It’s the big Tesla question: Are you a bull or a bear?

The stock fell more than 10% last week.

The company slashed prices on its electric vehicles (EVs), and now recently raised prices on its luxury models (Model S and Model X).

But ARK Invest’s Cathie Wood just announced her new TSLA price target: $2,000 by 2027 — 10X.

So what’s our outlook for the world’s biggest EV maker? [See it here: 1:15]

One thing is certain.

In this world of Alexa devices, ChatGPT, self-driving semitrucks, and robo-taxis— artificial intelligence and automation are not just the future.

It’s the present. And the investment potential is HUGE.

There’s not just one path to gains. There are many.

That’s why we’re sharing one of our top exchange-traded funds (ETFs) you can buy today.

But if you want more direct exposure, I’m recommending a new stock for the autonomous vehicle revolution in the next edition of our Strategic Fortunes newsletter. If you’re not a subscriber, find out how you can get the stock ticker here.

In Today’s Video:

Amber Lancaster and I are covering:

- Tech News: Autonomous cars. How self-driving technology is accelerating today. [5:00]

- Demo This: Tradesmith helps us track stocks in our portfolios with trade stops. Watch this analysis on Tesla (Nasdaq: TSLA). [13:40]

- World of Crypto: Are cryptocurrency and blockchain technology too complicated to be mainstream? [14:50] And for crypto beginners: Where should you open an account to start trading? [27:00]

- Mega Trend: Within 10 years, a new report says autonomous cars will be mainstream. [27:30]

- Investment Opportunity: We recommend this ETF if you want to tap into the AI and robotics trend! [29:50]

(Or read the transcript here.)

What Do You Think About Tesla?

If you’re into EVs like we are, are you bullish or bearish about the stock? Let us know!

Send us an email at [email protected].

See you soon,

Ian KingEditor, Strategic Fortunes

My chat with Ian yesterday on The Banyan Edge Podcast got me thinking.

China really is screwed.

And it’s not something that can be fixed with small tweaks to government policy. As I said, the country lost 850,000 people last year. The United Nations’ projections show China’s population shrinking by 100 million to 200 million by 2050, which is less than 30 years from now.

That’s the equivalent of a country the size of Mexico just … disappearing.

Not only is their population shrinking, but those that remain are getting older. The average age of a China citizen in 2050 is projected to be over 50, up from about 38 today.

I touched on what this means for China’s labor market with Ian in the podcast. (Spoiler alert: It means a massive investment in robotics automation and artificial intelligence.)

But today, I’m more interested in the implications for consumer spending.

If you’re Apple, Nike or Starbucks, China’s growth market is over. Over the next 30 years, you’ll have fewer and fewer people to sell iPhones, Air Jordans or frappuccinos to.

How do you plan for something like that? How do you justify building office buildings or apartments, or even basic infrastructure like schools or roads … if there will be fewer people using it year after year?

More fundamentally, how do you grow your economy?

The short answer is: you don’t.

Consider the case of China’s neighbor, Japan.

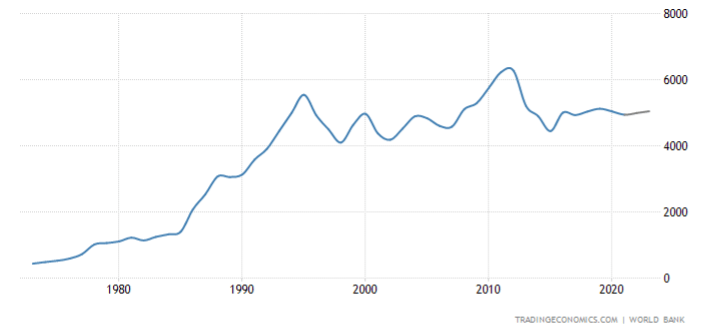

Japan’s Real GDP In U.S. Dollars

Japan hasn’t had meaningful or sustained economic growth since the mid-1990s. Japan’s economy has been stagnant since Bill Clinton was still in his first presidential term and Friends was in its second season.

As for the “why,” tell me if this sounds familiar. Japan had a huge real estate building spree that went bust just as Japan’s population started to rapidly age in the 1990s. (Due in part to Japan’s high living standards, the population didn’t actually start to decline until 2008.)

Once you’re in your 50s, you probably already own the largest and most expensive house you will ever own, and you’ve already crammed it full of furniture and appliances. You’ve already bought all the things that people tend to buy on credit, and you’ve shifted your focus to saving for retirement.

Today, Japan is estimated to have over 10 million abandoned houses. These are properties that the owners gave up on trying to sell because the buyers simply don’t exist. They were never born.

Of course, every crisis is an opportunity. And China’s shrinkage will potentially be offset by growth in India and other emerging markets with younger populations.

We’re already seeing companies move with their feet. As I mentioned in Saturday’s Weekly Recap, Apple just opened its first stores in India. You can bet there will be more coming.

So if you enjoyed Ian and Amber’s video on the massive autonomous vehicle trend (and how you can invest in it), make sure you tune in to tomorrow’s Banyan Edge for another great investment opportunity.

Charles Mizrahi is going to show you how to find 200%+ winners like one of the stocks in his microcap portfolio.

And that’s just the beginning…

Because he says one decision can turn into a billion-dollar move for a company. And it can change your life forever.

Charles told me:

I have found the one company I’m convinced will be making the next billion-dollar move.

It’s a small energy company — and the CEO has made a bold decision that now allows his company to generate up to 5X more money from their energy than others can get from theirs.

And the kicker?

It’s trading for less than $5 a share.

I’m sharing all the details in my new event — “The Next Billion-Dollar Move.”

I just finished watching it and trust me … you do not want to miss this. Click here to watch it now (and see how to unlock that $5 stock before it moves higher.)

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge