Published on March 31st, 2023 by Aristofanis Papadatos

Most investors dismiss nickel stocks, as nickel is a metal that has traditional been in abundant supply. However, the situation has changed in recent years. Nickel is a vital component in the batteries of electric vehicles. Thanks to the immense growth of the sales of electric vehicles, the global demand for nickel has skyrocketed. This led the price of the metal to more than quadruple, from about $11,000 per metric ton in early 2020 to a nearly all-time high of $49,000 in early 2022. The last part of the rally was fueled by the invasion of Russia in Ukraine, which adversely affected the supply of nickel. The price of nickel peaked about a month after the invasion.

Since it peaked, the price of nickel has corrected more than 50% and it is now hovering around $23,000. Nevertheless, this price is still much higher than the historical average price of the metal. Even better for nickel producers, the industry of electric vehicles has several more years of high growth ahead. This secular trend is likely to greatly benefit nickel producers in the upcoming years.

Some of the stocks in this list are blue-chip stocks. We’ve created a full list of the 350+ Blue Chips available today, which you can download below:

In this article, we will discuss the prospects of seven nickel stocks, namely BHP Group (BHP), Vale (VALE), Glencore (GLNCY), Anglo American (NGLOY), Canada Nickel Company (CNIKF), First Quantum Minerals (FQVLF) and Rio Tinto (RIO).

Table of Contents

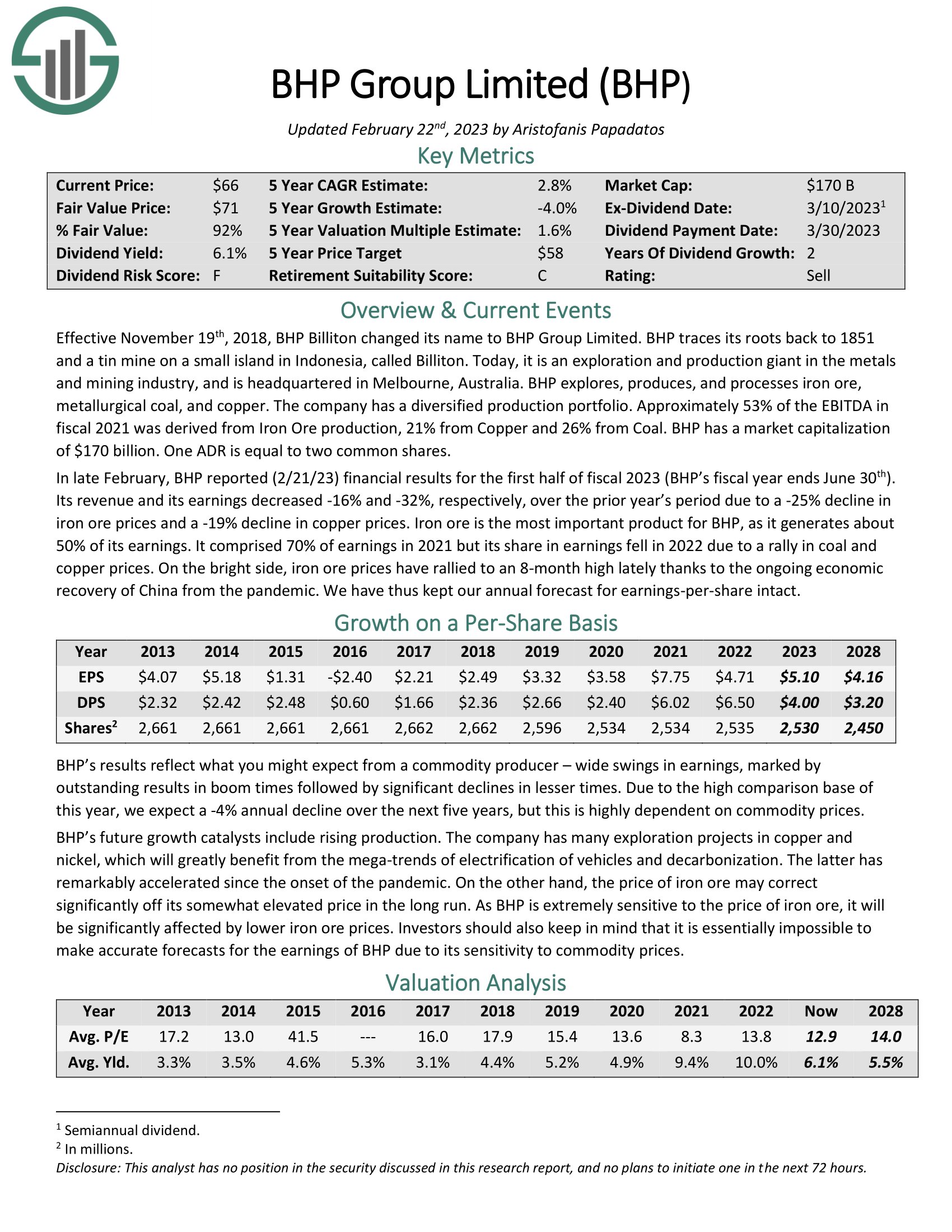

Best Nickel Stock #7: BHP Group (BHP)

BHP Group traces its roots back to 1851 and a tin mine on a small island in Indonesia, which is called Billiton. Today, BHP is an exploration and production giant in the metals and mining industry. It is headquartered in Melbourne, Australia, and has a market capitalization of $152 billion.

BHP explores, produces, and processes iron ore, metallurgical coal and copper while it also has a massive nickel extraction and refining operation. The refining operation is essential, as nickel should be as pure as possible in its use in batteries.

Source: Investor Presentation

BHP has a diversified production portfolio. It generates approximately 53% of the EBITDA from iron ore production, 21% from copper and 26% from the other metals. It is thus evident that iron ore is the most important determinant of the earnings of BHP.

The coronavirus crisis affected the global supply of iron ore while it also accelerated the shift from conventional vehicles to electric vehicles. Given also the pent-up demand for electric vehicles in 2021, when the world began to recover from the pandemic, the price of iron ore and other metals enjoyed an impressive rally in that year. As a result, BHP posted 10-year high earnings per share of $7.75 in that year.

Since it peaked in May 2021, the price of iron ore has incurred a nearly 50% correction but it remains much higher than its historical average price. As a result, BHP posted earnings per share of $4.71 in 2022, which were 39% lower than those in 2021 but still marked the second-best performance of the company in the last 8 years. Thanks to a favorable environment of commodity prices, BHP is likely to grow its earnings per share to about $5.10 this year.

Moreover, based on the dividend of BHP in the first half of this year, the stock is currently offering a 5.7% dividend yield, which is nearly quadruple the 1.6% yield of the S&P 500. The company has a decent payout ratio of 70% and a rock-solid balance sheet. However, investors should be aware of the high cyclicality of the earnings and dividends of BHP. This cyclicality results from the dramatic swings of commodity prices. For instance, BHP posted strong earnings per share of $5.18 in 2014 but the company saw its earnings collapse in 2015 and incurred material losses in 2016 due to the fierce downcycle of commodities in 2015-2016.

On the bright side, BHP greatly benefits from the secular growth of electric vehicles, which will provide a strong tailwind to the commodity producer in the upcoming years. Overall, BHP is ideally positioned to benefit from the boom in the global demand for iron ore, copper and nickel and enjoys great economies of scale thanks to the immense size of its operations but its results are inevitably sensitive to the cycles of commodity prices.

Click here to download our most recent Sure Analysis report on BHP (preview of page 1 of 3 shown below):

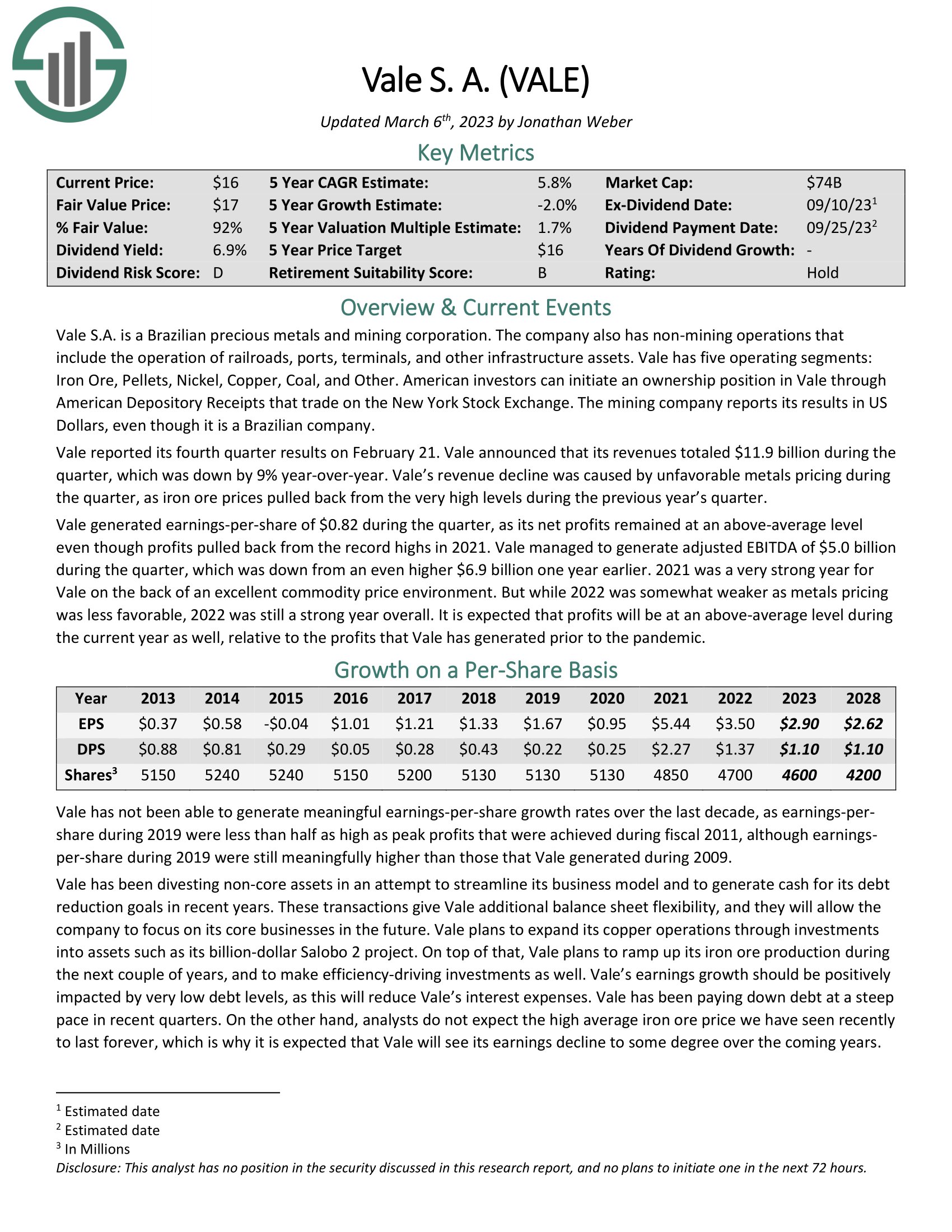

Best Nickel Stock #6: Vale (VALE)

Vale is a Brazilian precious metals and mining corporation. It is one of the top metal miners in the world and the greatest producer of nickel in the world. The company also has non-mining operations, which include the operation of railroads, ports, terminals, and other infrastructure assets.

Just like BHP, Vale has greatly benefited from the favorable environment of prices of iron ore and other metals in the last two years. In fact, the earnings of the company have followed the path of the earnings of BHP in a very similar fashion. In 2021, Vale posted record earnings per share of $5.44 thanks to the breathtaking rally of commodity prices. In 2022, commodity prices somewhat deflated and thus the company incurred a 36% decrease in its earnings per share but still posted its second-best performance in the last decade.

Vale greatly benefits from the secular growth in the global demand for iron ore, which is used in the production of steel. The penetration of steel in the housing market of China is expected to grow from 0.8% in 2018 to 6.0% in 2025.

Source: Investor Presentation

In addition, 150-200 million Chinese people are expected to move from rural areas to urban areas over the next 30 years. Thanks to all the positive underlying factors in the Chinese market, the production of steel is expected to more than double in Southeast Asia by 2030. This trend will provide a strong tailwind for the global demand for iron ore. Vale is ideally positioned to benefit from this tailwind.

Moreover, Vale is in the process of divesting some non-core assets in order to focus on its most promising operations and reduce its debt load. The company has already strengthened its balance sheet remarkably, primarily thanks to its excessive free cash flows, which have resulted from the high commodity prices that have prevailed over the last two years.

Vale is also offering a 7.0% dividend yield with a payout ratio of only 38%. Nevertheless, just like BHP, Vale is highly sensitive to the cycles of commodity prices. The company incurred losses in 2015 and saw its earnings collapse in 2020 due to the coronavirus crisis. Whenever the commodity business of Vale faces a headwind, such as a global recession, the earnings and the dividend of the company will probably plunge. Overall, Vale is ideally positioned to benefit from the secular growth in the global demand for iron ore and nickel but it is not immune to the cycles of its commodity business.

Click here to download our most recent Sure Analysis report on VALE (preview of page 1 of 3 shown below):

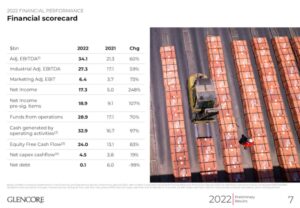

Best Nickel Stock #5: Glencore (GLNCY)

Glencore was founded in 1974 and is one of the global leaders in the mining sector. In its current form, the company is the result of the merger between Glencore with Xstrata in 2013. The company smelts, refines, mines, processes and stores silver, copper, zinc, aluminum, nickel, cobalt, iron ore and other metals.

Glencore, which is the largest company in Switzerland, also has an energy and agricultural products segment. As a result, it is the most diversified company in its peer group. Diversification is paramount when considering commodity stocks, given the boom-and-bust cycles of commodity prices.

The unparalleled diversification of Glencore has another advantage as well. When one or two commodities experience a strong rally, they result in an asymmetric increase in the earnings of Glencore. Thanks to its exceptionally wide portfolio of assets, Glencore is positioned to take advantage of a rally in the price of essentially any commodity.

The merits of the wide diversification of Glencore were in full display in 2022. While most commodity producers incurred a material decline in their earnings due to the correction of commodity prices last year, Glencore posted blowout results, primarily thanks to exceptionally high prices of coal and wide margins in its LNG business.

Source: Investor Presentation

As shown in the above slide, Glencore more than doubled its adjusted earnings in 2022. In addition, the company took advantage of the favorable business environment and drastically reduced its net debt. This move should certainly be praised, as a strong balance sheet is paramount for commodity producers during the downturns of their business.

Some investors view Glencore as vulnerable to the ongoing shift from fossil fuels to clean energy sources, particularly given the acceleration of this shift during the last three years. However, the energy crisis experienced last year proved that the potential of renewable energy sources is limited so far. Moreover, Glencore has performed excessive investments in key transition metals, such as copper, cobalt and nickel. Given also the promising prospects of its LNG business, the company seems to be well positioned for the ongoing transition of the global energy market.

Best Nickel Stock #4: Anglo American (NGLOY)

Anglo American operates as a mining company worldwide. It explores for rough and polished diamonds, copper, platinum group metals, metallurgical and thermal coal, steelmaking coal, iron ore, nickel, polyhalite, and manganese ores, as well as alloys. The company was founded in 1917 and is headquartered in London, the United Kingdom.

Just like most commodity producers, Anglo American incurred a decrease in its earnings last year due to somewhat lower commodity prices as well as increased operating costs, which resulted from the surge of inflation to a 40-year high level. The company also incurred a modest decrease in its total production over the prior year. Nevertheless, it posted just a 10% decrease in its EBITDA, from $20.6 billion in 2021 to $18.6 billion in 2022.

Source: Investor Presentation

The performance of Anglo American in 2022 was the second-best performance in the history of the company. It is also important to note that the company faced some safety issues in 2021 but it greatly improved its safety performance last year.

Going forward, Anglo American is likely to continue to benefit from the high-grade iron ore it produces at the Venetia open pit. It will also benefit from the increasing demand for iron ore from China, as the country is recovering strongly from the coronavirus crisis. The steel production in China is expected to surge to an 8-year high this year. This is a key factor behind the recent rally in iron ore prices.

On the other hand, Anglo American is sensitive to the cycles of commodity prices. Like many of its peers, the company saw its earnings collapse in 2016 and suspended its dividend in that year. On the bright side, its business fundamentals look promising for the foreseeable future thanks to the growing global demand for metals.

Based on its dividend in the first half of this year, Anglo American is offering a 4.4% dividend with a healthy payout ratio of 30%. Given also the strong balance sheet of the company, the dividend is well covered. Nevertheless, whenever commodity prices incur a major correction, the dividend is likely to be cut sharply.

Best Nickel Stock #3: Canada Nickel Company (CNIKF)

Canada Nickel Company engages in the exploration, discovery, and development of nickel sulphide assets. It owns a 100% interest in the Crawford Nickel-Cobalt Sulphide project, which is located in northern Ontario, Canada. The company serves electric vehicle, green energy and stainless-steel markets. Canada Nickel was incorporated in 2019 and is headquartered in Toronto, Canada. Anglo American is a major stakeholder of Canada Nickel, as it owns 9.9% of the shares of the company.

In contrast to the aforementioned companies, Canada Nickel is focused exclusively on the production of nickel. As a result, it is extremely sensitive to the fluctuation of the price of nickel. This sensitivity results in high vulnerability during downturns but excessive profits during boom times. Fortunately for the company, the fundamentals of the nickel industry look promising right now.

Source: Investor Presentation

Thanks to the surging demand for electric vehicles, global demand for nickel is on a reliable growth trajectory. Global demand grew 17% between 2021 and 2022, from 2.4 to 2.8 million tons. Even better, it is expected to nearly double by 2030, to 5.1 million tons. At the same time, there is minimum supply growth outside China and Indonesia. As a result, Canada Nickel is one of the extremely few potential suppliers who can grow their nickel output in the upcoming years.

The Crawford Nickel-Cobalt Sulphide project of Canada Nickel has many positive characteristics. It is one of the largest nickel sulphide resources in the world, with major support infrastructure in place. Moreover, it is close to contractors and producing mines and has the potential to use the Kidd Creek mill of Glencore for smaller scale start-up. The Crawford Nickel-Cobalt Sulphide project has a low production cost and an expected after-tax investment return in excess of 16%.

In sharp contrast to the aforementioned companies, Canada Nickel has a very short history, as it was formed only in 2019, and does not pay a dividend. It is thus somewhat more speculative and risky than the other stocks of this group. On the other hand, thanks to its exclusive focus on nickel production, this stock is likely to offer outsized returns if the fundamentals of supply and demand in this business remain favorable in the upcoming years.

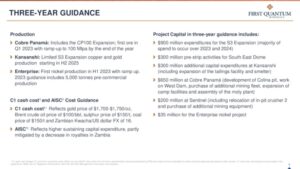

Best Nickel Stock #2: First Quantum Minerals (FQVLF)

Together with its subsidiaries, First Quantum Minerals engages in the exploration, development, and production of mineral properties. It primarily explores for copper, nickel, pyrite, gold, silver, and zinc ores. The company has operating mines that are located in Zambia, Panama, Finland, Turkey, Spain, Australia, and Mauritania. It is exploring the Taca Taca copper-gold-molybdenum project in Argentina, as well as the Haquira copper deposit in Peru. The company was formerly known as First Quantum Ventures and changed its name to First Quantum Minerals in 1996. First Quantum Minerals was formed in 1983 and is based in Vancouver, Canada.

Due to the correction of commodity prices last year, First Quantum Minerals incurred a 17% decrease in its earnings per share, from $1.40 in 2021 to $1.16 in 2022. The decrease also resulted from adverse weather, which somewhat affected the operations in some of the mines of the company.

However, First Quantum Minerals has promising growth prospects ahead thanks to its major growth projects.

Source: Investor Presentation

First Quantum Minerals expects to ramp up its production of iron ore to 100 metric tons by the end of this year. In addition, it expects to achieve its first nickel production in its Enterprise project in the first half of this year. This project has significant production growth potential as well.

On the other hand, First Quantum Minerals has some differences from the other commodity producers mentioned in this article. First Quantum Minerals has exhibited a much more volatile performance record during the last nine years, with material losses in three of the last nine years. In other words, the company has proved more vulnerable to the cycles of its business.

Moreover, First Quantum Minerals has a weaker balance sheet than most of its peers. Its interest expense consumes 28% of its operating income while its net debt is standing at $10.2 billion. As this amount is 66% of the market capitalization of the stock, it is manageable but it is not negligible. To provide a perspective, the interest expense of BHP consumes less than 1% of the operating income of the company. To cut a long story short, First Quantum Minerals has promising growth prospects ahead but it is more vulnerable than most of its peers to the cycles of its business.

Best Nickel Stock Stock #1: Rio Tinto (RIO)

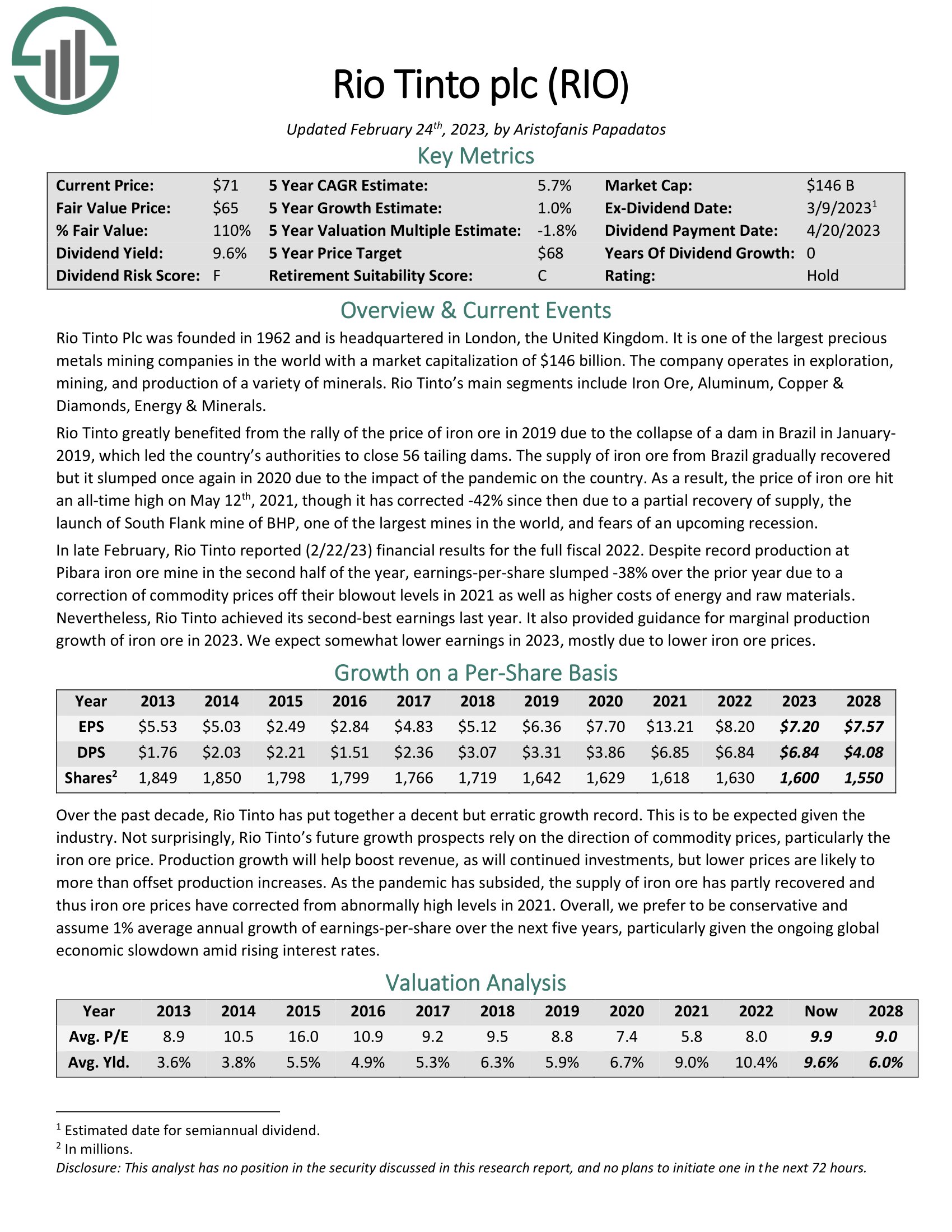

Rio Tinto was founded in 1962 and is headquartered in London, the United Kingdom. It is one of the largest precious metals mining companies in the world, with a market capitalization of $113 billion. The company operates in exploration, mining and production of a variety of minerals. The main segments of the company are: Iron Ore, Aluminum, Copper & Diamonds, Energy & Minerals.

Rio Tinto exhibited similar performance to that of its peers last year. Despite record production at Pibara iron ore mine in the second half of the year, the earnings per share of the company slumped 38% over the prior year due to a correction of commodity prices off their blowout levels in 2021 as well as higher costs of energy and raw materials. Nevertheless, Rio Tinto achieved its second-best earnings last year. It also provided guidance for marginal production growth of iron ore in 2023.

The primary competitive advantage of Rio Tinto is its global operations and its top industry position. The company operates in 35 countries across six continents. It has the ability to acquire new properties for development that smaller competitors cannot match. The company also has a foothold in several premier emerging markets, which are the most attractive locations for long-term growth.

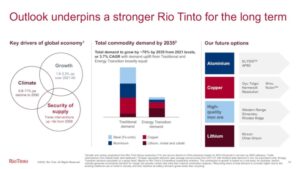

Rio Tinto expects the total commodity demand to grow 70% between 2021 and 2035, for a 3.7% average annual growth rate.

Source: Investor Presentation

Thanks to its dominant business position and its promising pipeline of growth projects, Rio Tinto is properly positioned to benefit from the long-term growth in the global demand for commodities.

Based on its dividend in the first half of this year, Rio Tinto is currently offering a 6.6% dividend yield, with a decent payout ratio of 63%. It is also important to note that the company has taken advantage of its excessive free cash flows, which have resulted from the high commodity prices during the last two years, and thus it has remarkably strengthened its balance sheet. To be sure, interest expense consumes just 2% of operating income and hence it is negligible.

Due to the cyclicality of its business, Rio Tinto has exhibited volatile results, in line with its peers. However, the company has proved somewhat more resilient than its peers, as it has remained profitable in every single year over the last decade. It has also exhibited less volatility than its peers thanks to its discipline to invest in high-return production growth projects. Overall, Rio Tinto may not offer the upside potential of some smaller metals producers but it has proved less vulnerable to the downturns of its business and is on a reliable long-term growth trajectory.

Click here to download our most recent Sure Analysis report on RIO (preview of page 1 of 3 shown below):

Final Thoughts

Most investors dismiss the stocks of nickel producers due to their historical cyclicality. However, investors should note that the global demand for nickel has entered a sustainable growth trajectory thanks to the high growth of the sales of electric vehicles, whose batteries require pure nickel as a component. In the absence of a severe global recession, nickel producers are likely to continue thriving. Nevertheless, due to the sensitivity of commodity producers to downturns, only the investors who can endure extended periods of low commodity prices and high stock price volatility should consider including nickel producers to their investment portfolios.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].