David Beckworth just lately requested former Fed governor Randal Quarles why the Fed didn’t transfer final fall to cease inflation. Right here’s how Quarles responded:

Quarles: That is perhaps an eccentric perception. I don’t assume that it’s universally shared and even extensively shared on the FOMC. However my perception is that it’s a separate component of the Fed faith that resulted in not shifting within the fall, and it turned clear that it was time to pivot to withdrawing lodging, and it’s a long-standing sort of Fed precept that you simply shouldn’t step on the gasoline and the brake on the identical time; which means that you simply shouldn’t be elevating rates of interest similtaneously you might be nonetheless growing the scale of the stability sheet. And so we had determined that we would have liked to taper the stability sheet purchases. The lesson of the taper tantrum underneath Bernanke was that you simply’ve bought to telegraph that nicely upfront. You’ve bought to try this steadily, with the intention to keep away from disrupting markets. And you must have accomplished that earlier than you can begin elevating rates of interest so that you simply’re not doing two conflicting issues. In order that was the sequencing.

Macroeconomics is stuffed with myths. There’s a extensively held (false) perception that the US ran unusually huge price range deficits in the course of the Sixties, and that the excessive inflation of the Seventies was because of provide shocks. The concept there was a “taper tantrum” in 2013 that “disrupted markets” appears to be one other fashionable fantasy. The place is the proof for that declare?

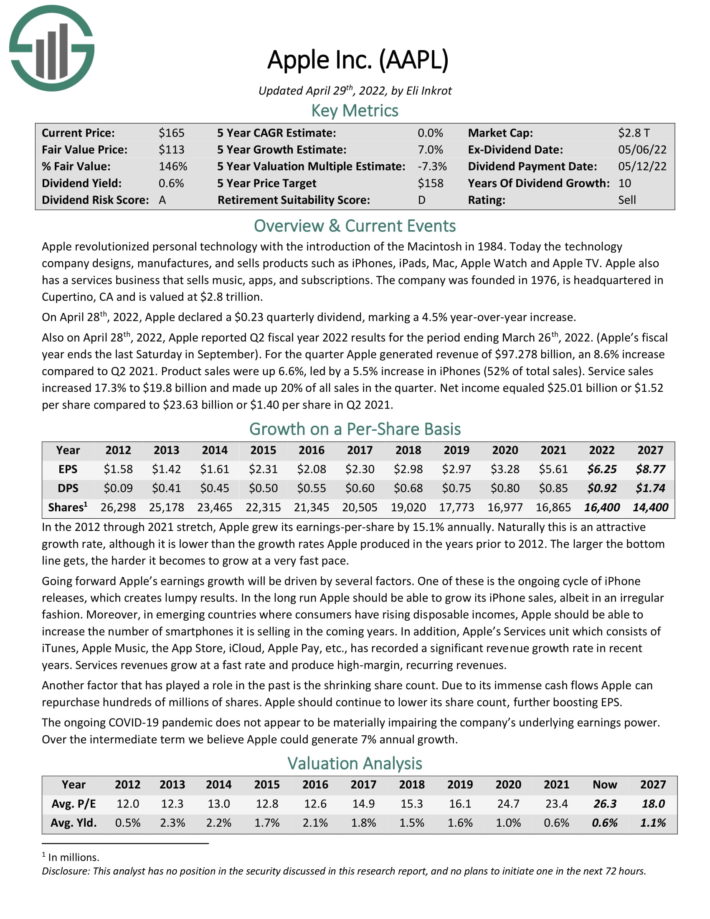

FWIW, right here is the S&P500 within the 12 months after Bernanke’s Could 22, 2013, speech on the necessity to ultimately taper bond purchases (a fairly apparent level, BTW):

Discover that the speech didn’t trigger any inventory market turmoil, both instantly or over the subsequent 12 months. Nor was there any main market response to Bernanke’s speech within the bond market, though long-term charges did pattern upwards because of a stronger than anticipated financial system in late 2013. (The coverage was unwise, however that’s as a result of inflation was too low on the time.)

Quarles means that within the fall of 2021, the Fed responded to this phony “lesson” by doing nothing to restrain inflation. Right this moment, annoyed inventory and bond market members have to be grumbling “thanks for nothing”, because the Fed’s inaction ended up inflicting a market tantrum in 2022, with the financial system surging to excessive inflation and as inventory and bond costs falling sharply:

As I hold saying, the Fed mustn’t deal with stabilizing monetary markets; they need to deal with stabilizing anticipated NGDP development. Steady monetary markets can’t be engineered artificially; they outcome from stability within the broader financial system.

The Fed must hold its eye on the ball: