https://www.statista.com/chart/29002/tesla-market-capitalization/

Shockingly, Tesla’s drop in market capitalization, roughly $800 billion from its peak, is bigger than the combined valuation of pretty much any legacy car manufacturer you could think of. As the following chart shows, the combined market capitalization of Toyota, Volkswagen, Mercedes-Benz, BMW, GM, Ford, Stellantis (Fiat Chrysler and PSA), Honda, Hyundai, Kia, Nissan and Renault is still more than $100 billion shy of Tesla’s market cap decline.

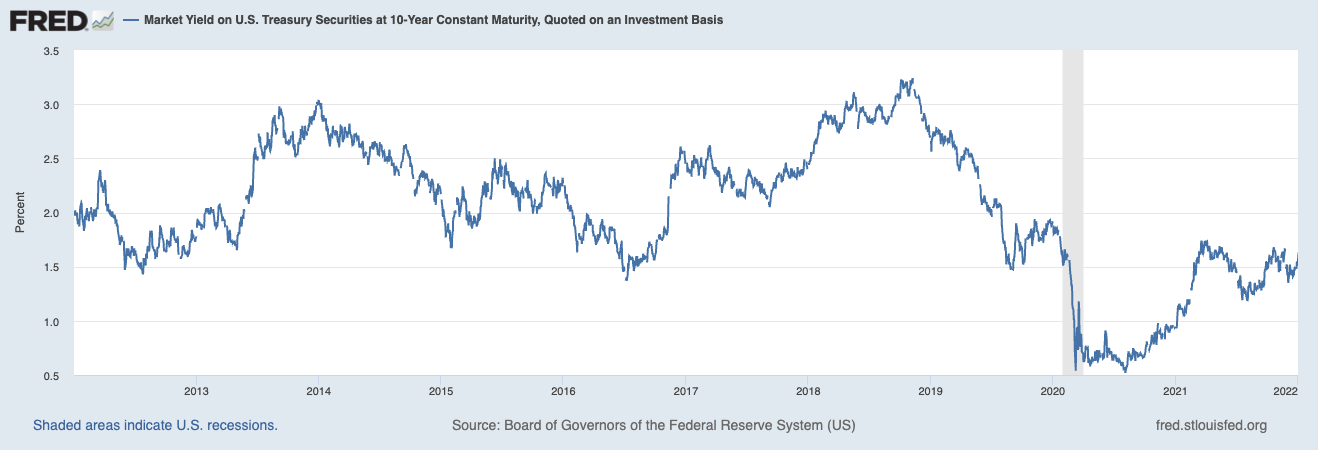

So what caused that extraordinary fall of one of the best-performing stocks of 2020 and 2021? Firstly, Tesla was always valued as a high-growth stock, meaning much of its valuation was based on its future potential. As the economic outlook darkened throughout 2022, so did Tesla’s potential for future growth, especially considering that inflation and high interest rates will eventually affect consumer spending on big-ticket items such as cars.

Secondly, Elon Musk’s acquisition of Twitter is clearly playing a role in Tesla’s recent decline. Not only did Musk sell billions worth of Tesla shares this year to finance the deal, but he’s also been tied up in leading the social media platform since the deal was completed at the end of October. His very public approach to overhauling Twitter has left many Tesla shareholders wondering whether he’s still fully focused on his role as Tesla CEO.

Musk himself offered a different explanation for Tesla’s decline on Tuesday: “In simple terms: As bank savings account interest rates, which are guaranteed, start to approach stock market returns, which are not guaranteed, people will increasingly move their money out of stocks into cash, thus causing stocks to drop,” he tweeted, not explaining why Tesla has underperformed the overall market significantly this year.

Just a note, this article was from Dec 2022, so there’s been a further drop in TSLA since then.