Sean Anthony Eddy

An Institute for Clinical and Economic Review (ICER) report has questioned the price tag of TG Therapeutics, Inc.’s (NASDAQ:TGTX) briumvi, saying that, to be cost-effective, the company should price it between $16.5K – $34.9K. ICER has not targeted briumvi alone – according to it, every anti-CD20 antibody targeting Multiple Sclerosis is overpriced.

Here’s a list of these drugs and their prices (courtesy comment from a reader):

-

BRIUMVI $59,000

-

OCREVUS $71,187

-

KESIMPTA $91,560

-

TYSABRI $102,126.

And here’s a list of their approximate annual revenues:

OCREVUS – $6bn, Roche (OTCQX:RHHBY), approval March 2017

KESIMPTA – $1bn, Novartis (NVS), August 2020

TYSABRI – $2bn, Biogen (BIIB), Nov 2014.

ICER publishes cost-effectiveness reports on various drugs. I read a report from 2019 where they analyzed such metrics for AbbVie Inc.’s (ABBV) Humira among other drugs. About Humira, ICER noted:

Over the 24-month (eight quarters) period for which price changes were assessed, adalimumab’s WAC increased by approximately 19%, while its net price increased by almost 16%. Considering the average volume sold in 2017-18, this net price change over the assessed eight quarters resulted in an estimated increase in drug spending of $1.86 billion.

And ICER concluded:

After careful review of the evidence submitted by the manufacturer, we conclude that adalimumab (Humira) had a price increase unsupported by new clinical evidence.

This was in Oct-Nov 2019. In that year, Humira’s WAC was $5174 per month. AbbVie, Humira’s seller, disputed ICER’s findings (Humira appears in each of its 3 reports). In the next year, Humira did not reduce its list price. ICER published another report. However, this did not lead to any noticeable reduction in Humira sales.

Humira is an exception because, according to ICER, it has increased its price the most over the years. Let us consider Tysabri, which also made ICER’s list. It increased list price by 7.1% and 4.2% in 2019 and 2020, respectively, and made the ICER list in 2020. There was no noticeable decrease in revenue.

The point I am trying to make here is that ICER reports do not always impact the company top line. From Fiercepharma:

Year-over-year price hikes have “slowed considerably since ICER began issuing these UPI reports,” David Rind, M.D., ICER’s chief medical officer, said in a statement.

However, looking at some of the drugs covered in these reports, they do not seem to be having much impact.

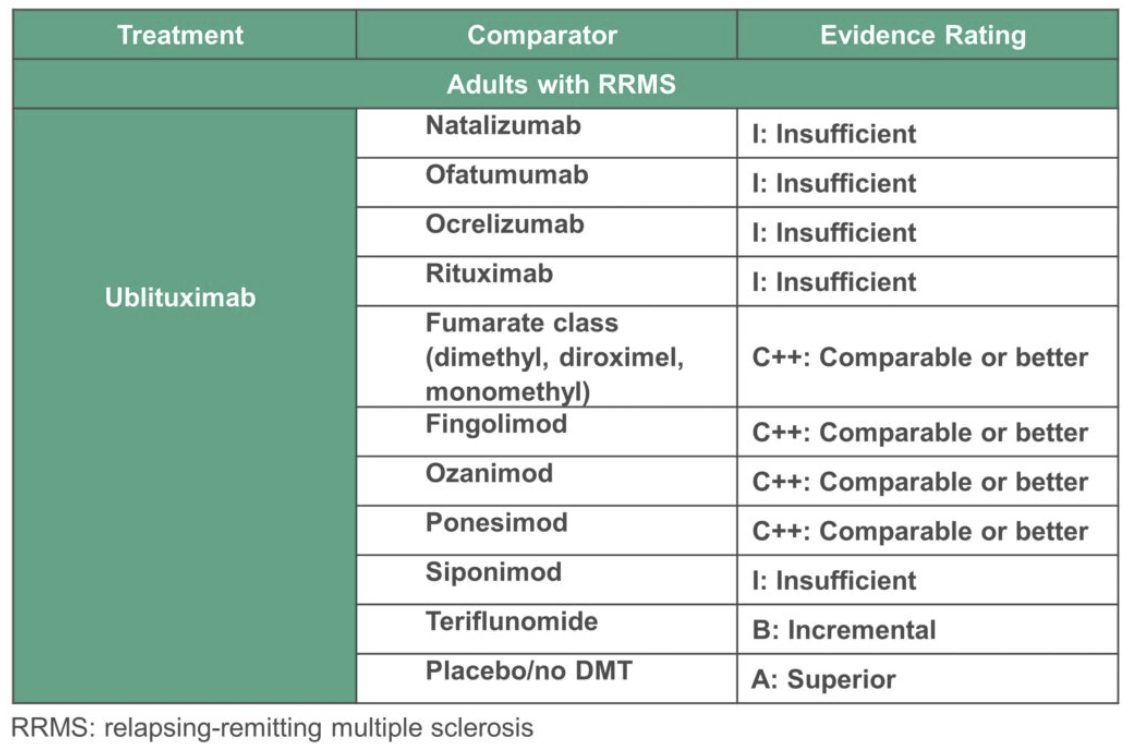

Also interestingly, briumvi is the least expensive of these anti cd20 drugs, and according to ICER’s own report, some of these are not better drugs at all:

TGTX ICER REPORT (ICER PRESS RELEASE)

Thus, I do not expect any major change to the TGTX bottom line in the coming quarters because of these reports. Other factors are taken to be constant when making that statement.

In my February coverage of TGTX, I noted some of the reasons briumvi has a better profile than competitors like ocrevus, although there has never been a direct comparison. These are, briefly, and in no particular order of importance, lower infusion time, briefer hospital stay, better safety profile, better annualized relapse rate or ARR, and the percentage of relapse-free patients. Despite all of that, the company has priced itself the least, probably because it is looking to balance its small-cap stature versus its big pharma rivals against this major price discount. So yes, unless these other players all substantially reduce their prices, there is no reason TGTX should suffer.

Cantor analysts agree. According to one analyst:

“….The anti-CD20 class share is far from reaching peak penetration,” he added, raising the estimated peak global revenue for Briumvi to $2.2B from $1.8B.

Financials

TGTX now has a market cap of $2bn and a cash balance of $174mn plus a $45mn term loan facility from Hercules Capital (note that Hercules banked at SVB). Total research and development (R&D) expense was $29.6 million for the December quarter, and SG&A expenses were $22.5 million. At that rate, they have a cash runway to mid to late 2024. That should give them enough time to start generating good numbers.

TGTX is not a heavily insider bought or sold stock, but there was a small insider buy (~200k) in January. CEO Michael Weiss owns some 11 million shares. In July 2022, he sold $1mn worth of shares at $18.8. On that same day, the CFO, too, sold nearly $1.6mn worth of shares. But that was a long time ago. Just a couple weeks ago, the CEO was granted $1mn worth of TGTX shares, bringing his total owned shares to 11,973,021.

Bottom Line

In my last article, I discussed my personal history with TG Therapeutics, Inc. stock. I am going to keep holding TG Therapeutics, Inc. stock for 4 more quarters and see if I can make a profit this second time. However, I have no plans to buy at these prices even if I think TG Therapeutics, Inc. stock will appreciate, because I have a low risk appetite.