Up to date on June tenth, 2022 by Aristofanis Papadatos

Airline shares was averted by worth and revenue traders, and for good cause. Airways are extremely weak throughout recessions. They’re additionally weak to industry-specific forces that may erase earnings for a number of years, and even drive some airways out of enterprise.

That’s why legendary worth investor Warren Buffett had, for a few years, averted airways and suggested traders to do the identical.

Nonetheless, because of a collection of bankruptcies and mergers, the airline {industry} has consolidated. In consequence, the 4 main U.S. airways–American Airways (AAL), Delta Air Traces (DAL), United Airways Holdings (UAL) and Southwest Airways (LUV)–now have 80% market share.

Trade consolidation led Buffett to vary his stance and buy important stakes within the 4 main U.S. airways in 2016. All 4 airways have been amongst Buffett’s prime 20 inventory holdings in 2016.

Nonetheless, the airline {industry} went via an unprecedented downturn as a result of coronavirus disaster in 2020-2021. In consequence, the Oracle of Omaha bought all his shares of airline shares in 2020.

You may see your entire listing of Buffett’s largest inventory holdings right here.

With all this in thoughts, we created a downloadable listing of airline shares. You may obtain an Excel spreadsheet of all airline shares (with metrics that matter like dividend yields and price-to-earnings ratios) by clicking the hyperlink beneath:

This text will talk about our prime 6-ranked airline shares, in accordance with the Positive Evaluation Analysis Database. The shares are ranked in accordance with anticipated whole returns over the following 5 years, listed so as of lowest to highest.

Desk Of Contents

Trade Overview

Because of the {industry} consolidation, many airways loved robust revenue margins in 2015-2019.

Nonetheless, airways at the moment are going via one of many fiercest downturns of their historical past as a result of coronavirus disaster. Because of the measures taken by the U.S. authorities in an effort to restrict the enlargement of the virus, the air visitors plunged roughly 80% in 2020.

Even in 2021, the entire variety of air vacationers around the globe was solely 47% of the pre-pandemic degree. Consequently, all of the airways burnt money at a document tempo in 2020-2021 and remained solvent solely because of the immense fiscal stimulus packages supplied by the federal government.

Thankfully, because of the large distribution of vaccines worldwide, the pandemic has begun to subside and the airline {industry} has begun to get better from this disaster. In response to the most recent forecast of IATA, the entire variety of passengers is anticipated to succeed in 4.0 billion by 2024 and thus it’s going to exceed the pre-pandemic degree (in 2019) by 3% in that yr.

The airways are additionally going through one other headwind, specifically the surge of inflation to a 40-year excessive this yr. Gasoline prices have skyrocketed as a result of rally of the oil worth to a 13-year excessive, which has resulted from the sanctions of western international locations on Russia for its invasion in Ukraine. Nonetheless, because of pent-up demand for flights, airways try to go their incremental prices to their clients.

Traders ought to be conscious that each one the airways of this text have suspended their dividends since early 2020 as a result of influence of the pandemic on their enterprise.

On this article, we’ll examine the anticipated 5-year returns of the six main U.S. airways. Shares are ranked by way of 5-year anticipated whole returns, from lowest to highest.

Greatest Airline Inventory #6: Delta Air Traces (DAL)

Delta Air Traces is likely one of the largest worldwide airways, serving 275 locations in 52 international locations. Delta purchased a refinery in 2012 with a purpose to restrict its threat of excessive jet gasoline costs. Nonetheless, a single refinery isn’t enough to remove this threat completely. It limits the impact of a rise within the unfold between the costs of jet gasoline and crude oil however doesn’t present any safety towards a rise within the worth of crude oil.

As well as, Delta has proved incapable of hedging its gasoline value. It was hedging its gasoline value earlier than the downturn of the oil market in 2014-2016. Consequently, it incurred heavy losses from these hedges when the worth of jet gasoline collapsed. Then, on account of that traumatic expertise, it stopped hedging its gasoline value so it was uncovered to rising jet gasoline costs within the oil worth restoration of 2016-2018.

Delta incurred extreme losses in 2020-2021 as a result of collapse of worldwide air visitors amid the pandemic. It was additionally caught with a excessive debt load on this disaster and thus it survived principally because of the immense monetary support of the federal government.

Thankfully, the pandemic has begun to subside and thus Delta is poised to turn into worthwhile once more this yr. Within the first quarter, its income was 79% of its pre-pandemic income and the corporate posted a loss per share of -$1.23. Nonetheless, it exceeded the analysts’ consensus by $0.04.

Even higher, enterprise momentum has accelerated within the second quarter. Delta expects its income to return to its pre-pandemic degree on this quarter and its working margin to rebound to 13%-14%.

Supply: Investor Presentation

Furthermore, Delta expects its refinery to scale back gasoline prices by $0.37 per gallon, although it nonetheless expects excessive gasoline prices ($3.60-$3.70 per gallon), thus confirming that its refinery can do little to mitigate gasoline prices. Nonetheless, the essence is that Delta enjoys accelerated client demand and therefore it’s on monitor for a powerful restoration this yr. We count on the airline to turn into worthwhile this yr after two years of losses, with earnings per share round $2.95.

Given the restoration of Delta off a low comparability base, we count on 18% common annual development of earnings per share over the following 5 years. Alternatively, Delta is presently buying and selling at a price-to-earnings ratio of 12.5, which is increased than the historic common price-to-earnings ratio of 8.3 of the inventory.

If the inventory reverts to its common valuation degree in 5 years, it’s going to incur a -7.9% annualized contraction of its earnings a number of. In consequence, we imagine the inventory can provide an 8.6% common annual return over the following 5 years.

Greatest Airline Inventory #5: Alaska Air Group (ALK)

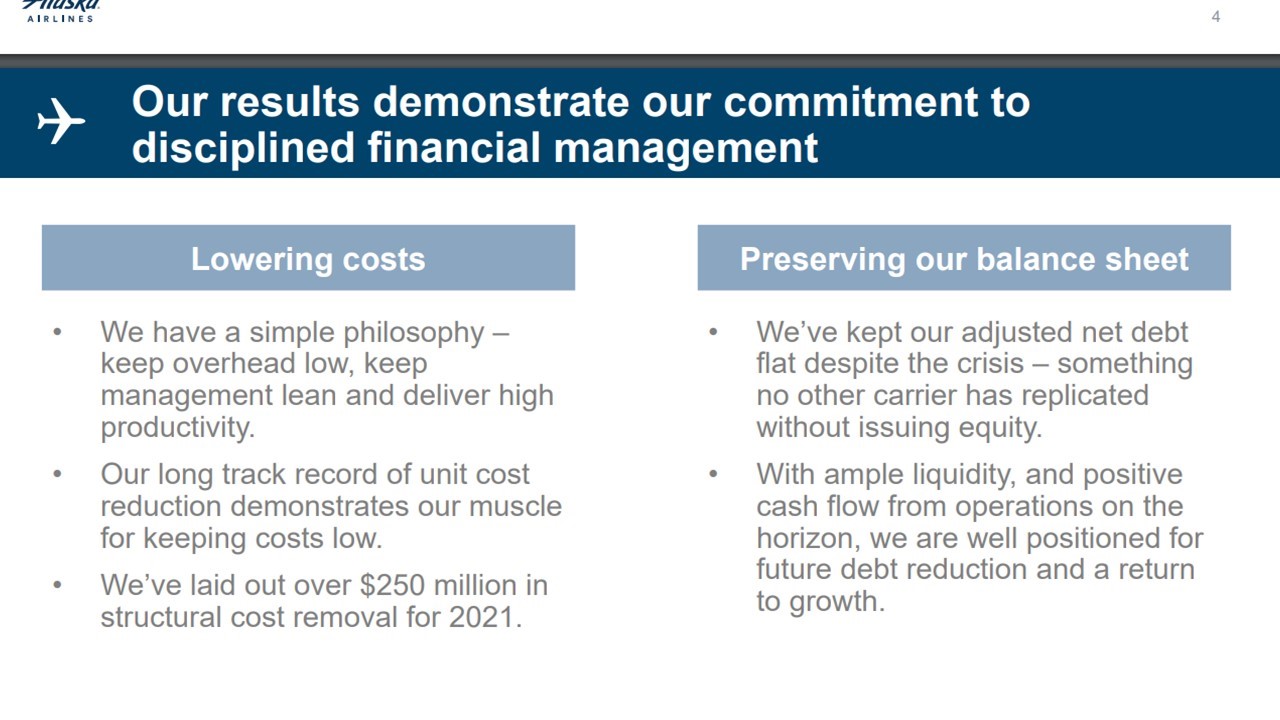

Alaska Air Group serves greater than 115 locations within the U.S., Mexico, Costa Rica and Canada. The corporate operates with a low-cost enterprise mannequin with a purpose to safe a big aggressive benefit over its friends.

Supply: Investor Presentation

Because of its low-cost mannequin and its respectable stability sheet, Alaska Air has endured the coronavirus disaster far more readily than different airways, that are extremely leveraged. Alaska Air has internet debt of $7.0 billion, which is increased than its market capitalization of $6.1 billion however not excessive.

Furthermore, the airline is recovering strongly from the pandemic proper now. It just lately offered optimistic steerage for the second quarter, anticipating a load issue of 87%-88% and income development of 12%-14% in comparison with the pre-pandemic degree. We thus count on Alaska Air to publish a powerful revenue per share round $4.40 this yr.

Given the continuing restoration of Alaska Air, we count on 9% common annual development of earnings per share over the following 5 years. Furthermore, the inventory is presently buying and selling at a ahead price-to-earnings ratio of 10.5, which is barely decrease than its historic common price-to-earnings ratio of 11.0.

If the inventory trades at its common valuation degree in 5 years, it’s going to get pleasure from a 1.0% annualized enlargement of its earnings a number of. In consequence, we imagine the inventory can provide a ten.1% common annual return over the following 5 years.

Greatest Airline Inventory #4: Hawaiian Holdings (HA)

Hawaiian Holdings is the biggest air provider in Hawaii, transferring about 12 million passengers per yr below regular enterprise situations. It has a market capitalization of $0.9 billion, the bottom among the many airways mentioned on this article.

Hawaiian hedges its gasoline prices however that is a lot simpler stated than performed. To make sure, within the years 2012-2014, when the worth of oil was buying and selling round $100 per barrel, the airline posted poor earnings.

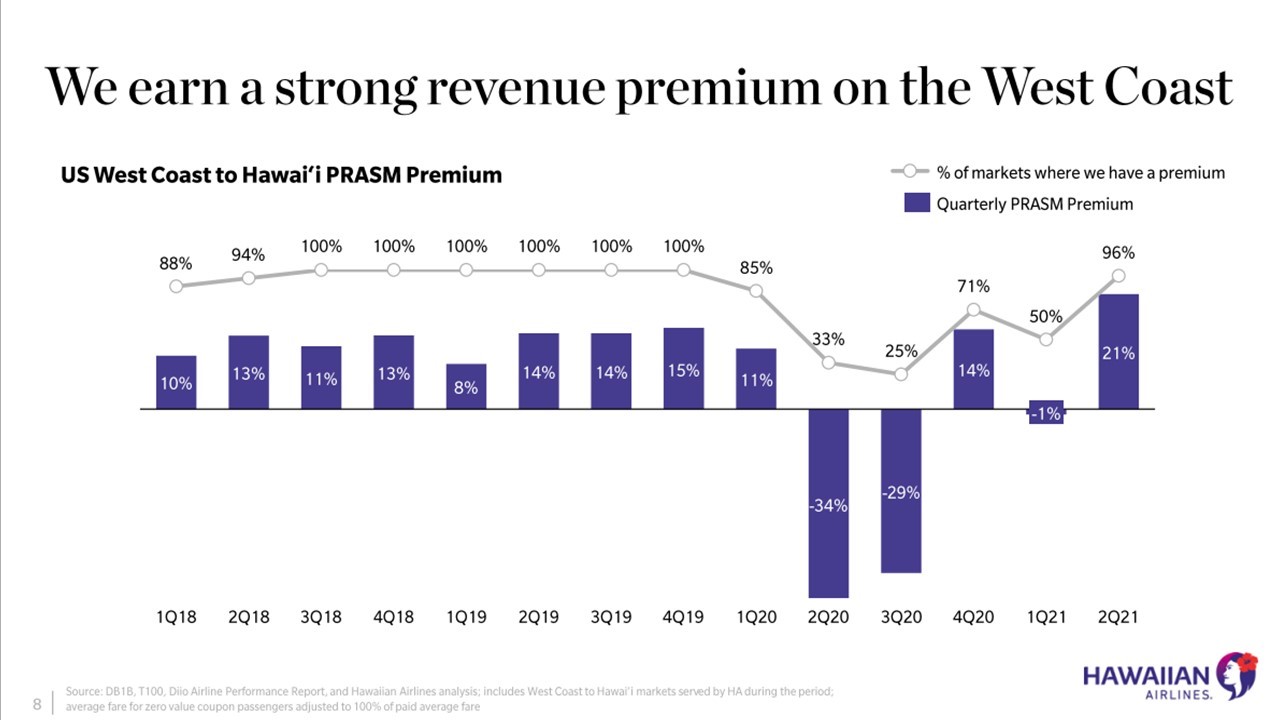

Hawaiian enjoys a significant aggressive benefit, specifically its dominant place in Hawaii. Because of this benefit, the airline has loved premium fares in comparison with the fares of the West Coast.

Supply: Investor Presentation

Nonetheless, Hawaiian has been severely harm by the coronavirus disaster. The airline is considerably extra weak to downturns than its friends on account of its lack of diversification and its tie to vacationer visitors. This helps clarify the extreme mixture losses per share of -$19.51 in 2020-2021.

These losses exceed the present market capitalization of the inventory and therefore they increase a pink flag. Given additionally the excessive internet debt of $2.3 billion, which is sort of triple the market capitalization of the inventory, Hawaiian shall be extremely weak within the occasion of a protracted downturn.

Furthermore, Hawaiian has a lot weaker enterprise momentum than most of its friends this yr. Whereas Southwest, Delta, United Airways and Alaska Air are poised to turn into worthwhile this yr, Hawaiian is anticipated to publish a cloth loss for a 3rd consecutive yr. The corporate doesn’t count on its capability to return to pre-pandemic ranges anytime quickly whereas it has not offered steerage for the complete yr on account of excessive uncertainty.

Because of the challenges going through Hawaiian, we assume a good price-to-earnings ratio of seven.0 for the inventory. As well as, we count on the corporate to earn roughly $4.00 per share by 2027. In consequence, we count on the inventory to commerce round $28 by 2027 and thus provide a 12.6% common annual return over the following 5 years.

General, whereas Hawaiian is recovering far more slowly than its friends, the inventory seems to have been punished to the intense by the market.

Greatest Airline Inventory #3: Southwest Airways (LUV)

Southwest Airways is the second-largest U.S. provider primarily based on market capitalization and serves 121 locations in 42 states and 10 near-international international locations. Southwest stands out amongst its friends for its distinctive consistency.

Whereas its friends exhibit extremely cyclical efficiency and have a tendency to publish losses throughout recessions, Southwest remained worthwhile for 47 consecutive years, till the onset of the pandemic.

Supply: Investor Presentation

Southwest additionally stands out in its sector for 2 extra causes, specifically its robust free money flows and its low debt degree. It’s the solely airline that posted optimistic free money flows in each single yr within the decade resulting in the pandemic. It additionally has by far the bottom debt-to-assets ratio. Its internet debt is simply $9.4 billion, which is barely 35% of its market capitalization.

Because of its robust stability sheet, Southwest enjoys by far the best score from the three main credit standing corporations in its peer group. Its superior stability sheet is of paramount significance, because it provides the corporate resilience throughout downturns. This helps clarify its above talked about consistency, which is exclusive in its sector.

The market clearly appreciates the distinctive consistency and the superior stability sheet of Southwest with a better valuation a number of. The inventory has held a median price-to-earnings ratio of 16.8 over the past decade, in contrast with single-digit ratios throughout the {industry}. As Southwest has by far the strongest stability sheet in its peer group, it’s the most resilient airline through the ongoing coronavirus disaster.

Furthermore, Southwest has begun to get better strongly from the pandemic. In its newest enterprise replace, the corporate said that it expects 12%-15% income development within the second quarter because of robust load elements and accelerated demand for summer time journey. We count on the airline to turn into worthwhile this yr after two years of losses, with earnings per share round $2.70.

Given the robust restoration of Southwest off a low comparability base, we count on 18% common annual development of earnings per share over the following 5 years. Alternatively, Southwest is presently buying and selling at a price-to-earnings ratio of 15.9, which is increased than our truthful worth estimate of 13. If the inventory reaches our truthful valuation degree in 5 years, it’s going to incur a -4.0% annualized contraction of its earnings a number of. In consequence, we imagine the inventory can provide a 13.3% common annual return over the following 5 years.

Greatest Airline Inventory #2: American Airways (AAL)

American Airways is the world’s largest airline in income and fleet measurement, with hundreds of day by day flights to greater than 365 locations in 61 international locations. The corporate emerged from Chapter 11 chapter in December 2013.

American Airways has a extra unstable efficiency document than its friends, primarily on account of its excessive sensitivity to gasoline prices, as the corporate doesn’t hedge its gasoline value. The worth of jet gasoline has jumped to a 13-year excessive this yr as a result of ongoing warfare in Ukraine and thus it supplies a powerful headwind to American Airways.

Furthermore, American Airways has been caught within the ongoing coronavirus disaster off-guard, with an extreme debt pile. The debt-to-assets ratio has climbed from 100% earlier than the pandemic to 114% whereas its internet debt has climbed from $54.4 billion to $62.3 billion. This quantity is sort of 6 instances the market capitalization of the inventory and therefore it’s undoubtedly extreme.

Furthermore, the annual curiosity expense of American Airways has practically doubled through the pandemic, from $1.1 billion to $1.9 billion. The corporate has posted destructive free money flows in every of the final 5 years, partly on account of its excessive capital bills.

All these elements render the inventory by far the riskiest in its peer group within the ongoing downturn of the aviation {industry}. That is additionally evident from the truth that American Airways is anticipated to incur a loss for a 3rd consecutive yr in 2022, in sharp distinction to Southwest, Delta, United Airways and Alaska Air, that are anticipated to return to profitability this yr.

Alternatively, leverage is a double-edged sword. Which means that American Airways is a perfect inventory for many who are assured in a sustained, multi-year restoration of the aviation {industry}. American Airways has offered a extremely optimistic outlook.

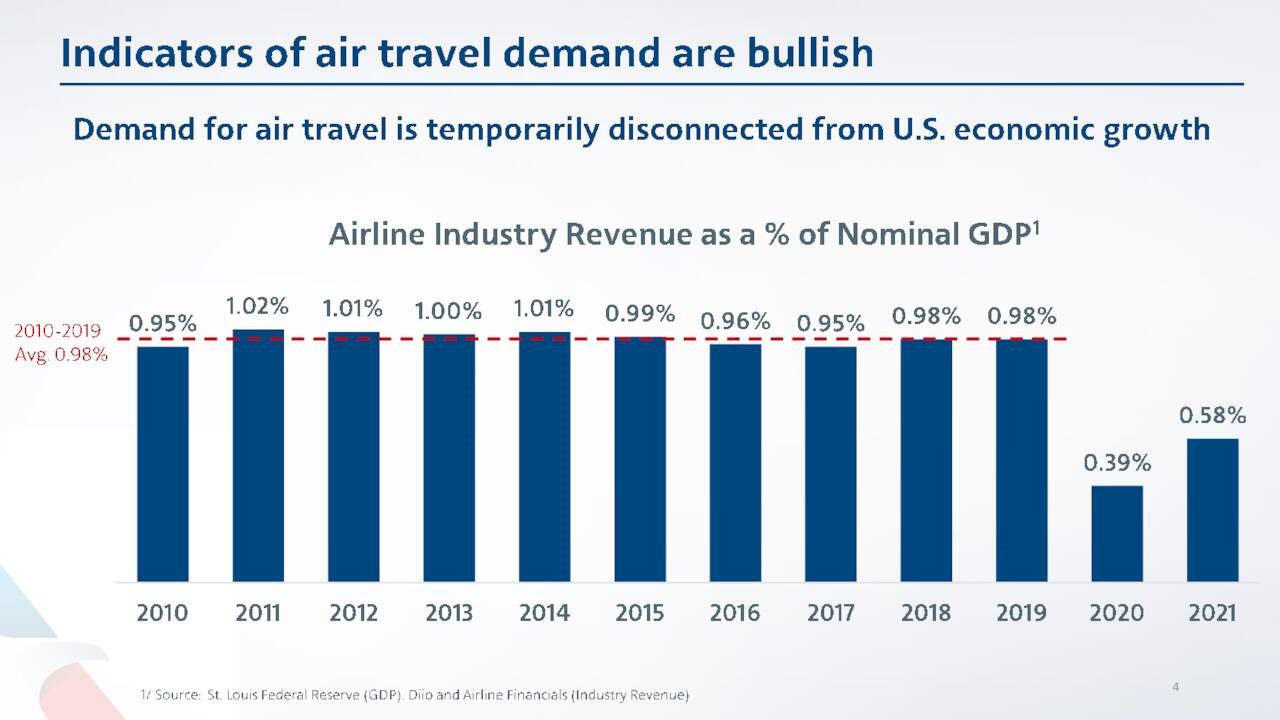

Supply: Investor Presentation

As proven within the above chart, whole airline {industry} income has at all times moved in tandem with financial development. This relationship has been quickly disrupted as a result of pandemic however it’s affordable to count on the income of the airline {industry} to rebound strongly within the upcoming years to meet up with international GDP. Such a rebound will present a powerful tailwind to the enterprise of American Airways.

As we count on American Airways to publish a loss this yr, we have now used a mid-cycle degree of earnings per share of $3.50 for our calculations. Given the anticipated restoration of American Airways but in addition its extreme debt pile, we count on 7% common annual development of earnings per share over the following 5 years off its mid-cycle degree. Furthermore, the inventory is presently buying and selling at 4.4 instances its mid-cycle earnings.

Given the excessive debt load of the corporate, we assume a good price-to-earnings ratio of 6.0. If the inventory trades at its truthful valuation degree in 5 years, it’s going to get pleasure from a 6.3% annualized enlargement of its earnings a number of. In consequence, we imagine the inventory can provide a 13.7% common annual return over the following 5 years however we word that such a excessive return will materialize solely within the absence of one other downturn.

Greatest Airline Inventory #1: United Airways Holdings (UAL)

United Airways Holdings owns United Airways and Continental Airways and operates hundreds of flights each day to quite a few home and worldwide locations.

United launched 93 new routes in 2018, greater than another U.S. airline. Because of its technique, United generates a a lot increased portion of its revenues from worldwide flights than its friends. Because of its worldwide publicity, the corporate is considerably extra uncovered than its friends, as worldwide flights have been hit more durable than home flights thus far. Notably, United lowered its worldwide flights by 95% within the first stage of the pandemic on account of a collapse in demand.

Within the first quarter of 2022, its income was 19% decrease than the pre-pandemic degree and thus the corporate incurred a loss per share of -$4.24. Nonetheless, United has offered remarkably optimistic steerage for the second quarter. Administration said that it presently observes the best restoration in demand within the final 30 years and thus it expects a powerful revenue within the second quarter, with whole income per accessible seat mile 17% increased than the pre-pandemic degree.

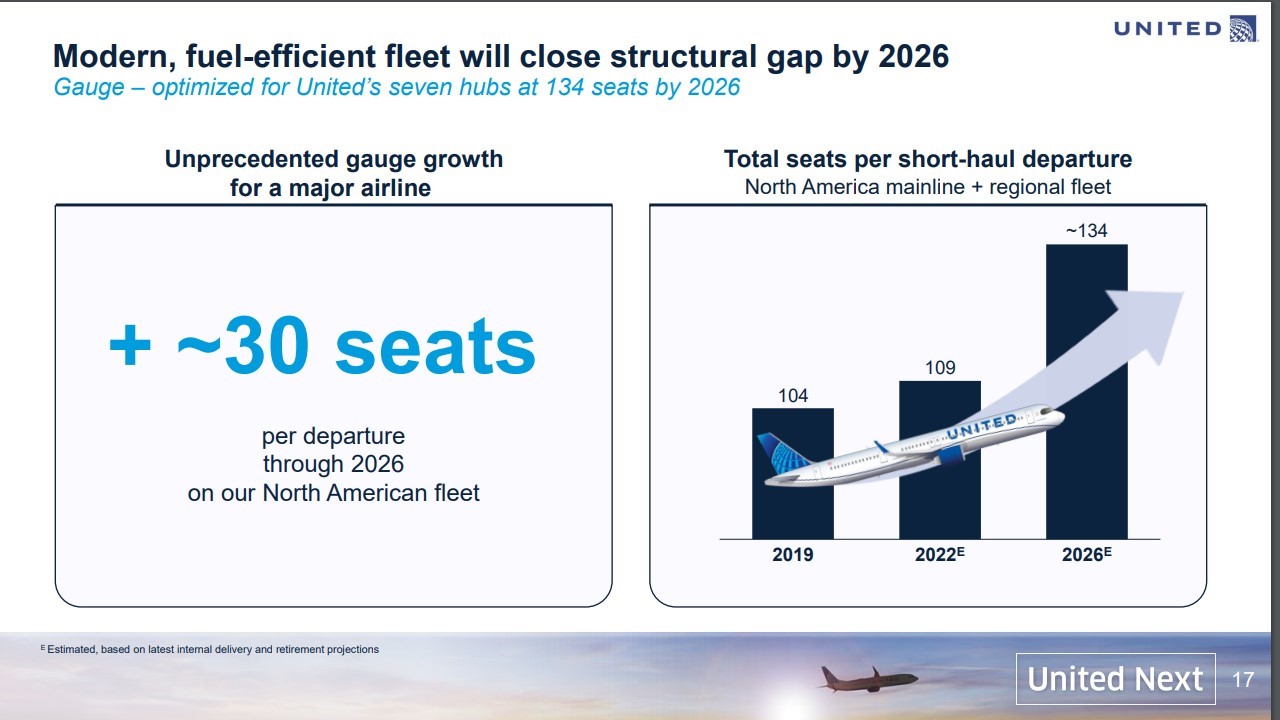

Furthermore, United is doing its greatest to extend the variety of seats of its fleet in an effort to enhance its effectivity.

Supply: Investor Presentation

The corporate has set a purpose to extend the entire seats per short-haul flight from 104 in 2019 to 134 by 2026.

Sadly, United has a excessive debt load, with internet debt of $44.7 billion, which is greater than triple the market capitalization of the inventory. If the airline enjoys a sustained restoration from the pandemic, it’s going to simply service its debt. Alternatively, it will likely be weak if it faces one other downturn within the close to future.

Because of the excessive debt load of United, we assume a good price-to-earnings ratio of seven.0 for the inventory. As well as, we count on the corporate to earn roughly $12.00 per share by 2027. In consequence, we count on the inventory to commerce round $84 by 2027 and thus provide a 14.3% common annual return over the following 5 years.

Closing Ideas

Airline shares are principally leveraged proxies for underlying U.S. and international financial development. So long as the financial system grows, the airways thrive however within the present downturn they’re all going via nice stress on account of their leveraged stability sheets.

Thankfully, the aviation {industry} has begun to get better from the pandemic, as persons are claiming again their regular way of life, after two years of social distancing. So long as international air visitors continues to get better, all of the above airways are prone to extremely reward those that buy them round their present inventory costs.

United presently presents the best 5-year anticipated return of the airline shares. Nonetheless, on account of its excessive debt load and its publicity to worldwide flights, the inventory carries a big quantity of threat, albeit with a excessive potential return as properly.

Southwest presents the third-highest anticipated return of the airline shares, however we imagine that it presents by far the best risk-adjusted annual return over the following 5 years because of its decrease threat profile.

Southwest posted a revenue for 47 consecutive years till 2020, whereas its friends have incurred heavy losses throughout previous recessions. Southwest additionally has by far the strongest stability sheet in its group. Because the resilience on this downturn is of paramount significance, we imagine that Southwest is your best option proper now for risk-averse traders.

Different Dividend Lists

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].