Up to date on June 14th, 2022

It’s no secret that we advocate traders deal with the highest-quality dividend development shares. One in all our favourite locations to search for one of the best dividend shares is the checklist of Dividend Aristocrats, an unique group of 65 shares within the S&P 500 with a minimum of 25 consecutive years of annual dividend will increase.

You’ll be able to obtain an Excel spreadsheet of all 65 Dividend Aristocrats, together with necessary monetary metrics comparable to P/E ratios and dividend yields, by clicking the hyperlink under:

However there are various high-quality dividend shares to be discovered exterior the Dividend Aristocrats. Buyers can discover robust funding alternatives within the U.S. and world wide, and in each market sector. What issues is that traders choose firms with sturdy aggressive benefits and future development potential.

Associated: Two’s Are Now Underestimated: The Mikan Drill for Shares.

To assist with the search, we reached out to a number of authors of common investing web sites in addition to Positive Dividend writers for his or her particular person suggestions. The next checklist represents these contributors’ favourite dividend shares for the rest of 2022, in no specific order.

Desk Of Contents

You’ll be able to bounce immediately to any particular contributor by clicking on the hyperlinks under:

The ten Greatest Dividend Shares Now

Greatest Dividend Inventory #10: T.Rowe Worth (TROW)

This finest dividend inventory choice is from Dividend Development Investor.

T. Rowe Worth Group, Inc. (TROW) is a publicly owned funding supervisor. T.Rowe Worth is a dividend champion with a 36 12 months streak of consecutive annual dividend will increase. The final enhance occurred in February 2022, when the Board of Administrators hiked distributions by 11.11% to $1.20/share.

Up to now decade, the corporate has managed to extend dividends at an annual price of 13.30%/12 months. Dividends went up quicker than earnings per share over the previous decade, due to a rising payout ratio. I might anticipate future dividends development within the vary of seven% – 8%/12 months over the following decade.

T.Rowe Worth has managed to extend earnings per share at an annual price of 12.90%/annum since 2007. Earnings rose from $2.40/share in 2007 to $13.12/share in 2021.

The primary drivers behind future earnings development will come from natural development in property below administration, long-term development in fairness markets, and new product introductions. As property below administration enhance from inflows and rising costs over time, the corporate achieves larger scale, which reduces per unit value and will increase general earnings.

Two-thirds of property below administration are in retirement accounts, which are usually stickier. Inertia is a strong power within the mutual fund enterprise – as soon as most unusual traders make an funding, they’re extra more likely to stick with it and preserve the established order. That is nice information for firms like T.Rowe Worth, since it could possibly gather charges for many years down the street on these investments.

At present the inventory is attractively valued at 12 occasions ahead earnings and yields 3.84%.

About this finest dividend inventory choice’s writer: Dividend Development Investor is a non-public investor who has been protecting dividend development shares since 2008.

Greatest Dividend Inventory #9 Air Merchandise & Chemical compounds (APD)

This finest dividend inventory choice is from Mike with Dividend Shares Rock

APD has a various method of positioning its enterprise in a sector the place most are caught with commodity value fluctuations. As a supplier of business gases, APD indicators long-term contracts with its prospects. Industrial prospects are extra involved with stability and reliability than prices since gases make up a small a part of their bills however are important to their enterprise.

APD strategically acquired Shell’s and GE’s gasification companies in 2018. The corporate grew to become a frontrunner in its business and has opened doorways to broaden its enterprise in China and India. APD has a formidable backlog of tasks that we predict will proceed to enhance its top-tier return on invested capital. APD’s bold development plan, together with $14.1B to be spent in its undertaking backlog, has potential to proceed bettering ADP’s invested capital. Demand for hydrogen ought to proceed to extend in 2022 and 2023 as demand for jet gas recovers.

Whereas the corporate’s core enterprise is protected with long-term contracts, development continues to be linked to the financial cycle. As an industrial fuel provider, APD’s gross sales are contingent on demand for gases. Evidently the corporate recovered from the present financial downturn, nevertheless demand stays cyclical.

Business opponents additionally made precious acquisitions just lately: Air Liquide purchased Airgas in 2016 (market cap of over $80B) and the Praxair-Linde merger in 2018 (market cap of over $170B) resulted in a second large with whom APD should compete. The ensuing competitors for market share is fierce, with value wars resulting in decrease margins. Increased uncooked materials enter prices might additionally put stress on ADP’s backside line.

Whereas APD has nice prospects for increasing its enterprise in rising markets, different gamers additionally face the identical alternative.

Greatest Dividend Inventory #8: Parker-Hannifin (PH)

This finest dividend inventory choice is from Craig with Retire Earlier than Dad.

Parker Hannifin is a Cleveland-based diversified tools and elements firm that manufactures a variety of business movement and management applied sciences. The corporate claims the #1 place within the $135 billion movement and management business with $16 billion in income, 11% of worldwide market share, and greater than 900,000 merchandise offered.

Its specialties embrace engineered supplies, hydraulics, course of management, filtration, fluid connectors, instrumentation, movement methods, and aerospace applied sciences. Most of Parker Hannifin’s merchandise are unfamiliar to customers however broadly utilized in engineering, bettering our lives behind the scenes.

Parker Hannifin is usually missed as a stalwart dividend development inventory as a result of it doesn’t qualify as a Dividend Aristocrat as decided by S&P World Rankings. Parker Hannifin’s dividend enhance streak relies on its fiscal 12 months (ending June thirtieth) slightly than the calendar 12 months.

The corporate has elevated its dividend for 66 years, together with the newest enhance of 29% in April 2022. This streak places it amongst an elite group of firms, the Dividend Kings, which have elevated their dividends for 50 years or extra. Parker Hannifin’s 10-year dividend development price is about 10%.

Administration goals to keep up a goal 5-year common payout ratio of 30%-35% of internet revenue. This subdues the 5-year common dividend yield (about 1.6%). However wholesome dividend development and value appreciation have rewarded affected person shareholders previously. The inventory is presently buying and selling at about 14 occasions subsequent 12 months’s estimated earnings.

The 1.92% present dividend yield and valuation make this a horny inventory for long-term revenue traders to think about.

Greatest Dividend Inventory #7: T.Rowe Worth (TROW)

This finest dividend inventory choice is from Prakash Kolli of Dividend Energy.

T. Rowe Worth (TROW) has struggled in 2022 due to the broader market decline. TROW derives its income primarily from charges from property below administration (AUM) as an funding supervisor. Consequently, market motion and internet outflows decreasing AUM have an effect on payment revenue. Because of this, the market has punished TROW, and the inventory value is down practically 36% year-to-date.

Nonetheless, TROW is a profitable asset supervisor rising AUM over time due to its retirement plans. Moreover, the agency’s funds are inclined to beat their friends and benchmarks over prolonged durations. Because of this, TROW’s AUM has elevated to over $1.5 trillion on the finish of the primary quarter.

The primary attraction for dividend development traders is the 36-years of annual dividend will increase making the inventory a Dividend Aristocrat. The agency has a stable report of double-digit will increase for 5-years at roughly 14.9% and 10-years at ~13.3%. Furthermore, the conservative payout ratio of ~34% suggests extra positive aspects sooner or later.

Supply: Portfolio Perception

The decline in inventory value has concurrently elevated the dividend yield. Because of this, traders are getting a 3.83% yield, greater than the 5-year common of two.62%. The dividend yield can also be greater than double the common of the S&P 500 Index. Moreover the low payout ratio, the dividend is supported by a internet money place on the stability sheet.

From a valuation perspective, TROW is buying and selling at a ahead price-to-earnings (P/E) ratio of roughly 12X, lower than the vary previously 5-years and 10-years. Dividend traders can buy an undervalued Dividend Aristocrat with a historical past of double-digit dividend will increase yielding nearly 4%. For my part, TROW is a long-term purchase.

Disclosure: Lengthy TROW

Creator Bio: Prakash Kolli is the founding father of the Dividend Energy website. He’s a self-taught investor and blogger on dividend development shares and monetary independence. A few of his writings could be discovered on Searching for Alpha, InvestorPlace, TalkMarkets, ValueWalk, The Cash Present, Forbes, Yahoo Finance, FXMag, and main monetary blogs. He additionally works as a part-time freelance fairness analyst with a number one e-newsletter on dividend shares. He was just lately within the prime 100 and 1.0% (81st out of over 9,459) of economic bloggers as tracked by TipRanks (an unbiased analyst monitoring website) for his articles on Searching for Alpha.

Disclaimer: The writer is just not a licensed or registered funding adviser or dealer/supplier. He’s not offering you with particular person funding recommendation. Please seek the advice of with a licensed funding skilled earlier than you make investments your cash.

Greatest Dividend Inventory #6: American Water Works (AWK)

This finest dividend inventory choice is from Nikolaos Sismanis.

American Water Works is the most important and most geographically numerous, publicly traded water and wastewater utility firm in the USA, as measured by each working revenues and inhabitants served. The corporate serves over 15 million individuals in 46 states.

Moreover its tremendously diversified operations, there are a number of components to love about American Water Works as a dividend inventory, together with a extremely resilient enterprise mannequin. This is because of water being a necessity each for residential and industrial utilization, in addition to a mission-critical asset for the army.

With the 1.77%-yielding firm experiencing predictable money flows because of restricted volatility in water consumption ranges, it has been in a position to develop its community and operations with restricted dangers. Moreover step by step unlocking economies of scale amid increasing its community and buying smaller opponents, the corporate is ready to develop its earnings by requesting regulators for infrequent price will increase.

By combining distinctive money circulation visibility, and a predictable earnings development pathway, administration has offered probably the most exact medium-term outlooks now we have encountered.

Particularly, the corporate expects its earnings per share to develop by roughly 7%-9% yearly via 2026. This contains price base will increase, which the corporate estimates to develop by a CAGR of 8%-9% via 2031. Accordingly, administration expects to develop the dividend by a CAGR between 7%-10% over the identical interval. Thus, traders face diminished threat when assessing the corporate’s funding case.

Shares of American Water Works are presently buying and selling at round 33 occasions this 12 months’s anticipated internet revenue, which is admittedly a wealthy a number of. The market might proceed attaching a premium to the inventory as a result of its sturdy qualities and reassuring funding case. Valuation compression dangers needs to be thought of by potential traders, nonetheless.

Greatest Dividend Inventory #5: Qualcomm Inc. (QCOM)

This finest dividend inventory choice is from Nate Parsh.

In selecting a dividend development identify that may outperform going ahead, an investor must determine an organization that has positives working in its favor.

Qualcomm Inc. (QCOM) has a number of tailwinds that ought to set the inventory as much as be top-of-the-line dividend development names for the rest of 2022. The corporate reported earnings outcomes on the finish of April, with income surging 41% to $11.2 billion and produced adjusted earnings-per-share of $3.21, which in contrast favorably to $1.90 within the prior 12 months.

Qualcomm Know-how Licensing did decline 2%, however that is the a lot smaller of the 2 segments that make up the corporate. Qualcomm CDMA Applied sciences, which accounted for 85% of quarterly income, was larger by 52% year-over-year. Every enterprise inside the phase noticed double-digit income development. Web of Issues, Handsets, Automotive, and RF front-end grew 61%, 56%, 41%, and 28%, respectively.

Whereas all companies are acting at a excessive degree, Handsets are more likely to be a serious contributor to leads to the approaching quarters because the ramp up and deployment of 5G service continues. Because the rollout of 5G continues, prospects are more likely to improve their gadgets, requiring the acquisition of a brand new telephone. As a serious provider of the elements present in handsets, Qualcomm’s largest contributor to income is more likely to proceed to submit spectacular development charges.

With nearly all of the corporate exhibiting robust outcomes, shareholders are more likely to see continued dividend will increase. Qualcomm has raised its dividend for 20 consecutive years, together with a ten.3% enhance for the upcoming June twenty third fee date. Shares yield 2.3% as we speak, above the 1.7% common yield for the S&P 500 Index.

Editor’s Word: The following two analysts independently picked the identical inventory.

Greatest Dividend Inventory #4: Stanley Black & Decker (SWK)

This finest dividend inventory choice is from Josh Arnold.

AbbVie, a drug maker that makes a speciality of virology, immunology, and oncology merchandise, is likely one of the finest dividend shares available in the market. The corporate possesses a powerful product portfolio, which is presently led by Humira, and a pipeline of acquired and developed merchandise to assist with future development. Whereas Humira faces patent expiration globally within the subsequent few years, AbbVie is creating a alternative, in addition to a slate of different merchandise to assist curb the inevitable decline in income that can include patent expiration.

AbbVie’s acquisition of Allergan is one other method it’s boosting future development to offset misplaced Humira income, and the present deal value – which relies partly on AbbVie’s share value – is simply 12 occasions Allergan’s projected 2020 earnings. This deal might be accretive to AbbVie nearly instantly, and assist diversify the mixed firm’s income stream over time.

AbbVie – even with out the good thing about Allergan – ought to see ~5.5% earnings-per-share development yearly within the coming years as its margins proceed to enhance, it buys again its personal shares, and sees barely larger income over time. Humira continues to be a blockbuster value billions of {dollars} per 12 months, so the corporate has ample time to switch that misplaced income. This degree of earnings development, mixed with an inexpensive payout ratio that’s proper at half of earnings-per-share, means AbbVie can maintain its very spectacular dividend enhance streak alive for a few years to come back.

With a present yield of ~5%, a really protected payout that’s well-covered, earnings development potential, a horny pipeline, and a favorably-priced acquisition, AbbVie has a singular mixture of present yield, dividend development, earnings development, and worth. AbbVie, subsequently, is actually top-of-the-line dividend shares available in the market as we speak.

About this finest dividend inventory choice’s writer: Josh Arnold is an unbiased fairness analyst and a prolific author with regards to dividend shares. His work could be seen right here on Positive Dividend, in addition to different monetary websites comparable to Searching for Alpha.

Greatest Dividend Inventory #3: Stanley Black & Decker (SWK)

This finest dividend inventory choice is from Eli Inkrot of Positive Dividend.

Tracing its roots to 1843, Stanley Black & Decker is the world’s largest instrument firm with iconic manufacturers together with Stanley, Black + Decker, DeWalt, Craftsman, Cub Cadet and Troy-Bilt. The $19 billion firm employs over 60,000 individuals and generated $17 billion in gross sales final 12 months.

Stanley Black & Decker has stood the take a look at of time and has confirmed itself to be a top quality enterprise. Its dividend report can also be notable, having paid a dividend for practically 150 years and having elevated this payout for over 5 a long time.

Within the 2011 via 2021 interval, Stanley Black & Decker elevated its dividend every year between 3.0% and 10.0% yearly. For the whole interval, the dividend grew at a median compound development price of 6.2% per 12 months.

This dividend development was supported by earnings-per-share development. In the identical stretch, Stanley Black & Decker’s earnings-per-share elevated 9 out of 10 years, rising by a median compound development price of seven.5% per 12 months. By the way, as a result of earnings-per-share development outpaced dividend development, this implies the payout ratio declined during the last decade – from ~40% in 2011 all the way down to below 30% in 2021.

Lastly, the share value grew by a compound common development price of 10.6% per 12 months over this era. The explanation the share value outpaced earnings-per-share development was as a result of an increasing P/E ratio. The safety’s valuation went from below 13 occasions earnings to over 17 occasions earnings throughout this time.

These components are attention-grabbing to notice in regards to the previous, but in addition useful in enthusiastic about the long run. There are moments when an funding can outperform the enterprise outcomes. At the moment might as soon as once more be a kind of moments.

Because the finish of 2021, Stanley Black & Decker’s share value is down -35%. It needs to be famous that the corporate’s earnings-per-share steerage is down as properly (from $12.00 – $12.50 to $9.50 – $10.50), however these are the types of issues that permit for outsized positive aspects. Shares are actually again all the way down to ~12 occasions anticipated earnings.

Within the Positive Evaluation Analysis Database, we’re forecasting the potential for 16.9% annualized whole returns over the following 5 years. That is pushed by the two.6% beginning yield, 8% anticipated development price and an ending P/E ratio of 16.5.

After all, all types of issues can occur within the investing world. Nonetheless, even with a 4% development price and an ending P/E ratio of 14, this nonetheless equates to the potential for 9.4% annualized positive aspects. Good issues occur you pair a high-quality enterprise with a margin of security.

Disclosure: I’m lengthy SWK.

About this finest dividend inventory choice’s writer: Eli Inkrot is President of Premium Companies at Positive Dividend, overseeing the Positive Evaluation Analysis Database, Newsletters and Particular Experiences. Beforehand, Eli was an analyst in non-public actual property, VP and Portfolio Supervisor for a cash administration agency, VP for a monetary software program firm and an unbiased fairness analyst. Eli obtained a level in Enterprise and Economics from Otterbein College and a Grasp’s in Finance from the College of Tampa, the place he was named the “most excellent graduate pupil.”

Greatest Dividend Inventory #2: Texas Devices (TXN)

This finest dividend inventory choice is from Bob Ciura of Positive Dividend.

The perfect dividend shares typically have a mix of a market-beating dividend yield, stable development prospects, and an inexpensive valuation. It seems Texas Devices (TXN) inventory has all three of those qualities, which is why it’s my prime decide for the rest of 2022.

Texas Devices is a semiconductor firm that operates two enterprise models: Analog and Embedded Processing. Its merchandise embrace semiconductors that measure sound, temperature and different bodily knowledge and convert them to digital indicators, in addition to semiconductors which might be designed to deal with particular duties and functions.

This has been a difficult 12 months for tech shares, as rising rates of interest and the specter of a world recession have prompted share costs throughout the tech sector to fall. However this solely makes TXN inventory much more interesting for bargain-hunters.

The inventory has a present yield of three.0%, which beats the S&P 500’s common yield of ~1.5%. And, Texas Devices is a improbable dividend development firm. It generates a degree of free money circulation, a good portion of which is returned to traders via money returns.

In keeping with the corporate, Texas Devices generated 12% annual development in free money circulation per share from 2004-2021. On this interval, Texas Devices has elevated its dividend yearly, at a median development price of 25% per 12 months. The corporate has additionally diminished its excellent share depend by 46% since 2004, proving that Texas Devices is a shareholder-friendly firm.

Plus, the corporate has carried out extraordinarily properly this 12 months, even with the aforementioned headwinds.

In the newest quarter, Texas Devices grew income by 15% versus the earlier 12 months’s quarter. This was the results of a income enhance of 16% within the Analog enterprise, whereas revenues within the Processing phase grew by 2% year-over-year. Maybe extra impressively, Texas Devices managed to develop its gross revenue margin to a horny degree of 70%.

TXN presently trades for a 2022 P/E of 16.9. We consider that is too low for such a top quality firm, as our truthful worth P/E estimate is 20. The mix of earnings development, dividends and a number of growth might end in annual returns of practically 14% per 12 months.

Subsequently, TXN is an undervalued inventory with robust development, a 3% dividend yield, and a excessive degree of anticipated returns. This makes TXN my prime decide for the rest of 2022.

About this finest dividend inventory choice’s writer: Bob Ciura is President of Content material at Positive Dividend. He has labored at Positive Dividend since October 2016. He oversees all content material for Positive Dividend and its accomplice websites. Previous to becoming a member of Positive Dividend, Bob was an unbiased fairness analyst publishing his analysis with numerous shops together with The Motley Idiot and Searching for Alpha. Bob obtained a Bachelor’s diploma in Finance from DePaul College, and an MBA with a focus in Investments from the College of Notre Dame.

Greatest Dividend Inventory #1: 3M Firm (MMM)

This finest dividend inventory choice is from Ben Reynolds of Positive Dividend.

3M (MMM) is a blue-chip dividend inventory with a formidable historical past. The corporate was based in 1902, 120 years in the past. And 3M has paid rising dividends for an unimaginable 64 consecutive years.

With a dividend streak of fifty+ years, 3M is a member of the unique Dividend Kings checklist. The Dividend Kings are the gold normal in dividend longevity.

3M is a producer with a deal with analysis and improvement. The corporate’s lengthy historical past of innovation has spurred its development during the last 12 a long time. The corporate presently spends 6% of gross sales – round $2 billion yearly – on analysis and improvement.

3M is clearly a high-quality enterprise with a powerful and sturdy aggressive benefit. However an excellent enterprise bought at too excessive of a value doesn’t make a compelling funding.

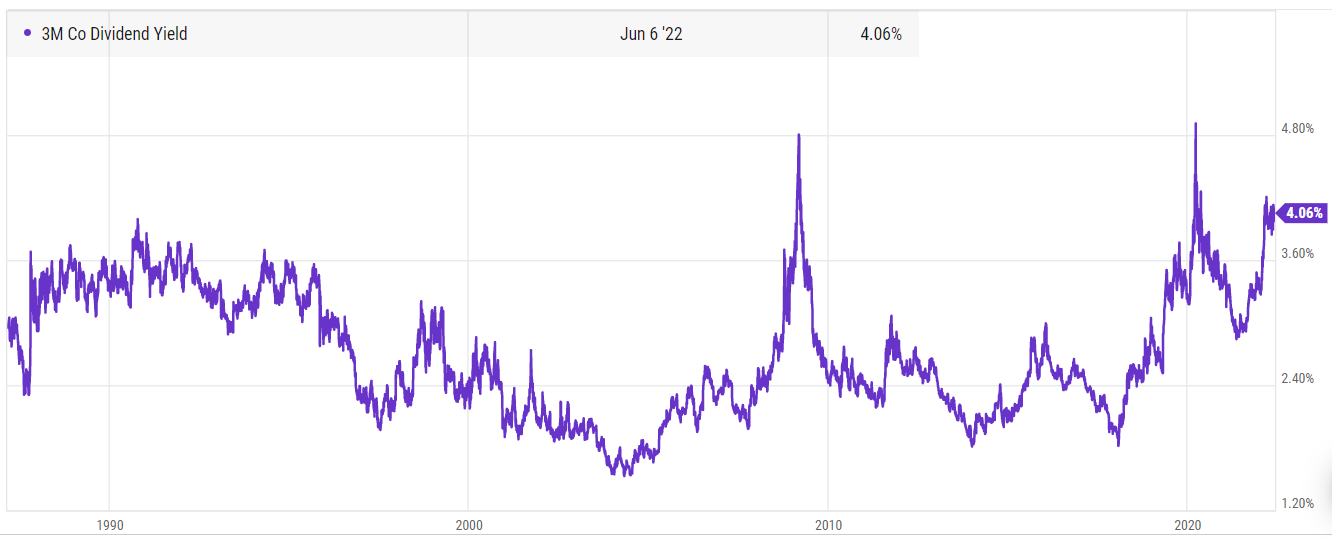

Fortuitously for dividend development traders trying to purchase now, 3M is buying and selling for a dividend yield of greater than 4%. This can be a uncommon alternative to lock in a excessive beginning 12 months for this high quality dividend development inventory.

Supply: Ycharts

The one different occasions since 1990 that 3M was buying and selling for a dividend yield of 4% or larger was throughout the Nice Recession and throughout the COVID-19 crash in 2020.

3M is cheap proper now as a result of it’s dealing with practically 300,000 lawsuits surrounding claims that its earplugs utilized by fight troops had been faulty. We don’t consider this considerably impacts the businesses long-term prospects.

Moreover, 3M has not carried out as much as its ordinary requirements over the previous few years. In fiscal 2018, the corporate generated earnings-per-share of $10.46. We expect earnings-per-share of $11.00 in fiscal 2022, for under marginal development over 4 years.

Regardless of this, there’s a lot to love about 3M as an funding proper now. First, the 4%+ dividend yield instantly stands out. We anticipate average development of round 5% a 12 months going ahead. And with a price-to-earnings ratio of solely 13.3, we anticipate important valuation a number of growth to our truthful worth price-to-earnings ratio estimate of 19.0.

3M is a confirmed enterprise that rewards shareholders with rising dividends over the long term. The corporate has not carried out as much as its ordinary requirements during the last a number of years, but it surely nonetheless has a sturdy aggressive benefit and ample money circulation producing capacity. Close to-term headwinds have created a shopping for alternative at 3M.

About this finest dividend inventory choice’s writer: Ben Reynolds based Positive Dividend in 2014. Reynolds has lengthy held a ardour for enterprise normally and investing specifically. He graduated Summa Cum Laude with a bachelor’s diploma in Finance and a minor in Chinese language research from The College of Houston. At the moment, Reynolds enjoys watching motion pictures, studying, and exercising (not on the identical time) in his spare time.

Different Dividend Lists

The Dividend Aristocrats checklist is just not the one option to rapidly display for shares that recurrently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].