Updated on October 28th, 2022 by Bob Ciura

Spreadsheet data updated daily

Income investors looking for quality dividend stocks typically buy large-cap stocks. This is understandable, as many companies with long histories of dividend increases have grown to dominate their respective industries.

But income investors should not automatically dismiss small-cap dividend stocks, as small-cap stocks have historically outperformed large-caps. Many small-cap dividend stocks have strong yields, in addition to their high growth potential.

The Russell 2000 Index is arguably the world’s best-known benchmark for small-cap U.S. stocks. Accordingly, the Russell 2000 Index can be an intriguing place to look for new investment opportunities.

You can download your free Excel list of Russell 2000 stocks, along with relevant financial metrics like dividend yields and P/E ratios, by clicking on the link below:

Small-cap dividend stocks, generally defined as having market capitalizations below $2 billion, are widely perceived to have better long-term growth potential than large-caps.

Investors can combine this outsized growth potential, with dividends and potential for capital gains through an expanding valuation multiple. As a result, the top small-cap dividend stocks presented here could generate superior returns over the next five years.

This article will list our top 10 small-cap dividend stocks right now, ranked by expected total returns over the next five years.

Table Of Contents

Small-Cap Dividend Stock #10: Southside Bancshares Inc. (SBSI)

Southside Bancshares is a bank holding company for the Southside Bank based in Texas. There are many banks among the list of small cap dividend stocks, because they tend to have small operations, but pay solid dividends and their stocks appear undervalued.

Southside Bancshares’ loan portfolio consists of residential, home equity, home improvement, auto, construction and commercial loans. It has assets of more than $7 billion and operates 57 branches throughout the state of Texas. On February 3rd, 2022, Southside Bancshares announced that it was raising its quarterly dividend 3.0% to $0.34, extending the company’s dividend growth streak to 28 consecutive years.

On October 25th, 2022, Southside Bancshares announced third quarter results for the period ending September 30th, 2022. Revenue grew 10.5% to $69.6 million, but missed estimates by $1.32 million. GAAP earnings-per-share of $0.84 compared to $0.89 in the prior year and was $0.06 less than expected.

Excluding the Paycheck Protection Program, loans increased 13.5% to $483.1 million due to strength in commercial and construction loans. Total assets of $7.45 billion compared to $7.14 billion in the prior year. Nonperforming loans represented just 0.16% of total assets, matching the results for the three prior quarters.

Net interest income grew 15.1% to $55.5 million while net interest margin of 3.15% compared to 2.96% in Q3 2021 and 3.07% in Q2 2022.

We expect SBSI to grow earnings by 3% per year over the next five years. The stock has a current dividend yield of 4.1%. Expansion of the P/E multiple will add to returns, leading to expected annual returns of 10.7% per year.

Click here to download our most recent Sure Analysis report on SBSI (preview of page 1 of 3 shown below):

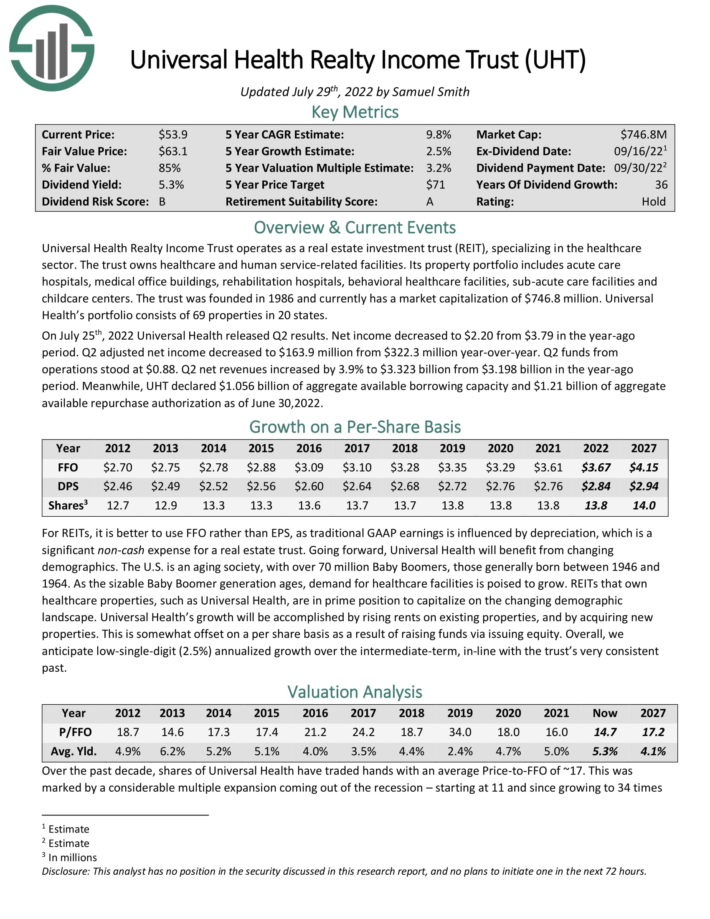

Small-Cap Dividend Stock #9: Universal Health Realty Income Trust (UHT)

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities. Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 69 properties in 20 states.

Related: Top 10 Highest Yielding Dividend Champions

On July 25th, 2022 Universal Health released Q2 results. Net income decreased to $2.20 from $3.79 in the year-ago period. Q2 adjusted net income decreased to $163.9 million from $322.3 million year-over-year. Q2 funds from operations stood at $0.88. Q2 net revenues increased by 3.9% to $3.323 billion from $3.198 billion in the year-ago period. Meanwhile, UHT declared $1.056 billion of aggregate available borrowing capacity and $1.21 billion of aggregate available repurchase authorization as of June 30,2022.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

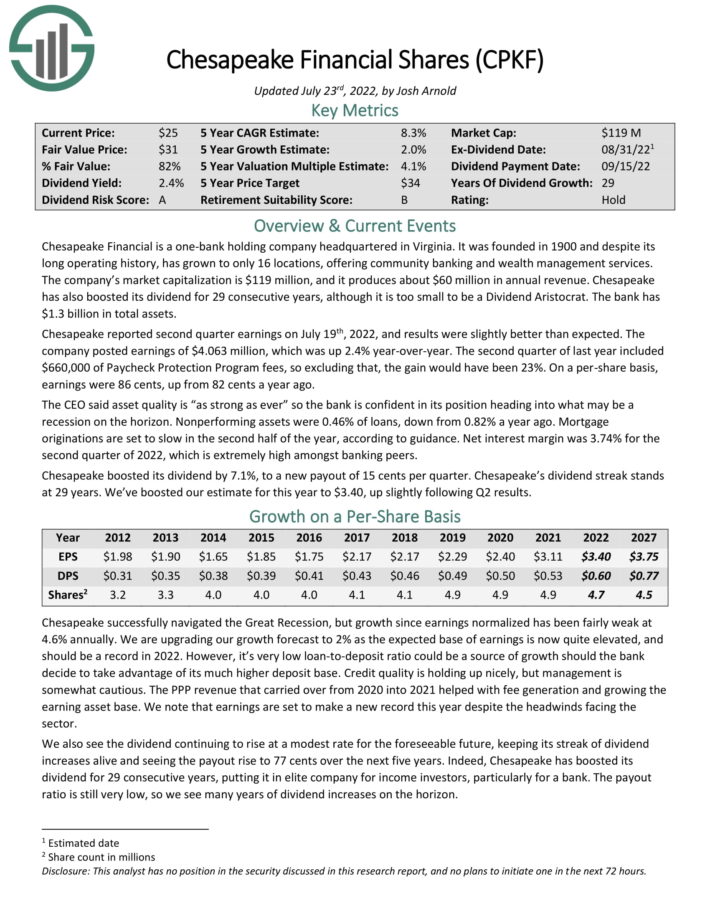

Small-Cap Dividend Stock #8: Chesapeake Financial Shares (CPKF)

Chesapeake Financial is a one-bank holding company that has a long history of operations. The company consist of 16 branch locations and provides services such as deposits to individuals and businesses, lending, wealth management, and trust and estate planning. Chesapeake Financial has a market capitalization of $123 million and generates annual revenue of close to $60 million.

Chesapeake Financial reported second quarter earnings results on July 19th, 2022. The company’s earnings totaled $4.063 million, which was a 2.4% improvement from the prior year. Looking closer, the comparable period in the previous year included $660,000 of Paycheck Protection Program fees. Excluding these fees, earnings grew 23% from the prior year. On a per-share, earnings totaled $0.86 compared to $0.82 in the second quarter of 2021.

The company’s asset quality remains very high as nonperforming assets sat at just 0.46%, down from 0.815% in the previous year. Net interest margin was a health 3.74% for the second quarter as interest rate hikes have been a material tailwind to Chesapeake Financial’s business.

Following second quarter results, we raised our expected earnings-per-share for 2022 to $3.40 from $3.30. If achieved, this would represent a more than 9% increase from the prior year as well as a new company record.

Click here to download our most recent Sure Analysis report on CPKF (preview of page 1 of 3 shown below):

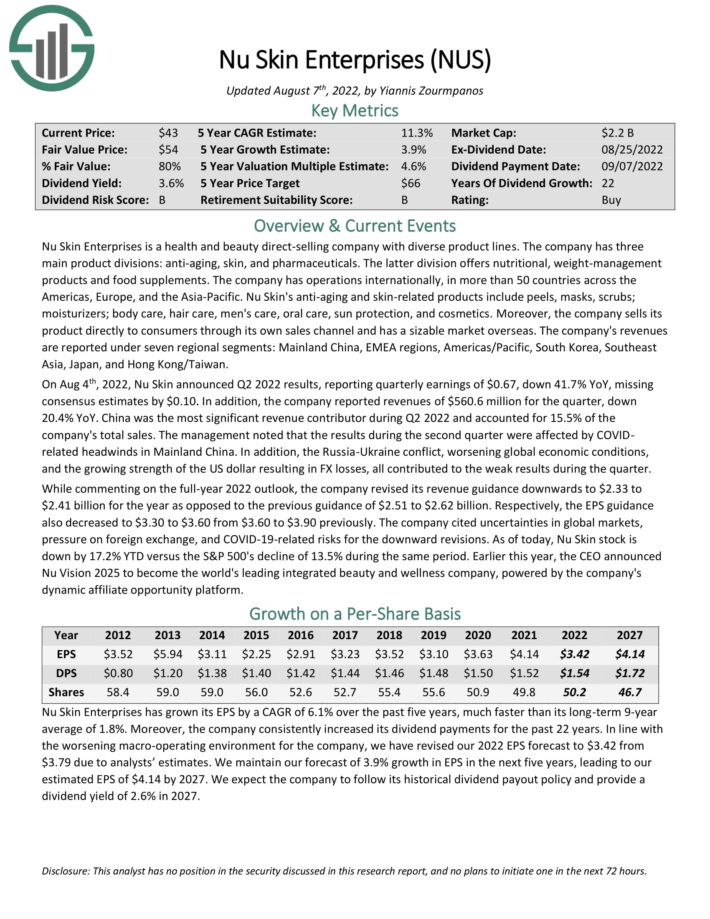

Small-Cap Dividend Stock #7: Nu Skin Enterprises (NUS)

Nu Skin Enterprises is a health and beauty direct-selling company with diverse product lines. The company has three main product divisions: anti-aging, skin, and pharmaceuticals. The latter division offers nutritional, weight-management products and food supplements.

The company has operations internationally, in more than 50 countries across the Americas, Europe, and the Asia-Pacific. The company sells its product directly to consumers through its own sales channel and has a sizable market overseas.

On Aug 4th, 2022, Nu Skin announced Q2 2022 results, reporting quarterly earnings of $0.67, down 41.7% YoY, missing consensus estimates by $0.10. In addition, the company reported revenues of $560.6 million for the quarter, down 20.4% YoY. China was the most significant revenue contributor during Q2 2022 and accounted for 15.5% of the company’s total sales.

Management noted that the results during the second quarter were affected by COVID related headwinds in Mainland China. In addition, the Russia-Ukraine conflict, worsening global economic conditions, and the growing strength of the US dollar resulting in FX losses, all contributed to the weak results during the quarter.

The stock has a current dividend yield of 3.9%. In addition, we expect 3.9% annual EPS growth. Total returns are expected to reach 13.5% per year over the next five years.

Click here to download our most recent Sure Analysis report on NUS (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #6: Enterprise Bancorp (EBTC)

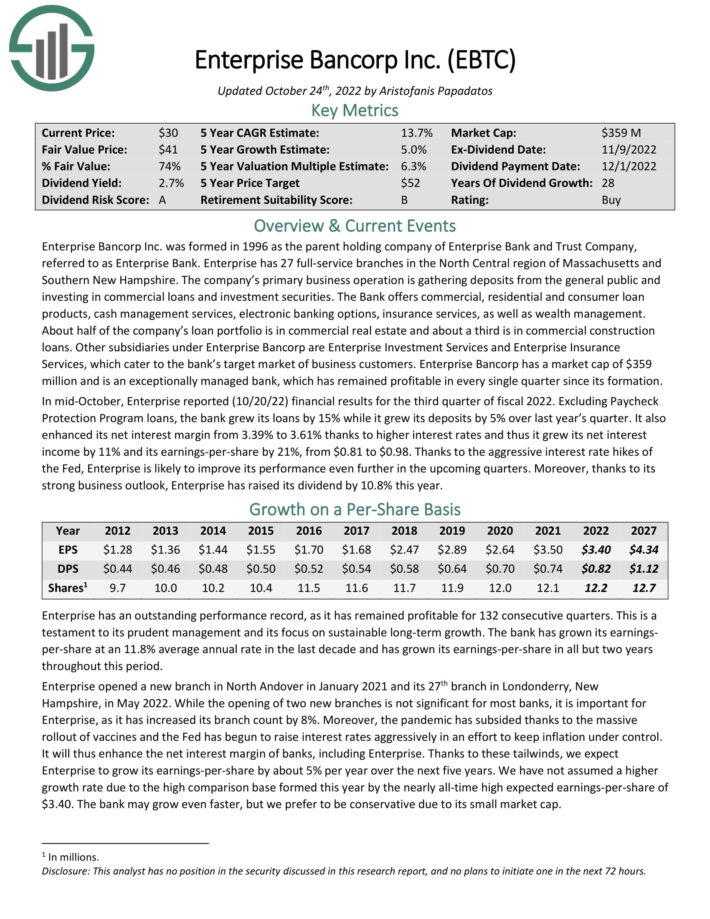

Enterprise Bancorp Inc. was formed in 1996 as the parent holding company of Enterprise Bank and Trust Company,

referred to as Enterprise Bank. Enterprise has 27 full-service branches in the North Central region of Massachusetts and Southern New Hampshire. The company’s primary business operation is gathering deposits from the general public and investing in commercial loans and investment securities.

The Bank offers commercial, residential and consumer loan products, cash management services, electronic banking options, insurance services, as well as wealth management. About half of the company’s loan portfolio is in commercial real estate and about a third is in commercial construction loans.

In mid-October, Enterprise reported (10/20/22) financial results for the third quarter of fiscal 2022. Excluding Paycheck Protection Program loans, the bank grew its loans by 15% while it grew its deposits by 5% over last year’s quarter. It also enhanced its net interest margin from 3.39% to 3.61% thanks to higher interest rates and thus it grew its net interest income by 11% and its earnings-per-share by 21%, from $0.81 to $0.98.

Thanks to the aggressive interest rate hikes of the Fed, Enterprise is likely to improve its performance even further in the upcoming quarters. Moreover, thanks to its strong business outlook, Enterprise has raised its dividend by 10.8% this year. The stock currently yields 2.7%.

We also expect 5% annual EPS growth going forward. Total returns are expected to reach 14% per year through 2027.

Click here to download our most recent Sure Analysis report on EBTC (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #5: Tennant Co. (TNC)

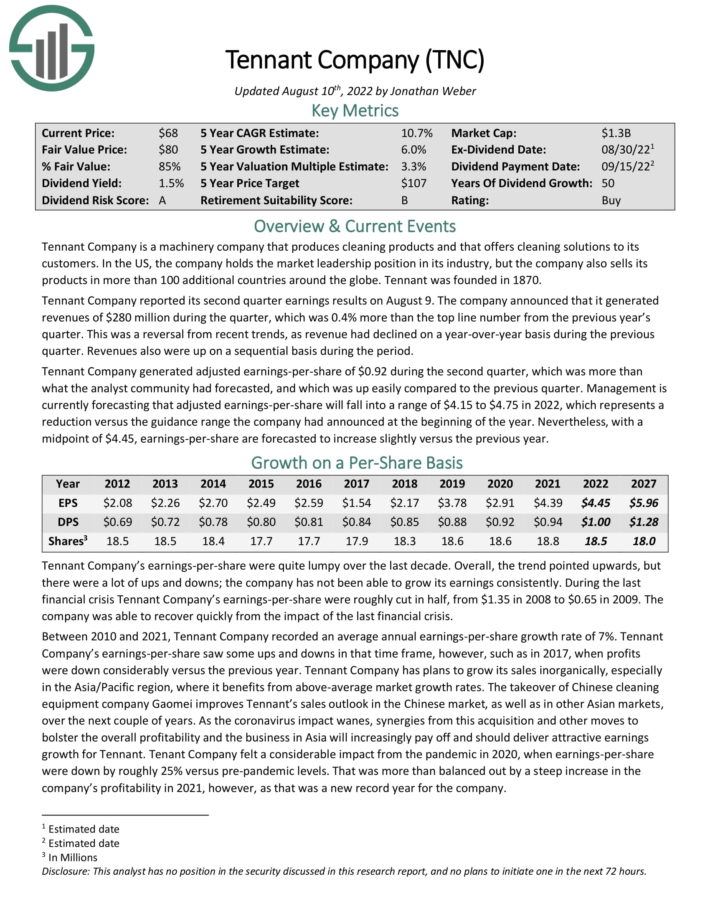

Tennant Company is a machinery company that produces cleaning products and offers cleaning solutions to its customers. In the US, the company holds the market leadership position in its industry, but the company also sells its products in more than 100 additional countries around the globe. Tennant was founded in 1870.

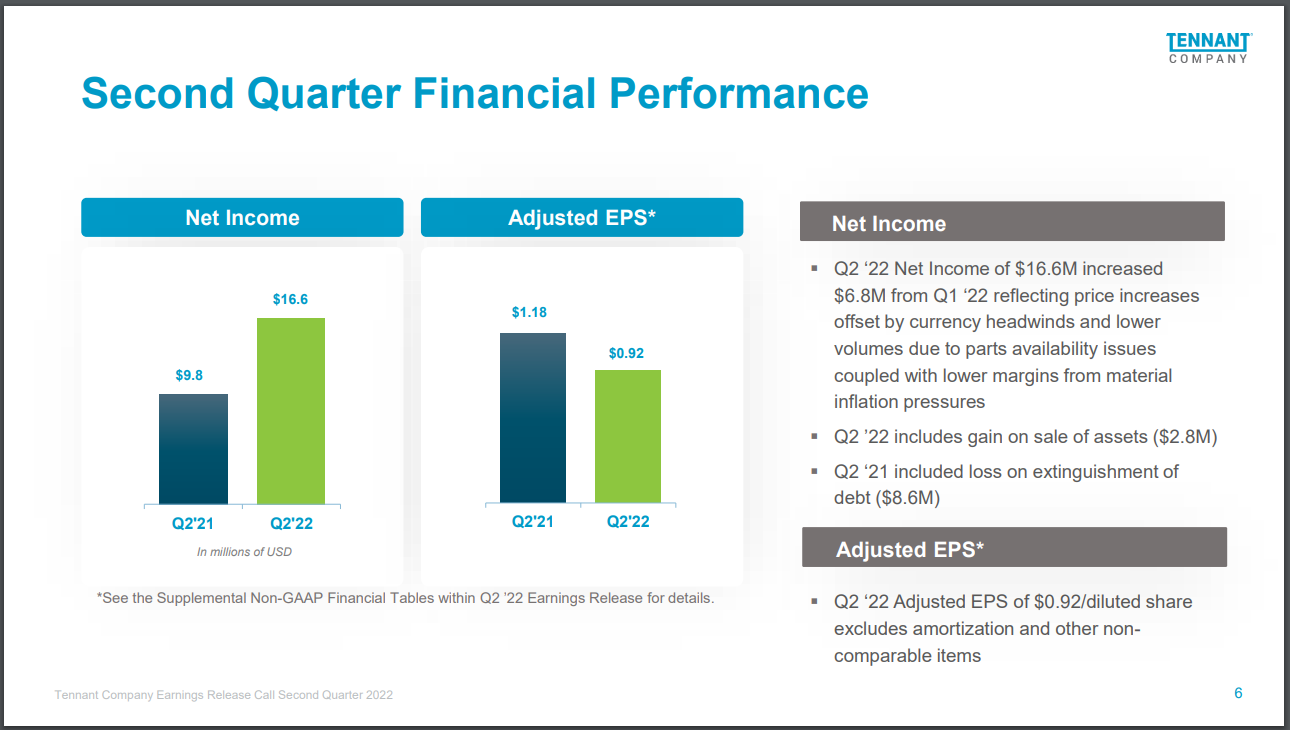

Tennant Company reported its second-quarter earnings results on August 9th. The company generated revenues of $280 million during the quarter, which was 0.4% higher year-over-year. Revenue was also up sequentially.

Tennant Company generated adjusted earnings-per-share of $0.92 during the quarter, which was a 22% decrease compared to $1.18 in Q2 2021.

Source: Investor Presentation

Management is forecasting that adjusted earnings-per-share will fall into a range of $4.15 to $4.75 in 2022, which would be an improvement at the midpoint versus 2021, and which means new record profits for the current year.

Tennant has plans to grow its sales inorganically, especially in the Asia/Pacific region, where it benefits from above-average market growth rates.

The takeover of Chinese cleaning equipment company Gaomei improves Tennant’s sales outlook in the Chinese market, as well as in other Asian markets, over the next couple of years.

Tennant is expected to generate earnings-per-share of $4.45 for 2022. Based on this, the stock trades for a price-to-earnings ratio of ~13. Our fair value estimate is a price-to-earnings ratio of 18. The stock appears significantly undervalued. Future returns will also be comprised of earnings-per-share growth and dividends. We expect Tennant to grow earnings-per-share each year by 6.0%, consisting of organic revenue growth and acquisitions.

In addition, shares have a 1.8% current dividend yield. The combination of valuation changes, earnings growth, and dividends results in total expected returns of 14.2% per year over the next five years.

Click here to download our most recent Sure Analysis report on Tennant (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #4: First of Long Island Corp. (FLIC)

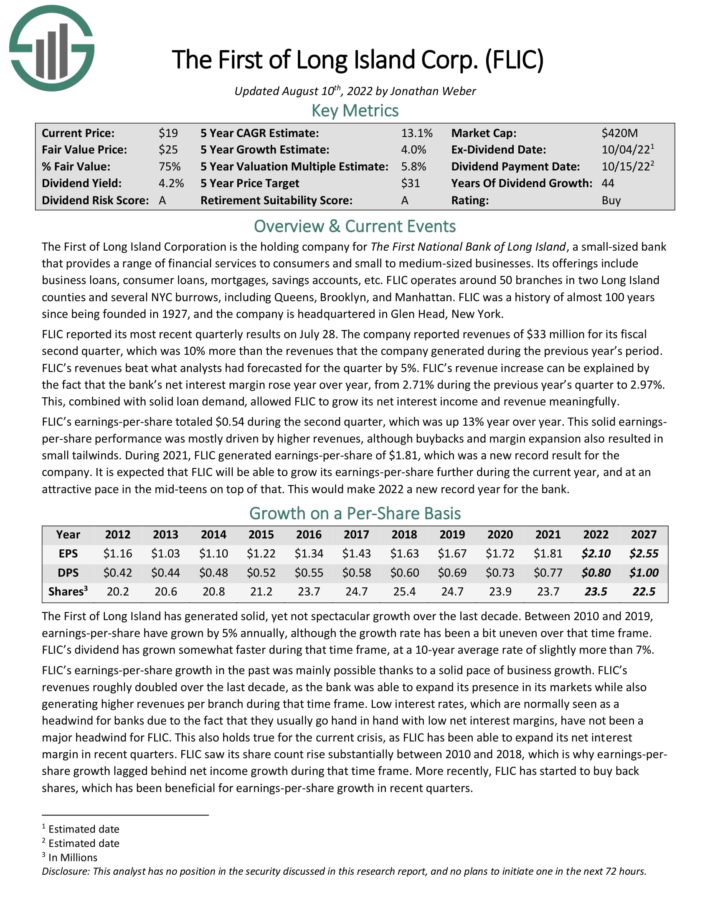

The First of Long Island Corporation is the holding company for The First National Bank of Long Island, a small-sized bank that provides a range of financial services to consumers and small to medium-sized businesses. Its offerings include business loans, consumer loans, mortgages, savings accounts, etc. FLIC operates around 50 branches in two Long Island counties and several NYC burrows, including Queens, Brooklyn, and Manhattan.

FLIC reported its most recent quarterly results on July 28. The company reported revenues of $33 million for its fiscal second quarter, which was 10% more than the revenues that the company generated during the previous year’s period. FLIC’s revenues beat what analysts had forecasted for the quarter by 5%.

FLIC’s revenue increase can be explained by the fact that the bank’s net interest margin rose year over year, from 2.71% during the previous year’s quarter to 2.97%. This, combined with solid loan demand, allowed FLIC to grow its net interest income and revenue meaningfully. FLIC’s earnings-per-share totaled $0.54 during the second quarter, which was up 13% year over year.

This solid earnings-per-share performance was mostly driven by higher revenues, although buybacks and margin expansion also resulted in small tailwinds. During 2021, FLIC generated earnings-per-share of $1.81, which was a new record result for the company. It is expected that FLIC will be able to grow its earnings-per-share further during the current year, and at an attractive pace in the mid-teens on top of that. This would make 2022 a new record year for the bank.

Total returns are expected to reach 14.2% per year over the next five years.

Click here to download our most recent Sure Analysis report on FLIC (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #3: Industrial Logistics Properties Trust (ILPT)

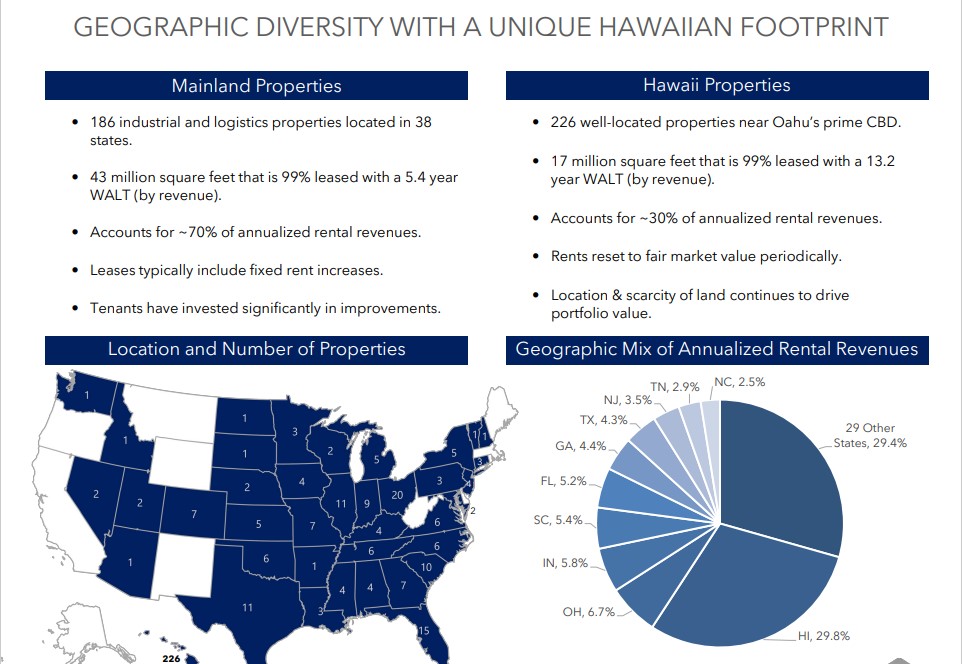

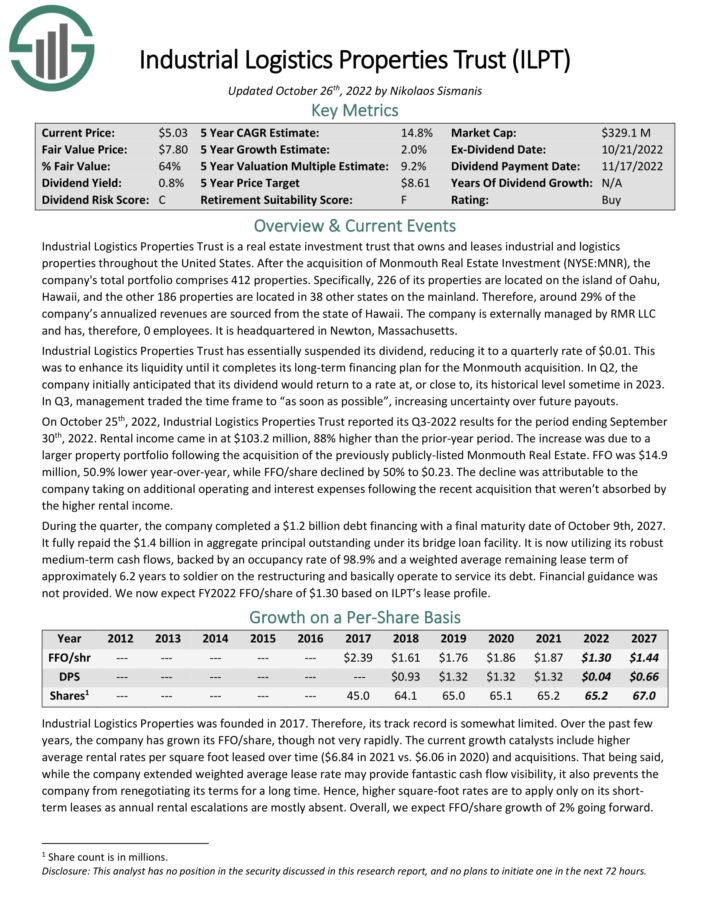

Industrial Logistics Properties Trust is a real estate investment trust that owns and leases industrial and logistics properties throughout the United States. After the acquisition of Monmouth Real Estate Investment, the company’s total portfolio comprises 412 properties.

Specifically, 226 of its properties are located on the island of Oahu, Hawaii, and the other 186 properties are located in 38 other states on the mainland. Therefore, around 29% of the company’s annualized revenues are sourced from Hawaii.

Source: Investor Presentation

On July 14th, Industrial Logistics Properties Trust essentially suspended its dividend, reducing it to a quarterly rate of $0.01. This was to enhance its liquidity until it completes its long term financing plan for the Monmouth acquisition. The company currently anticipates that its dividend will return to a rate at, or close to, its historical level sometime in 2023.

On October 25th, 2022, Industrial Logistics Properties Trust reported its Q3-2022 results for the period ending September 30th, 2022. Rental income came in at $103.2 million, 88% higher than the prior-year period. The increase was due to a larger property portfolio following the acquisition of the previously publicly-listed Monmouth Real Estate.

FFO was $14.9 million, 50.9% lower year-over-year, while FFO/share declined by 50% to $0.23. The decline was attributable to the company taking on additional operating and interest expenses following the recent acquisition that weren’t absorbed by the higher rental income.

Annual FFO growth is estimated at 2%, while the stock has a ~1% dividend yield. Shares appear to be significantly undervalued, leading to total estimated returns of 15.8% per year through 2027.

Click here to download our most recent Sure Analysis report on ILPT (preview of page 1 of 3 shown below):

Small-Cap Dividend Stock #2: City Office REIT Inc. (CIO)

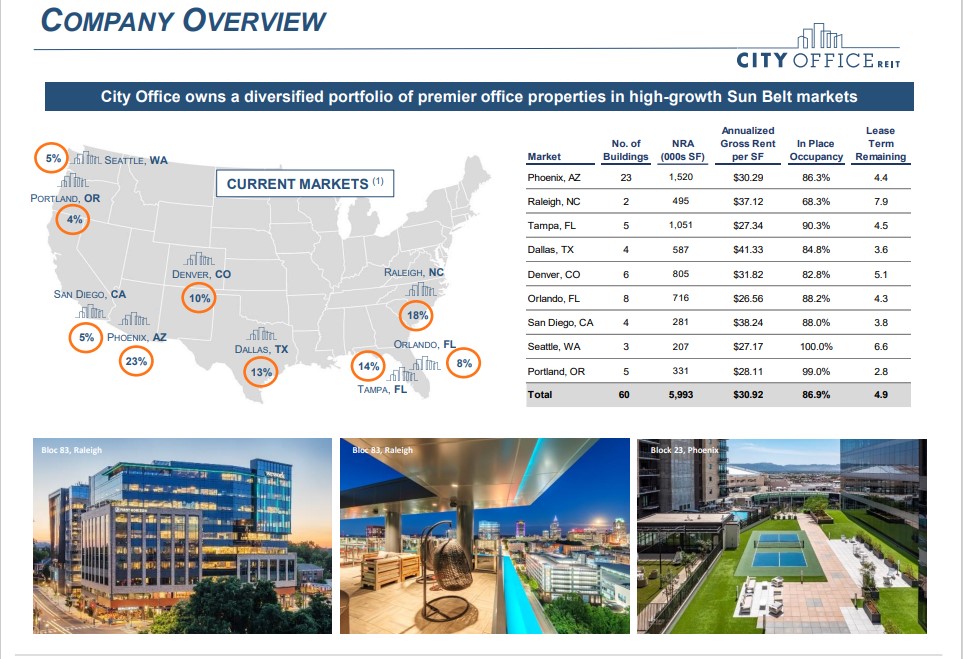

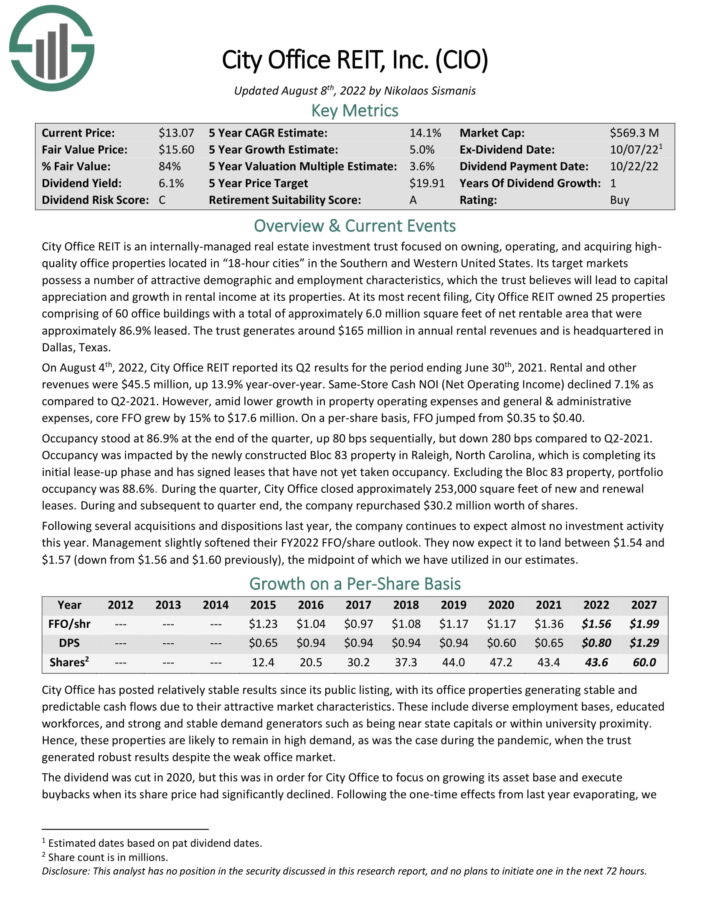

City Office REIT is an internally-managed Real Estate Investment Trust focused on owning, operating, and acquiring highquality office properties located in “18-hour cities” in the Southern and Western United States. Its target markets possess a number of attractive demographic and employment characteristics, which the trust believes will lead to capital appreciation and growth in rental income at its properties.

At its most recent filing, City Office REIT owned 25 properties comprising of 60 office buildings with a total of approximately 6.0 million square feet of net rentable area that were approximately 86.9% leased. The trust generates around $165 million in annual rental revenues and is headquartered in Dallas, Texas.

On August 4th, 2022, City Office REIT reported its Q2 results for the period ending June 30th, 2021. Rental and other revenues were $45.5 million, up 13.9% year-over-year. Same-Store Cash NOI (Net Operating Income) declined 7.1% as compared to Q2-2021. However, amid lower growth in property operating expenses and general & administrative expenses, core FFO grew by 15% to $17.6 million. On a per-share basis, FFO jumped from $0.35 to $0.40.

Occupancy stood at 86.9% at the end of the quarter, up 80 bps sequentially, but down 280 bps compared to Q2-2021. Occupancy was impacted by the newly constructed Bloc 83 property in Raleigh, North Carolina, which is completing its initial lease-up phase and has signed leases that have not yet taken occupancy. Excluding the Bloc 83 property, portfolio occupancy was 88.6%. During the quarter, City Office closed approximately 253,000 square feet of new and renewal leases.

Click here to download our most recent Sure Analysis report on CIO (preview of page 1 of 3 shown below):

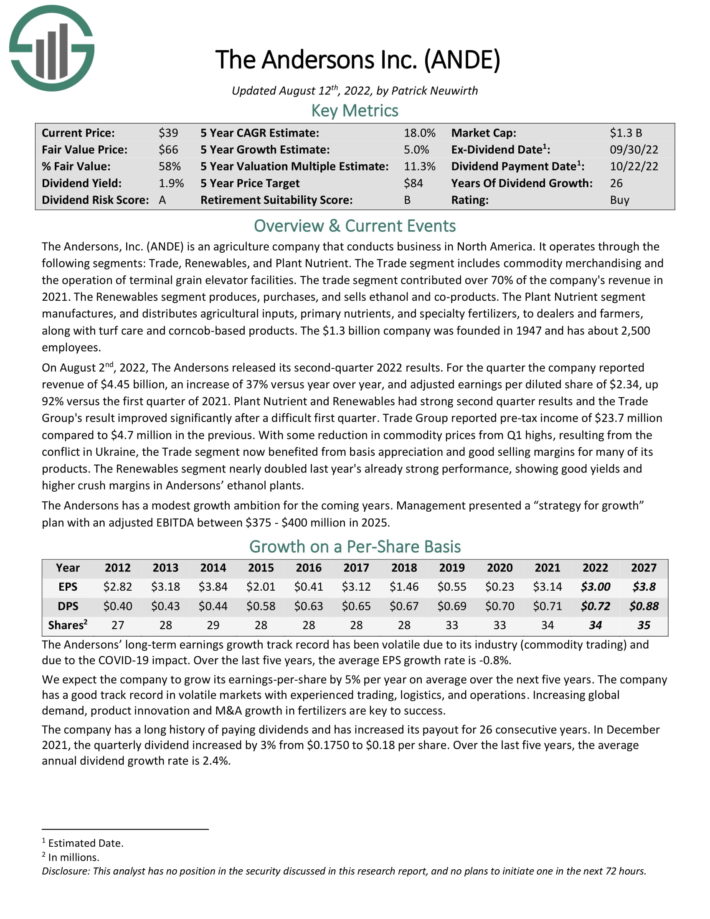

Small-Cap Dividend Stock #1: Andersons Inc. (ANDE)

The Andersons, Inc. is an agriculture company that conducts business in North America. It operates through the following segments: Trade, Renewables, and Plant Nutrient. The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021.

On August 2nd, 2022, The Andersons released its second-quarter 2022 results. For the quarter the company reported revenue of $4.45 billion, an increase of 37% versus year over year, and adjusted earnings per diluted share of $2.34, up 92% versus the first quarter of 2021. Plant Nutrient and Renewables had strong second quarter results and the Trade Group’s result improved significantly after a difficult first quarter. Trade Group reported pre-tax income of $23.7 million compared to $4.7 million in the previous.

With some reduction in commodity prices from Q1 highs, resulting from the conflict in Ukraine, the Trade segment now benefited from basis appreciation and good selling margins for many of its products. The Renewables segment nearly doubled last year’s already strong performance, showing good yields and higher crush margins in Andersons’ ethanol plants.

The Andersons has a modest growth ambition for the coming years. Management presented a “strategy for growth” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. Shares currently yield 2.1%. Total returns are estimated at 20.7% per year.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

Final Thoughts & Additional Reading

Small-cap dividend stocks could generate stronger growth than their large-cap peers, due to their smaller sizes. In addition, many small-cap stocks pay dividends to shareholders.

The 10 small-cap dividend stocks on this list all pay dividends, have a positive growth outlook, and could generate total returns above 10% per year.

In addition to small cap dividend stocks, Sure Dividend maintains similar databases on the following useful universes of stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected]