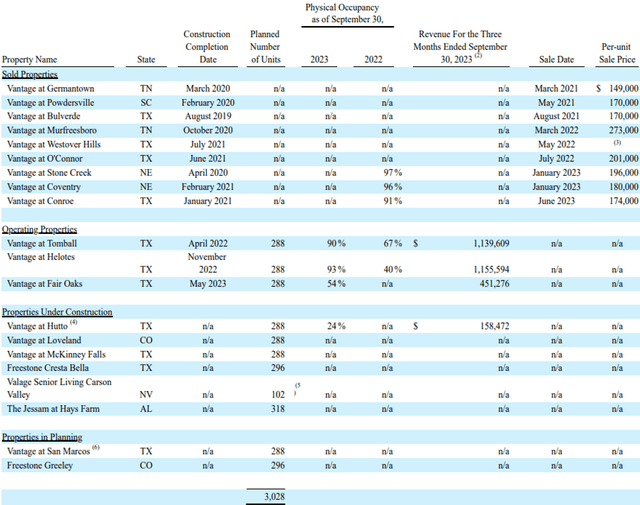

This is possible because while GHI’s MRB business is seeing lower cash flows, the other side of its business has been thriving. GHI’s “Vantage” joint venture develops apartments. GHI provides the capital, and gets a preferred position. The partner builds and operates the apartment, and once occupancy is stabilized over 90%, it sells the apartment complex for a profit. GHI gets some cash flow while the apartment is operational, and then gets a share of the profits when it sells. This results in lumpy returns for GHI quarter to quarter since the gains at sale are relatively large and a sale doesn’t happen every quarter. This is why GHI has taken on the strategy of paying out supplemental distributions based on the gains from these sales.

GHI has been averaging three sales per year since 2021. There are two properties with occupancy over 90% and could be sold at any time, and another property where construction is complete and is in the process of being leased.

GHI Q3 2023 10-Q

There are another eight projects that are under construction or in planning. It is very reasonable to believe that GHI can maintain the current pace for this segment.

The gains from this segment have more than made up for the headwinds on GHI’s MRB business. Investors like us have been rewarded with a generous regular distribution and frequent supplements. As we see interest rates decline, we could see GHI benefit from rising income from the MRB business and still be seeing the current pace of gains from their development strategy. We don’t know when interest rates will come down, but we know that they will come down eventually. 2024 or 2025 could easily see the stars align for GHI where both business segments are firing on all cylinders. If not, we can have a lot of confidence that one of GHI’s segments will be doing well and providing us with a healthy income. GHI’s diversification and dual strategy help ensure that at least one of its segments is doing well and protects our income!

GHI issues a K-1, and the income from MRBs is tax-exempt, a benefit that is passed along to shareholders for a portion of the annual distribution. Therefore, it is best to hold GHI in a taxable account.

Conclusion

With O and GHI, I’m able to hold and invest in companies that have a rock steady history of success. Both of these companies invest in real estate, and as the famous saying goes, “they’re not making new land anymore,” but not only have they invested in real estate – they’re run by management teams that understand the sector exceptionally well.

O has a long history of paying monthly dividends and growing those dividends. While it is beaten down because it is viewed as a bond alternative, it is ready to spring to new heights when interest rates fall, and continue to provide its shareholders with excellent income.

GHI invests in mortgage revenue bonds that provide tax-free income but also help with affordable housing – a need that is massive in so many cities and states. Furthermore, they’re active in building multifamily units, leasing those, and turning around and selling them. This has been a successful side business for them that I expect that they will continue to use to provide more returns in the future. They give a 1-2 punch of a rock-steady base and a supplemental side gig.

When it comes to retirement, I want your rock-steady base to be enjoying your hobbies and spending time with loved ones. Your side gig? Checking on your income portfolio to count the endless supply of dollars pouring into your account.

That’s the beauty of my Income Method. That’s the beauty of income investing.