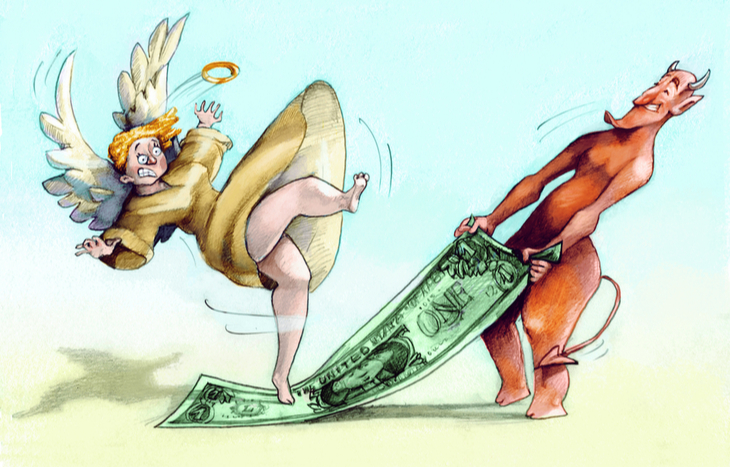

Crypto scams are available a wide range of variations. However probably, probably the most well-known is the dreaded rug pull. On this article, we’ll clarify what a rug pull is in addition to tips on how to attempt avoiding them.

Let’s begin with a primary clarification of what a rug pull consists of. These are basically initiatives the place the event group drums up curiosity within the token they created… Solely to desert the undertaking after sufficient outdoors funding {dollars} have poured in. Then the group cashes out and disappears with the funds raised. And ultimately, buyers are left with an asset that holds no worth.

That being stated, there a few variations on the theme of a rug pull…

Rug Pull No. 1: Limiting Sells

One of many newer (and notorious) examples is a rug pull by the use of limiting promote orders. This was how the builders of the Squid Recreation token made off with thousands and thousands from would-be buyers.

On this case, the Squid token was marketed as a play-to-earn token impressed by the Netflix collection Squid Recreation. The concept being that buyers would be capable of purchase tokens now as a way to play a forthcoming recreation based mostly on the present. Curiosity was rampant. And shortly after greater than 40,000 buyers drove the worth above $2,500 a token, the group behind it pulled the plug and made off like bandits.

This was achieved by coding an anti-selling mechanism into the token. On the time, it may have been seen as harmless. The thought being that the builders didn’t wish to have the worth pushed down by a number of promoting earlier than the sport was launched. However ultimately, that was clearly not the case. The token all however vanished. And buyers misplaced nearly every part they invested.

No. 2 The Liquidity Steal

To ensure that a coin listed on a serious crypto trade like Coinbase or Crypto.com, the token has to have sufficient liquidity. All this boils all the way down to is there must be sufficient tokens accessible in order that various them may be purchased or offered with out having an affect available on the market value. The extra steady an asset worth is amidst shopping for or promoting, the extra liquidity it has. And vice versa.

As a result of most centralized exchanges require a specific amount of liquidity earlier than itemizing a token, they’re often proof against liquidity steals. Decentralized exchanges (DEX) are a distinct story although. As a result of there’s little to no oversight on how a lot liquidity is supplied for any given token, merchants of latest cash on most of these exchanges tackle a bit extra threat.

Let’s say some new token exhibits up. It’s getting a number of consideration on Reddit. A few widespread YouTubers speak it up. And it’s received an energetic presence on Telegram and Twitter. However the one place to choose up one in every of these new tokens is on a decentralized trade. Whereas that doesn’t imply it’s a rug pull in and of itself, it ought to give pause.

The creators of this new token solely traded on a DEX may have the flexibility to yank all the tokens within the liquidity pool. This, in flip, drives the worth of the tokens all the way down to zero. And in all chance, cash invested on this new token won’t ever be recovered.

Additional Variations of a Rug Pull

Along with restrict sells and liquidity steals, there are additionally your run-of-the-mill pump-and-dump schemes. That is when the creators of a token maintain onto a big provide of it. When the worth goes up, they dump the quantity they maintain, money out and head off on a years-long trip.

There are additionally conventional Ponzi schemes that may occur in crypto markets. Whereas these aren’t conventional rug pulls, they’re one thing to look out for. One of the crucial well-known examples was OneCoin.

OneCoin wasn’t even an precise cryptocurrency – although it was marketed as such. It was truly a centralized “foreign money” host on OneCoin’s servers. There was no blockchain mannequin. It was by no means traded. And it couldn’t even be used to purchase something. There was no fee system for it. However ultimately, the creators of this have been in a position to half an estimated $4 billion from buyers.

The Backside Line on Rug Pulls

To sum issues up, there’s nonetheless loads to be cautious about within the crypto world. Rug pulls are simply one in every of many. The dearth of rules within the crypto world are each a blessing and a curse. A lot of the impetus behind crypto was to keep away from conventional banking. This lack of oversight has led to a number of fraudulent habits.

For context, rug pulls stole an estimated $2.8 billion from buyers in 2021. Nevertheless, a document $30 billion of investor {dollars} poured into crypto markets in 2021. So fraudulent actions make up a small portion of precise buying and selling. Nonetheless, it’s one thing to be conscious of.

So on the very least, the subsequent time you hear concerning the newest and biggest “moonshot” debuting on a DEX, you’re finest off not trusting your intestine… Or strangers on the web.

Listed here are a few guidelines of thumb we use to keep away from crypto scams:

- Know the liquidity

- Learn the token’s whitepaper (If there isn’t one, that’s a purple flag)

- Study concerning the builders (In the event that they haven’t doxed the group, that’s a purple flag)

- Verify to see what number of tokens have been or shall be burned (no point out of it is a purple flag)

There’ll all the time be a brand new spherical of intelligent crooks. They’ll provide you with information methods to get rookie buyers to half with their cash. And sure, a few of these actions are certainly unlawful. However the decentralized nature of DeFi makes it very tough to trace down and prosecute crypto crooks. And that is more likely to be the case for the approaching future… Whether or not it’s a rug pull or some new-fangled option to rip off crypto buyers.

Earlier than you resolve to leap into a brand new funding, check out our crypto calculator. If the projected returns sound too good to be true, they only may be. There are lots of funding alternatives to think about right this moment…

Matthew Makowski is a senior analysis analyst and author at Funding U. He has been finding out and writing concerning the markets for 20 years. Equally comfy figuring out worth shares as he’s reductions within the crypto markets, Matthew started mining Bitcoin in 2011 and has since honed his give attention to the cryptocurrency markets as a complete. He’s a graduate of Rutgers College and lives in Colorado along with his canine, Dorito.