Roman Tiraspolsky

Tesla, Inc.’s (NASDAQ:TSLA) Cybertruck met a lot of contention from investors when it was first being brought to market. CEO Elon Musk announced that the electric vehicle (“EV”) would not be profitable until around 2025. Pilot production of the vehicles has begun at Tesla’s Gigafactory, but there are concerns about the Cybertruck generating positive cash flow in the short term due to the difficulty of scaling the manufacturing process despite high demand.

My thesis is that although the considerable short-term issues are real and could hurt Tesla’s share price, the long-term brand and revenue strengths provided by Cybertruck outweigh this.

Cybertruck: Current Operational Picture

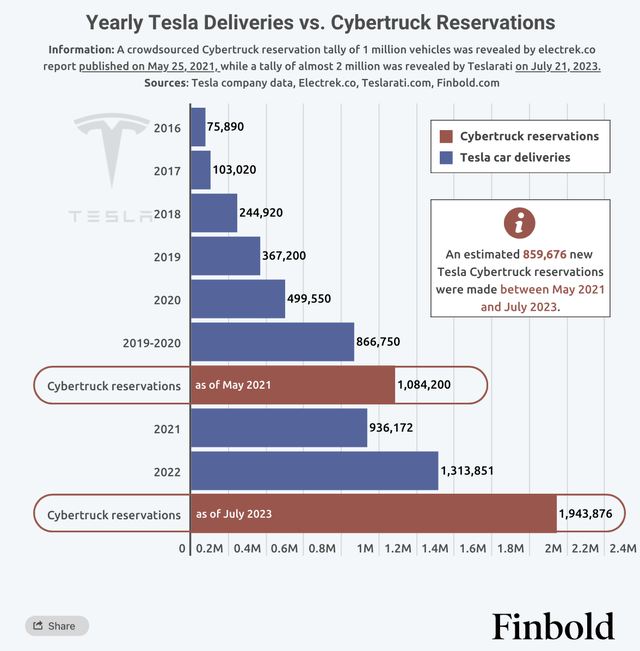

Elon Musk has mentioned that the issue is not a demand but a production one. To evidence this, Ark Investment Management, on Seeking Alpha, suggested that there were 1.5 million Cybertruck reservations in May. The same report indicated the truck could be as popular as the Model Y based on early Google Trends data.

Specific production challenges include a stainless steel body that is difficult to work with, a challenging new high-voltage architecture, delays in battery production, and a 12-18 month intense production ramp-up. While 40 Cybertrucks were spotted at the Texas Gigafactory recently, the company will take a long time to work through its order backlog for the product.

One of the immediate operational advantages Cybertruck provides is a focus on a new market for Tesla. This market is particularly popular in the U.S. Pickup trucks were 20.5% of new automobile sales in the U.S. in 2022 and 16.8% in 2016.

Over the long term, the new truck from Tesla could positively reinforce revenue growth and provide product diversity. If the trend in electric vehicles continues, the Cybertruck will likely be another asset for Tesla. The market is experiencing exponential growth; electric car sales were over 10 million in 2022.

However, significant competitors in the space already exist. Rivian’s (RIVN) R1T has entered the market already, Ford (F) has made its F-Series electric, and General Motors (GM) has announced electric versions of its popular pickup trucks. I think these are significant competitors for Tesla, particularly if many customers may be looking for a more traditional aesthetic and driving experience.

General Financial Considerations

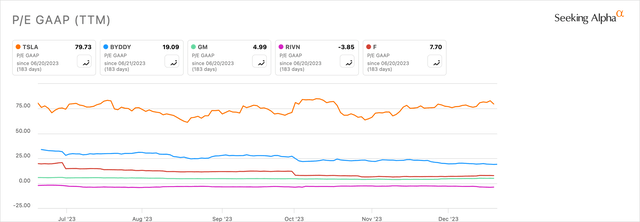

Tesla’s general financial picture looks strong to me, with the weakest component being the company’s valuation on the surface. It has a forward P/E ratio of almost 80, which is considerably low compared to historical levels, while revenue has continued to grow at a very healthy rate in the long term:

Author, Using Seeking Alpha

Considering Seeking Alpha’s Quant Factor Grade of F for Tesla’s valuation, it may seem logical initially to consider the company overvalued. However, based on previous higher multiples and future operating margin expansion to potentially over 50% due to autonomous taxis, as estimated by RBC Capital Markets, the current valuation may be justified on a long-term basis. However, this remains somewhat speculative at this stage. As such, I’m not overly exposed to the stock in my portfolio, holding it at around 6.5% of assets on an optimistic view of future operations impacting the company’s fundamentals with a long-term holding period.

With the potential future expansion of Tesla’s margins and Cybertruck production success around 2025, the stock could be considered an opportunity right now based on the lower price, even at such a high P/E multiple and a poor valuation relative to peers. I say this particularly because if the company meets positive expectations regarding its autonomous driving plans in the next few years, the share price should increase significantly based on the associated significant margin expansion, in my opinion. This is a view also shared by Cathie Wood of Ark Invest.

Author, Using Seeking Alpha

However, there are considerable hurdles with autonomous technology hitting the mainstream, including significant regulatory challenges that could delay and limit revenue growth in these divisions and issues with driving technology recently. As such, a delay in these plans materializing, or not materializing at all, is a real risk. It could be 5-10 years in a worst-case scenario for delays in fully autonomous taxi operations, in my estimation.

Yet, I am more optimistic about this and see it happening sooner in the next few years. Delay concerns are particularly increased when considering the company’s recent recall of 2 million vehicles, announced on 13 December 2023, to install new safety features in its Autopilot ADAS system. This was caused by concerns raised by the National Highway Traffic Safety Administration.

Cybertruck Production & Sales Estimates

Considering the advent of Cybertruck, it’s crucial to understand how this product could affect the company’s financial picture moving forward. This is especially prudent when I consider buying Tesla shares at the current lower price than historically.

Victor Dergunov outlined in his Seeking Alpha analysis a Cybertruck production capacity estimate of 170,000 in 2025, with an average price of $85,000. However, Goldman Sachs estimates 150,000 Cybertrucks will be produced in 2025.

Wedbush estimates 230,000 units will be sold that year. Wedbush’s sales estimate starkly contrasts with Morgan Stanley’s (MS) projections of 78,000 units sold. Morgan Stanley’s estimate seems to be heavily accounting for production issues, in my opinion, which is a genuine and very valid concern, but not unbeatable.

If production goals can be met, the data released by Finbold is promising for Tesla. As of July 2023, 1,943,876 Cybertrucks have been reported as reserved, which, depending on how the company can ramp up its production capacity, could see Morgan Stanley’s sales estimate beaten considerably and look much more like the Wedbush estimate, in my opinion.

Finbold

The reservation data and the popularity, as outlined in ARK Investment Management’s analysis related to Google Trends, signals to me that future Cybertruck sales could potentially outperform all of the conservative Wall Street estimates if the company’s medium-term production goals are met.

Elon Musk’s own production capacity ambition is 200,000 units produced annually, with 250,000 units produced annually in 2025. However, in the Q3 earnings report, Tesla mentioned they could produce 125,000 Cybertrucks per year—the only official figure currently available. Based on this, if 125,000 Cybertrucks are produced per year and sold at $80,000 on average each, revenue per annum from the Cybertruck would be $10 billion (125,000 units x $80,000 per unit). This estimate is based on the following price list, which could change:

- Rear-Wheel Cybertruck: $60,990

- All-Wheel Cybertruck: $79,990

- Top-Tier “Cyberbeast”: $99,990.

My annual Cybertruck revenue estimate, which is based on a conservative picture limited to official production figures released by Tesla, looks strong based on price and demand. However, the major concern I and many others will have with this is the cost of production, which seems like it will be quite high initially as the company scales out its manufacturing capabilities for the model but lower relative to peers following this.

MotorTrend estimated an expense as low as $30 million for 50,000 units, which I consider too low. It mentioned that for 600,000 units, the cost of production could increase to around $125 million, less than conventional trucks, with an estimated cost of around $615 million. While these figures seem both speculative and too optimistic to me, I think the premise that the production of the Cybertruck, when up and running and fully scaled, will be significantly cheaper than traditional pickup manufacturing makes sense, particularly when considering the source’s point on the cost efficiency of the stainless body panels.

Cybertruck Cash Flow & Profitability Risks

The most significant risk to Tesla’s success with the Cybertruck is its short-term profitability. The main risks here I’ve noticed are the cost of production, the spending required to build out to a scaled manufacturing situation, and the short-term effect of high demand and supply issues on cash flow.

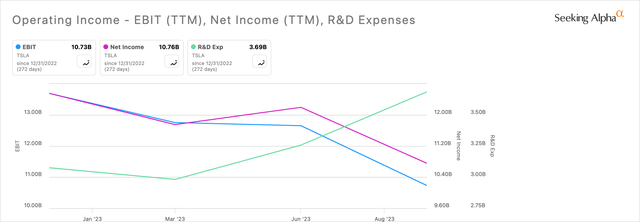

There is very little released at the moment on the official costs of manufacturing the different Cybertrucks. Still, Musk has mentioned the difficulty of reaching volume production, so I expect a ramp-up in R&D expenses and a short-term decrease in operating margin.

I think this could hurt the share price in the short term, so Cybertruck could be called a short-term liability, but my analysis shows it is certainly a long-term asset and a high revenue generator in years to come.

Author, Using Seeking Alpha

The above chart nicely illustrates my concern, which is already evident in the reported financials. I think as Tesla implements more of its autonomous driving strategies related to taxis and other higher-margin opportunities, as well as stabilizing Cybertruck production, the R&D uptrend and margin downtrend could inverse, which will be the best time to be a shareholder having bought the company at the current low prices.

Yet, there is some unpredictability surrounding these operations due to the low level of information released, specifically related to manufacturing costs and R&D spending directly related to Cybertruck. While Musk’s comments and directions shed some light on the situation, I believe the situation remains somewhat speculative to outsiders, and the reality of slow production, high demand, and increased expenditures related to the project will take time to price into the stock accordingly. Yet, I have confidence in the business and the management that the Cybertruck and autonomous taxi services will provide a strong picture for Tesla in years to come.

Conclusion

I’m a confident shareholder in Tesla. While this analysis describes the current situation related to Cybertruck, Tesla, Inc. is multifaceted, and there are many strong revenue streams for the company to continue to innovate on.

While I think the company may struggle in the short term, I firmly believe the long-term future for Tesla, including the Cybertruck, is immensely positive. Therefore, I consider the current share price a unique opportunity even at the high P/E ratio. I would not say this if the future operations didn’t look compelling to me, but I believe if margins increase and operations stabilize in relation to the Cybertruck and autonomous driving plans in the long term, Tesla, Inc. stock is currently attractive.