Updated on April 26th, 2023

This article was originally a guest contribution from Jaren Nichols, the Chief Operating Officer at ZipBooks. Jaren was previously a Product Manager at Google and holds a Master of Accountancy degree from Brigham Young University and an MBA from Harvard Business School. The April 2023 update is by Ben Reynolds.

Note: This article corresponds to C-Corporations. For sole proprietors and S-Corporations the accounting treatment of dividends may differ markedly. Individuals may wish to consult an accountant or tax advisor for more.

Profitable companies have a choice of what to do with their earnings:

- Reinvest the profits back into the company

- Distribute profits to shareholders in the form of a dividend

Note: There are other capital allocation options as well such as share repurchases or acquisitions.

This isn’t an either/or decision. A percentage of profits can be paid as dividends, and a percentage can be reinvested back into the business.

Most of the time, businesses and business owners aren’t required to issue dividends. Preferred shareholders can be an exception.

Whether you issue dividends monthly or choose to only issue dividends following a strong fiscal period, you’ll need to record the transaction. This article will explain the accounting treatment of dividends.

And not all businesses are strong enough to issue dividends year-in and year-out. Even fewer can pay rising dividends every year. That’s what makes the Dividend Champions so special. To be a Dividend Champion, a stock must have paid rising dividends for 25+ consecutive years.

Declaring a Dividend

The first step in recording the issuance of your dividends is dependent on the date of declaration, i.e., when your company’s Board of Directors officially authorizes the payment of the dividends.

Applying Generally Accepted Accounting Procedures (GAAP), which is required for any public company and a good practice for private companies, means recording the dividend when it is incurred.

GAAP is telling everyone that once dividends are declared, instantly the money is owed. The company is liable for the dividends and you recognize or record the liability.

The Board’s declaration includes the date a shareholder must own stock to qualify for the payment along with the date the payments will be issued.

Retained Earnings

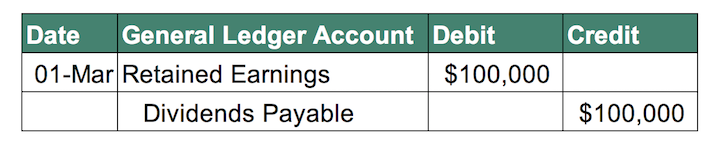

To record the declaration, you’ll debit the retained earnings account — the company’s undistributed accumulated profits for the year or period of several years. This entry will reflect the full amount of the dividends to be paid.

Debiting the account will act as a decrease because the money that is being paid out would otherwise have been held as retained earnings.

Dividends Payable

The Dividends Payable account records the amount your company owes to its shareholders. It’s the liability. In the general ledger hierarchy, it usually nestles under current liabilities.

On the date of declaration, credit the dividend payable account.

And as with debiting the retained earnings account, you’ll credit the total declared dividend value. These two lines make the balance journal entry.

Here’s an example of declaring a dividend with Your Co.:

- The Board of Directors for Your Co. declares a cash dividend on March 1st.

- Shareholders will be paid on April 10th.

- The date of record will be March 15th.

- Your Co. has 100,000 shares outstanding.

- The dividend total will be $1-per-share or $100,000.

Date of Declaration Journal Entry

In this situation, the date the liability will be recorded in Your Co.’s books is March 1 — the date of the Board’s original declaration.

Date of Record

This is where GAAP accountants catch a break. The date of record is when the business identifies the shareholders to be paid.

Since shares of some companies can change hands quickly, the date of record marks a point in time to determine which individuals will receive the dividends.

Since accountants at Your Co. have already created the liability (Dividends Payable) and have not yet paid the cash dividend, no accounting financial statement is changed.

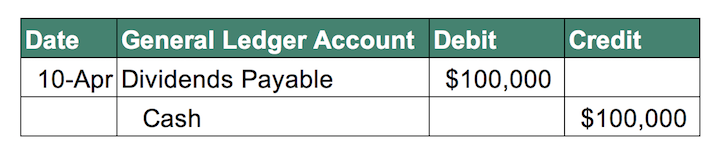

Date of Payment

The final entry required to record issuing a cash dividend is to document the entry on the date the company pays out the cash dividend.

This transaction signifies money that is leaving your company, so we’ll credit or reduce your company’s cash account and debit your dividends payable account. Use the date of the actual payment for the total value of all dividends paid.

Let’s go back to our initial example with Your Co.:

- The Board of Directors for Your Co. declares a cash dividend on March 1st.

- Shareholders will be paid on April 10th.

- The date of record will be March 15th.

- Your Co. has 100,000 shares outstanding.

- The dividend total will be $1-per-share or $100,000.

Date of Payment

Impacts to your financial statements

As you would expect, dividends shouldn’t impact the operating activities of your company. That means declaring, paying, and recording dividends won’t change anything on your income statement or profit and loss statement.

Declaring and paying dividends will change your company’s balance sheet. Don’t worry, your balance sheet will still balance since there will be offsetting changes.

After your date or record, your liabilities will increase and your retained earnings will decrease. Then after the payment, both your cash account and your liability will be reduced.

The end result across both entries will be an overall reduction in retained earnings and cash for the amount of the dividend.

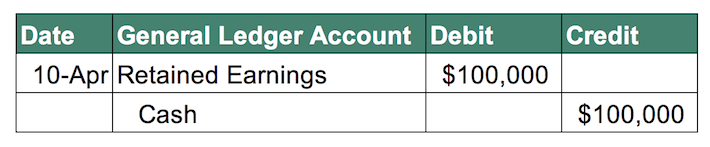

Simplified for non-GAAP or Cash Basis

If you don’t need to report in GAAP, you probably have a simpler business structure and fewer shareholders. This also corresponds to a less-than-formal dividend announcement.

However, the principle is the same, you are just able to skip the temporary dividends payable portions of the entry.

Here’s an example of cash-basis reporting with Your LLC.:

- Your LLC has 100,000 shares outstanding.

- Your LLC directors determine to pay a dividend of $1-per-share or $100,000 in total.

- Payment is made on April 10th.

Deciding when to start paying dividends, how much to pay, and how frequently to pay them can be difficult. These can be key signals in the maturity of your business and optimism of the business owners or directors.

However, recording dividends should be simple (especially if you have your bookkeeper do it). Whether you follow GAAP or use cash-basis accounting, you can make sure your financial reports are accurate with proper dividend reporting.

the following Sure Dividend resources contain many of the most reliable dividend growers in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].