Scott Olson

After the bell on Wednesday, we received third quarter results from electric vehicle maker Tesla (NASDAQ:TSLA), seen in this shareholder letter. Analyst estimates had come down a bit recently thanks to deliveries falling short plus some previous production hiccups, and the stock had fallen with the market in recent weeks. Unfortunately, the overall numbers were not great, sending shares lower in the after-hours session.

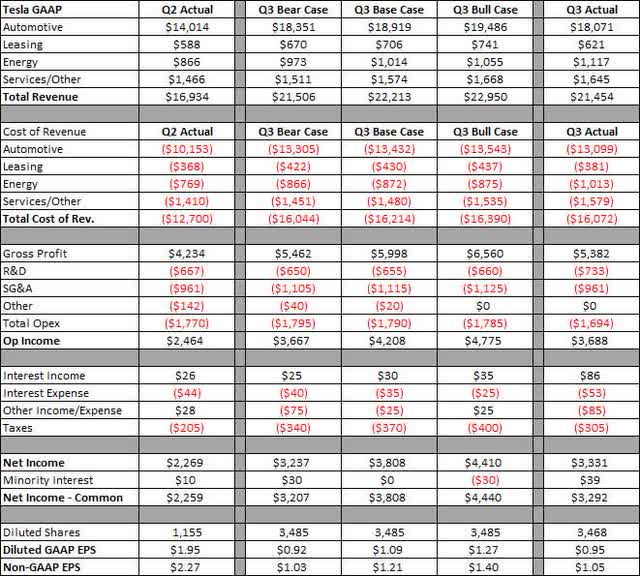

As I discussed in my earnings preview article, expectations were that Tesla would put on a good show. Most have theorized that Elon Musk needs to sell billions more in shares to fund his Twitter (TWTR) purchase, and every dollar that the stock declines hurts that process. Going into the report, the street was looking for $21.93 billion in revenues and non-GAAP EPS of $1.01. The company compiled headline estimates sent out by investor relations were just slightly lower, and also called for automotive margins excluding credits of 27.5%. In the graphic below, you can see how Tesla fared overall against my three cases, with dollar values in millions except per share amounts.

Tesla Q3 2022 Results (Shareholder letter, Author’s model)

Total revenues fell about half a billion short of the street and were even more of a disappointment against my base case. The company’s average selling prices actually came down sequentially despite a slightly higher Model S/X sales mix and price increases so far this year. Management said this was due to more deliveries coming out of Shanghai. Credit sales were also nearly $100 million shy of my estimate, and leasing revenues have not shown as much growth as I was looking for. Energy and services revenues showed strong increases, but certainly not enough to offset the weaker than expected automotive segment numbers.

When excluding credit sales, automotive gross margins came in at 26.8%, about three quarters of a percentage point worse than street estimates. Again, the lower selling prices definitely hurt, driven by foreign exchange a bit, with materials and logistics costs providing an adding headwind. Interestingly enough, quarterly SG&A expenses were dead flat sequentially despite the surge in revenues. On the adjusted bottom line, Tesla beat by 4 cents, but there was also a more than 6 cent benefit on GAAP EPS from a much lower than expected tax expense against the company compiled estimate.

When looking at Tesla’s balance sheet, there were not too many surprises. Inventory jumped by more than $2 billion, partially due to the extra vehicles that were in-transit, while accounts payable and accrued liabilities jumped by about $2.9 billion. Customer deposits actually declined sequentially by $99 million, indicating Tesla’s backlog may be declining a bit. Tesla reported $3.3 billion in free cash flow, and on the conference call Elon Musk alluded to the potential of a $5 billion to $10 billion buyback next year.

In terms of guidance, Tesla management was pretty vague as usual. The statement about 50% growth in deliveries per year over a multi-year horizon line remained the same, and the Tesla Semi will see its first deliveries this December after a lengthy delay. The Cybertruck is in the tooling process and will follow the Texas Model Y ramp next year, and the overall annual production capacity figure of more than 1.9 million vehicles was left unchanged.

As for Tesla shares, they were down more than 3 percent after this report. I think that’s a fair reaction given the revenue and margin miss. While analysts see this stock worth more than $300, we might see some price targets down a little in the near term. Unless we get some fireworks on the conference call, this was certainly not the Q3 report that the bulls were hoping for, despite the progress Tesla has made over the past year. Now, investors will turn to Elon Musk’s Twitter deal, expected to close by next Friday. Shares are just $10 away from their 52-week low currently, a level that could be taken out if Elon does in fact sell a meaningful amount of Tesla shares.