imaginima

Investment thesis

Our current investment thesis is:

- AAN is an uncompelling business with no real scope for outperformance or significant shareholder returns. The company is growing modestly but underwhelmingly, with macroeconomic headwinds positioned to harm the business in the coming quarters.

- Beyond this, we struggle to see material growth in its target market. With a relaxed interest rate environment that we will likely return to, consumers have access to far more flexible forms of financing. AAN is essentially only targeted at the desperate and other niche scenarios.

- Although the business is undervalued, it shows little relative upside compared to its peers or from organic development.

Company description

Aaron’s Company (NYSE:AAN) is a leading omnichannel provider of lease-purchase solutions. The company operates through three primary business segments: Progressive Leasing, Aaron’s Business, and Vive. Aaron’s focuses on providing consumers with access to high-quality, durable goods such as furniture, appliances, electronics, and more.

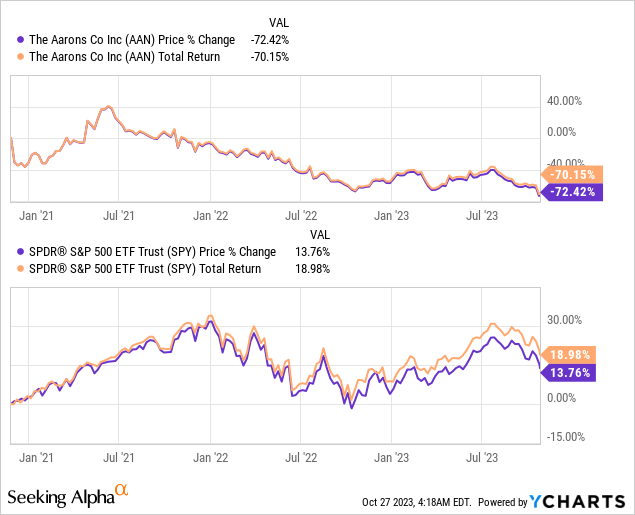

Share price

AAN’s share price performance has been disastrous, losing over 60% of its value since 2021. The wider market has struggled during this period but there is a large degree of this attributable to AAN’s financial performance.

Financial analysis

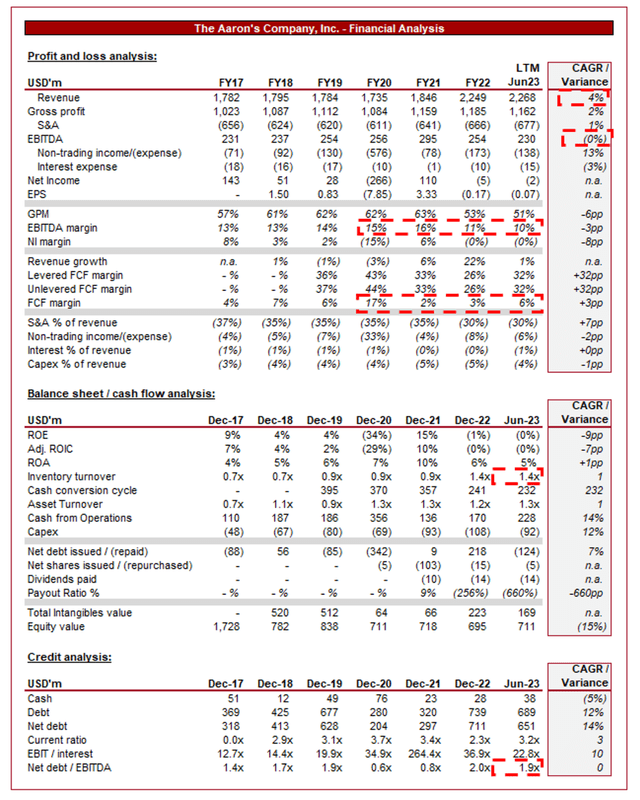

Aaron’s Company financial (Capital IQ)

Presented above are AAN’s financial results.

Revenue & Commercial Factors

AAN’s revenue has grown modestly since FY17, with a CAGR of +4%. Growth has been inconsistent, with a significant post-pandemic acceleration. EBITDA has materially lagged behind, trading flat following an initial improvement.

Business Model

AAN allows customers to lease products with the option to own them eventually. This model appeals to customers with limited financial resources or credit issues, enabling them to access products they might not afford otherwise. This is AAN’s core demographic, with most others preferring traditional financing facilities (such as credit cards, BNPL, etc.).

AAN’s control over financing allows them to offer flexible payment options tailored to their customers’ financial situations, a fair superior approach to those in difficult situations.

AAN offers a wide range of products, from furniture to electronics. This diversification attempts to cater to different customer needs and preferences, aiming to attract a broader customer base. This has given the company a positive runway for growth and store expansion nationally.

AAN operates a substantial number of retail stores across the United States and Canada. This wide network is positioned to improve brand visibility and accessibility. In line with the digitalization trend, AAN has increasingly focused on driving e-commerce sales, with good success relative to a number of traditional retailers.

AAN’s business model is reasonably attractive, with its key value offering being its breadth of stock and geographical reach across the US. This said, we do not see anything unique about the company, and this is likely partially why its growth has been underwhelming. We also attribute its poor growth to the following factors, many of which continue to be an issue:

- E-commerce – With the rise of online shopping and the popularity of e-commerce platforms, consumers have increasingly turned to digital avenues for purchasing goods. Although AAN has responded with its own offering, this is likely capturing its existing customers rather than winning new ones. Its inherent niche focus means the average consumer is unlikely to be interested. This is likely why AAN has attempted to revitalize interest through its “GenNext” initiative (improving store experience through re-engineering stores).

- Financing options – The last decade has seen the democratization of access to credit, with record-low interest rates contributing to soaring household debt balances. With this access, consumers are dissuaded from utilizing AAN’s services. Why limit yourself to AAN’s stock when you can shop anywhere on credit? This has further forced AAN into a niche, with only bad-credit individuals being its core focus.

- Market Saturation – In some regions, especially urban areas, the market has likely reached saturation, with a number of traditional and lease-to-own options. This saturation limits AAN’s ability to expand.

- Regulatory Challenges – Regulatory changes, especially concerning credit and consumer finance, could pose challenges to AAN. Regulators are regularly clamping down on what they consider exploitative measures, such as payday loans several years ago. Although we do not suggest AAN is doing anything untoward in the slightest, regulatory changes or scandals could easily force AAN into an uncomfortable position.

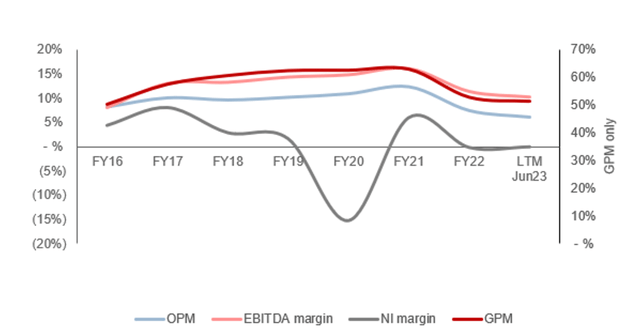

Margins

Margins (Capital IQ)

AAN’s margins had been on an upward trajectory in the lead-up to the pandemic, although this has been wholly withdrawn from FY22. The company’s margins are heavily linked to the level of demand and consumer confidence in the economy, contributing to inherent cyclicality. We do not expect this trend to subside and so future margin development will be linked to revenue progression.

On a normalized basis, we suspect the company will post an EBITDA-M of 11.5%-13.5%, with levels above and below this based on upcycles and downturns.

Quarterly results

AAN’s recent performance had been strong but is now showing signs of a material slowdown. Top-line revenue growth in the last four quarters was +32.5%, +21.5%, (13.1)% and (11.4)%. In conjunction with this, margins have continued to remain at the lower FY22 levels, although have are still continuing to trend down.

The company’s worsening financial performance is attributable to the current macroeconomic environment in our view. With elevated interest rates and inflation, consumers are being forced to reduce spending, particularly discretionary and large-ticket, as living costs soar. The products provided by AAN fall into this category, particularly furniture and appliances. There is an argument to suggest LTOs could benefit from this, as consumers lose the ability to purchase outright. We argue against this as following a decade of rapid credit expansion, consumers are more weighted toward utilizing credit cards. Its target demographic would logically be dissuaded from layering its liabilities with LTOs.

We expect conditions to remain difficult, with scope for a further economic decline in the coming quarters. This will only compound the impact on AAN, with the rate of write-offs primed to increase.

Key takeaways from its most recent quarter are:

Revenue has decreased YoY across both Aaron’s Business and at BrandsMart, attributed to the wider market environment.

Aaron’s Business is struggling with a smaller lease portfolio size, lower lease renewal rates, fewer exercises of early purchase options, and lower retail sales. The business is essentially losing on every front.

E-commerce and “GenNext Store” penetration continues to be strong, supporting the modernization of its business and safeguarding its long-term growth story.

Provision for lease merchandise write-offs was 6.1% (7.5% PY), attributable to lease decisioning enhancements. This remains within control, although we see risks associated with this beginning to tick up.

32+ Day Non-Renewal Rate has incrementally increased, primarily due to normal seasonal trends

Balance sheet & cash flows

AAN’s balance sheet is clean. The company has a ND/EBITDA ratio of 1.9x, which is a sustainable level. Regardless of this, Management has deleveraged to reduce its interest costs, allowing for superior cash returns.

FCF has been broadly strong, tracking in line with margin development. The nature of its services means the company is unlikely to run into liquidity issues so long as it continues to maintain its strong lease decision-making.

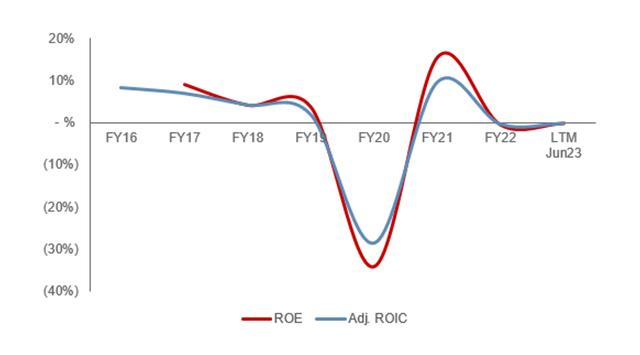

AAN has operated with a mediocre ROE, which suggests the return on cash reinvestment for shareholders is not overly attractive. We would like to see distributions increase and capex spending soften for this reason.

Return on equity (Capital IQ)

Outlook

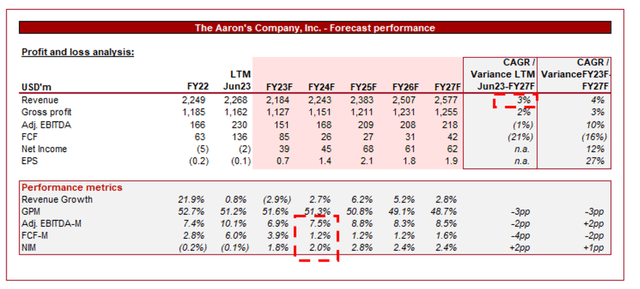

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a continuation of its mild growth, with a CAGR of +3% into FY27F. In conjunction with this, margins are expected to remain broadly in line with FY22 levels.

These assumptions appear reasonable in our view. Management’s store expansion strategy and increased e-commerce penetration should allow for LSD growth. Further, the margin assumption appears reasonable given the limited normalized trading data, although we suspect this can be higher with e-commerce.

Industry analysis

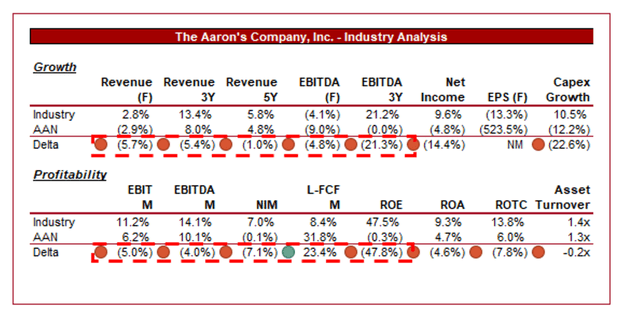

Homefurnishing Retail Stocks (Seeking Alpha)

Presented above is a comparison of AAN’s growth and profitability to the average of its industry, as defined by Seeking Alpha (6 companies).

AAN performs poorly relative to its peers. The company’s revenue and profitability growth have lagged behind the industry, reflecting shifting trends away from the use of its service relative to its competitors. AAN is seemingly losing market share to the traditional model.

Further, the company operates with below-average margins, reflecting strong competition and customer acquisition costs. Additionally, the business does proportionately benefit from the traditional production-scale model that allows for substantial economies of scale.

Valuation

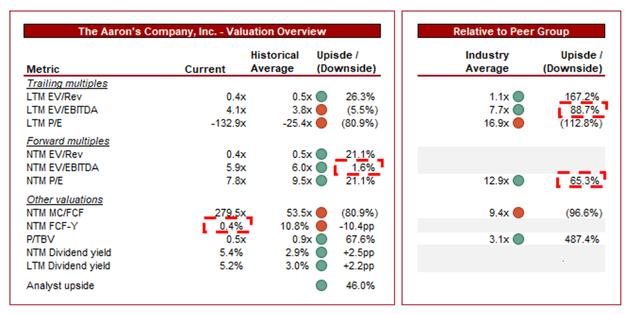

Valuation (Capital IQ)

AAN is currently trading at 4x LTM EBITDA and 6x NTM EBITDA. This is broadly in line with its short historical average.

AAN is currently trading at a ~88% discount to its peers on an LTM EBITDA basis and ~65% on a NTM P/E basis. The discount reflects its competitive position in our view, with below-average cost and margins. The company’s alternative business model allows for good cash returns and a competitive advantage, but its attractiveness does not appear overly high.

AAN’s valuation does not appear overly attractive in our view. The company is likely undervalued given the size of the discount but it is not screaming value. Its growth is mediocre at best and it is lagging its peers. The business faces equal cyclicality risk but is overexposed through potential write-offs.

Investors could see value through its cash generation, which allows for a current yield of ~5% and a historical average of ~3%.

Key risks with our thesis

The risks to our current thesis are:

- Successful market share growth through e-commerce and GenNext stores.

- Customer base expansion (through say wider product offering).

- Economic recession impacting consumer spending

- Regulatory changes affecting business operations

- Online competition eroding market share.

Final thoughts

AAN is am “okay” business, with no standout features and nothing screaming “invest in me”. The company’s growth trajectory is just fine, with sufficient runway across the US to expand its footprint. E-commerce provides modernization, with good penetration (although we suspect it’s not into new markets).

The company is facing headwinds with the current macroeconomic environment, as we feel it will contribute to reduced spending. We should highlight that some believe this is a tailwind due to other financing options being closed off, but we see this as a small offset.

Overall, AAN is likely slightly undervalued but is not compelling enough for a buy rating.