Guest Contribution by ValueWalk

New investors are cautioned to exercise due diligence over the coming months, as the stock market is being challenged by rising interest rates, and the potential for slowing economic activity.

This comes against a backdrop of several bearish developments, such as central banks tightening their monetary policy, which has now started filtering through to real estate markets.

Multiple factors are now driving a volatile market.

Sure Dividend recommends new investors consider high-quality dividend stocks such as the Dividend Aristocrats, a select group of 67 S&P 500 stocks with 25+ years of consecutive dividend increases.

There are currently 67 Dividend Aristocrats. You can download an Excel spreadsheet of all 67 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

As investors continue to seek recession-proof stocks, these 5 dividend payers will provide their portfolios with substantial buoyancy in the coming months.

JPMorgan Chase & Co (JPM)

As the biggest bank in the U.S. with more than $417 billion in market capitalization, JPMorgan Chase & Co has exhibited strong performance throughout much of the year.

For starters, the bank reported $35.71 billion in revenues for the quarter ending June 2023, which represented a 20.58% increase from the same period last year. Total net income experienced similar growth, with the bank seeing more than $14.47 billion in total net income for the period ending June 2023, marking a 67.33% year-over-year increase.

JPM is currently trading 8.98% below its earlier peak in the year, however, year-to-date performance has remained steady at 6.40% at the start of October. As a trailblazer in the banking and financial sector, JPM holds a steady dividend yield of 2.92%.

Why choose JPM as a beginning investor? Well, for any new investor who wants to minimize risk, JPM continues to outpace market volatility and remains largely unaffected by rising interest rates and infation.

Consolidated Edison (ED)

Beginners that are looking for a simple, yet reliable dividend income can look towards U.S. utility companies, many of which continue to see regional monopolies due to increasing demand, and higher utility costs.

Consolidated Edison (ED) is one of the utilities dividing picks on the more affordable side, with a current year range of $78.10 – $100.92 per share. In terms of dividend yield, ED provides a steady 3.97% return, which remains in line with other prominent utility dividend options.

On a year-to-date performance basis, prices have slipped just under 15% already, which could help play in favor of new investors who are looking to minimize their risk exposure to volatile stock options at the moment.

While overall market performance has remained somewhat stagnant this year, Consolidated Edison has a strong track record of raising dividend yields.

It has raised dividends for 46 consecutive years, making it one of the most reliable Dividend Aristocrats for short-term income investors.

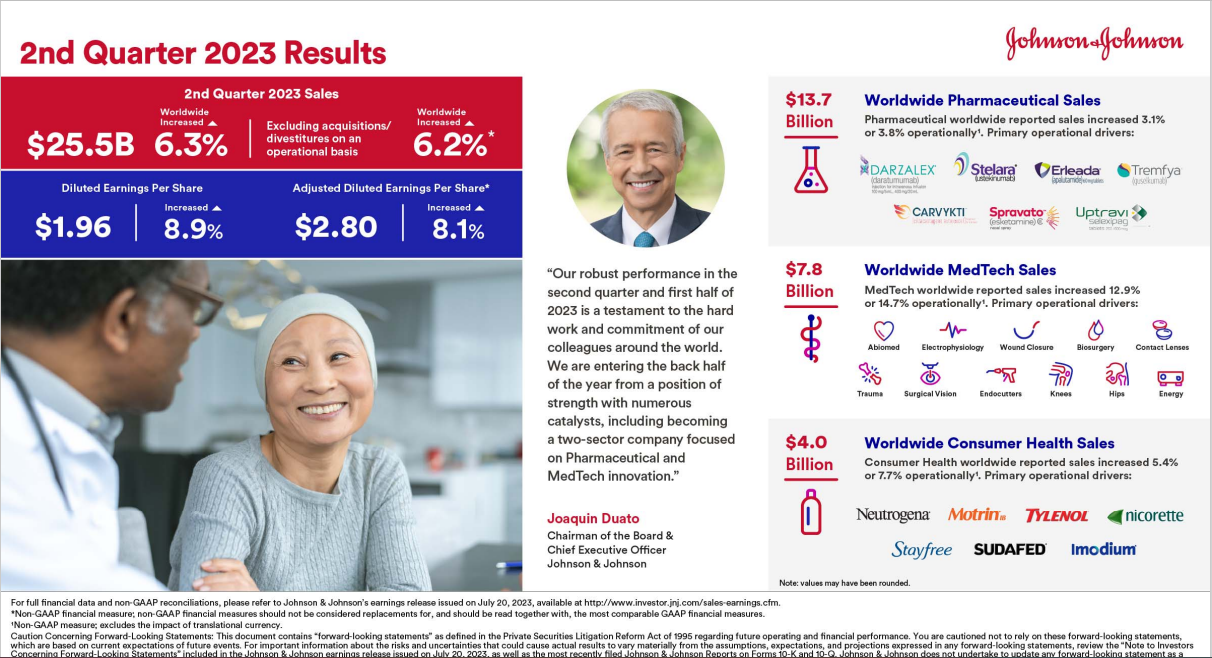

Johnson & Johnson (JNJ)

The American multinational pharmaceutical company, Johnson & Johnson has come under the magnifying glass during much of last year due to a lawsuit settlement case, and this year already, new legislation to lower the cost of prescription drugs could hamper JNJ in the U.S.

However, JNJ remains a robust behemoth that currently operates three business segments, including consumer health, pharmaceuticals, and medtech.

Source: Investor Presentation

Each of these has proven to provide the company with both near and long-term success, due to their global footprint, despite the company now edging closer to losing some of its exclusivity for some of its biggest drugs in the U.S. market.

Nonetheless, JNJ remains one of the biggest healthcare-focused companies, with all three key business segments generating more than $79 billion in revenue last year, despite demand for COVID-19 vaccines now reaching an all-time low.

J&J stock provides an opportunity to enter the big-pharma and MedTech market at a more reasonable pace, that provides them with trusted performance, and ongoing company development.

Wells Fargo (WFC)

As the second bank on our watch list, Wells Fargo & Co is currently trading at almost 20% above its lowest point of the year, which saw stocks plummet to a low of $36.23 per share back in March.

Since tumbling by more than 22.30% earlier in the year, stock performance has managed to shape up, peaking again in July at around $47.13 per share before sliding towards its current range of $39.44 – $40.76 per share.

Current dividend yields of 3.53% remain somewhat higher than the likes of JPM, however, investors have slower growth potential in terms of the bank’s long-term outlook, despite WFC having reported positive quarterly earnings for the period ending June 2023.

Overall, the bank generated $18.82 billion in revenues, a 14.34% year-over-year improvement. More importantly, the bank, and mortgage lender have managed to take advantage of the higher interest rate environment over the last two quarters, further surpassing analysts’ estimates.

For the most recent quarter, WFC reported earnings of $1.25 per share, outpacing the expected $1.15 per share, surprising estimates by 8.70%. WFC stocks have a positive rating, and analysts look to keep a “Buy” consensus on Wells Fargo, seeing as it provides investors with a positive upside and better earnings in the near term.

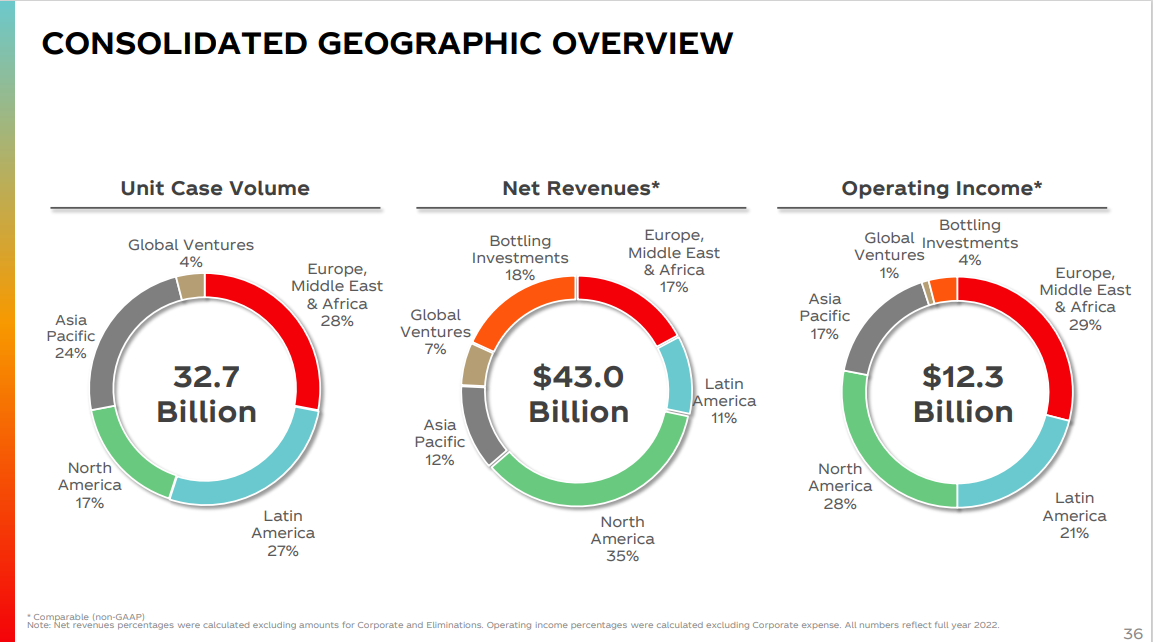

Coca Cola (KO)

Perhaps one of the most recognizable, and widely available brands in the world, Coca-Cola has raised its base annual dividend earnings for more than 61 consecutive years, making it one of the most prominent Dividend Kings.

Source: Investor Presentation

While many investors have historically shifted their attention away from consumer companies such as Coca-Cola during slower growth periods, and rather focus on growth stocks in tech and software, KO has remained unaffected by volatile headwinds, and less price sensitive to higher interest rates due to low borrowing rates.

KO has a steady dividend yield of 3.32%, and current share prices are trading 13% below their earlier peak of the year. This year, stock performance has slipped by 11.87% year to date, due to inflationary pressure causing the company to raise prices across numerous markets.

While KO may often be impacted by lower consumer spending, and fluctuating currency movements in foreign markets, these near-term developments remain a smaller issue for the company considering the long-turn upside potential.

Operating around 26 brands in its portfolio, these generated more than $1 billion in annual sales last year, and during its most recent quarter, the company reported $11.79 billion in revenue, which represented a 5.71% increase from the same period last year. Not bad for a company that primarily sells consumer beverages.

Concluding Thoughts

New investors need to take note of how market conditions are unfolding and the impact it’s driving on dividend stocks. In addition, new investors need to consider their long-term performance and income growth upside.

Some stocks provide new investors with extremely high dividends, but their financial performance has been anything but extraordinary, meaning their dividends could be cut.

Instead of taking a stake in extreme high-yield stocks, new investors should weigh the risks and rewards to determine how well these stocks will complement your portfolio over the long run.

This is why new investors would be wise to consider high-quality dividend growth stocks such as those mentioned in this article.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].