Updated on December 16th, 2022 by Aristofanis Papadatos

Coal is the most burdensome form of energy for the environment. This has led numerous countries to coordinate efforts to phase out coal in favor of natural gas and renewable energy sources, such as solar and wind power.

As a result, coal production has steadily declined in the U.S. since the 2008 peak. Fortunately for domestic producers, exports have remained strong due to rising demand in emerging markets. Even better for these companies, the sanctions imposed by Europe and the U.S. on Russia for its invasion of Ukraine have caused an energy crisis this year.

Russia provided about one-third of natural gas consumed in Europe before the sanctions. Due to the sanctions, many countries have become deficient in energy; thus, the global demand for coal has dramatically increased this year. This has increased the price of coal 5-fold, from $80 in early 2021 to an all-time high of $400 this year. This is a robust tailwind for coal stocks and a stern reminder that transitioning from fossil fuels to clean energy sources is much more complex than initially expected.

This has allowed several coal stocks to enjoy excessive profits this year and return cash to shareholders through dividends.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Coal stocks are a subset of the broader materials sector.

While many investors have concluded that coal stocks will soon become irrelevant, this may not be true. In this article, we will analyze the four best coal stocks today.

Table Of Contents

You can use the following table of contents to instantly jump to a specific stock:

The top four coal stocks are ranked based on total expected returns over the next five years, from lowest to highest. These four coal stocks collectively represent our top picks in the coal industry over the next five years.

BHP Group (BHP)

BHP traces its roots back to 1851 and a tin mine on a small island in Indonesia called Billiton. Today, it is an exploration and production giant in the metals and mining industry and is headquartered in Melbourne, Australia. BHP explores, produces, and processes iron ore, metallurgical coal, and copper.

The company has a diversified product portfolio. Approximately 53% of EBITDA in fiscal 2021 was derived from Iron Ore production, 21% from Copper, and 26% from Coal.

BHP posted 10-year high earnings per share of $7.75 in 2021 thanks to the rally of the iron ore price, which resulted primarily from supply disruptions. However, iron ore prices have plunged more than 50% off their peak in late 2021 due to fears of an upcoming global recession and the zero-tolerance policy of China about the pandemic. Nevertheless, iron ore prices remain above historical average levels. Given the all-time high coal prices prevailing right now, BHP is likely to post strong earnings per share of about $5.10 this year.

BHP is currently trading at a P/E ratio of 12.2, which is lower than our assumed fair P/E ratio of 14.0 for the stock. If the stock trades at our assumed fair valuation level in five years, it will enjoy a 2.9% annualized valuation tailwind. Given also the 6.5% dividend of the stock and an expected -4.0% annual decline of earnings per share due to an expected moderation of commodity prices, the stock is likely to offer a 4.1% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on BHP Group (preview of page 1 of 3 shown below):

Rio Tinto Group (RIO)

Rio Tinto Plc was founded in 1962 and is headquartered in London, United Kingdom. It is one of the world’s largest precious metals mining companies, with a market capitalization of $114 billion.

The company operates in the exploration, mining, and production of various minerals. Rio Tinto’s main segments include Iron Ore, Aluminum, Copper & Diamonds, and Energy & Minerals.

Just like BHP, Rio Tinto enjoyed blowout earnings last year, primarily thanks to the impressive rally in the price of iron ore. Due to a correction of commodity prices this year, the company’s earnings have decreased in 2022 but remain far above historical levels. We expect Rio Tinto to post earnings per share of $10.50 this year, 21% lower than the record earnings per share of $13.21 in 2021.

Rio Tinto is currently trading at a P/E ratio of 6.7, which is lower than our assumed fair P/E ratio of 9.0 for the stock. If the stock trades at our assumed fair valuation level in five years, it will enjoy a 6.2% annualized valuation gain. Given the stock’s 9.8% starting dividend yield and an expected -6.5% annual decline of earnings per share due to an expected moderation of commodity prices, the stock is likely to offer a 5.8% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Rio Tinto (preview of page 1 of 3 shown below):

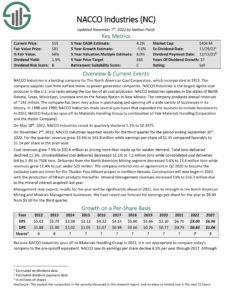

NACCO Industries (NC)

NACCO Industries is a holding company for The North American Coal Corporation, which was incorporated in 1913. The company supplies coal from surface mines to power generation companies.

At 35 million tons of annual production, NACCO Industries is the largest lignite coal producer in the U.S. and ranks among the top ten of all coal producers.

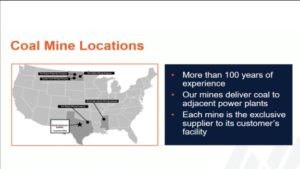

NACCO Industries operates in North Dakota, Texas, Mississippi, Louisiana, and the Navajo Nation in New Mexico.

Source: Investor Presentation

The company produces annual revenues of ~$200 million in normalized conditions.

NACCO Industries enjoys great business momentum this year thanks to the impressive rally of the price of coal, which has resulted from the sanctions of western countries on Russia. Thanks to this tailwind, the company is on track to post record earnings per share of about $9.00 this year.

On the other hand, the aforementioned tailwind from the sanctions is likely to attenuate in the upcoming years, especially given the cyclical nature of this commodity business. Given the secular decline of the coal industry, we expect the company’s earnings per share to decline by 5% per year on average over the next five years. However, we view the stock as deeply undervalued, with a 2022 P/E ratio of 4.3. Our fair value estimate is a P/E of 9, implying significant undervaluation.

In addition, shares currently yield 2.1%. Overall, total returns are expected to reach 11.6% per year over the next five years.

Click here to download our most recent Sure Analysis report on NACCO Industries (preview of page 1 of 3 shown below):

Alliance Resource Partners (ARLP)

Alliance Resource Partners is the first publicly traded Master Limited Partnership and the second–largest coal producer in the eastern United States.

Apart from its primary operations of producing and marketing coal to major domestic and international utility users, the company also owns mineral and royalty interests in premier oil & gas regions, like the Permian, Anadarko, and Williston Basins.

Finally, the company provides terminal services, including transporting and loading coal and technology products and services. The company generated $1.5 billion in annual revenues in 2021 and is based in Tulsa, Oklahoma.

Thanks to the relentless rally of the price of coal this year, ARLP is on track to achieve 8-year high earnings per share of about $4.00 this year.

ARLP is currently trading at a P/E ratio of 5.5, which is lower than our assumed fair P/E ratio of 7.0 for the stock. If the stock trades at our assumed fair valuation level in five years, it will enjoy a 4.9% annualized valuation tailwind. Given also the stock’s 9.1% starting dividend yield and expected 4.0% annual growth of earnings per share, which will partly result from lower interest expense amid a steep decrease in debt load, the stock can offer a 16.3% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Alliance Resource Partners (preview of page 1 of 3 shown below):

Final Thoughts

Coal stocks are highly cyclical and operate in an industry that has been suffering from a secular decline. Therefore, investors should consider the elevated risks of investing in such a troubled industry.

With that said, multiple coal stocks still pay dividends to shareholders and have reasonable valuations. As a result, the best coal stocks could still generate strong returns in the years ahead.

Overall, while risk-averse investors should avoid coal stocks in general, those comfortable with the risks might consider purchasing the above coal stocks.

The Dividend Champions list is not the only way to quickly screen for stocks that regularly pay rising dividends.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].