Up to date on April fifteenth, 2022 by Bob Ciura

DRIP stands for Dividend Reinvestment Plan. When an investor is enrolled in DRIP shares, it signifies that incoming dividend funds are used to buy extra shares of the issuing firm – mechanically.

Many companies provide DRIPs that require the buyers to pay charges. Clearly, paying charges is a unfavourable for buyers. As a basic rule, buyers are higher off avoiding DRIP shares that cost charges.

Luckily, many firms provide no-fee DRIP shares. These permit buyers to make use of their hard-earned dividends to construct even bigger positions of their favourite high-quality, dividend-paying firms – free of charge.

Dividend Aristocrats are the proper type of DRIP shares. Dividend Aristocrats are elite firms that fulfill the next:

- Are within the S&P 500 Index

- Have 25+ consecutive years of dividend will increase

- Meet sure minimal dimension & liquidity necessities

You may obtain an Excel spreadsheet with the complete record of all 65 Dividend Aristocrats (with further monetary metrics similar to price-to-earnings ratios and dividend yields) by clicking the hyperlink under:

Take into consideration the highly effective mixture of DRIPs and Dividend Aristocrats…

You’re reinvesting dividends into an organization that pays larger dividends yearly. Which means that yearly you get extra shares – and every share is paying you extra dividend revenue than the earlier 12 months.

This makes a strong (and cost-effective) compounding machine.

This text takes a take a look at the highest 15 Dividend Aristocrats which can be no-fee DRIP shares, ranked so as of anticipated complete returns from lowest to highest.

The up to date record for 2022 contains our prime 15 Dividend Aristocrats, ranked by anticipated returns based on the Certain Evaluation Analysis Database, that provide no-fee DRIPs to shareholders.

You may skip to evaluation of any particular person Dividend Aristocrat under:

Moreover, please see the video under for extra protection.

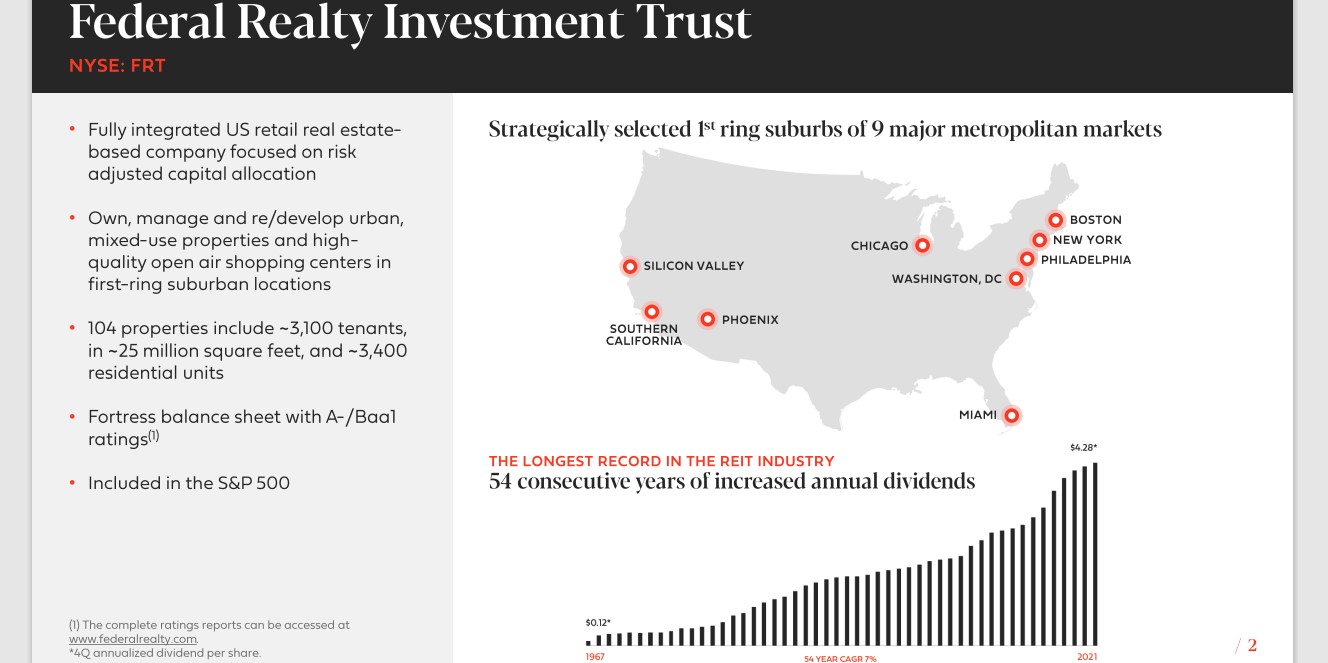

No-Charge DRIP Dividend Aristocrat #15: Chubb Restricted (CB)

Chubb Ltd is a worldwide supplier of insurance coverage and reinsurance providers headquartered in Zurich, Switzerland. The corporate gives insurance coverage providers together with property & casualty insurance coverage, accident & medical health insurance, life insurance coverage, and reinsurance.

The present model of Chubb was created in 2016, when Ace Restricted acquired the ‘previous’ Chubb and adopted its identify. Chubb has a big and diversified product portfolio.

Supply: Investor Presentation

Chubb reported its fourth quarter earnings outcomes on February 1. The corporate reported that its revenues totaled $9.3 billion through the quarter, which was 11% greater than the revenues that Chubb generated through the earlier 12 months’s quarter.

Internet written premiums had been up 10% year-over-year in Chubb’s P&C phase, which was according to development recorded within the earlier quarter. Chubb was in a position to generate web funding revenue of $900 million through the quarter, which was down barely on a sequential foundation.

Shares commerce for a price-to-book ratio of 1.39, which is above our honest worth estimate of 1.05. In the meantime, anticipated book-value-per-share development of 5% and the 1.5% dividend yield result in complete anticipated returns of 0.8% per 12 months by 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on Chubb (preview of web page 1 of three proven under):

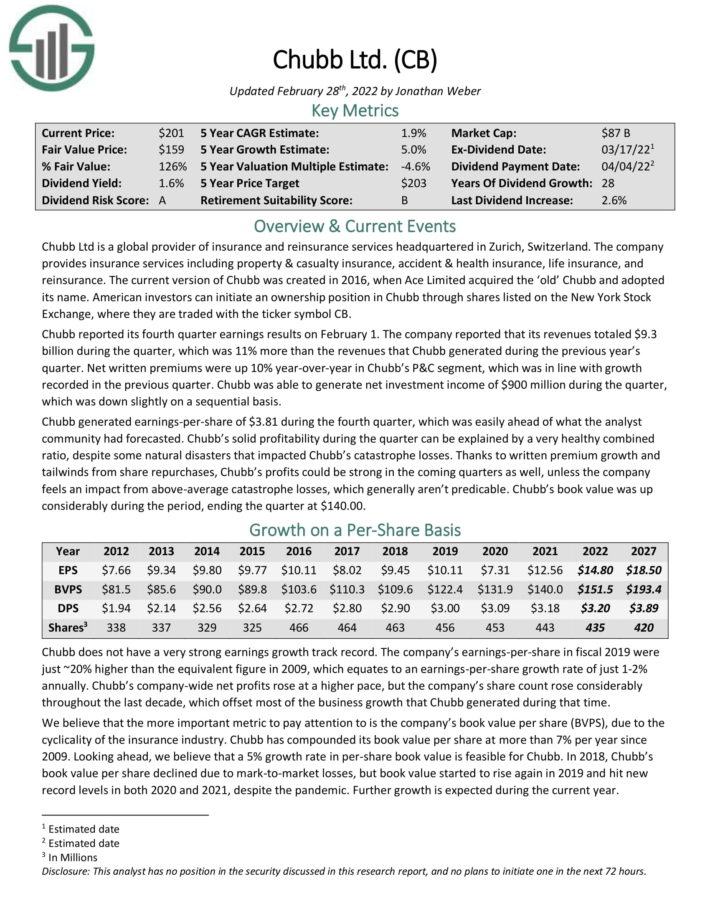

No-Charge DRIP Dividend Aristocrat #14: Abbott Laboratories (ABT)

Abbott Laboratories is likely one of the largest medical home equipment & gear producers on the earth, comprised of 4 segments: Diet, Diagnostics, Established Prescribed drugs and Medical Units.

Supply: Infographic

Abbott has elevated its dividend for 50 years. Abbott has a big and diversified product portfolio, with management throughout a number of classes.

With a P/E close to 25, Abbott seems overvalued. Our honest worth estimate is a P/E of 20. Overvaluation may considerably weigh on shareholder returns going ahead.

Anticipated EPS development of 5% per 12 months plus the 1.6% dividend yield will offset the impression of a declining P/E a number of, however complete returns are anticipated at simply 2.1% per 12 months over the following 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Abbott Laboratories (preview of web page 1 of three proven under):

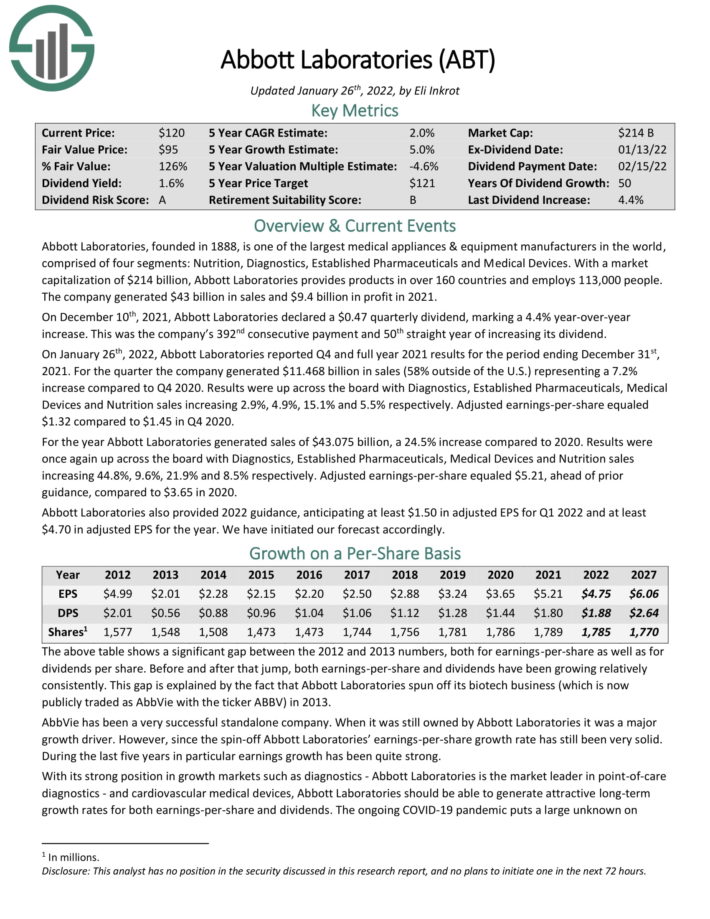

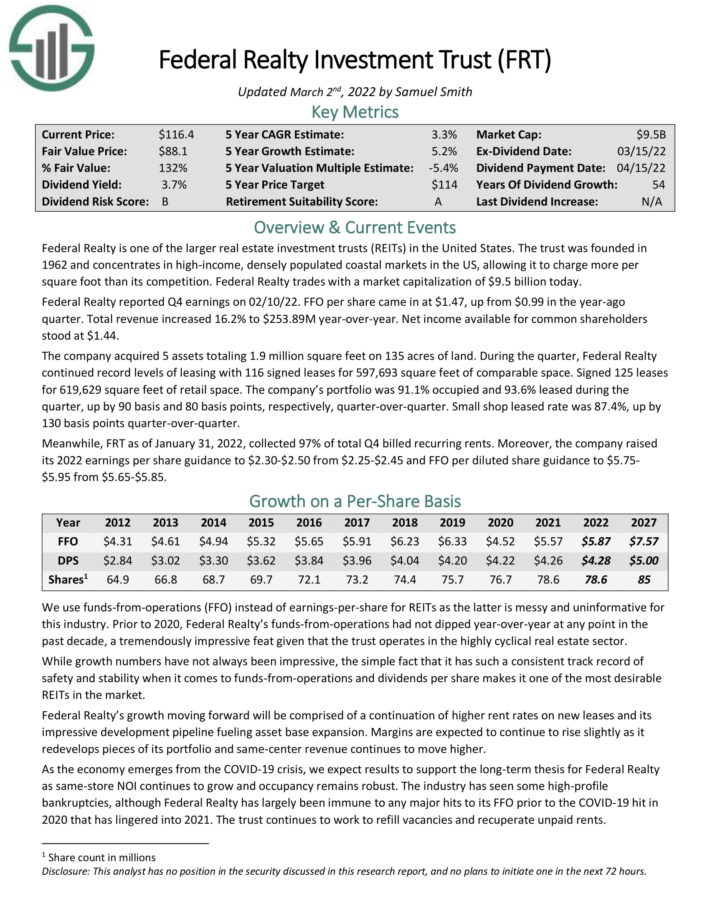

No-Charge DRIP Dividend Aristocrat #13: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and lease out actual property properties. It makes use of a good portion of its rental revenue, in addition to exterior financing, to accumulate new properties. This helps create a “snow-ball” impact of rising revenue over time.

Federal Realty primarily owns purchasing facilities. Nevertheless, it additionally operates in redevelopment of multi-purpose properties together with retail, flats, and condominiums. The portfolio is very diversified when it comes to tenant base. Federal Realty has a high-quality tenant portfolio.

Supply: Investor Presentation

Federal Realty reported This fall earnings on 02/10/22. FFO per share got here in at $1.47, up from $0.99 within the year-ago

quarter. Whole income elevated 16.2% to $253.89M year-over-year. Internet revenue accessible for widespread shareholders stood at $1.44. The corporate acquired 5 property totaling 1.9 million sq. toes on 135 acres of land.

In the course of the quarter, Federal Realty continued file ranges of leasing with 116 signed leases for 597,693 sq. toes of comparable house. The corporate’s portfolio was 91.1% occupied and 93.6% leased through the quarter, up by 90 foundation and 80 foundation factors, respectively, quarter-over-quarter. Small store leased fee was 87.4%, up by 130 foundation factors quarter-over-quarter

Nevertheless, shares seem considerably overvalued, with a 2021 P/FFO ratio of 21, in contrast with our honest worth estimate of 15. Even with the three.5% dividend yield and 5.2% anticipated FFO-per-share development per 12 months, we count on complete returns of simply 2.3% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven under):

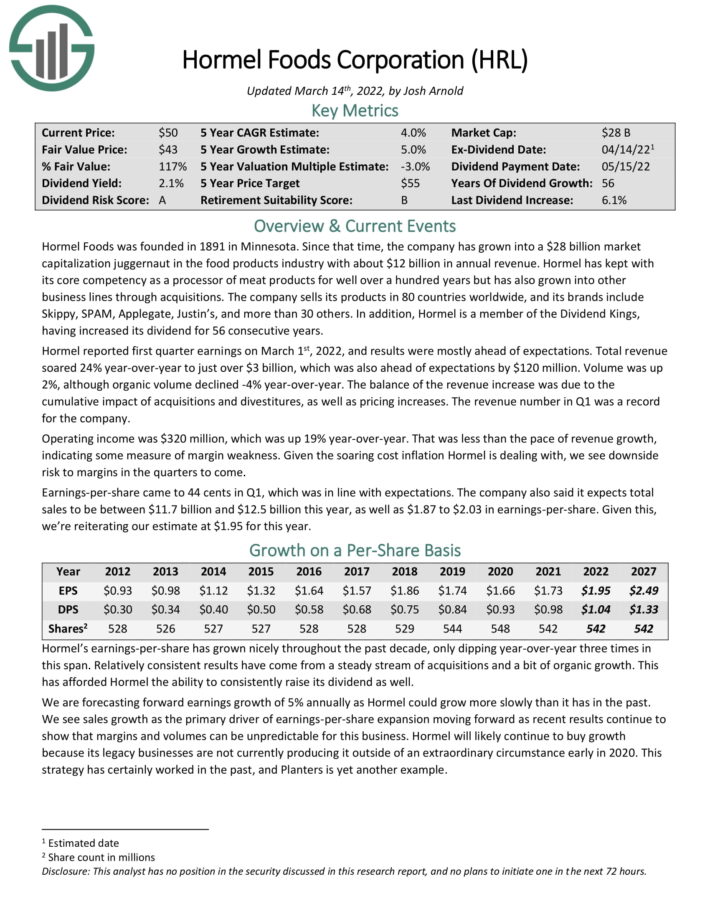

No-Charge DRIP Dividend Aristocrat #12: Hormel Meals (HRL)

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise business with practically $10 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for nicely over 100 years, however has additionally grown into different enterprise traces by acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its prime manufacturers embrace embrace Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

Hormel reported first quarter earnings on March 1st, 2022, and outcomes had been principally forward of expectations. Whole income soared 24% year-over-year to only over $3 billion, which was additionally forward of expectations by $120 million. Quantity was up 2%, though natural quantity declined -4% year-over-year. The steadiness of the income improve was as a result of cumulative impression of acquisitions and divestitures, in addition to pricing will increase.

Supply: Investor Presentation

Hormel inventory seems overvalued. We count on 5% annual EPS development, whereas the inventory has a 1.9% dividend yield. Total, we count on annual returns of two.6% per 12 months by 2026.

Click on right here to obtain our most up-to-date Certain Evaluation report on Hormel (preview of web page 1 of three proven under):

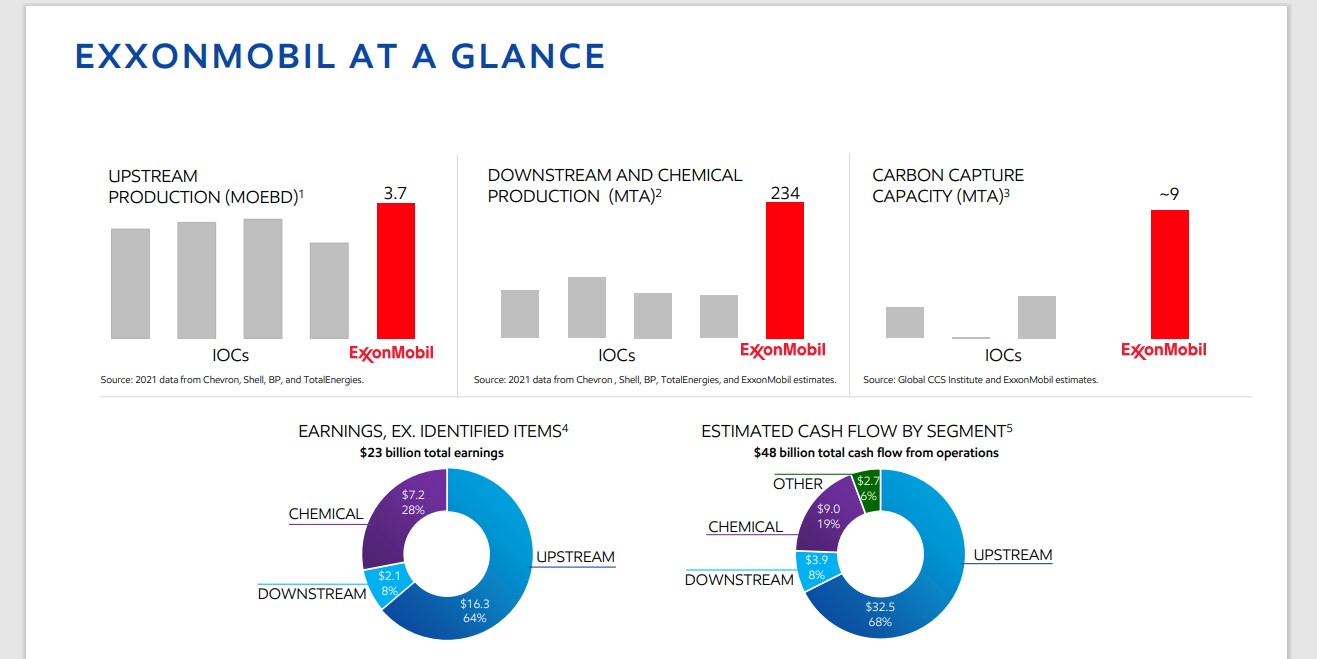

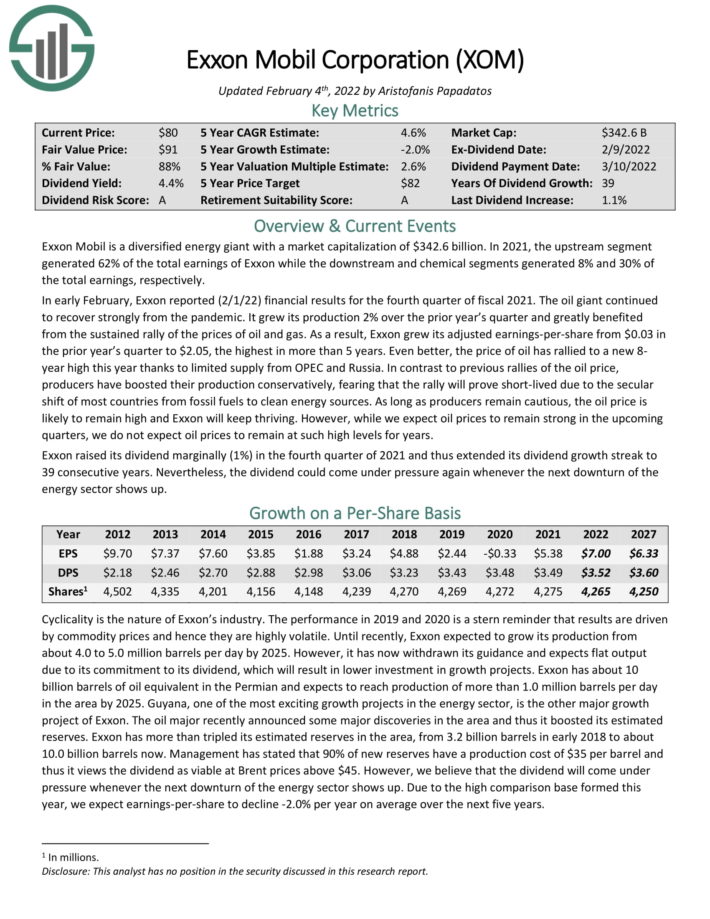

No-Charge DRIP Dividend Aristocrat #11: Exxon Mobil (XOM)

Exxon Mobil is an built-in super-major, with operations throughout the oil and gasoline business. It derives the vast majority of its earnings from its upstream phase, with the rest from its downstream (principally refining) phase and its chemical substances phase.

Supply: Investor Presentation

In early February, Exxon reported (2/1/22) monetary outcomes for the fourth quarter of fiscal 2021. The oil large continued to get well strongly from the pandemic. It grew its manufacturing 2% over the prior 12 months’s quarter and significantly benefited from the sustained rally of the costs of oil and gasoline. In consequence, Exxon grew its adjusted earnings-per-share from $0.03 within the prior 12 months’s quarter to $2.05, the very best in additional than 5 years.

Even higher, the worth of oil has rallied to a brand new 8-year excessive this 12 months due to restricted provide from OPEC and Russia. In distinction to earlier rallies of the oil worth, producers have boosted their manufacturing conservatively, fearing that the rally will show short-lived as a result of secular shift of most nations from fossil fuels to wash power sources.

So long as producers stay cautious, the oil worth is more likely to stay excessive and Exxon will maintain thriving. Nevertheless, whereas we count on oil costs to stay sturdy within the upcoming quarters, we don’t count on oil costs to stay at such excessive ranges for years.

Together with the 4% dividend yield, -2% annual EPS development, and a small increase from a rising P/E a number of, we count on complete annual returns of two.9% per 12 months over the following 5 years. Exxon Mobil is a riskier Dividend Aristocrat on account of its unstable business.

Click on right here to obtain our most up-to-date Certain Evaluation report on Exxon Mobil (preview of web page 1 of three proven under):

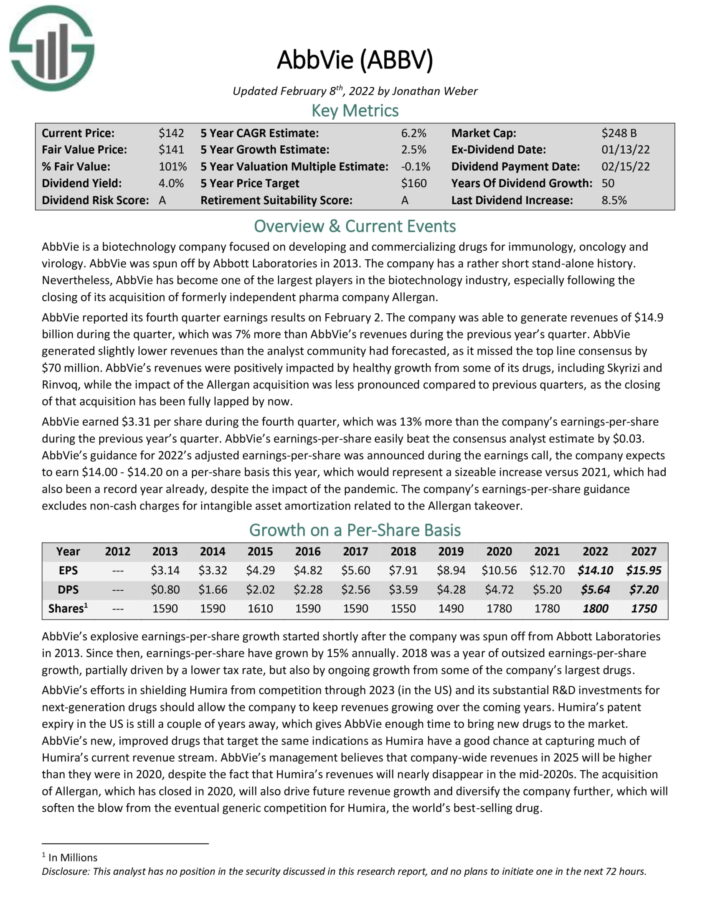

No-Charge DRIP Dividend Aristocrat #10: AbbVie Inc. (ABBV)

AbbVie Inc. is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most necessary product is Humira, which is now going through biosimilar competitors in Europe, which has had a noticeable impression on the corporate. Humira will lose patent safety within the U.S. in 2023.

Even so, AbbVie stays an enormous within the healthcare sector, with a big and diversified product portfolio.

AbbVie reported its fourth quarter earnings outcomes on February 2. Revenues of $14.9 billion rose 7% from the earlier 12 months’s quarter. Revenues had been positively impacted by wholesome development from a few of its medicine, together with Skyrizi and Rinvoq. AbbVie earned $3.31 per share through the fourth quarter, which was up 13% year-over-year.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie (preview of web page 1 of three proven under):

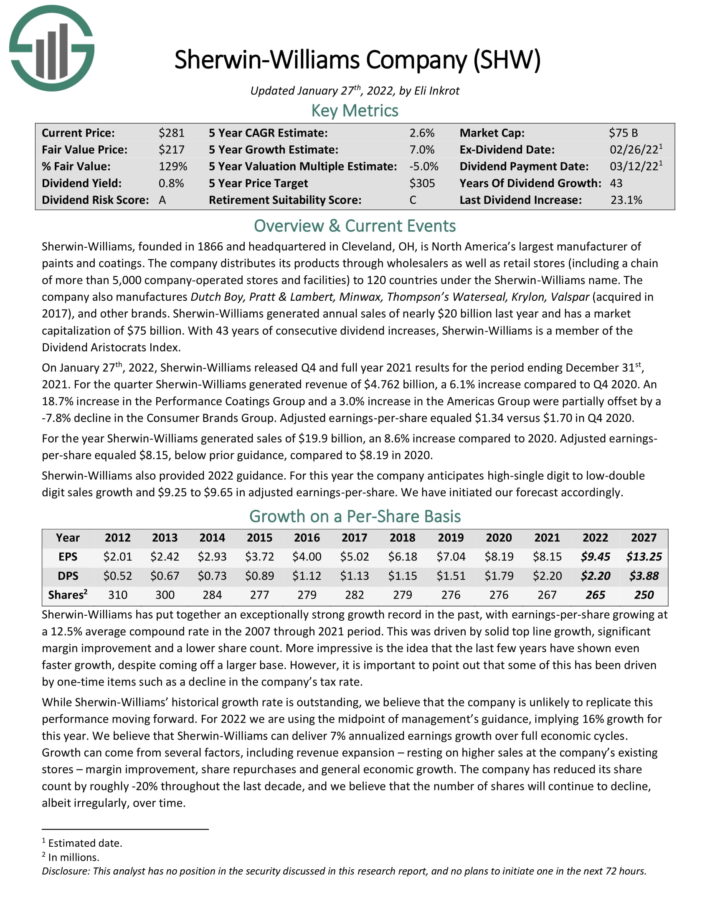

No-Charge DRIP Dividend Aristocrat #9: Sherwin-Williams (SHW)

Sherwin-Williams, based in 1866 and headquartered in Cleveland, OH, is North America’s largest producer of paints and coatings.

The corporate distributes its merchandise by wholesalers in addition to retail shops (together with a series of greater than 4,900 company-operated shops and services) to 120 nations beneath the Sherwin-Williams identify.

The corporate additionally manufactures Dutch Boy, Pratt & Lambert, Minwax, Thompson’s Waterseal, Krylon, Valspar (acquired in 2017), and different manufacturers.

The inventory trades for greater than 30 instances earnings. We imagine shares are considerably overvalued right now.

The mixture of valuation adjustments, 8% annual EPS development, and the 0.9% dividend yield lead to anticipated annual returns of 4.4% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Sherwin-Williams (preview of web page 1 of three proven under):

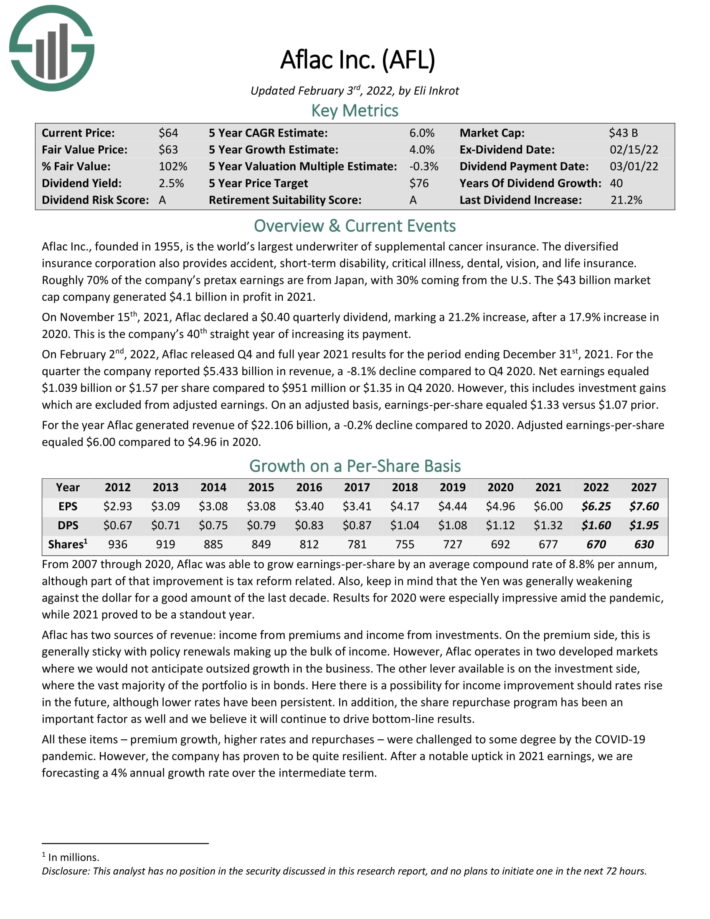

No-Charge DRIP Dividend Aristocrat #8: Aflac Inc. (AFL)

Aflac was fashioned in 1955, when three brothers — John, Paul, and Invoice Amos — got here up with the concept to promote insurance coverage merchandise that paid money if a policyholder acquired sick or injured. Within the mid-Twentieth century, office accidents had been widespread, with no insurance coverage product on the time to cowl this danger.

Associated: Detailed evaluation on the very best insurance coverage shares.

Right this moment, Aflac has a variety of product choices, a few of which embrace accident, short-term incapacity, essential sickness, hospital indemnity, dental, imaginative and prescient, and life insurance coverage.

The corporate focuses on supplemental insurance coverage, which pays out to coverage holders if they’re sick or injured, and can’t work. Aflac operates within the U.S. and Japan, with Japan accounting for about 70% of the corporate’s income. Due to this, buyers are uncovered to forex danger.

Usually phrases, Aflac has two sources of revenue: revenue from premiums and revenue from investments. Taking the objects collectively, along with an energetic share repurchase program, cheap expectations can be for 4% annual earnings-per-share development over the following 5 years.

Shares seem barely over-valued proper now. The present dividend yield of two.4%, plus 4% anticipated EPS development, results in complete anticipated returns of 5.7% per 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on Aflac (preview of web page 1 of three proven under):

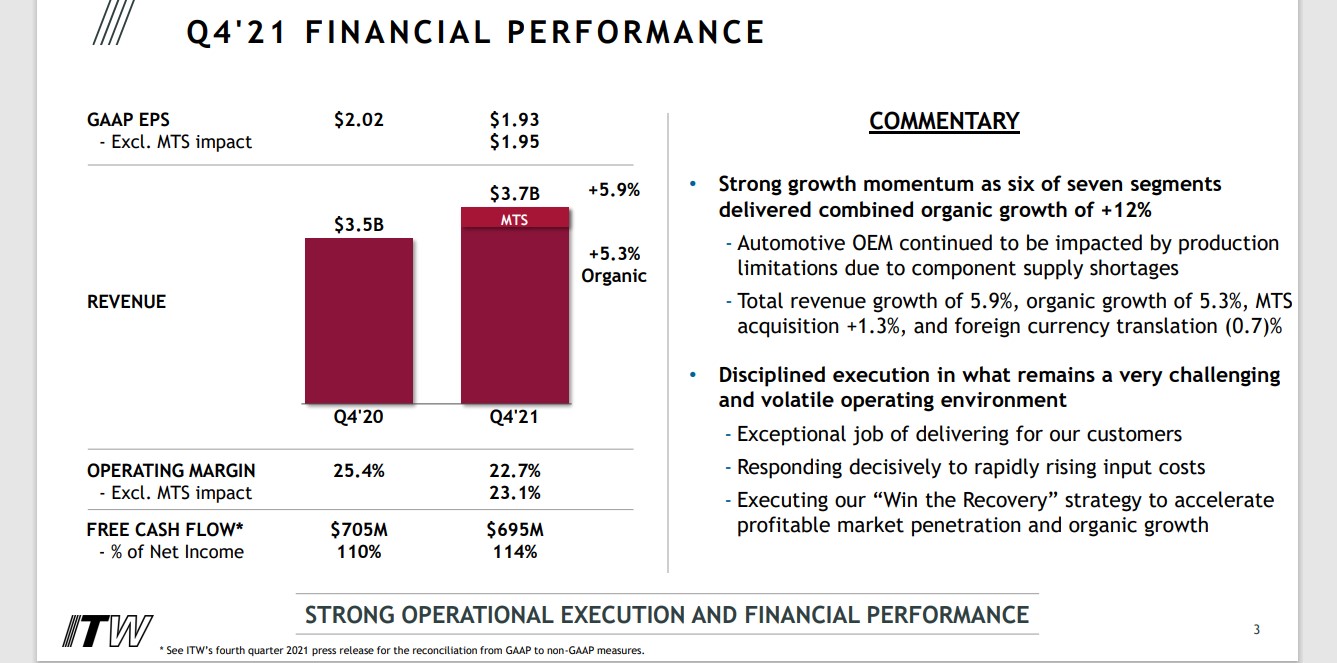

No-Charge DRIP Dividend Aristocrat #7: Illinois Software Works (ITW)

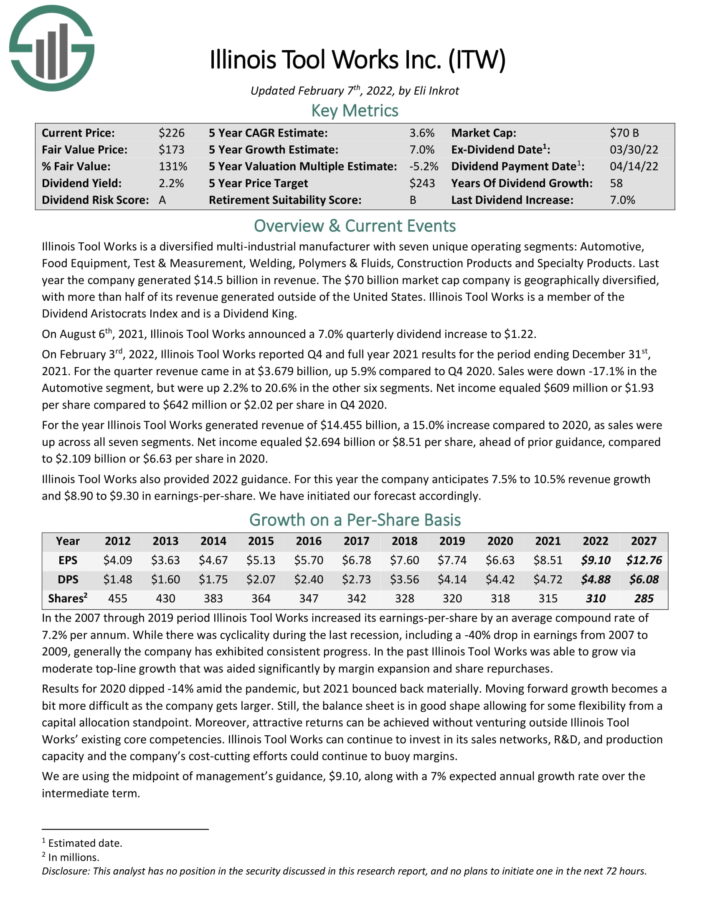

Illinois Software Works is a diversified multi-industrial producer with seven distinctive working segments: Automotive, Meals Tools, Take a look at & Measurement, Welding, Polymers & Fluids, Development Merchandise and Specialty Merchandise.

On February third, 2022, Illinois Software Works reported This fall and full 12 months 2021 outcomes for the interval ending December thirty first, 2021. For the quarter income got here in at $3.679 billion, up 5.9% in comparison with This fall 2020. Gross sales had been down -17.1% within the Automotive phase, however had been up 2.2% to twenty.6% within the different six segments. Internet revenue equaled $609 million or $1.93 per share in comparison with $642 million or $2.02 per share in This fall 2020.

Supply: Investor Presentation

For the 12 months Illinois Software Works generated income of $14.455 billion, a 15.0% improve in comparison with 2020, as gross sales had been up throughout all seven segments. Internet revenue equaled $2.694 billion or $8.51 per share, forward of prior steering, in comparison with $2.109 billion or $6.63 per share in 2020.

Shares commerce for a P/E of 21.7, above our honest worth P/E estimate of 19. Anticipated EPS development of seven% per 12 months and the two.5% dividend yield will offset the impression of overvaluation, resulting in anticipated returns of 6.3% per 12 months over the following 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Illinois Software Works (preview of web page 1 of three proven under):

No-Charge DRIP Dividend Aristocrat #6: Realty Earnings (O)

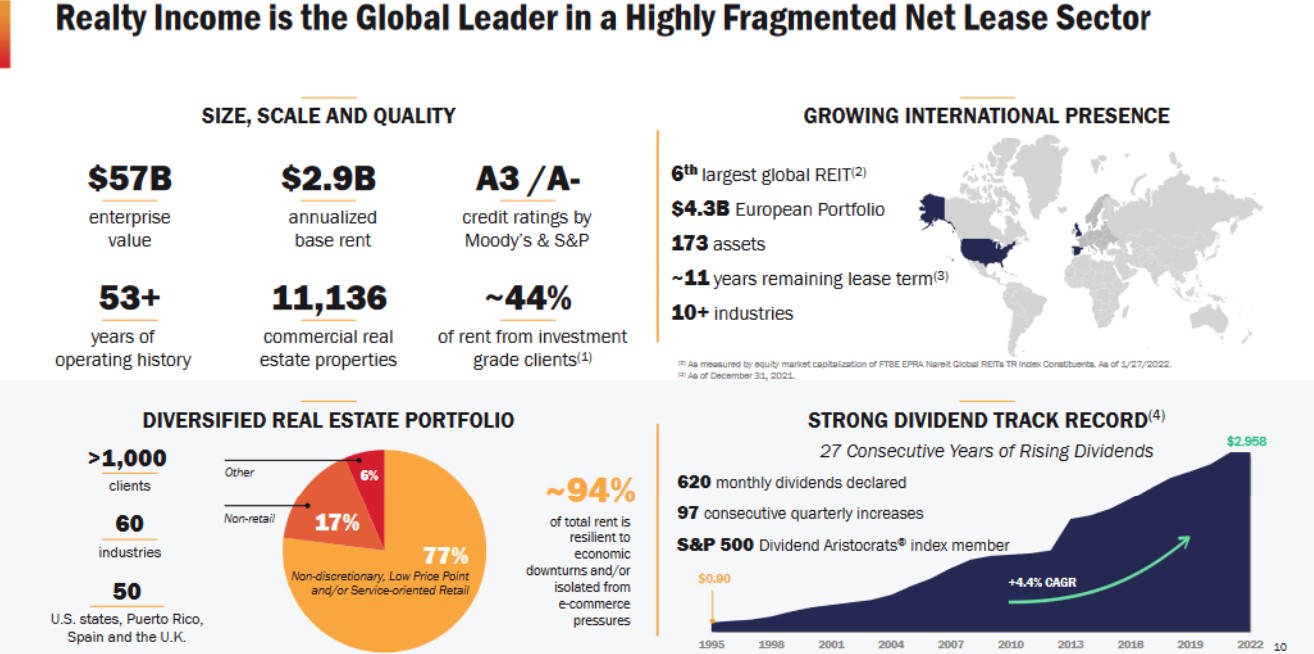

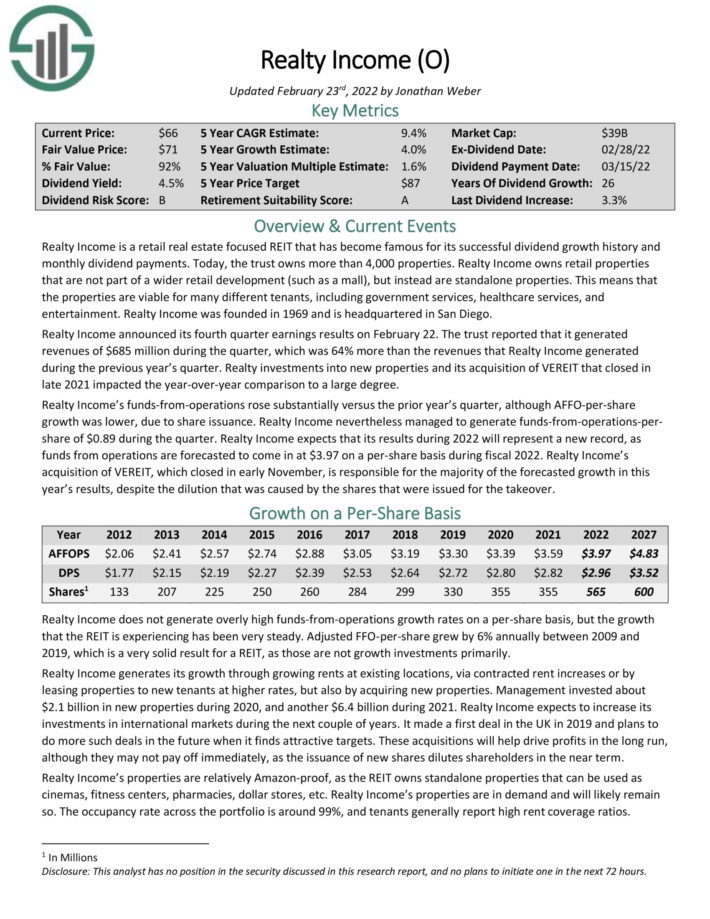

Realty Earnings is a retail-focused REIT that owns greater than 6,500 properties. It owns retail properties that aren’t a part of a wider retail growth (similar to a mall), however as an alternative are standalone properties.

Which means that the properties are viable for a lot of totally different tenants, together with authorities providers, healthcare providers, and leisure.

Supply: Investor Presentation

The corporate’s lengthy historical past of dividend funds and will increase is because of its high-quality enterprise mannequin and diversified property portfolio.

Realty Earnings introduced its fourth quarter earnings outcomes on February 22. Revenues of $685 million through the quarter rose 64% from the earlier 12 months’s quarter. Investments in new properties and its acquisition of VEREIT accounted for a lot of the development. Funds from operation rose considerably versus the prior 12 months’s quarter, though AFFO-per-share development was decrease, on account of share issuance.

We count on 7.3% annual returns, pushed by anticipated FFO-per-share development of 4%, plus the 4.1% dividend yield, partially offset by a slight decline within the P/FFO a number of.

Click on right here to obtain our most up-to-date Certain Evaluation report on Realty Earnings (preview of web page 1 of three proven under):

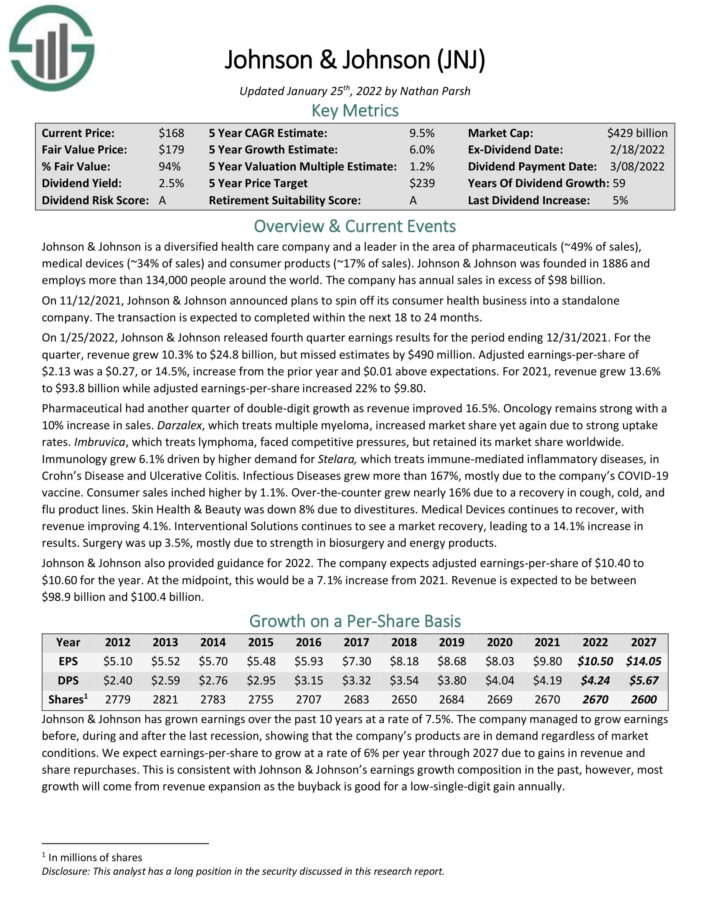

No-Charge DRIP Dividend Aristocrat #5: Johnson & Johnson (JNJ)

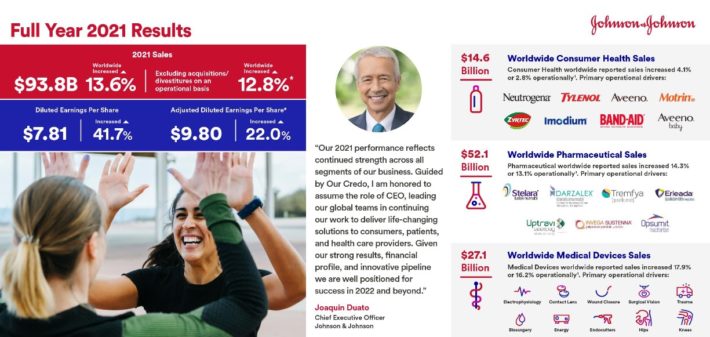

Johnson & Johnson is a worldwide healthcare large. It has a market capitalization above $400 billion, and generates annual income of greater than $93 billion.

On 1/25/2022, Johnson & Johnson launched fourth quarter earnings outcomes for the interval ending 12/31/2021. For the quarter, income grew 10.3% to $24.8 billion, however missed estimates by $490 million. Adjusted earnings-per-share of $2.13 was a $0.27, or 14.5%, improve from the prior 12 months and $0.01 above expectations.

For 2021, income grew 13.6% to $93.8 billion whereas adjusted earnings-per-share elevated 22% to $9.80.

Supply: Investor Presentation

J&J has elevated its dividend for 59 consecutive years. The inventory yields 2.4% proper now. As well as, we count on roughly 6% annual earnings-per-share development over the following 5 years.

Lastly, the inventory has a P/E of 17.1, barely above our honest worth P/E estimate of 17. All collectively, we count on complete returns of 8.0% per 12 months for J&J inventory.

Click on right here to obtain our most up-to-date Certain Evaluation report on J&J (preview of web page 1 of three proven under):

No-Charge DRIP Dividend Aristocrat #4: S&P World Inc. (SPGI)

S&P World is a worldwide supplier of monetary providers and enterprise info. The corporate has generated sturdy development over the previous a number of years.

S&P World reported fourth quarter and full-year earnings on February eighth, 2022, and outcomes had been higher than anticipated on each the highest and backside traces. Fourth quarter income got here to $2.09 billion, a achieve of 12% year-over-year. S&P noticed development in all 4 of its enterprise traces.

For the complete 12 months, income was up 11% to $8.3 billion. Internet revenue for the 12 months was 29% larger to $3.02 billion, and on a per-share foundation rose 17% on an adjusted foundation from $11.69 to $13.70.

For the fourth quarter, web revenue was up 17% on an adjusted foundation to $762 million as income features and productiveness enhancements produced larger margins. On a per-share foundation, earnings had been $3.15, a 16% improve year-over-year.

We count on 8% annual EPS development over the following 5 years. The inventory has a low dividend yield of 0.9%, however raises its dividend at a excessive fee. Shares look like simply barely overvalued. We estimate complete return potential at 8.0% per 12 months over the following 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on S&P World (preview of web page 1 of three proven under):

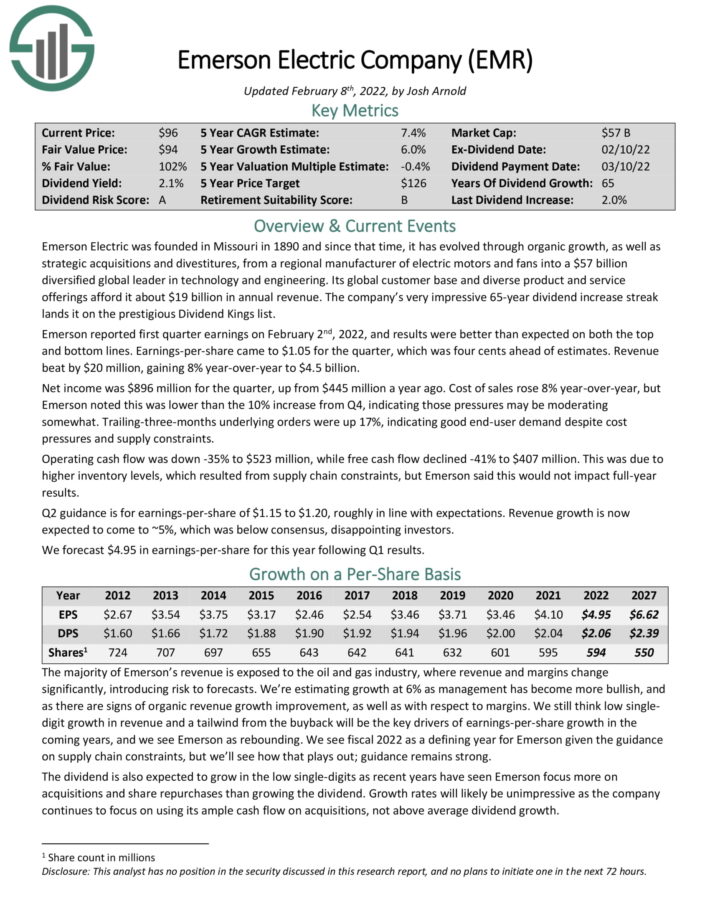

No-Charge DRIP Dividend Aristocrat #3: Emerson Electrical (EMR)

Emerson Electrical is a perfect candidate for a no-fee DRIP program, as the corporate has elevated its dividend for over 60 years in a row. Emerson Electrical was based in Missouri in 1890. Right this moment, it generates $18+ billion in annual income.

Emerson is organized into two main reporting segments known as Automation Options and Industrial & Residential Options. Automation Options helps producers decrease power utilization, waste, and different prices of their processes. The Industrial & Residential Options phase makes merchandise that shield meals high quality and security, in addition to increase effectivity within the manufacturing course of.

Shares seem barely overvalued proper now. Nevertheless, we count on annual EPS development of 6%, and Emerson inventory has a 2.2% dividend yield. Total, we count on complete returns of 8.0% per 12 months by 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on Emerson Electrical (preview of web page 1 of three proven under):

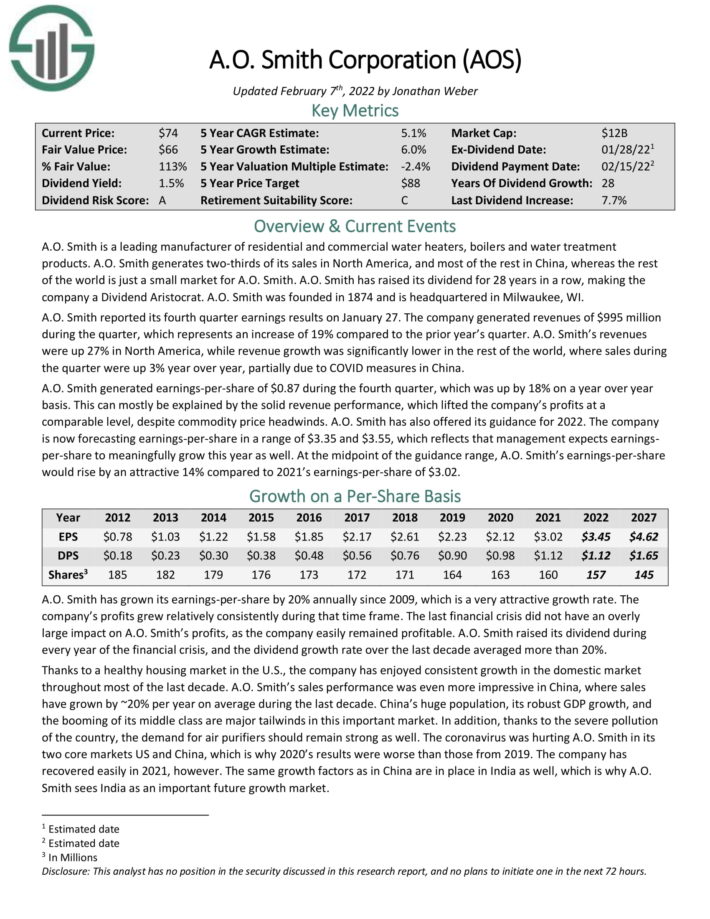

No-Charge DRIP Dividend Aristocrat #2: A.O. Smith (AOS)

A.O. Smith is a number one producer of residential and industrial water heaters, boilers and water remedy merchandise. A.O. Smith generates the vast majority of its gross sales in North America, with the rest from the remainder of the world. It has category-leading manufacturers throughout its varied geographic markets.

The corporate is probably best-known for its water heaters. A.O. Smith has raised its dividend for 27 years in a row, together with an ~8% improve in October 2021.

Over the long-term, we imagine that A.O. Smith can develop its EPS by 6% per 12 months. With a 1.7% dividend yield and annual dividend will increase, A.O. Smith is an interesting inventory for dividend development buyers.

We count on 8.1% annual returns by 2027.

Click on right here to obtain our most up-to-date Certain Evaluation report on A.O. Smith (preview of web page 1 of three proven under):

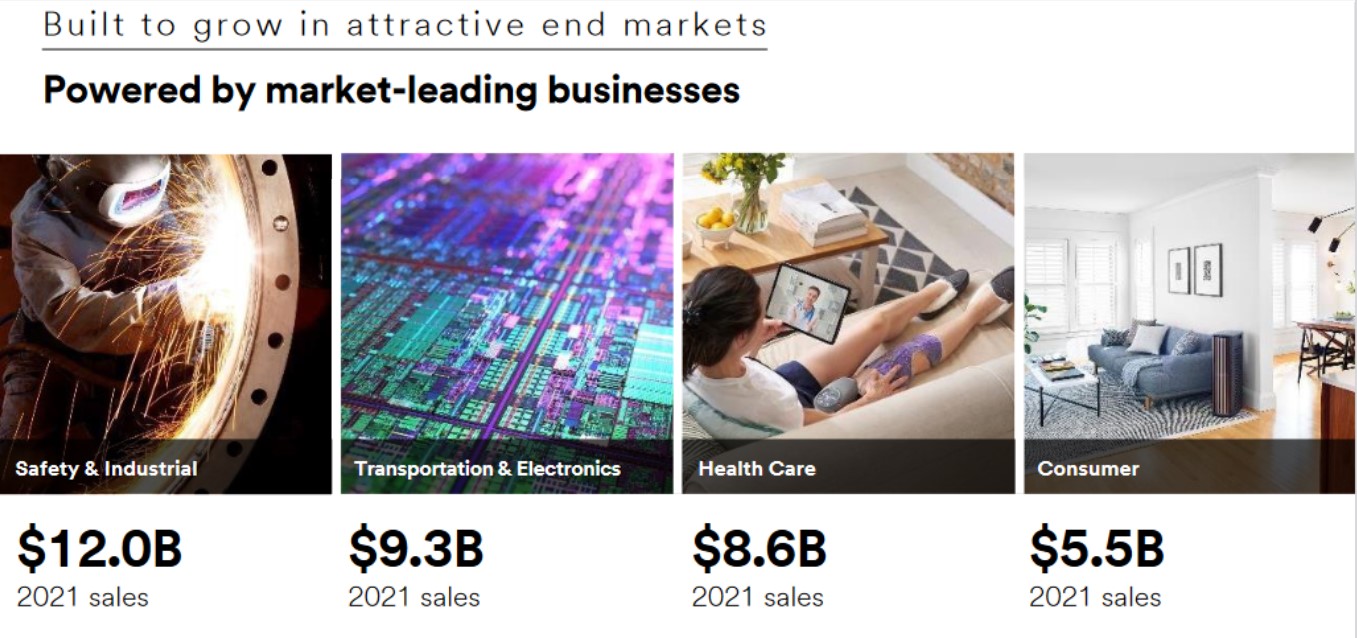

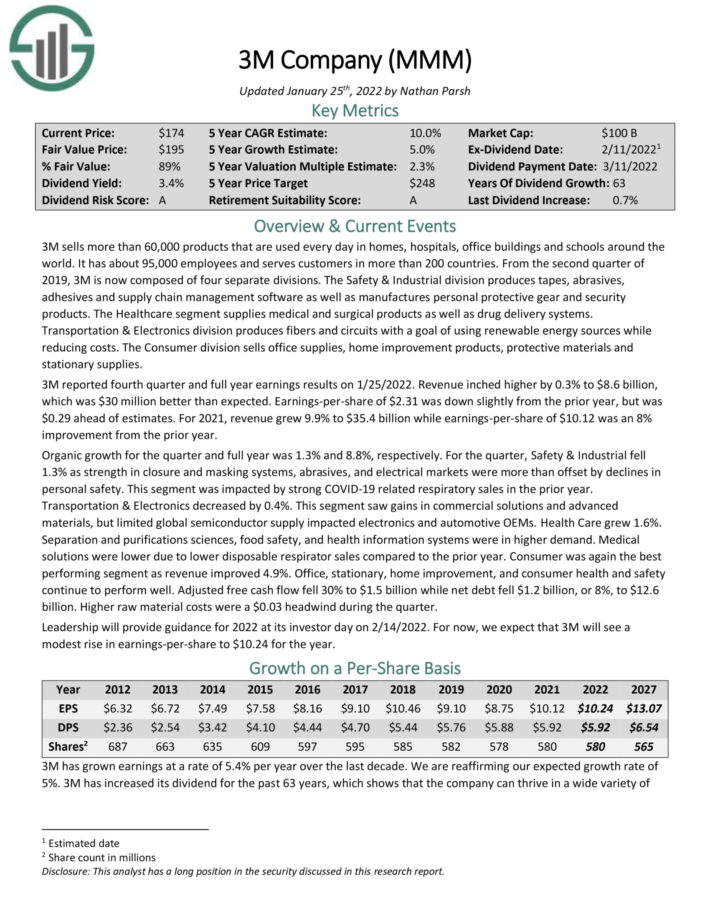

No-Charge DRIP Dividend Aristocrat #1: 3M Firm (MMM)

3M sells greater than 60,000 merchandise which can be used every single day in houses, hospitals, workplace buildings and faculties across the world. It has about 95,000 workers and serves prospects in additional than 200 nations.

Supply: Investor Presentation

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare phase provides medical and surgical merchandise in addition to drug supply methods. Transportation & Digitals division produces fibers and circuits with a objective of utilizing renewable power sources whereas decreasing prices. The Client division sells workplace provides, residence enchancment merchandise, protecting supplies and stationary provides.

3M reported fourth-quarter and full 12 months earnings outcomes on 1/25/2022. Revenue inched larger by 0.3% to $8.6 billion, which was $30 million higher than anticipated. Earnings–per–share of $2.31 was down barely from the prior 12 months, however was $0.29 forward of estimates.

For 2021, income grew 9.9% to $35.4 billion whereas earnings–per–share of $10.12 was an 8% enchancment from the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on 3M (preview of web page 1 of three proven under):

Ultimate Ideas and Further Assets

Enrolling in DRIP shares could be a good way to compound your portfolio revenue over time.

Further sources are listed under for buyers all in favour of additional analysis for DRIP shares.

For dividend development buyers all in favour of DRIP shares, the 15 firms talked about on this article are an ideal place to start out. Every enterprise may be very shareholder pleasant, as evidenced by their lengthy dividend histories and their willingness to supply buyers no-fee DRIP shares.

At Certain Dividend, we frequently advocate for investing in firms with a excessive chance of accelerating their dividends each 12 months.

If that technique appeals to you, it could be helpful to flick through the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].