Far700/iStock via Getty Images

The Federal Reserve’s (Fed) single-minded commitment to fighting inflation has been communicated so many times and in so many ways that the execution of monetary policy almost seems to be—dare I say—on “autopilot.” Whenever the markets seem to doubt their commitment, Chair Jerome Powell and other Fed officials quickly reinforce the message through their communications apparatus, including speeches, the Statement of Economic Projections, and media signaling.

We all should remember what happened the last time the Fed suggested that the future course of policy was predetermined: After Powell’s infamous reference to the Fed balance sheet reduction being on “autopilot” in a December 2018 press conference, stocks collapsed and the Fed was forced to backtrack from the statement, which marked the start of a policy pivot.

Scott Minerd joins CNBC to discuss opportunities for investors in a market beset by policy and economic challenges

Some Fed policymakers seem to have learned their lesson from December 2018, which is why they are quick to invoke data dependency as a disclaimer to their messaging. Fed Governor Lael Brainard demonstrated a prime example of this when she said in a Sept. 30 speech, “Monetary policy will need to be restrictive for some time to have confidence that inflation is moving back to target. For these reasons, we are committed to avoiding pulling back prematurely.” Two sentences later she added that the Fed will proceed “in a data-dependent manner.”

While this caveat suggests that Brainard and her colleagues will be watching the inflation and employment data for direction, financial stability and market functioning should also be on the Fed’s radar. As I have stated before, the Fed will keep hiking until something breaks, and clearly the cracks are forming.

Plunge in Gilts Spark An Intervention

30-Year UK Gilt Price Intraday

Source: Guggenheim Investments, Bloomberg. Data as of 10.03.2022.

In the last two weeks we have seen not one but two interventions by foreign central banks—the Bank of Japan (BoJ) to support the yen (reportedly using up a large chunk of its currency reserves in the process), and the Bank of England (BoE) to support the gilt market. Even schoolchildren can see the yen story developing, where the BoJ’s attempts to hold down interest rates through bond purchases which increases the supply of yen while simultaneously buying yen with their foreign currency reserve. Which major market participants or policymakers had on their 2022 bingo card that the sleepy U.K. pension market would be the next Orange County—brought down by the derivatives in their supposed sophisticated liability-driven strategies (a good idea carried to ludicrous extremes). While different in their target and scope, both operations addressed market fragilities exposed by the rapid and super-sized rate hikes in the United States and around the world. I also note that the People’s Bank of China has directed that nation’s six largest banks to offer financing support for the beleaguered real estate and property sector, a policy that results in a weakening yuan. For the moment, these interventions seem to have helped, but none have done anything to address the structural causes which underlie each crisis.

The dollar has become a giant wrecking ball, its ongoing appreciation due to the indifference of Fed policymakers to the impact of its relentlessly hawkish rhetoric and actions on financial stability around the globe. And while U.S. financial institutions seem to be more resilient than prior to the 2007 housing crisis, risk has migrated into shadow banks, collateralized loan obligations, emerging market bonds, and other yet-to-be-discovered corners of the market.

The Fed has raised the fed funds rate 300 basis points in the past seven months (an increase of 1,200 percent), a pace with few if any comparisons in history. Given that the economy was strong and balance sheets were healthy when this accelerated hiking regimen began, the first 225 basis points were relatively easy for the markets and the economy to digest, which bring the policy rate close to neutral. Up until then, financial conditions tightened and markets were fairly orderly. But now the markets—and the Fed—are starting to learn that tightening aggressively as they have moved into restrictive territory is a different ballgame.

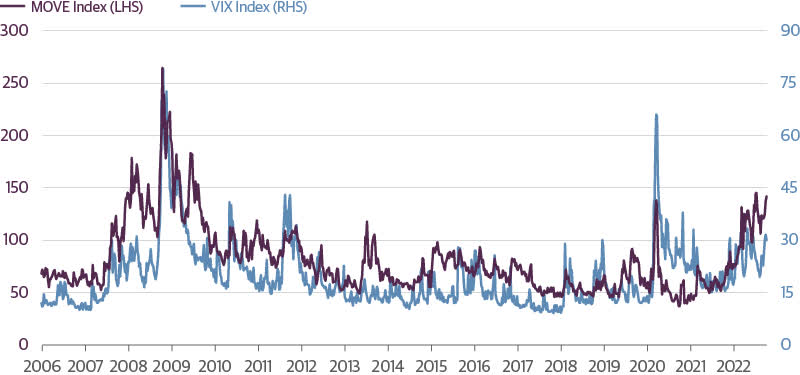

The further we get into restrictive territory, the more likely it becomes that we begin to see black swans just as we have seen in the U.K. gilt market, an event that had the potential to spiral into a global financial crisis if not for the quick action of the BoE (and that story is yet to be resolved). We are already seeing cracks in the credit markets, as deals get pulled, banks take large losses on bridge financings, mutual fund outflows increase, and global liquidity dries up. Mortgage-backed securities markets are under significant pressure as leveraged holders try to unwind positions, while the Fed simultaneously moves to reduce its holdings in the same. Even Treasury securities have to be broken into smaller lots to trade. Bonds on the European periphery and in emerging markets are challenging to trade at all, while equity markets can’t hold on to gains. The VIX Index, a measure of option-implied equity market volatility, has risen to above a red flag reading of 30 yet has failed to reach levels associated with capitulation, indicating that stocks are deeply entrenched in a bear market. The ICE Bank of America MOVE Index, a measure of option-implied bond price volatility, is close to 150, a level only exceeded at the very outset of the pandemic in March 2020 and the Global Financial Crisis (GFC). Implied volatility in the foreign exchange market is also elevated. With cross-asset volatility so high, the risk of a financial accident is growing.

Implied Volatility Has Spiked for Both Stocks and Bonds

Source: Guggenheim Investments, Bloomberg. Data as of 9.30.2022.

My biggest concern is that further tightening will test the fragilities of market plumbing. Ever since the Dodd-Frank Act, the Volcker Rule, and Basel III changed the way the bond market functions, the ability of investors to move risk quickly and in size is constrained. Market makers on Wall Street trading desks were historically the primary source of liquidity, but since the GFC asset managers, hedge funds, and other non-banks are challenged to fill the liquidity void created by post-GFC macroprudential policy. We will soon witness how the players perform as market stresses increase as central banks around the world simultaneously remove liquidity at a record pace. Events of the last week demonstrate that shadow market participants, many of which are already highly levered, are facing their own margin calls resulting in them unwinding positions just at the moment when they should be providing liquidity and bidding for securities.

October is already proving to be another rocky month for investors. Historically, October is the month which has the highest volatility. The market is pricing in another rate hike of approximately 75 basis points for the Nov. 2 Federal Open Market Committee meeting. Between now and then, the market will have to absorb numerous pieces of data, including the jobs report on Oct 7, the Consumer Price Index on Oct. 13, and the advance estimate of third quarter Gross Domestic Product on Oct. 27, while uncertainty looms around the next European Central Bank meeting on Oct. 27 and the next BoJ meeting on Oct. 28.

The Fed is closer to the end of their tightening cycle, but it is clearly not done. My advice to Fed policymakers has been to remain focused on fighting inflation, but cool the rhetoric. When it comes to discussing financial conditions, Fed officials can’t keep telling the world “We like what we see” when markets are convulsing. They need to start working on a message that adds healthy market functioning to the data dependency caveat. The Fed needs to acknowledge that with financial conditions already tightening rapidly—perhaps faster than intended—and inflation expectations falling, a slower pace of rate hikes may be appropriate at upcoming meetings.

I was just starting out in the bond business when Paul Volcker was doing his level best to tame inflation and bonds were called “certificates of confiscation.” Since that time, the markets, interlocking relationships, financial products, and regulation that have come to define our modern financial system have all been built in an increasingly complex world where bonds have only been in a bull market.

Now in the middle of a sea change in financial markets, most of the professional talent that manages this complex global network—asset managers, market makers, financial advisors, bond issuers, macroprudential regulators, central bankers—have little to no experience with the market volatility associated with a sea change in global policy, whether it be monetary, fiscal, or geopolitical in nature. The good news is that as challenging as 2022 has been, investors with dry powder have the opportunity to take advantage of dislocations that have offered yields at levels we haven’t seen in decades.

Let’s begin by throwing out projecting an end of fed fund rate increases based upon inflation, unemployment, or other macroeconomic factors. The end of Fed tightening will come when something breaks and the Fed will have no choice but to reliquefy the system, an event which I would expect before year end, and most likely before the end of the World Series. The strains are already great, and as Scotty famously told Kirk, “I dannae if she can take anymore, Captain!” In the short run, a Fed pivot will be good for bonds and risk assets, which are cheap at today’s prices.

No one is going to ring a bell when the Fed is forced to pivot. Investors should focus more on value opportunities which abound and stop licking their wounds and trying to pick the bottom.

Important Notices and Disclosures

This material is distributed for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy, or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author’s opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk. In general, the value of fixed-income securities fall when interest rates rise. High-yield securities present more liquidity and credit risk than investment grade bonds and may be subject to greater volatility. Asset-backed securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity risk. Investments in floating rate senior secured syndicated bank loans and other floating rate securities involve special types of risks, including credit risk, interest rate risk, liquidity risk and prepayment risk.

Applicable to United Kingdom investors: Where this material is distributed in the United Kingdom, it is done so by Guggenheim Investment Advisers (Europe) Ltd., a U.K. Company authorized and regulated by the Financial Conduct Authority (FRN 499798) and is directed only at persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook.

Applicable to European Investors: Where this material is distributed to existing investors and pre 1 January 2021 prospect relationships based in mainland Europe, it is done so by Guggenheim Investment Advisers (Europe) Ltd., a U.K. Company authorized and regulated by the Financial Conduct Authority (FRN 499798) and is directed only at persons who are professional clients or eligible counterparties for the purposes of the FCA’s Conduct of Business Sourcebook.

Applicable to Middle East investors: Contents of this report prepared by Guggenheim Partners Investment Management, LLC, a registered entity in their respective jurisdiction, and affiliate of Guggenheim Partners Middle East Limited, the Authorized Firm regulated by the Dubai Financial Services Authority. This report is intended for qualified investor use only as defined in the DFSA Conduct of Business Module.

© 2022 Guggenheim Partners, LLC. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.