Up to date on Might twenty third, 2022 by Bob Ciura

Beer shares, similar to different beverage shares, are available in a number of completely different types. Corporations which might be engaged within the beer business supply direct publicity by way of manufacturing and distribution of beer, whereas different corporations in adjoining industries supply oblique publicity by way of fairness stakes in beer corporations.

The beer business is engaging for long-term earnings traders. Beer corporations take pleasure in great recession-resistance and constant income, that are used largely to pay dividends to shareholders.

With this in thoughts, we created a downloadable spreadsheet that focuses on beer shares. You may obtain our full Excel spreadsheet of beer shares (with essential monetary metrics like dividend yields and payout ratios) by clicking the hyperlink beneath:

This text will focus on the highest six beer shares, every of which provide traders robust aggressive benefits and first rate long-term development prospects. Because of this, they might match nicely within the diversified long-term dividend development portfolios that we aspire to assist traders construct right here at Certain Dividend.

The next shares have been chosen based on the Certain Evaluation Analysis Database. The six beer shares are ranked based on their 5-year anticipated annual returns, in ascending order from lowest to highest.

Desk Of Contents

You need to use the next hyperlinks to immediately bounce to any particular inventory:

Beer Inventory #6: Constellation Manufacturers (STZ)

- 5-year anticipated annual returns: 5.1%

Constellation Manufacturers was based in 1945 and has grown into a world alcoholic beverage big, producing and distributing over 100 manufacturers of beer, wine, and spirits, together with Corona, Modelo Especial, Modelo Negra, Pacifico, Ballast Level, Funky Buddha Brewery, Robert Mondavi, Clos du Bois, Kim Crawford, Mark West, Black Field, SVEDKA Vodka, Casa Noble Tequila and Excessive West Whiskey. The corporate additionally has a stake in hashish firm Cover Development (CGC).

Associated: The Greatest Marijuana Shares: Listing of 140+ Marijuana Trade Corporations

On April seventh, 2022, Constellation Manufacturers reported This autumn and FY 2022 outcomes for the interval ending February twenty eighth, 2022. (Constellation Manufacturers’ fiscal 12 months ends the final day of February). For the fiscal 12 months, the corporate recorded $8.8 billion in web gross sales, a 2% enhance in comparison with fiscal 12 months 2021. This consequence was pushed by an 11% year-over-year enhance in beer gross sales, offset by a 19% decline in wine and spirits gross sales.

Adjusted earnings-per-share equaled $10.20 in comparison with $9.97 in 2021. Constellation Manufacturers additionally offered its fiscal 2023 outlook. The corporate expects $11.20 to $11.50 in adjusted EPS. As well as, beer gross sales are anticipated to extend 7% to 9% and wine and spirit gross sales are anticipated to be down -1% to -3%.

Regardless of its clear strengths, Constellation Manufacturers does have some dangers. These embody its heavy dependence on Mexican Beer (which provides over two-thirds of its working income), ongoing and intensifying competitors from sizable rivals, and its massive stake in Cover Development.

Constellation Manufacturers inventory trades for a P/E ratio of 21.0, above our truthful worth P/E of 19. A declining valuation a number of might cut back annual returns. General, we anticipate Constellation Manufacturers delivering 5.1% whole returns over the subsequent 5 years from valuation headwinds, plus 5.5% annual earnings-per-share development and the 1.4% dividend yield

Click on right here to obtain our most up-to-date Certain Evaluation report on STZ (preview of web page 1 of three proven beneath):

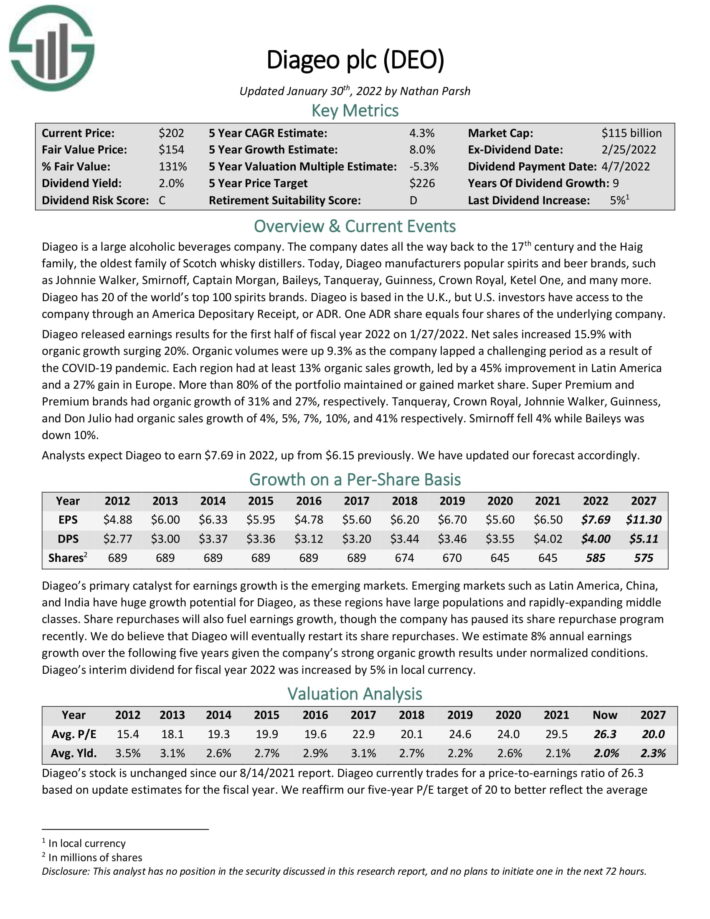

Beer Inventory #5: Diageo (DEO)

- 5-year anticipated annual returns: 6.5%

Diageo is without doubt one of the oldest and largest alcoholic drinks corporations. It dates all the best way again to the seventeenth century and immediately owns 20 of the world’s high 100 spirits manufacturers. Diageo producers standard spirits and beer manufacturers, comparable to Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and plenty of extra.

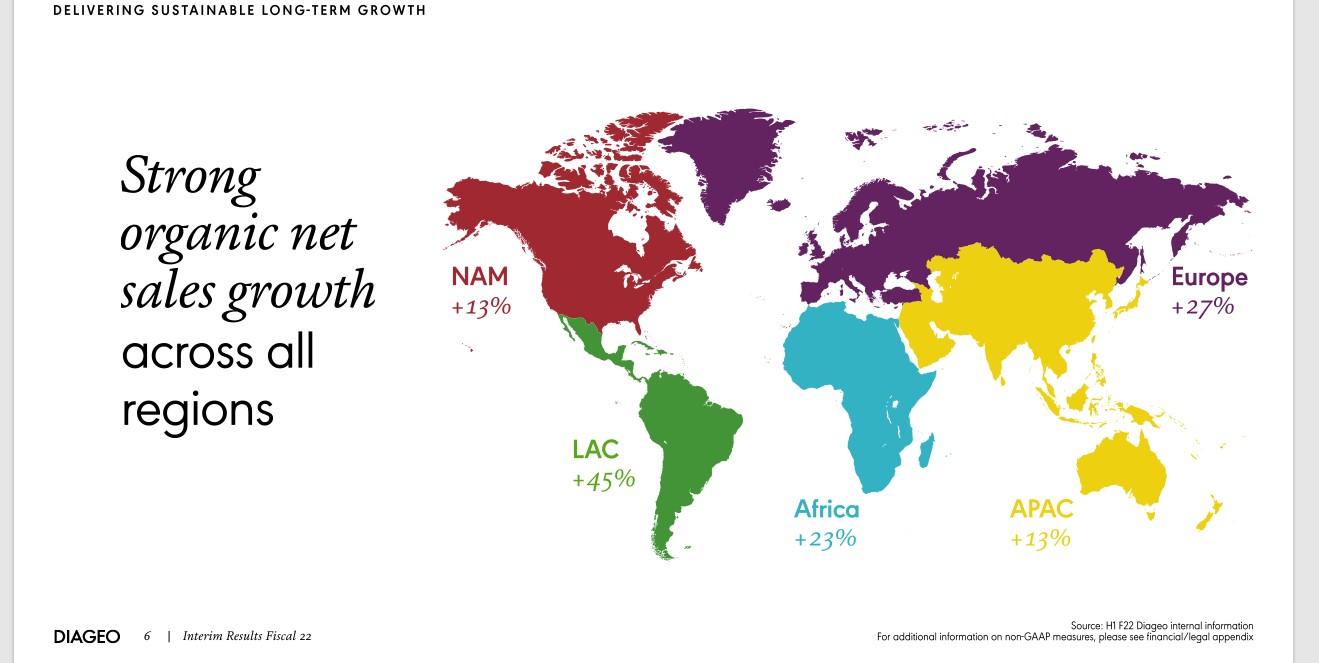

Diageo launched earnings outcomes for the primary half of fiscal 12 months 2022 on 1/27/2022. Internet gross sales elevated 15.9% with natural development surging 20%. Natural volumes have been up 9.3% as the corporate lapped a difficult interval on account of the COVID-19 pandemic. Every area had no less than 13% natural gross sales development, led by a forty five% enchancment in Latin America and a 27% achieve in Europe.

Supply: Investor Presentation

Greater than 80% of the portfolio maintained or gained market share. Tremendous Premium and Premium manufacturers had natural development of 31% and 27%, respectively. Tanqueray, Crown Royal, Johnnie Walker, Guinness, and Don Julio had natural gross sales development of 4%, 5%, 7%, 10%, and 41% respectively. Smirnoff fell 4% whereas Baileys was down 10%. Analysts anticipate Diageo to earn $7.69 in 2022.

We estimate 8% annual earnings development by way of 2025, comprised of mid-single-digit natural income development, margin growth, and resumption of share repurchases.

Just like its friends, Diageo’s robust development is pushed by its model energy and decrease value aggressive benefits. With 3 of the highest 10, 13 of the highest 50, and 20 of the world’s high 100 international premium distilled spirits manufacturers, the corporate enjoys robust client loyalty and new client desire. This allows them to cost larger costs and enhance their margins and returns on invested capital.

Moreover, the corporate’s massive international quantity provides them robust pricing energy with suppliers and higher economies of scale in manufacturing and distribution, chopping prices and additional bettering margins and economies of scale.

Along with the standard geopolitical, financial, and overseas alternate dangers shared by all international alcoholic beverage producers, Brexit poses a novel danger to Diageo. Provided that it’s headquartered and produces a lot of its product in Scotland, potential will increase in tariffs with the E.U. might damage the agency’s competitiveness and/or profitability in considered one of its main markets.

Diageo pays a semi-annual dividend, and will increase the dividend commonly. The inventory has a dividend yield of 1.7%.

Diageo shares at the moment commerce for a price-to-earnings ratio of 23.9, barely above our estimate of truthful worth at 20. This suggests unfavourable returns from a declining P/E ratio.

General, we anticipate the corporate to generate 6.5% annualized whole returns over the subsequent half decade as 8% earnings-per-share development, a 1.7% dividend yield and -3.2% annual returns from a declining P/E a number of. Diageo earns a maintain suggestion from Certain Dividend, however we imagine the opposite names on this listing supply even larger whole return potential.

Click on right here to obtain our most up-to-date Certain Evaluation report on Diageo (preview of web page 1 of three proven beneath):

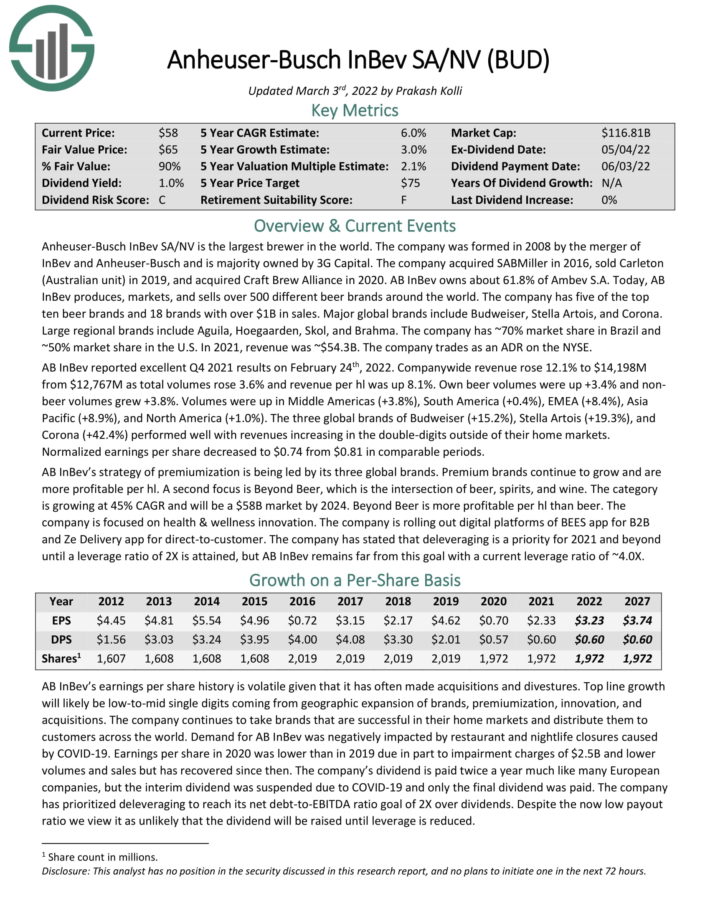

Beer Inventory #4: Anheuser-Busch InBev SA/NV (BUD)

- 5-year anticipated annual returns: 7.6%

Anheuser-Busch InBev SA/NV is the most important brewer on this planet because of the 2008 merger of InBev and Anheuser-Busch and the 2016 acquisition of SABMiller. The corporate produces, markets and sells over 500 completely different beer manufacturers world wide and owns 5 of the highest ten beer manufacturers and 18 manufacturers with over $1B in gross sales. These embody Budweiser, Stella Artois and Corona.

General, AB-InBev has 17 particular person beers that every generate no less than $1 billion in annual gross sales. You may see an in depth evaluation of AB-InBev’s 17 billion-dollar manufacturers right here.

AB InBev reported glorious This autumn 2021 outcomes on February twenty fourth, 2022. Companywide income rose 12.1% to $14,198M from $12,767M as whole volumes rose 3.6% and income per hl was up 8.1%. Personal beer volumes have been up +3.4% and nonbeer volumes grew +3.8%. Volumes have been up in Center Americas (+3.8%), South America (+0.4%), EMEA (+8.4%), Asia Pacific (+8.9%), and North America (+1.0%).

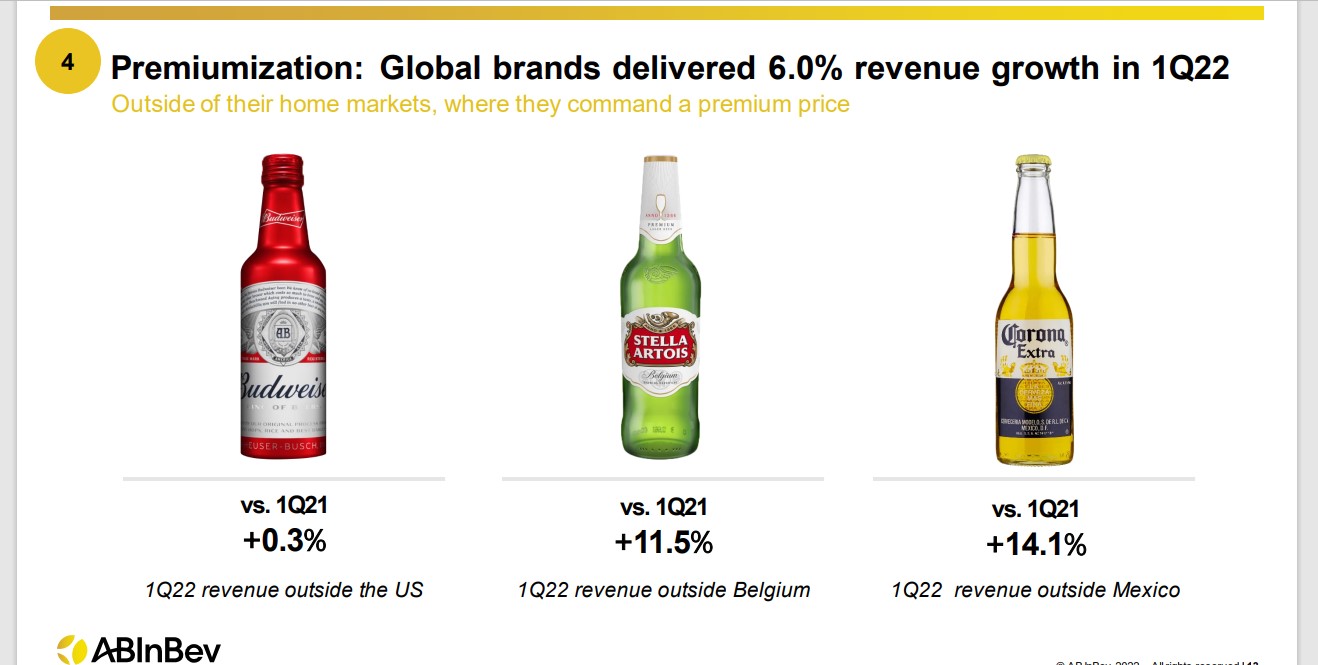

The three international manufacturers of Budweiser (+15.2%), Stella Artois (+19.3%), and Corona (+42.4%) carried out nicely with revenues rising within the double-digits outdoors of their dwelling markets. Normalized earnings per share decreased to $0.74 from $0.81 in comparable intervals.

AB InBev’s technique of premiumization is being led by its three international manufacturers.

Supply: Investor Presentation

AB-InBev lower its dividend late in 2018 in an effort to spend additional money on debt discount as a substitute of a large dividend. AB-InBev additionally lower its remaining 2019 dividend payout by 50%. This dividend discount saved the corporate roughly $1.1 billion, which has helped with debt reimbursement. The inventory at the moment yields 1%.

Associated: 3 Causes Why Corporations Reduce Their Dividends (With Examples)

We anticipate AB-InBev to develop earnings-per-share by 3% per 12 months over the subsequent 5 years. Development might be fueled by gross sales development by way of larger costs and volumes, in addition to share repurchases. Shares commerce for 17.2 occasions our earnings estimates, which is beneath our estimate of truthful worth at 20 occasions earnings.

Complete returns are anticipated at 7.6% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on BUD (preview of web page 1 of three proven beneath):

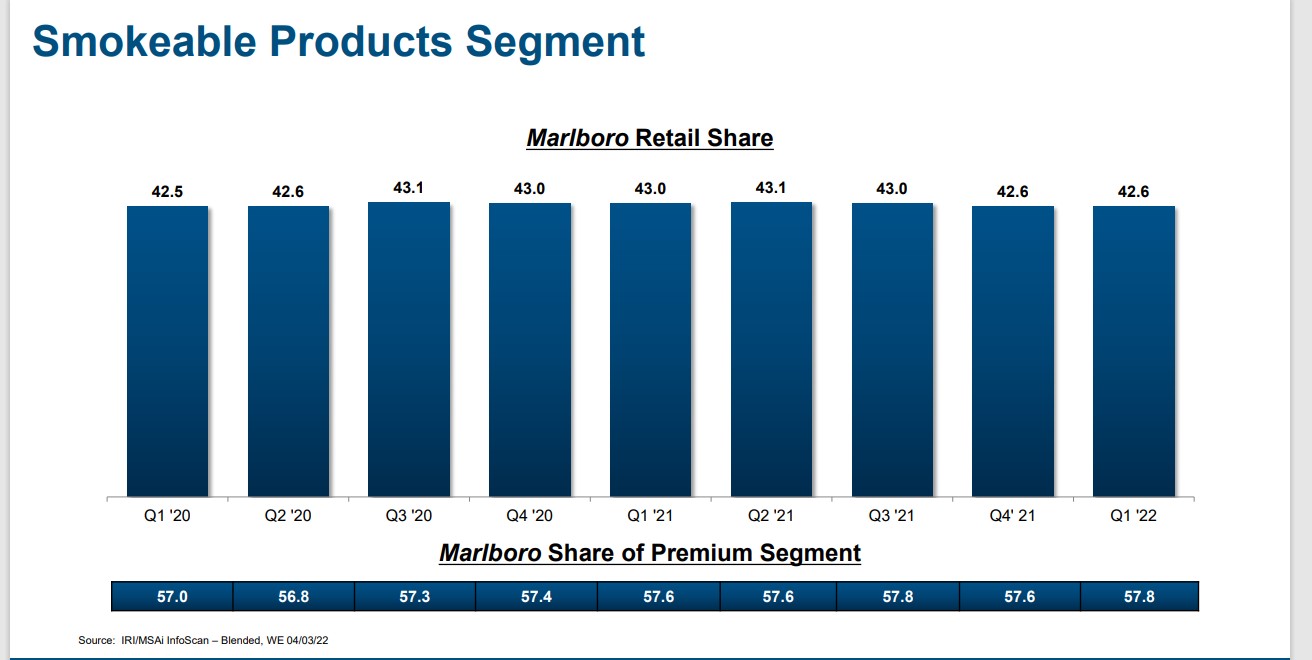

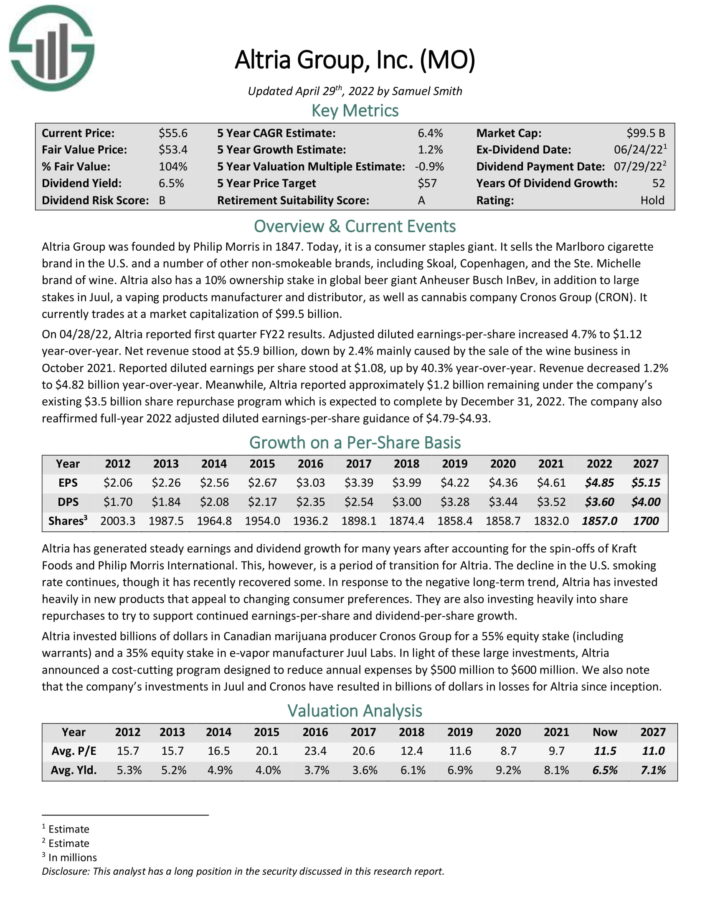

Beer Inventory #3: Altria Group (MO)

- 5-year anticipated annual returns: 8.2%

Altria Group was based by Philip Morris in 1847 and immediately has grown right into a client staples big. Whereas it’s primarily identified for its tobacco merchandise, it’s considerably concerned within the beer enterprise on account of its 10% stake in international beer big Anheuser-Busch InBev.

Associated: The Greatest Tobacco Shares Now, Ranked In Order

The flagship model continues to be Marlboro, which instructions over 40% retail market share within the U.S.

Supply: Investor Presentation

Altria additionally has a 10% possession stake in international beer big Anheuser-Busch InBev, along with massive stakes in Juul, a vaping merchandise producer and distributor, in addition to hashish firm Cronos Group (CRON).

On 04/28/22, Altria reported first quarter FY22 outcomes. Adjusted diluted earnings-per-share elevated 4.7% to $1.12 year-over-year. Internet income stood at $5.9 billion, down by 2.4% primarily brought on by the sale of the wine enterprise in October 2021. Reported diluted earnings per share stood at $1.08, up by 40.3% year-over-year. Income decreased 1.2% to $4.82 billion year-over-year.

In the meantime, Altria reported roughly $1.2 billion remaining underneath the corporate’s present $3.5 billion share repurchase program which is anticipated to finish by December 31, 2022. The corporate additionally reaffirmed full-year 2022 adjusted diluted earnings-per-share steerage of $4.79-$4.93.

The long-term future is cloudy for cigarette producers comparable to Altria, which is why the corporate has invested closely in adjoining classes to gas its future development.

The corporate bought a 55% fairness stake in Canadian marijuana producer Cronos Group, invested practically $13 billion for a 35% fairness stake in e-vapor producer Juul Labs, and not too long ago acquired an 80% possession stake in Switzerland-based Burger Söhne Group, for its on! oral nicotine pouch model. These investments might present Altria much-needed development because the cigarette market steadily declines.

Nonetheless, regardless of these dangers we proceed to view Altria favorably, due largely to its glorious dividend historical past and excessive yield. Altria has elevated its dividend for over 50 years, which locations it on the listing of Dividend Kings.

You may see the total downloadable spreadsheet of all 44 Dividend Kings (together with related monetary metrics that matter) by clicking on the hyperlink beneath:

It’s not solely one of the crucial engaging picks within the tobacco area, nevertheless it is without doubt one of the most engaging shares within the beer sector because of its funding in BUD.

We anticipate anticipate Altria to develop adjusted EPS by roughly 1.2% per 12 months over the subsequent 5 years. Along with the 7.0% dividend yield (with a flat P/E a number of), whole returns are anticipated at 8.2% per 12 months over the subsequent 5 years

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

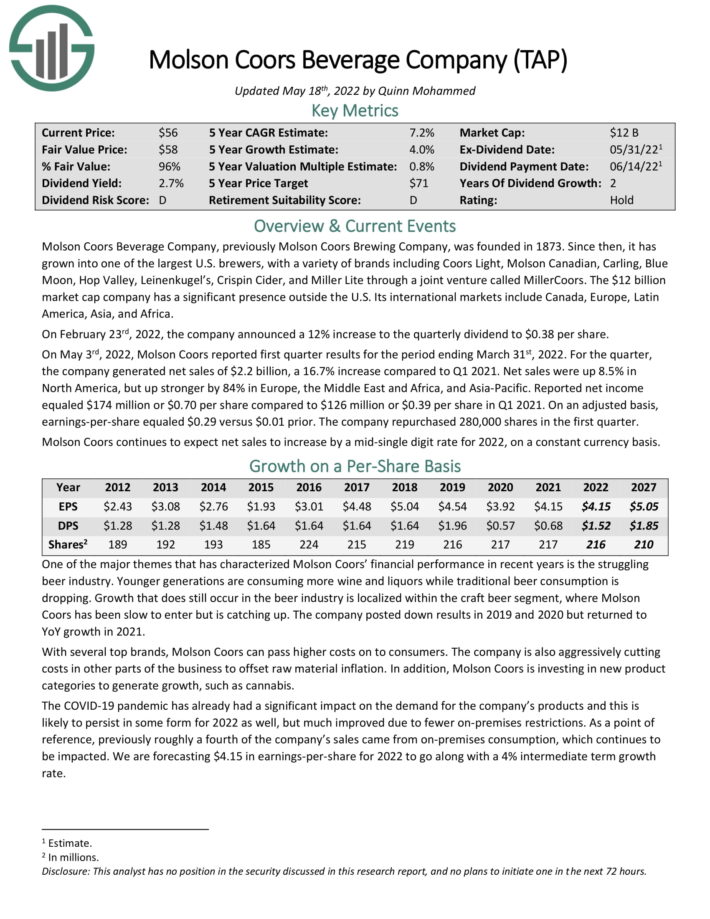

Beer Inventory #2: Molson Coors Brewing Firm (TAP)

- 5-year anticipated annual returns: 9.1%

Molson Coors Brewing Firm was based all the best way again in 1873 and has since grown into one of many largest U.S. brewers, with quite a lot of manufacturers together with Coors Mild, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, in addition to the Miller manufacturers together with Miller Lite.

Along with its sizable U.S. presence, the corporate has diversified internationally into Canada, Europe, Latin America, Asia, and Africa.

On February twenty third, 2022, the corporate introduced a 12% enhance to the quarterly dividend to $0.38 per share. On Might third, 2022, Molson Coors reported first quarter outcomes for the interval ending March thirty first, 2022. For the quarter, the corporate generated web gross sales of $2.2 billion, a 16.7% enhance in comparison with Q1 2021.

Supply: Investor Presentation

Internet gross sales have been up 8.5% in North America, however up stronger by 84% in Europe, the Center East and Africa, and Asia-Pacific. Reported web earnings equaled $174 million or $0.70 per share in comparison with $126 million or $0.39 per share in Q1 2021. On an adjusted foundation, earnings-per-share equaled $0.29 versus $0.01 prior.

Molson Coors continues to anticipate web gross sales to extend by a mid-single digit fee for 2022, on a continuing foreign money foundation.

Molson Coors enjoys long-standing, entrenched relationships with distributors, retailers, eating places, bars, and pubs in addition to robust client loyalty.

Because of this, the long-term outlook for the corporate stays stable, particularly as their steadiness sheet continues to enhance. Moreover, the corporate’s worldwide markets will possible proceed to be a supply of development, offsetting any lingering sluggishness within the U.S. beer market.

The first danger dealing with the corporate is its heavy dependence on the U.S. beer market, which not too long ago has been lackluster and weighing down its total outcomes considerably. Moreover, because the enterprise grows internationally, they’ll face rising overseas alternate and geopolitical dangers.

Molson Coors has one of the crucial engaging valuation of the main alcohol shares. Molson Coors inventory trades for a price-to-earnings ratio of 12.6. We view truthful worth as a price-to-earnings ratio of 14.0, which suggests Molson Coors inventory might generate returns of 6.5% per 12 months simply from growth of its valuation a number of.

Mixed with 4% anticipated EPS development and the two.1% dividend yield, we anticipate whole returns of 9.1% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Molson Coors (preview of web page 1 of three proven beneath):

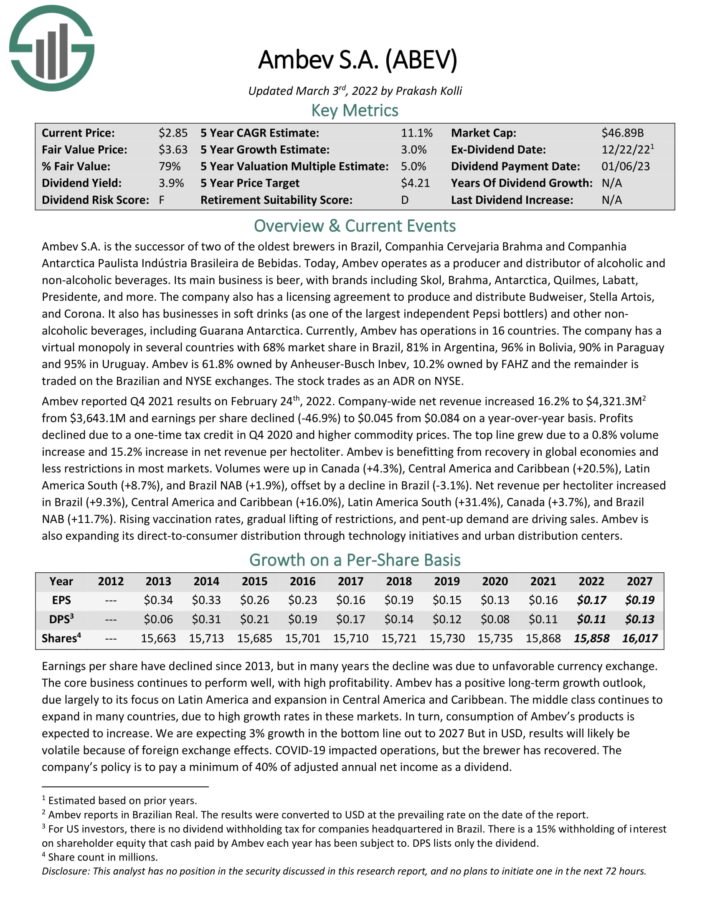

Beer Inventory #1: Ambev SA (ABEV)

- 5-year anticipated annual returns: 11.3%

Ambev SA is the most important brewer in Latin America, with a presence in 16 nations. It’s engaged in producing and distributing alcoholic and non-alcoholic drinks.

Its principal enterprise is beer, with manufacturers together with Skol, Brahma, Antarctica, Quilmes, Labatt, Presidente, and likewise has a licensing settlement to supply, bottle, promote and distribute Budweiser, Stella Artois, and Corona in South America.

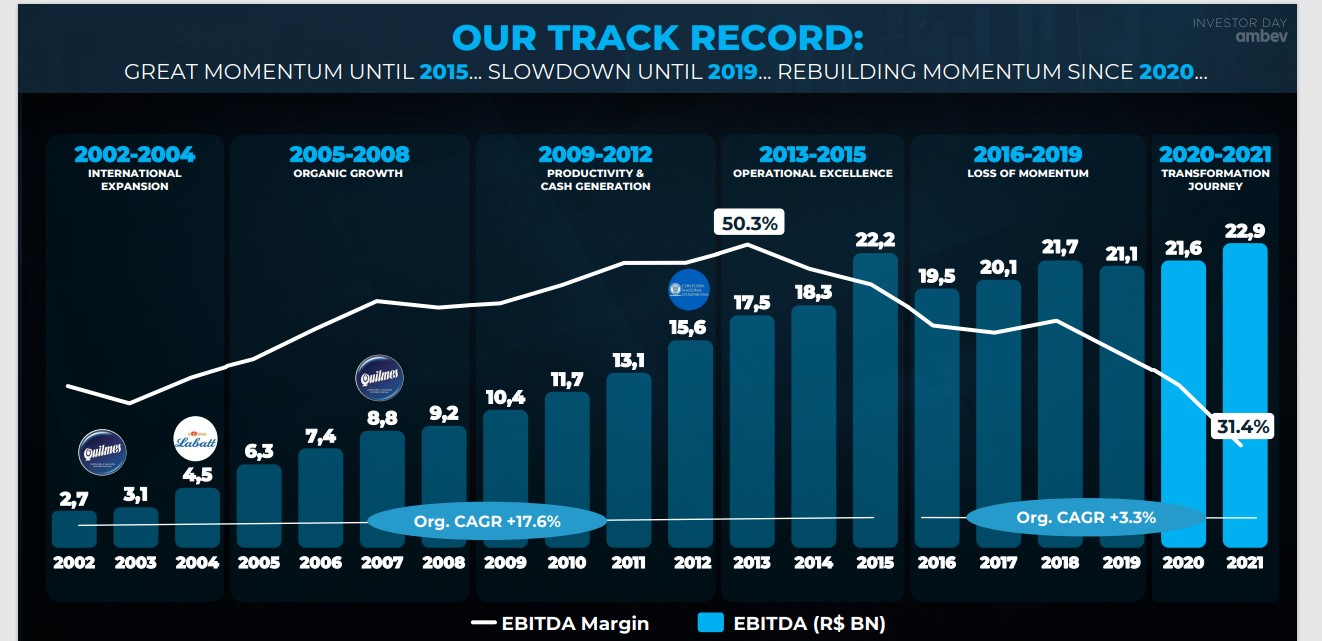

Ambev reported This autumn 2021 outcomes on February twenty fourth, 2022. Firm-wide web income elevated 16.2% to $4,321.3M from $3,643.1M and earnings per share declined (-46.9%) to $0.045 from $0.084 on a year-over-year foundation. Earnings declined on account of a one-time tax credit score in This autumn 2020 and better commodity costs.

The highest line grew on account of a 0.8% quantity enhance and 15.2% enhance in web income per hectoliter. Ambev is benefiting from restoration in international economies and fewer restrictions in most markets.

Supply: Investor Presentation

Volumes have been up in Canada (+4.3%), Central America and Caribbean (+20.5%), Latin America South (+8.7%), and Brazil NAB (+1.9%), offset by a decline in Brazil (-3.1%). Internet income per hectoliter elevated in Brazil (+9.3%), Central America and Caribbean (+16.0%), Latin America South (+31.4%), Canada (+3.7%), and Brazil NAB (+11.7%).

Rising vaccination charges, gradual lifting of restrictions, and pent-up demand are driving gross sales. Ambev can also be increasing its direct-to-consumer distribution by way of expertise initiatives and concrete distribution facilities.

We predict roughly 3% annual earnings development over the subsequent 5 years. Ambev inventory trades for a 2022 price-to-earnings a number of of 17.1, beneath our estimate of truthful worth at 22 occasions earnings. This reveals that the inventory seems to be under-valued.

The inventory additionally has a trailing dividend yield of three%, the product of the precipitous decline within the share worth. Buyers ought to observe that as a result of the dividend is said in Brazilian foreign money, cost in U.S. {dollars} will fluctuate based mostly on alternate charges. Ambev seems poised to ship whole returns of 11.3% per 12 months over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Ambev (preview of web page 1 of three proven beneath):

Closing Ideas

The beer business has quite a few gamers with international diversification and powerful aggressive benefits. Every presents traders a novel angle available on the market. Some focus closely on particular person geographies, comparable to Molson Coors within the U.S. market and Ambev in Latin America, whereas Altria presents oblique publicity to the beer business by way of its stake in AB InBev.

Corporations that function in beer extensively take pleasure in robust revenue margins, and the flexibility to face up to even the deepest recessions. Beer ought to proceed to see regular demand annually, and the most important beer shares take pleasure in excessive revenue margins because of their potential to lift costs over time.

These six beer shares have optimistic development prospects and return money to shareholders by way of hefty dividends. Danger-averse earnings traders in search of regular dividend payouts ought to take a better have a look at beer shares, significantly in unsure financial occasions.

Additional Studying

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].