Vertigo3d/E+ by way of Getty Pictures

Inflation chatter pushes rates of interest greater

This week’s 10-year sharp rise to 2.7% was a rerun to late final yr when it went quickly from 1.3% to 1.78%. That fast trot in charges brought on the tech names to get hammered for not being worthwhile throughout raging inflation (that is the accepted projection, not mine.) As soon as the 10-Yr reached that 1.78% peak stage it retreated to 1.3% and traded between these factors for therefore lengthy that by the point it broke 2% the market did not care. I feel the identical factor will occur within the coming days. We’re seemingly so far as the 10-year will go, for now, possibly it reaches 2.79 or a contact extra. It should once more commerce in a variety maybe from 2.2% to 2.7% till the Could assembly. Because the market will likely be discounting that stage of increase for the subsequent few weeks, we should always rally after the introduced increase. Throughout this time rates of interest will chop across the market as soon as once more, get tired of this greater stage, then the tech names will recuperate. By recognizing that this can be a sample we are able to anticipate what occurs subsequent. One other profit (maybe most necessary) in sample recognition is how this time differs from final time, and what affect this distinction can have on value motion going ahead.

Why would the 10-year bond maintain at this stage?

The greenback is powerful and a pair of.7% could be very juicy for the remainder of the world. Consider the European bond purchaser, they get 2.7%, and if the greenback continues to rise they’re making much more cash on the arbitrage between the Euro and the ever-stronger greenback. The Yen can also be weakening towards the greenback. That can preserve a cap on our rates of interest even because the Fed stops shopping for T-Payments.

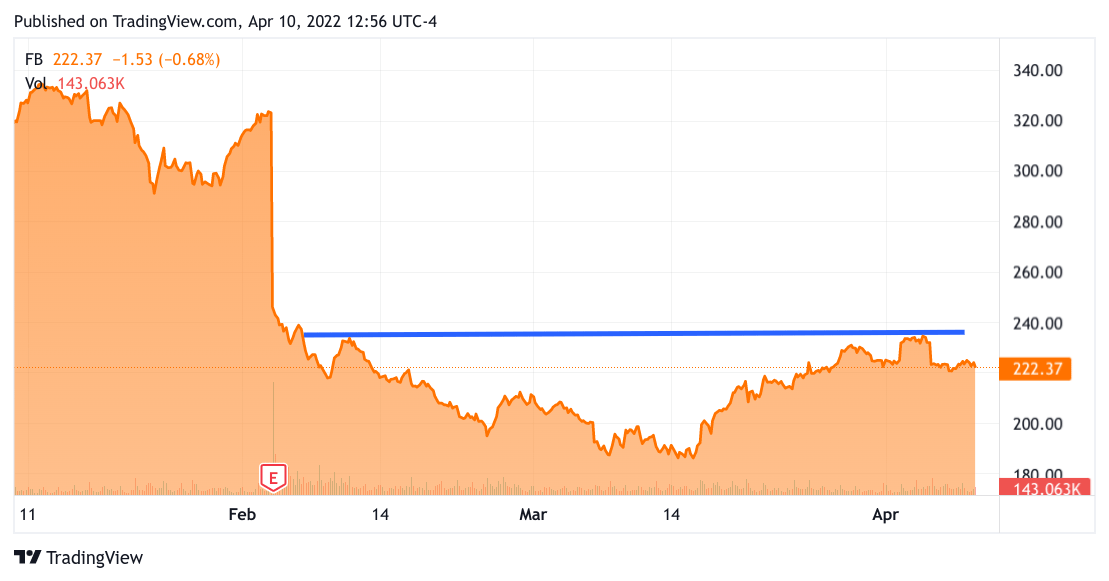

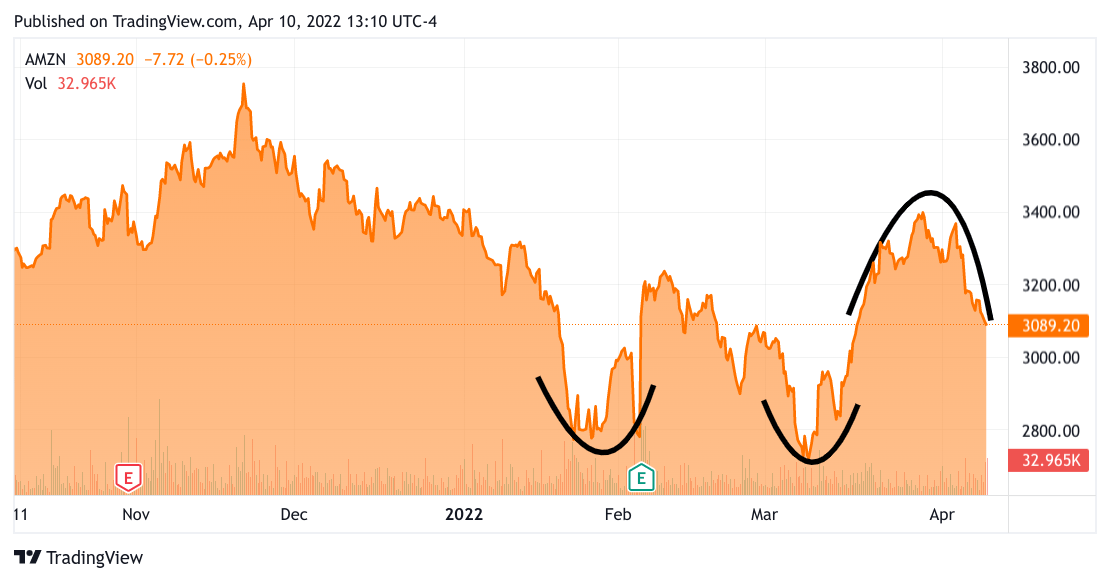

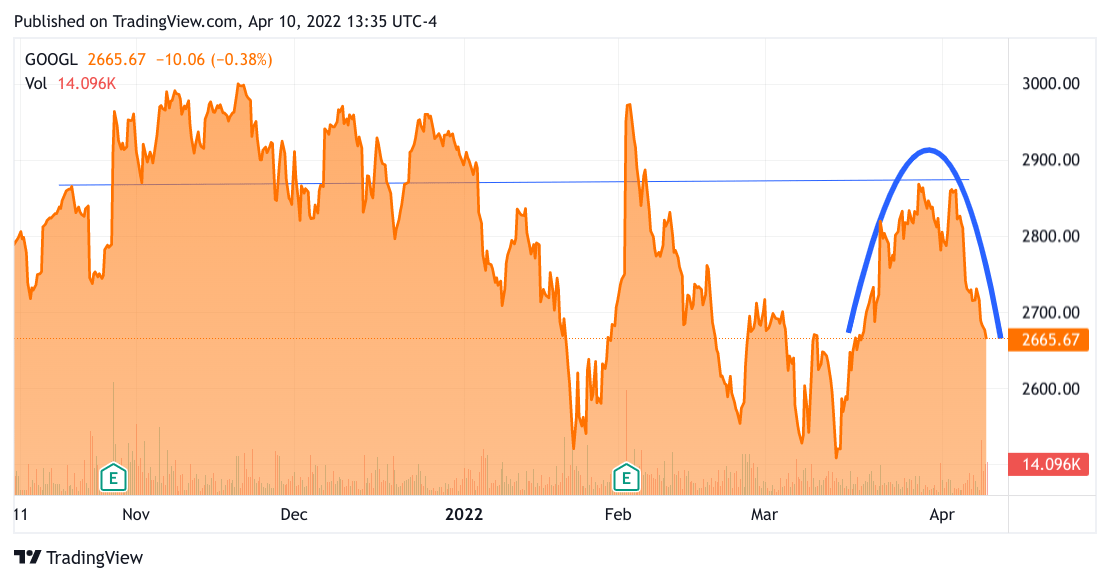

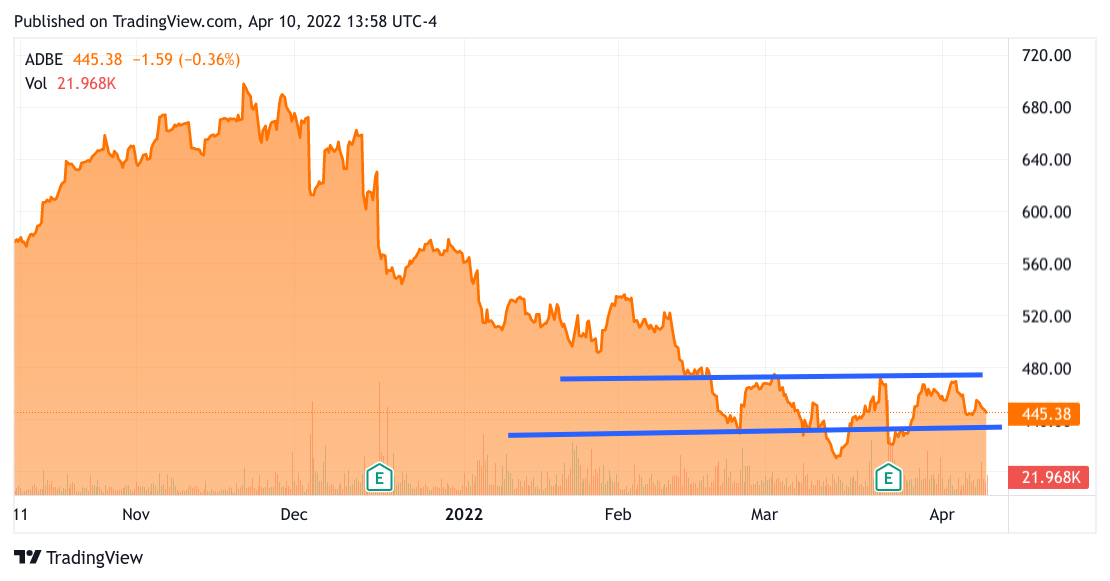

The excellent news is that many high-beta cloud tech names had hardly any harm on this current selloff. Take a look at the charts of Intuit (INTU), Adobe (ADBE), PayPal (PYPL), and even the likes of DocuSign (DOCU) and Zoom Video (ZM) held above current lows. Fb (FB) is far greater than its lows, too. So the place was the harm?.. Unusually, Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) (GOOG) did get harm. AMZN was doing nice on the information that they are going to be splitting 1 to twenty, it reached ranges final seen in December at nearly 3400. This Friday it closed on the lows and a mere skosh from the 2900 deal with. GOOGL additionally introduced a 1 to twenty inventory cut up, on the announcement it hit a stage first reached this previous September, earlier than dropping greater than 200 factors. The chart seems to be prefer it may fall one other 100 if there is no such thing as a additional constructive newsflow. This isn’t a unbelievable exhibiting for 3 of the trillion-dollar mega-caps. My thought is that this looks like an end-game, the autumn within the Nasdaq and the Nasdaq 100 is coming largely from these mega caps. They’re those left that also have some weak arms. I completely perceive if a few of you take this with a grain or two of salt since I lean bullish most instances. So let’s check out some charts, I’ll illustrate and annotate to make my case, and you’ll determine by yourself. Let’s check out FB and a 3 months chart.

TradingView

The above is a brilliant easy chart the place FB fell precipitously as all tech did firstly of the yr, but because the latter half of March, we see a reasonably even stage, even when the Nasdaq took an enormous dive lately. To my thoughts, which means FB has bottomed and is an effective threat for additional good points as soon as the 10-year consolidates its new stage. Now let’s check out Amazon, on the 6-month chart.

TradingView

As I stated earlier on the information of the 20 for 1 cut up. AMZN reached ranges not seen since December. Throughout the current robust promoting within the Nasdaq, we see that AMZN has rolled over considerably. Please observe that this rollover has already damaged by way of current assist and beneath additional stress will break beneath 3000 maybe as little as 2800. AMZN has not but constructed a robust base. If the 10-year takes a leg greater, maybe touching 2.8% I believe promoting will proceed. I’m basing this on the chart. Nevertheless, if AMZN has some bullish information then, after all, nothing is stopping it from altering instructions. Let’s take one other have a look at one other member of the trillion-dollar membership: GOOGL.

TradingView

Right here once more, GOOGL leaped on the information of the 1 to twenty cut up, and once more with the 10-year accelerating greater pressured the Nasdaq, and GOOGL rolled over as nicely. I’m making the case that the most important names have been answerable for a lot of the current losses within the Nasdaq. Now let’s pattern some well-known names that I imagine have already discounted inflation or greater charges, beginning with that ½ level increase in Could, and maybe past. First, let’s have a look at ADBE.

TradingView

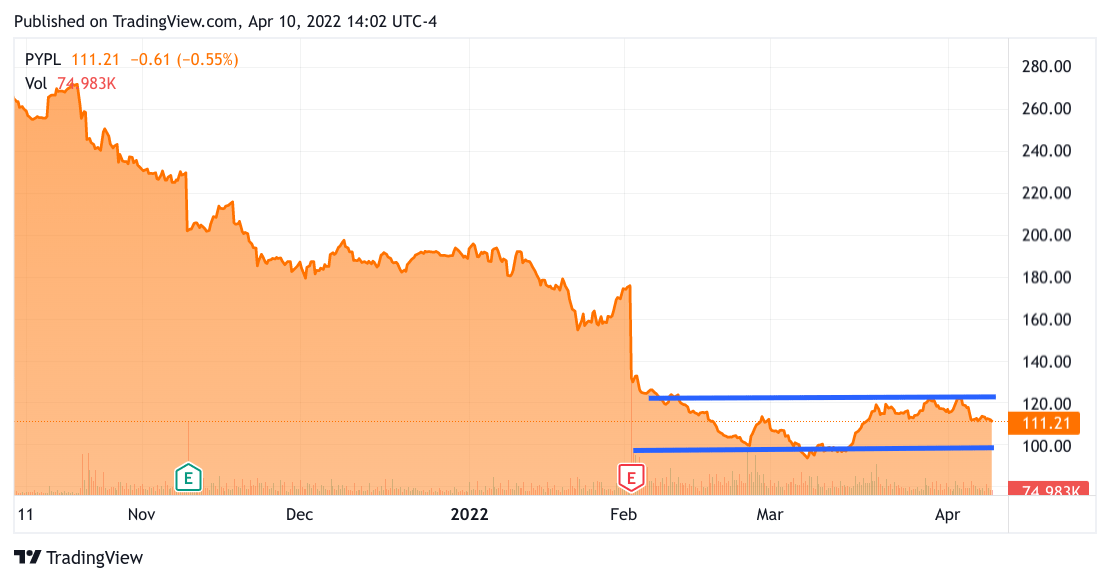

That is once more the 6-month chart for ADBE. Maybe ADBE is a little more unstable than FB however nonetheless fairly totally different than GOOGL or AMZN. Let’s check out PYPL, once more on the 6-month chart.

TradingView

This PYPL chart is almost similar to the ADBE, and FB. I feel this chart comparability train between the Mega-caps and the previous title illustrates a number of notions:

Many tech names beneath the mega-class stage, have already bottomed.

The autumn within the Nasdaq was primarily because of the trillionaire shares like AMZN and GOOGL.

This comparability justifies not solely holding names like ADBE, FB, PYPL, INTU, and different top-end cloud shares however to including to the positions or starting new positions in these names and others like this.

I began this piece with the popularity of a sample just like the prior 10-year leap to 1.79%. It’s now occurring with this fast transfer to 2.7%, what can we venture from this thesis

The upward transfer within the 10-year ought to quickly peter out. If solely as a result of a US 10-year treasury at 2.7% to the remainder of the world is fantastically aggressive.

If the sample is lively then as soon as the rate of interest settles down the tech names will as soon as once more begin rallying.

I’ll use these subsequent few weeks so as to add to my positions in non-Mega-cap tech.

Individually I feel MSFT, AMZN, and GOOGL have a great probability to proceed rolling over the subsequent 5 buying and selling days because the 10-year will mark out its peak on this new buying and selling vary. None of those names have damaged out to new highs in lots of months, and it’s clear that there’s a lot of overhead provide in these names. There must be some new information that can lastly propel them to even strategy their outdated highs. Proper now, they appear to be a supply of funds at any time when they’ve an inside rally. New cash goes into Ag, Oil, Nat Fuel, Chemical substances and maybe some choose industrial metals like Nickel, Lithium.

I’m not neglecting power both

Whilst my tech names have been getting hit. I’m glad that I put apart my feelings and received very aggressive with oil & nat fuel names. They blunted my losses in my total portfolio, I additionally did some hedging as I mentioned beneath. How lengthy will I add to this sector? I anticipate Oil to achieve that 130 stage once more. The drop in oil value is because of the launch of the SPR. I believe it’s not going to maneuver the needle ultimately, even when they’ll get the 1 Million BPD, and as I stated earlier I query whether or not the SPR launch will attain wherever shut. Oil will inch up, with WTI shifting strongly above 100 and nat fuel/LNG will rise as nicely. As soon as WTI reaches 110, I’ll cease accumulating EnP names and start decreasing, with sharper promoting if it hits 130 earlier than the driving season.

My Trades

I feel my setup of oils, ag, refiners, and intermediate chemical compounds from refining is a superb counterbalance for tech. I efficiently deployed some hedging, sadly, I closed early, but when I’d have held my SPXS, SQQQ, and UVXY positions I’d have executed even higher. As soon as the VIX falls beneath 20 once more, I’ll begin my hedging once more.

I added to my Devon (DVN) name choices, and I opened name positions in Kosmos Vitality (KOS). I additionally went lengthy on some Places on DWAC. This isn’t an expression of any political stance. It’s simply that the optimism for the way forward for Twitter (TWTR) being extra open to conservative issues makes DWAC and its eventual future reverse merger with Reality Social that a lot much less crucial. Additionally, there have been a number of current high-level resignations from the enterprise. Lastly, if market individuals are going to dump non-profitable shares, this one qualifies as nicely.

I’ve my eye out for extra alternatives to wager on the draw back. I’m considering of betting towards additional upside in HP Inc. (HPQ) Now that Buffett has made his huge funding, I don’t know what information will come alongside to take it greater. I feel TWTR may have comparable conduct. Now that Musk is on the board and made that giant funding.

For refiners, I added Phillips 66 (PSX), a broad-based refiner to my checklist of specialty refiners, Calumet (CLMT), Holly Vitality Companions (HEP), and Vertex (VTNR). I appeared on the PSX chart and I noticed that it had not damaged out to new highs, so I initiated a place on that huge boy.

For my Frackers, I used to be glad that I added to my Coterra (CTRA), and Occidental (OXY), additionally began with Vary Sources (RRC). Lastly, I added Apache (APA), Earthstone (ESTE), and Kosmos (KOS).

For LNG, I added shares to Tellurian (TELL), New Fortress Vitality (NFE), FLEX LNG (FLNG).

If I haven’t made this clear, I nonetheless anticipate volatility because the 10-Yr tries to maneuver a bit greater. On the opposite aspect of the coin, there are some inexperienced shoots on the aspect of decreasing value pressures. A giant one is trucking charges, they’ve fallen notably of late, additionally inventories are rising once more. As they get again towards regular ranges, costs, on the whole, will fall. Be ready for extra chatter in regards to the Fed not needing to take that 0.50% increase, however they seemingly will anyway. This units up the Could Fed assembly as one other second for volatility, and a few good trades.