Published on December 31st, 2022 by Nikolaos Sismanis

Dividend Aristocrats comprise an elite group of 65 S&P 500 stocks with 25+ years of consecutive dividend increases. These stocks are celebrated amongst dividend growth investors, as they are considered reliable vehicles for growing one’s income in a more predictable manner.

However, it’s important to note that not all Dividend Aristocrats are created equal. While most stocks in the group tend to increase their payouts meaningfully, others do so only marginally as a way to retain their Dividend Aristocrat status. In some cases, this may be a way for a Dividend Aristocrat to preserve liquidity or improve their financial position before more noteworthy dividend hikes resume.

That said, it’s worth considering whether decelerating dividend increases may actually be a signaling financial strain and whether it raises the risk of a dividend cut in the future. As such, these Dividend Aristocrats should be evaluated twice before making any investment decisions.

We have compiled a list of all 65 Dividend Aristocrats, along with relevant financial metrics like dividend yield and P/E ratios. You can download the full list of Dividend Aristocrats by clicking on the link below:

Table of Contents

Examples of Dividend Cuts Following a Declining Dividend Growth Pace

While it’s not a sure sign of financial strain, a Dividend Aristocrat slowing its pace of dividend increases could be a sign that the company is facing financial challenges. This could potentially lead to a cut in dividends. Here are some such examples that have previously occurred:

Pitney Bowes Inc. (PBI)

Pitney Bowes had grown its dividend annually between 1983 and 2013, boasting 30 years of consecutive annual dividend increases. In 2013, the company was forced to cut its dividend after financial distress, ending its multi-decade streak. Here’s how Pitney Bowes’ dividend growth pace looked prior to the cut:

- 1993 – 1998 DPS CAGR: 14.9%

- 1998 – 2003 DPS CAGR: 5.9%

- 2007 – 2012 DPS CAGR: 2.6%

AT&T Inc. (T)

Income-oriented investors’ darling AT&T was forced to cut its dividend by the end of 2021 after 37 years of consecutive annual dividend increases. With its indebtedness reaching unsustainable levels, a dividend cut was the only way for the company to start deleveraging meaningfully and pursue fresh growth initiatives. Here’s how AT&T’s dividend growth pace looked prior to the cut:

- 2003 – 2008 DPS CAGR: 6.8%

- 2008 – 2013 DPS CAGR: 2.4%

- 2016 – 2021 DPS CAGR: 1.5%

Mercury General Corporation (MCY)

Small-cap insurer Mercury General ultimately had to end its 35-year dividend growth streak in 2022 after years of over-distributing its earnings. The company’s payout ratio would often exceed 100%. Here’s how Mercury General’s dividend growth pace looked prior to the cut:

- 2002 – 2007 DPS CAGR: 11.6%

- 2007 – 2012 DPS CAGR: 3.3%

- 2016 – 2021 DPS CAGR: 0.4%

The 8 Dividend Aristocrats With The Smallest Dividend Increases

Besides AT&T’s unfortunate cut, Dividend Aristocrats continued to grow their dividends at rather satisfactory rates. The average dividend hike in 2022 by all 64 Dividend Aristocrats was 6.5%. Notably, 11 Dividend Aristocrats delivered double-digit hikes, while 28 Aristocrats grew their dividends by less than 5% for the year.

That said, eight companies, in particular, grew their dividends by a rate equal to or below 1%. Could their decelerating pace of dividend increases signal a potential cut moving forward?

#8: Dover Corporation (DOV)

- Years of dividend growth: 67

- Dividend yield: 1.5%

- 2005 – 2011 DPS CAGR: 10.7%

- 2011 – 2016 DPS CAGR: 7.8%

- 2016 – 2021 DPS CAGR: 3.0%

- Latest DPS increase: 1.0%

Dover Corporation is a diversified global industrial manufacturer with annual revenues of nearly $9 billion. Dover’s five reporting segments include Engineered Systems, Clean Energy & Fueling, Pumps & Process Solutions, Imaging & Identification, and Climate & Sustainability Technologies.

The company is a Dividend King with more than six decades of dividend increases. In fact, with 2022’s dividend increase marking 67 consecutive years of dividend growth, Dover boasts the second-longest dividend growth streak among U.S. companies.

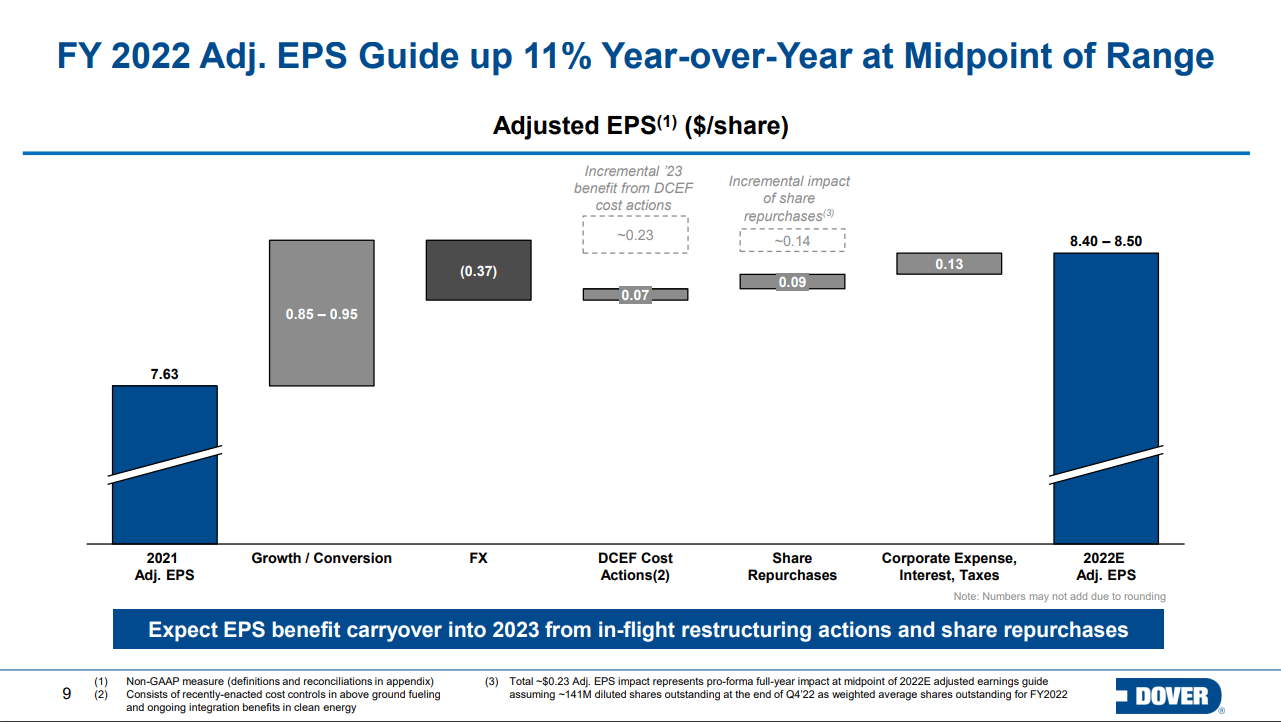

Dover’s earnings-per-share have compounded at 6% annually over the last decade. Growth, in fact, accelerated in the most recent years, with earnings-per-share growth growing at an annual rate of more than 14% over the past five years. Dover did suffer some setbacks during the worst of the COVID-19 pandemic, but the company quickly rebounded.

Source: Investor Presentation

Is Dover Corp Likely to Cut its Dividend?

Despite Dover’s dividend growth rate decelerating substantially over the past few years, we don’t believe the company is headed toward a dividend cut. While Dover is a cyclical stock, with its revenues subject to wild fluctuations during unfavorable market periods, the company has managed to sustain its earnings at solid levels and even grow then notably over time. Last year, the company’s net income hit a new all-time while following earnings growth surpassing dividend growth over the year, the stock’s payout ratio stands at a very healthy 24%

Click here to download our most recent Sure Analysis report on Dover Corporation (preview of page 1 of 3 shown below):

#7 Cardinal Health, Inc. (CAH)

- Years of dividend growth: 35

- Dividend yield: 2.5%

- 2005 – 2011 DPS CAGR: 24.3%

- 2011 – 2016 DPS CAGR: 15.0%

- 2016 – 2021 DPS CAGR: 3.9%

- Latest DPS increase: 1.0%

Dublin, Ohio-based Cardinal Health is one of the “Big 3” drug distribution companies along with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Health serves over 24,000 United States pharmacies and more than 85% of the country’s hospitals. The company has operations in more than 30 countries with approximately 46,000 employees.

With 35 years of dividend increases, the $20.4 billion market cap company is a member of the Dividend Aristocrats Index.

Between 2011 and 2021, Cardinal Health grew its earnings-per-share by an average compound rate of 7.6% per year, while the dividend grew at more than 9% annually. Moving forward, we do not anticipate this sort of growth, especially considering the slowdown in earnings improvement in the last few years.

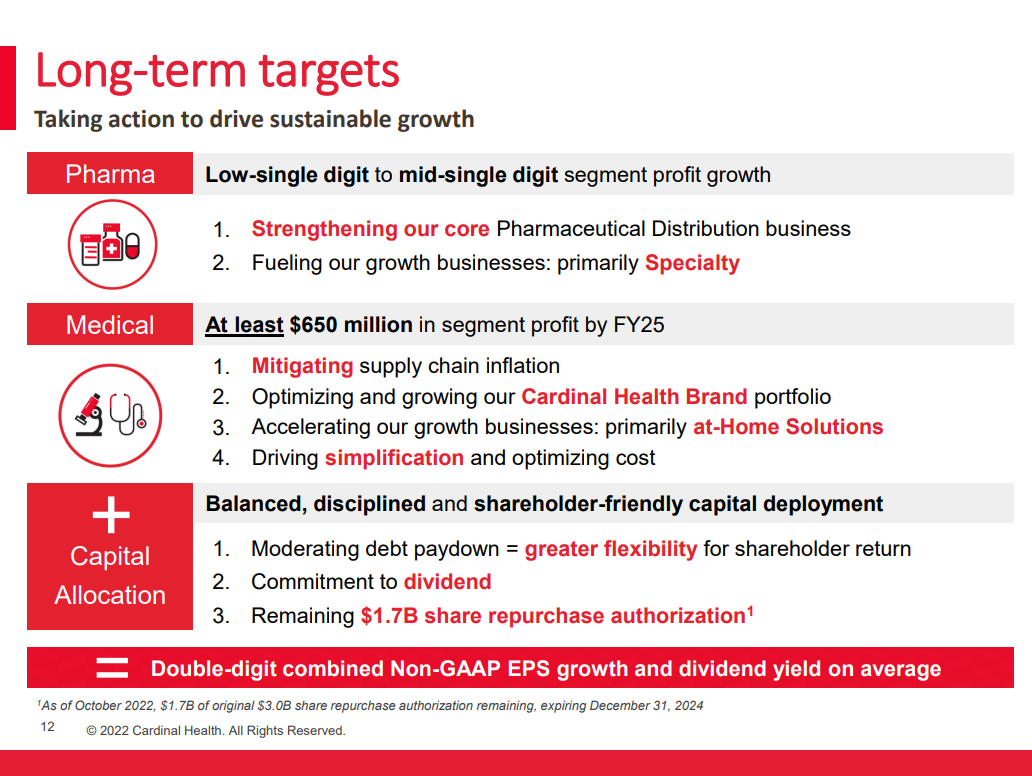

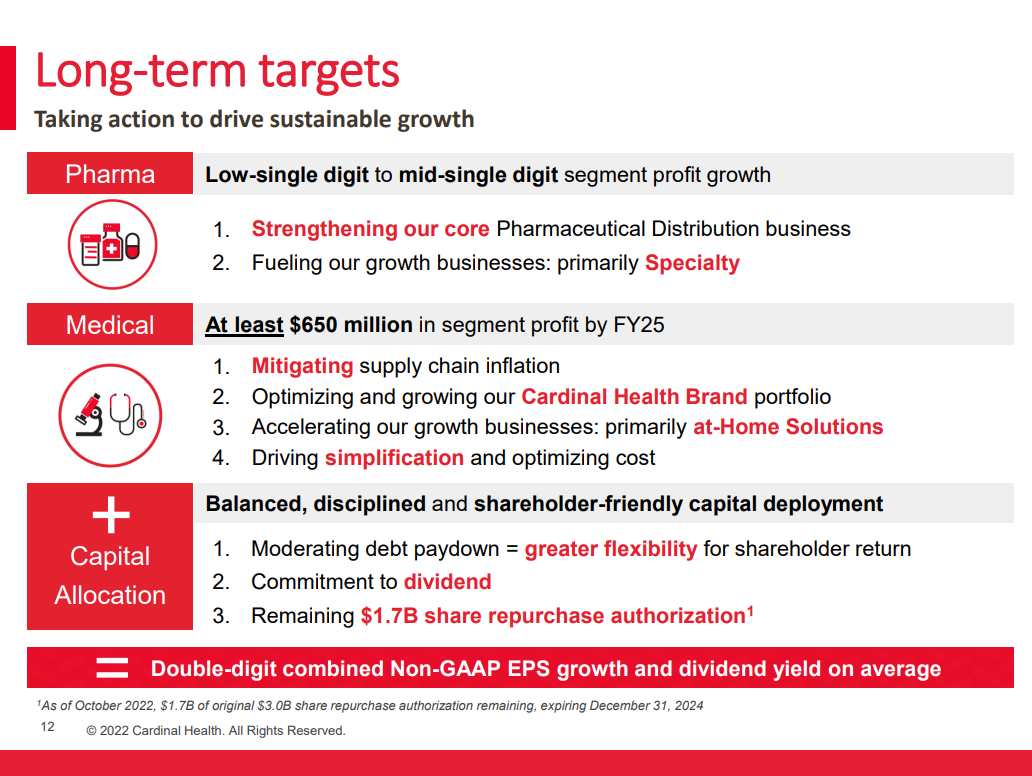

Source: Investor Presentation

Is Cardinal Health Likely to Cut its Dividend?

Indeed, Cardinal Health’s dividend growth pace has decelerated dramatically over the past decade, while its most recent 1% dividend increase was certainly underwhelming. Nevertheless, we don’t believe the company plans to cut its dividend anytime soon.

This is because the company’s earnings are likely to remain robust as drugs tend to generate consistent sales as their vital pharmaceutical products. Further, the company’s payout ratio stands at a comfortable 38%, while Cardinal’s overall financial health has been improving.

Specifically, Cardinal’s long-term debt has declined from $9.0 billion in 2017 to $4.7 billion as of its most recent Q3 2022 report. Finally, the company is likely to suspend its stock repurchases before touching the dividend, and stock repurchases have remained strong throughout the year.

Click here to download our most recent Sure Analysis report on Cardinal Health, Inc.(preview of page 1 of 3 shown below):

#6 Emerson Electric Co. (EMR)

- Years of dividend growth: 66

- Dividend yield: 2.2%

- 2005 – 2011 DPS CAGR: 9.2%

- 2011 – 2016 DPS CAGR: 6.6%

- 2016 – 2021 DPS CAGR: 1.2%

- Latest DPS increase: 1.0%

Emerson Electric was founded in Missouri in 1890. Since that time, it has evolved through organic growth, as well as strategic acquisitions and divestitures, from a regional manufacturer of electric motors and fans into a $56 billion diversified global leader in technology and engineering.

Its global customer base and diverse product and service offerings afford it about $20 billion in annual revenue. The company’s very impressive 66-year dividend increase streak lands it on the prestigious Dividend Kings list.

Source: Investor Presentation

Emerson is undergoing a significant shift in its strategy, whereby it is selling off legacy units and focusing more on automation and recurring revenue. We believe that low single-digit growth in revenue and a tailwind from the buybacks will be the key drivers of earnings-per-share growth in the coming years. The company has reduced its share count by about 37% since 1987.

Still, we note there is likely to be significant earnings weakness while the transformation plays out, including a slow start to fiscal 2023.

Is Emerson Electric Likely to Cut its Dividend?

Despite Emerson Electric having substantially slowed down the rate at which it grows its dividend, we don’t believe this to be a sign of a near-term cut. The dividend is well-covered.

In fact, with earnings-per-share growing at a CAGR of 7.3% over the past decade, Emerson’s payout ratio has relaxed significantly lately. It stood at 77% in 2016 but has now fallen to 51%. The deceleration in dividend hikes is most likely part of Emerson’s transformation plan.

Click here to download our most recent Sure Analysis report on Emerson Electric Co. (preview of page 1 of 3 shown below):

#5 Federal Realty Investment Trust (FRT)

- Years of dividend growth: 55

- Dividend yield: 4.2%

- 2005 – 2011 DPS CAGR: 3.8%

- 2011 – 2016 DPS CAGR: 7.1%

- 2016 – 2021 DPS CAGR: 2.1%

- Latest DPS increase: 0.9%

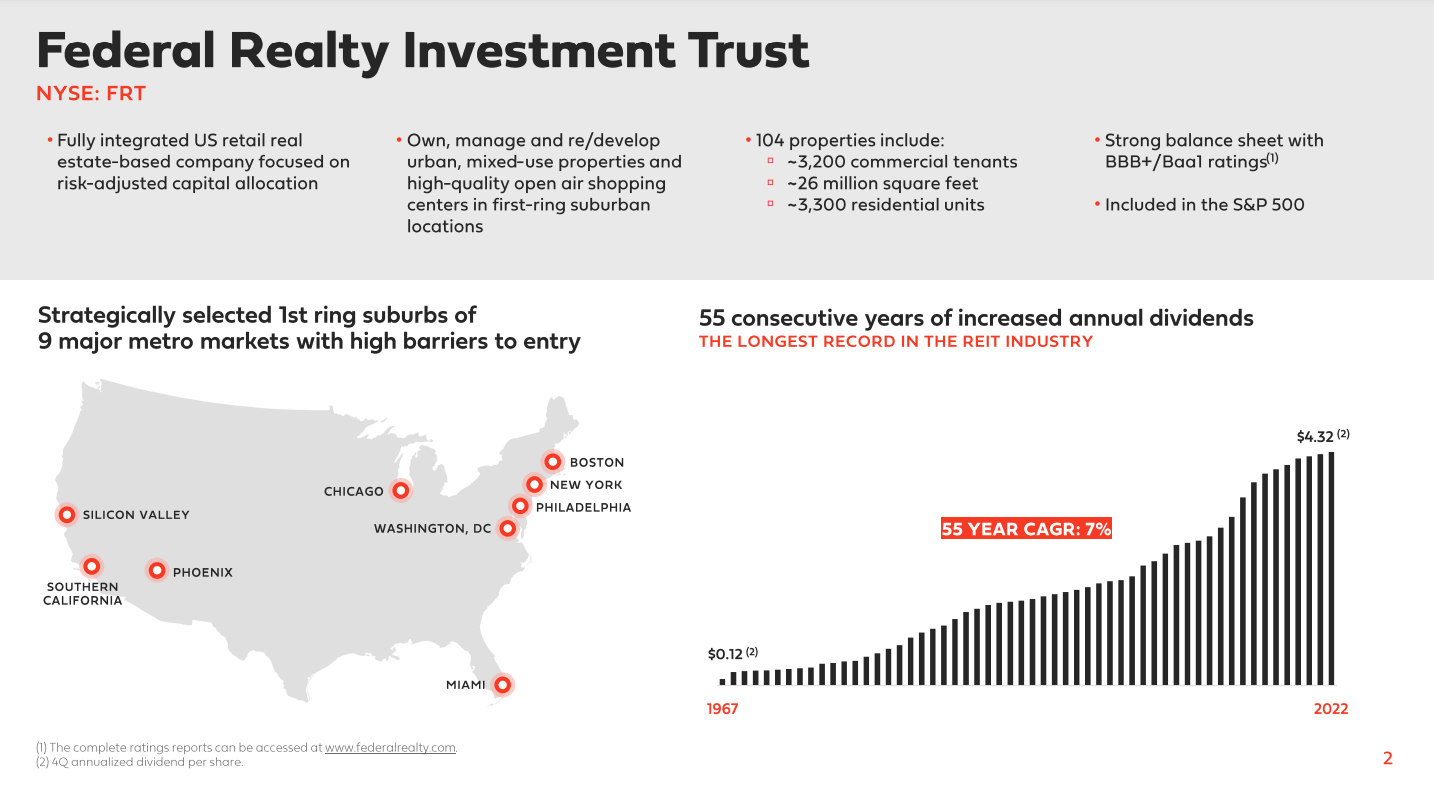

Federal Realty is one of the larger real estate investment trusts (REITs) in the United States. The trust was founded in 1962 and concentrates on high-income, densely populated coastal markets in the US, allowing it to charge more per square foot than its competition. Federal Realty trades with a market capitalization of $8.3 billion today.

Prior to 2020, Federal Realty’s funds-from-operations had not dipped year-over-year at any point in the past decade, a tremendously impressive feat given that the trust operates in the highly cyclical real estate sector. The company’s performance has normalized since, and Federal Realty is expected to achieve near-record earnings in Fiscal 2022.

Moving forward, we expect that Federal Realty’s growth will be comprised of a continuation of higher rent rates on new leases and its impressive development pipeline fueling asset base expansion. Margins are expected to continue to rise slightly as it redevelops pieces of its portfolio, and same-center revenue continues to move higher.

Federal Realty features the longest dividend growth streak amongst REITs, boasting 55 years of successive annual dividend increases.

Source: Investor Presentation

Is Federal Realty Likely to Cut its Dividend?

Federal Realty’s latest dividend increase of 0.9% was certainly disappointing, but we don’t believe it signals a potential dividend cut. The company is most likely just being conservative in the face of a tough real estate environment amid rising interest rates. Besides, Federal Realty is expected to record near-record FFO/share in Fiscal 2022.

Additionally, it’s not the first time a marginal dividend increase has occurred during a tough market landscape. In 2009, Federal Realty increased its dividend-per-share by just a cent (1.5%) to a quarterly rate of $0.66 before dividend increases re-accelerated as soon as market conditions normalized.

Federal Realty’s payout ratio remains quite healthy as well, currently standing below 70%.

Click here to download our most recent Sure Analysis report on Federal Realty Investment Trust (preview of page 1 of 3 shown below):

#4 Realty Income Corporation (O)

- Years of dividend growth: 27

- Dividend yield: 4.7%

- 2005 – 2011 DPS CAGR: 3.7%

- 2011 – 2016 DPS CAGR: 6.7%

- 2016 – 2021 DPS CAGR: 3.4%

- Latest DPS increase: 0.8%

Realty Income is a REIT that has become famous for its successful dividend growth history and monthly dividend payments. Today, the trust owns more than 4,000 properties that are not part of a wider retail development (such as a mall) but instead are stand-alone properties. This means that its locations are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income has trademarked itself as “The Monthly Dividend Company”, boasting 628 monthly dividends declared and 100 consecutive quarterly increases.

Source: Investor Presentation

Realty Income generates its growth through growing rents at existing locations, via contracted rent increases or by leasing properties to new tenants at higher rates, but also by acquiring new properties. Management invested about $2.1 billion in new properties in 2020 and another $6.4 billion in 2021. Realty Income expects to increase its investments in international markets during the next couple of years.

Is Realty Income Likely to Cut its Dividend?

Similar to Federal Realty, Realty Income’s latest dividend increase was below-average as management is being conservative in the face of a tough real estate environment amid rising interest rates. We don’t believe that Realty Income’s dividend safety is threatened for several reasons.

Firstly, at 76%, its payout ratio is actually the lowest it has been in over a decade. Secondly, management continues to grow the dividend multiple times a year (usually quarterly), which further cements their confidence in the dividend. Finally, Realty Income’s properties are in high demand and will likely remain so. The occupancy rate across the portfolio is around 99%, and tenants generally report high rent coverage ratios.

Click here to download our most recent Sure Analysis report on Realty Income Corporation (preview of page 1 of 3 shown below):

#3 3M Company (MMM)

- Years of dividend growth: 64

- Dividend yield: 5.0%

- 2005 – 2011 DPS CAGR: 3.5%

- 2011 – 2016 DPS CAGR: 15.0%

- 2016 – 2021 DPS CAGR: 5.9%

- Latest DPS increase: 0.7%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings, and schools around the world. It has about 95,000 employees and serves customers in more than 200 countries. 3M is composed of four separate divisions.

The Safety & Industrial division produces tapes, abrasives, adhesives, and supply chain management software, as well as manufactures personal protective gear and security products. The Healthcare segment supplies medical and surgical products as well as drug delivery systems.

The Transportation & Electronics division produces fibers and circuits with the goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials, and stationery supplies.

3M has grown earnings at a rate of 5.4% per year over the last decade. Easing raw material/logistics/labor inflation and a stabilizing global supply chain environment are likely to be positive earnings growth catalysts in 2023, according to management.

Source: Investor Presentation

Is 3M Likely to Cut its Dividend?

3M is facing several lawsuits, including nearly 300,000 claims that its earplugs used by U.S. combat troops and produced by a subsidiary were defective. On December 22nd, a U.S. judge blocked 3M from trying to dodge liability for injuries from its allegedly defective earplugs by diverting blame to a subsidiary. The ongoing situation likely explains management’s decision to decelerate dividend increases.

That said, we believe that 3M’s dividend should remain safe. While dividend growth has outpaced earnings growth in recent years, the payout ratio remains below 60%. Further, the company’s diversified portfolio of mission-critical products should continue to generate robust cash flows regardless of temporary headwinds in the economy.

Click here to download our most recent Sure Analysis report on 3M Company (preview of page 1 of 3 shown below):

#2 International Business Machines Corporation (IBM)

- Years of dividend growth: 27

- Dividend yield: 4.7%

- 2005 – 2011 DPS CAGR: 21.4%

- 2011 – 2016 DPS CAGR: 13.7%

- 2016 – 2021 DPS CAGR: 3.6%

- Latest DPS increase: 0.6%

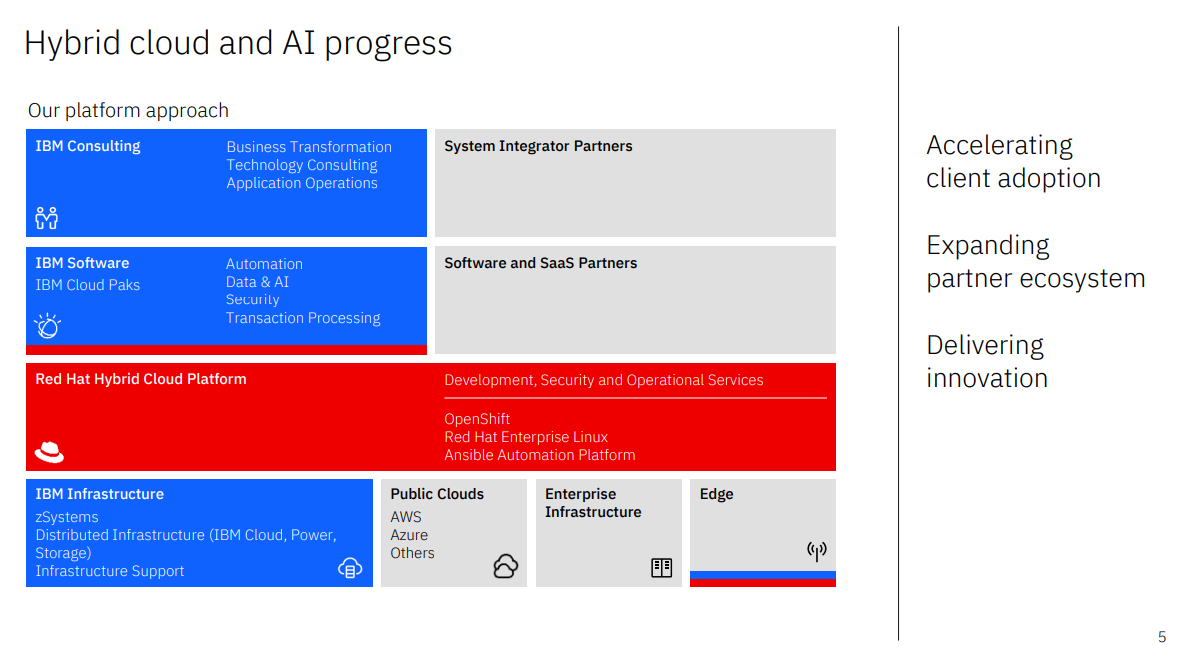

IBM is a global information technology company that provides integrated enterprise solutions for software, hardware, and services. IBM’s focus is running mission-critical systems for large, multi-national customers and governments.

Last year, IBM spun off Kyndryl, its managed infrastructure business, but it is still one of the largest IT services companies in the world. The company now has four business segments: Software, Consulting, Infrastructure, and Financing. IBM had annual revenue of ~$57.4 billion in 2021 (not including Kyndryl).

IBM’s core operations are profitable. But IBM had difficulty generating growth in the past several years due to the transition to cloud and SaaS in the IT industry and IBM’s late emphasis on this market. However, IBM is now focusing on cloud and SaaS and intends to be a major player in the hybrid cloud, as illustrated by the Red Hat and many smaller acquisitions.

Source: Investor Presentation

Is IBM Likely to Cut its Dividend?

IBM’s dividend growth has slowed down significantly lately. This makes sense, considering that the company is generating the same free cash flow per share as it did 15 years ago following years of declining revenues. We wouldn’t kill the possibility of a dividend cut in the medium term if IBM’s revenues and earnings were to continue to decline, as the payout ratio has already climbed to 67%. That said, positive catalysts are in place that should sustain payouts, including growing cloud revenues and continued deleveraging.

Click here to download our most recent Sure Analysis report on International Business Machines Corporation(preview of page 1 of 3 shown below):

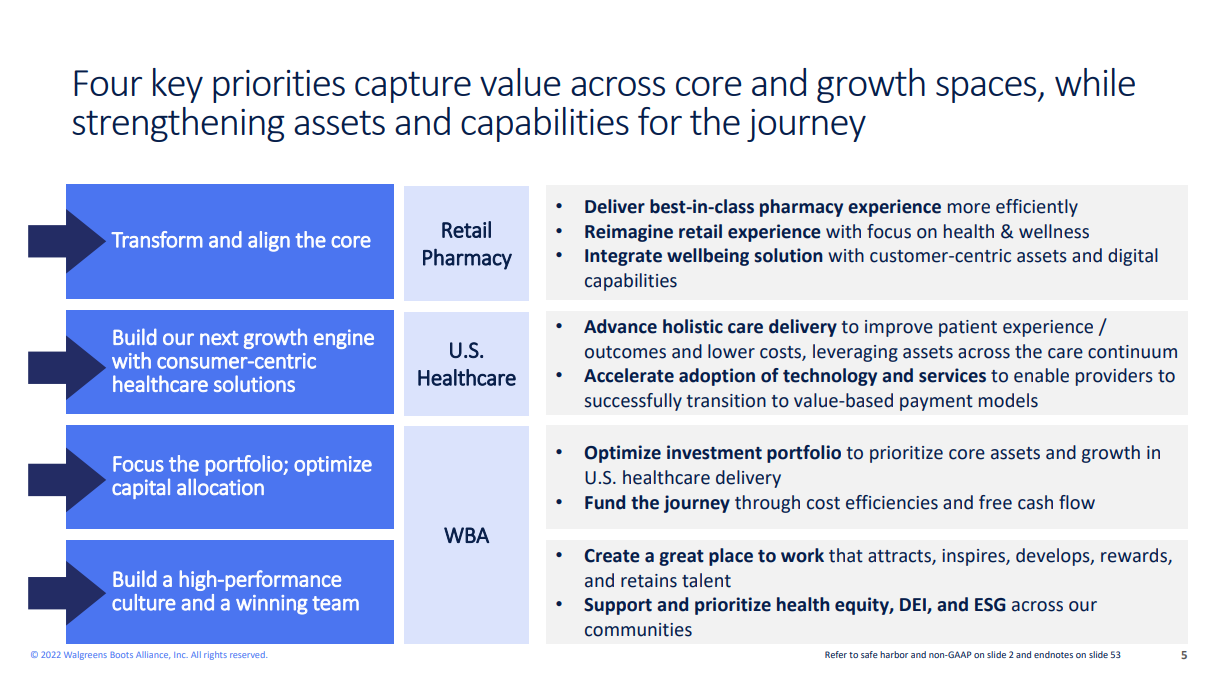

#1 Walgreens Boots Alliance (WBA)

- Years of dividend growth: 47

- Dividend yield: 5.1%

- 2005 – 2011 DPS CAGR: 22.4%

- 2011 – 2016 DPS CAGR: 14.7%

- 2016 – 2021 DPS CAGR: 5.3%

- Latest DPS increase: 0.5%

Walgreens Boots Alliance is the largest retail pharmacy in the United States and Europe. The $32.1 billion market cap company has a presence in more than nine countries through its flagship Walgreens business and other business ventures.

Walgreens’ earnings-per-share grew at a CAGR of 7.6% over the past decade, powered by growing revenues and a declining share count. This was driven by a combination of factors, including solid top-line growth ($72 billion to $133 billion), a steady net profit margin, and a reduction in the number of outstanding shares.

Source: Investor Presentation

Is Walgreens Boots Alliance Likely to Cut its Dividend?

Walgreens has been growing its dividend by smaller and smaller amounts over time. That said, we don’t believe its 47-year dividend growth is about to come to an end anytime soon. With earnings-per-share growing significantly faster than the dividend over the past decade, the stock’s payout ratio currently stands at 42%, lower than 44% in 2012. Due to selling necessary medications and other pharmaceuticals, we believe the company will continue generating solid cash flows. They should continue to protect the dividend and even for further dividend increases ahead, regardless of their growth rate.

Click here to download our most recent Sure Analysis report on Walgreens Boots Alliance (preview of page 1 of 3 shown below):

Final Thoughts

Examining a company’s dividend growth rate trend can be a helpful indicator for investors looking to review its financial health and dividend growth prospects. A prolonged slowdown in the pace at which dividends are growing could signal that the company is experiencing financial hurdles.

In that case, the company could potentially be at risk of a dividend cut in the future, regardless of how impressive its dividend growth streak is. We have seen this happen more than once, with Pitney Bowes Inc. (PBI), AT&T Inc. (T), and Mercury General Corporation (MCY) ending their multi-decade dividend growth track records as their financials could not sustain their payouts further. In all three cases, a dividend cut was followed by a continuous deceleration in dividend growth.

The eight Dividend Aristocrats discussed in this article all saw dividend growth of less than or equal to 1% in 2022, and many have also shown a trend of slowing dividend growth over the long term. While we cannot completely kill the possibility of a dividend cut for any of these companies, we believe that the majority, if not all of these Dividend Aristocrats, are currently not at risk of cutting their dividends.

Whether it’s a systematic risk, like rising interest rates in the case of Federal Realty Trust and Realty Income, or a systemic risk, like the ongoing lawsuit in the case of 3M, the relatively tiny dividend increases seen this year among these Dividend Aristocrats can likely be attributed to the caution exercised by their management teams.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].