Updated on December 26th, 2022 by Quinn Mohammed

The healthcare sector is a great place to find high-quality dividend growth stocks. Look no further than the list of Dividend Aristocrats for evidence of this.

The Dividend Aristocrats are a select group of 64 stocks in the S&P 500 Index with at least 25 consecutive years of dividend increases. There are currently 8 Dividend Aristocrats that come from the healthcare sector.

The healthcare sector has a long-term growth catalyst going forward, which is aging populations around the world. Healthcare spending in many developed countries is likely to grow over the long term as a result.

With this in mind, we’ve compiled a list of over 200 healthcare stocks (along with important investing metrics like price-to-earnings ratios and dividend yields) which you can download below:

It is easy to see why healthcare stocks make for excellent long-term investments. The U.S. healthcare sector widely enjoys high profitability with solid cash flows. After all, people often cannot go without health care, even in challenging economic climates.

The rankings in this article are derived primarily from our expected total return estimates for every healthcare dividend stock found in the Sure Analysis Research Database.

For investors interested in high-quality dividend growth stocks, this article will discuss the top 7 dividend-paying healthcare stocks to buy now.

Table Of Contents

The seven best healthcare stocks are listed below in order of total expected returns over the next five years, from lowest to highest. You can instantly jump to any individual stock analysis by clicking on the links below:

Health Care Stock #7: Humana Inc. (HUM)

- 5-year expected annual returns: 12.8%

Humana is one of the largest private health insurers in the U.S., focusing on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military’s Tricare program.

On September 30th, 2022, the company had approximately 17 million members in medical benefit plans and approximately 5 million members in specialty products. In 2021, 83% of premiums and services revenue were from contracts with the federal government.

On November 2nd, 2022, Humana reported third quarter 2022 results for the period ending September 30th, 2022. For the quarter, the company reported revenues of $22.8 billion and adjusted earnings per share of $6.88, which compared to revenue of $20.7 billion and adjusted earnings per share of $4.83 in the third quarter of 2021. Higher revenues in the quarter were supported by membership growth and higher Medicare Advantage premiums per member.

The company also increased its 2022 earnings guidance for the third time this year. Adjusted EPS is now expected to be $25.00, up from the previous estimate of $24.75, representing an increase of roughly 21% compared to 2021 adjusted EPS of $20.64.

Click here to download our most recent Sure Analysis report on Humana (preview of page 1 of 3 shown below):

Health Care Stock #6: GlaxoSmithKline ADR (GSK)

- 5-year expected annual returns: 12.8%

GlaxoSmithKline develops, manufactures, and markets healthcare products in the areas of pharmaceuticals, vaccines, and consumer products. GlaxoSmithKline’s pharmaceutical offerings address the following disease categories: central nervous system, cardiovascular, respiratory, and immune inflation. The company generates about $35 billion in annual sales.

On July 18th, 2022, GlaxoSmithKline announced that the company had completed the spinoff of it its consumer healthcare business into Haleon PLC (HLN). Haleon is expected to generate 4% to 6% organic growth annually.

On November 2nd, 2022, GlaxoSmithKline reported third quarter 2022 results for the period ending September 30th, 2022. All figures are listed in U.S. dollars and in constant exchange rates. Revenue decreased by 29% for the quarter, while adjusted earnings per share fell 15% to $1.07.

Specialty medicines continue to perform well, with these products growing 24% year-over-year. Respiratory grew 17% as a result of high demand both in the U.S. and worldwide. Benlysta and Nucala both had double-digit growth. Revenue for HIV products grew 7% due to strong demand for new products, such as Dovato and Juluca. Established Pharmaceuticals increased by 1%. Vaccines grew by 5% due to strength in Shingrix sales.

GlaxoSmithKline also raised its outlook for 2022, with the company now expecting sales growth of 8% to 10% for the year, up from 6% to 8% and 5% to 7% previously. Earnings per share are now expected to be $3.13 per ADR share this year, compared to $3.10 and $3.24 previously.

Click here to download our most recent Sure Analysis report on GlaxoSmithKline (preview of page 1 of 3 shown below):

Health Care Stock #5: Pfizer Inc. (PFE)

- 5-year expected annual returns: 13.9%

Pfizer Inc. is a global pharmaceutical company focusing on prescription drugs and vaccines. The stock has a market capitalization of $291 billion, making Pfizer a mega-cap stock.

Pfizer’s new CEO completed a series of transactions, significantly altering the company structure and strategy. Pfizer formed the GSK Consumer Healthcare Joint Venture in 2019 with GlaxoSmithKline plc (GSK), which includes Pfizer’s over-the-counter business. Pfizer owns 32% of the JV. The company also spun off its Upjohn segment and merged it with Mylan to form Viatris for its off-patent, branded, and generic medicines in 2020.

Pfizer’s top products are Eliquis, Ibrance, Prevnar 13, Enebrel (international), Sutent, Xtandi, Vyndaqel/ Vyndamax, Inlyta, Xeljanz, Plaxlovid, and Comiranty.

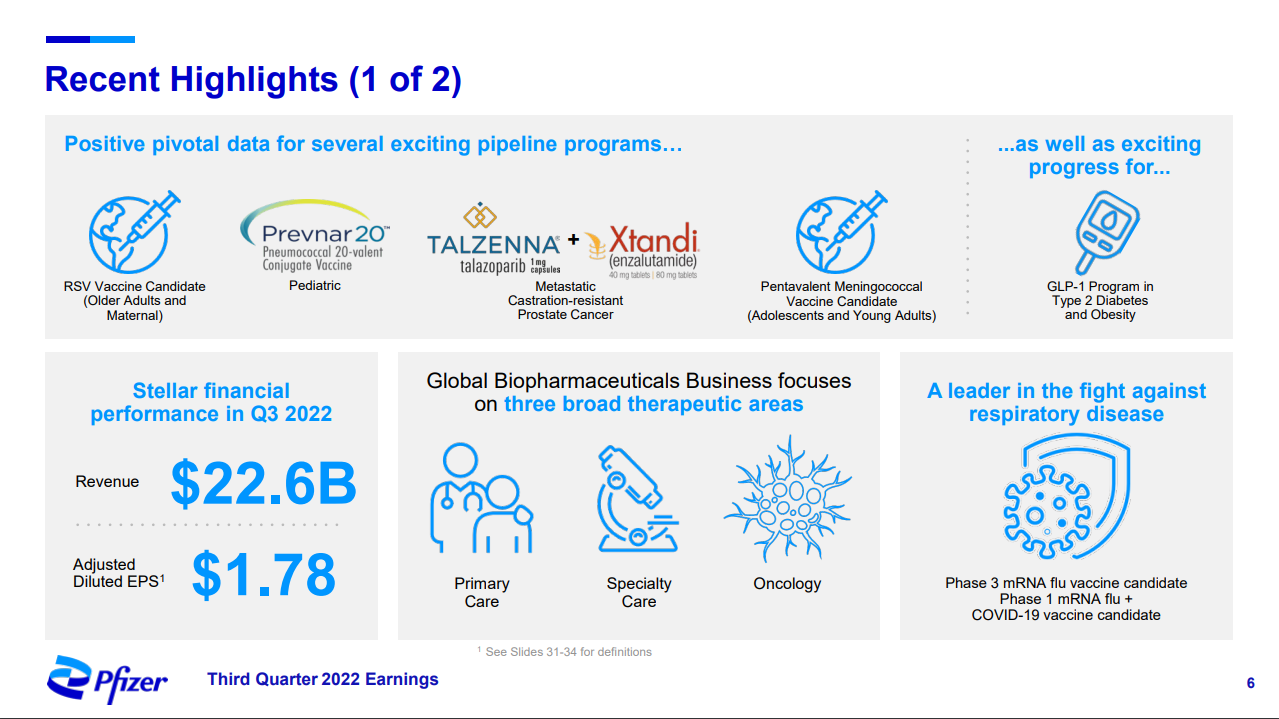

Pfizer reported Q3 2022 results on November 1st, 2022.

Source: Investor Presentation

Companywide revenue decreased by 6% to $22.6 billion from $24.0 billion, and adjusted diluted earnings per share grew by 40% to $1.78 compared to $1.27 a year ago. Pfizer increased revenue guidance to $99.5 billion to $102.0 billion and adjusted diluted EPS guidance to $6.40 to$6.50 for 2022.

Pfizer is a Kevin O’Leary dividend stock.

Click here to download our most recent Sure Analysis report on Pfizer (preview of page 1 of 3 shown below):

Health Care Stock #4: Sanofi SA (SNY)

- 5-year expected annual returns: 15.1%

Sanofi is a global pharmaceutical company. The company develops and markets a variety of therapeutic treatments and vaccines. Pharmaceuticals account for about 72% of sales, vaccines make up roughly 15% of sales, and consumer healthcare contributes the remainder of sales.

Sanofi is truly a global leader, with a third of sales coming from the U.S., a little more than a quarter coming from Western Europe, and the remainder of sales coming from emerging markets/the rest of the world. Sanofi produces annual revenues of about $43 billion.

On October 28th, 2022, Sanofi reported third-quarter results for the period ending September 30th, 2022. Revenue increased by 2.0% to $12.4 billion, surpassing estimates by $432 million. The company’s earnings per share per ADR of $1.44 compared favorably to $1.23 in the prior year and was 10 cents ahead of expectations.

Pharmaceutical revenues were higher by 5.1% during the quarter. Specialty Care had an excellent quarter, with 19.9% revenue growth. Oncology, however, fell 8.4%, primarily due to a 13.3% decline in Jevtana, which treats prostate cancer that has spread to other body parts.

The remainder of the portfolio continues to show solid growth rates. Rare Diseases grew 7.7%. Vaccine revenue surged 23.5% as gains were seen in almost all areas, with particular strength in influenza and travel and endemic vaccines. And Consumer Healthcare was up 1.9% as strength in cough and cold and digestive wellness were nearly offset by physical and mental wellness, allergy, pain care, and personal care.

Sanofi revised its outlook for 2022 as well. The company now expects earnings per share growth of approximately 16% for the year, to equal about $4.45 per ADR.

Click here to download our most recent Sure Analysis report on Sanofi (preview of page 1 of 3 shown below):

Health Care Stock #3: Baxter International (BAX)

- 5-year expected annual returns: 19.2%

Baxter International develops and sells various healthcare products, including biological products, medical devices, and connected care devices used to monitor patients. Its products are used in hospitals, kidney dialysis centers, nursing homes, doctors’ offices, and for patients at home under physician supervision.

On December 13th, 2021, Baxter announced the acquisition of Hillrom to pursue its vision to transform healthcare through technology. Hillrom makes smart technology, like patient beds and smart pumps, for hospitals, which helps to complement Baxter’s primary offerings.

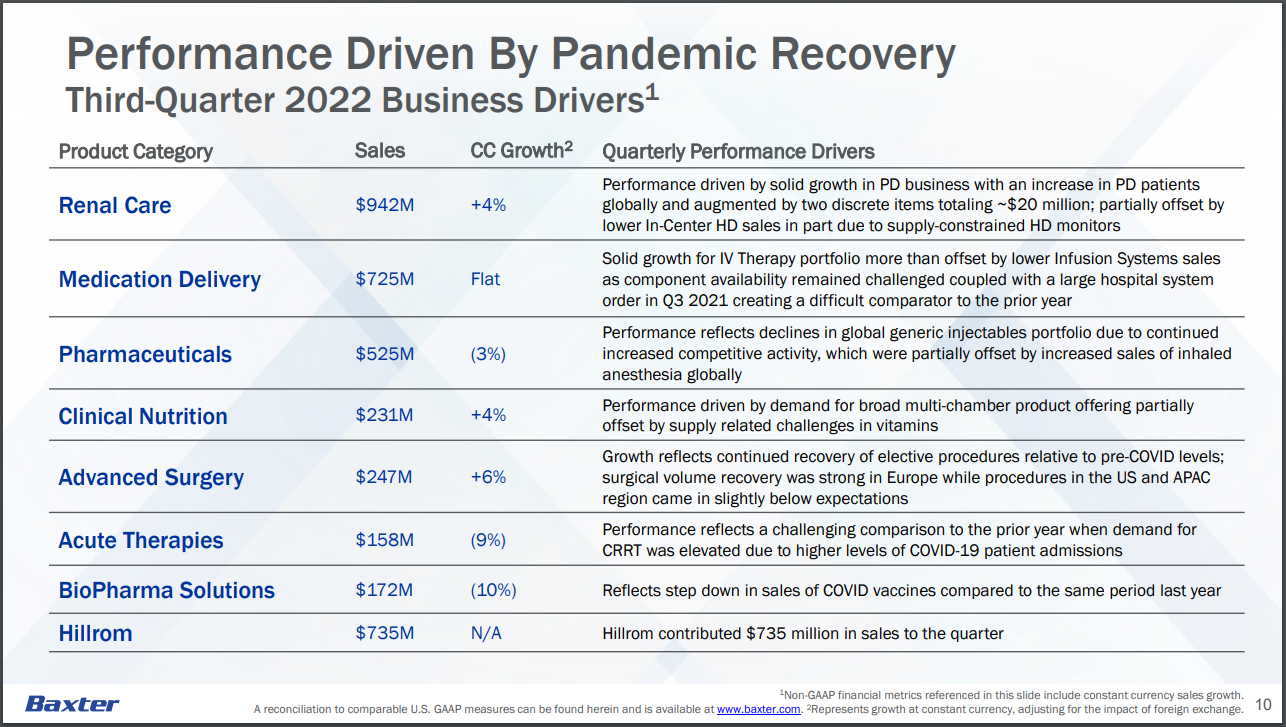

On October 27th, 2022, Baxter International reported third-quarter 2022 results for the period ending September 30th, 2022. The company beat consensus revenue estimates by $30 million, reporting a 17.6% year-over-year revenue increase to $3.8 billion.

Source: Investor Presentation

Baxter saw $0.82 in adjusted earnings per share for the quarter, which was in line with analysts’ estimates and equaled a 19.6% year-over-year decrease. Sales in the U.S. decreased by 1% year-over-year on an operational basis to $1.8 billion, and International sales grew 2% year-over-year on an operational basis to $1.9 billion.

We are forecasting 2022 earnings per share to be roughly $3.50 in 2022, driven by a full year of results from the Hillrom acquisition. Additionally, we forecast a 10% growth rate in EPS and the dividend per share over the next five years.

Click here to download our most recent Sure Analysis report on Baxter (preview of page 1 of 3 shown below):

Health Care Stock #2: Royalty Pharma (RPRX)

- 5-year expected annual returns: 19.6%

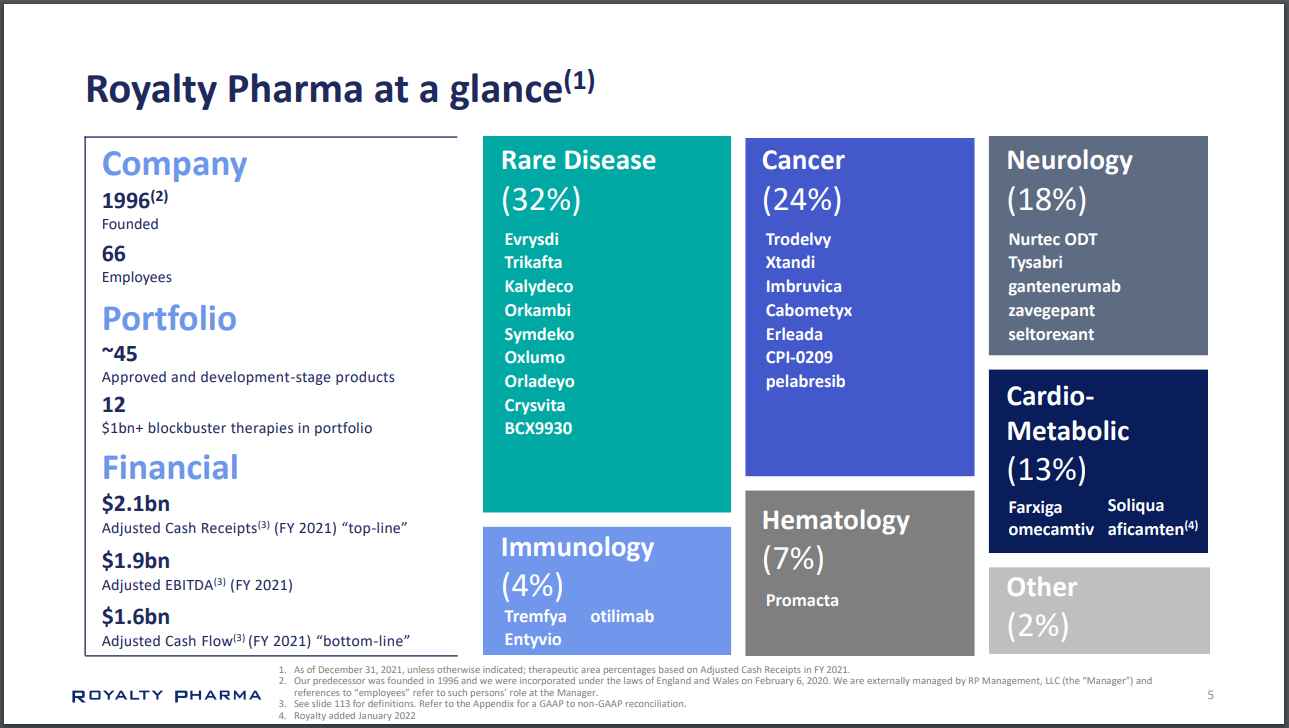

Royalty Pharma owns biopharmaceutical royalties and funds innovation in the biopharmaceutical industry in the U.S. The company’s portfolio holds royalties on roughly 35 marketed therapies and 11 development-stage product candidates, addressing areas such as rare diseases, cancer, neurology, infectious disease, hematology, and diabetes.

Some of Royalty Pharma’s royalties entitle them to payments linked to the top-line sales of some leading therapies, such as AbbVie and Johnson & Johnson’s Imbruvica, Astellas and Pfizer’s Xtandi, Gildea’s Trodelvy, and Novartis’ Promacta, plus many more.

Source: Investor Presentation

On November 8th, 2022, Royalty Pharma reported third quarter 2022 results for the period ending September 30th, 2022. The company saw adjusted earnings per share of $0.73, which beat analysts’ estimates by 2 cents and was unchanged compared to last year. Revenue decreased by 2.2% year-over-year to $573 million and missed analysts’ estimates by $37 million.

As a holding of Berkshire Hathaway (BRK.A)(BRK.B), Royalty Pharma is a Warren Buffett stock.

Click here to download our most recent Sure Analysis report on RPRX (preview of page 1 of 3 shown below):

Health Care Stock #1: Koninklijke Philips N.V. (PHG)

- 5-year expected annual returns: 20.5%

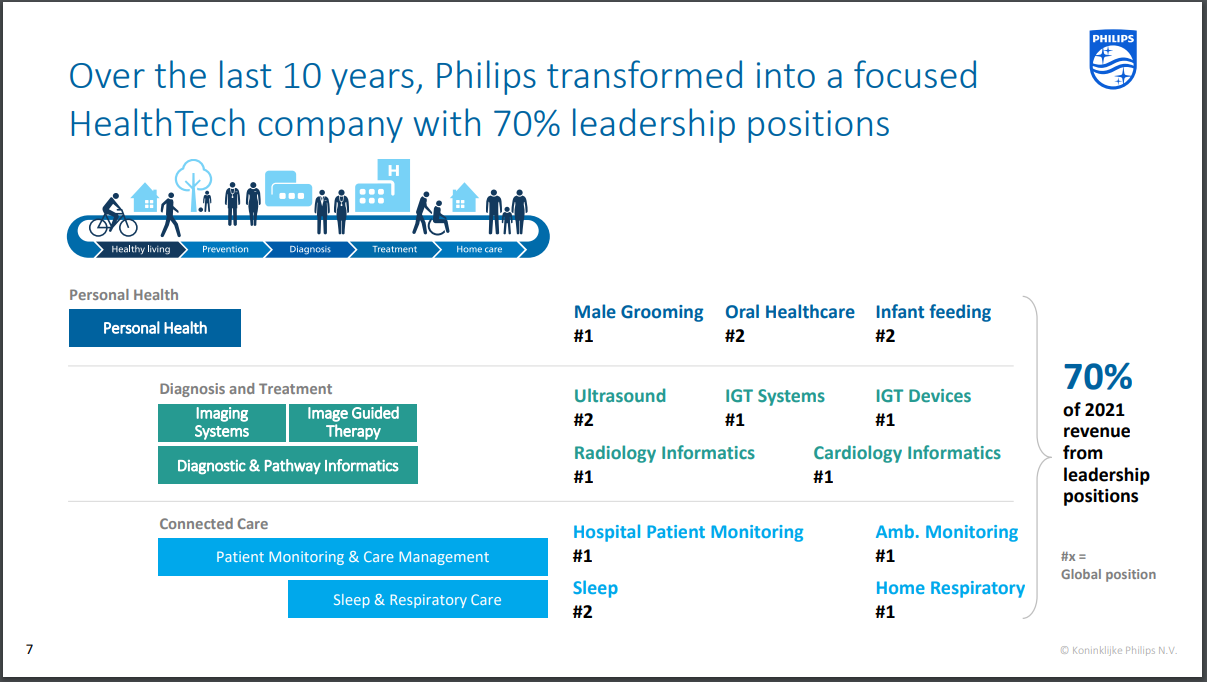

Philips Electronics NV is a global manufacturer of electronic products for healthcare, lighting, and other consumer products. The company used to generate about half of its sales from lighting, TV, and lifestyle entertainment products but has undergone a significant transformation in recent years and has become a health tech leader.

The company now has four operating segments: Diagnosis & Treatment (42% of total sales), Personal Health (28% of sales), Connected Care & Health Informatics (29% of sales), and Legacy Items (1% of sales).

Source: Investor Presentation

On October 24th, 2022, Philips Electronics reported financial results for the third quarter of fiscal 2022. Comparable sales fell by 6% due to supply chain issues and the sustained effect of the recall of respiratory devices. As a result, the adjusted EBITDA margin shrank from 12.3% to 4.8%.

The poor performance resulted primarily from the sustained effect of the recall of 4 million respiratory devices in 2021. Over 100 injuries have been reported from a foam part of the devices, which can degrade and cause cancer. The FDA has categorized the recall as “the most serious type.” The company recently changed its CEO to turn around the company. While this headwind is non-recurring, it may cost many billions of dollars and has increased the stock risk.

As a result of the short-term impact of this headwind, we have lowered our forecast for earnings per share in 2022 from $1.30 to $1.05. It also appears to be taking much longer than anticipated for the company to recover from this crisis, while management is blaming macro headwinds, such as supply chain disruptions and the war in Ukraine, for the poor results.

Click here to download our most recent Sure Analysis report on Koninklijke Philips N.V. (preview of page 1 of 3 shown below):

Final Thoughts

There are plenty of quality dividend stocks to be found in the healthcare sector. Many large healthcare companies are highly profitable, with long-term growth up ahead due to aging populations.

Shareholders of many healthcare stocks are likely to receive dividend increases each year. These seven healthcare stocks pay dividends to shareholders and are almost all reasonably valued, leading to high expected returns over the next five years.

Other Reading

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Comments 1