“When you give roses to others, their fragrance lingers on your hand,” Xi Jinping told guests at the 10th anniversary celebration of his Belt and Road Initiative in Beijing last week. “Helping others is also helping oneself.”

Even as China’s president played the exuberant host, welcoming world leaders from Russia’s Vladimir Putin to Indonesia’s Joko Widodo at the Great Hall of the People, an undercurrent of geopolitical animosity directed at the US was evident.

He did not mention Washington by name, but when he said that “ideological confrontation, geopolitical rivalry and bloc politics are not a choice for us”, the target of his comment was clear.

For Xi, the two-day forum to celebrate the flagship $1tn global infrastructure initiative — the biggest multilateral development programme ever undertaken by a single country — was a chance to further embed China’s influence across the developing world.

Dignitaries from countries that have received investment under the programme also lavished praise upon it. “The Americans spent $6tn on the so-called war on terror and the Chinese in the last 10 years spent $1tn on 3,000 projects all over the world,” says Mushahid Hussain Sayed, chair of Pakistan’s senate defence committee.

“So that’s the difference,” he adds. “They [the Americans] were security-centric, military-oriented. The Chinese are economic centric, development-oriented.”

Wang Yi, China’s foreign minister, also threw down the gauntlet to the west. Namechecking supposed alternatives to the BRI, the US “Partnership for Global Infrastructure” and the EU’s Global Gateway programme, Wang said he was confident in Beijing’s abilities.

“Some say that these . . . initiatives can compete,” he told reporters. “Maybe we could have a competition globally about who can build more roads, railways and bridges for developing countries, who can build more schools, hospitals and sports stadiums for the ordinary people in low-income countries,” Wang said.

“We have the confidence that we are able to deliver,” he added.

Yet over the course of a decade, China’s initiative to finance and build infrastructure in mostly poorer countries has attracted a chorus of criticism. Many projects have been mothballed, others have resulted in developing countries building up unsustainable debts and corruption has besmirched the programme’s image.

China’s capacity to deliver large infrastructure projects has never been in doubt. But the questions that critics of the BRI, who are mostly outside China, are asking is whether the project has been worth the tremendous cost and whether it can continue to operate as it has in years to come.

The BRI scorecard

For China, the BRI has won valuable overseas business for its large state-owned enterprises and strengthened diplomatic ties with the countries in the so-called global south. Those links have in turn increased China’s influence within other international organisations such as the UN and allowed it to advance Xi’s political vision for the world.

Recipient countries such as Pakistan find themselves able to finance projects they could never have dreamt of under old-style foreign bilateral or multilateral aid programmes, from power plants to high-speed data networks. But critics say the projects can become a debt trap and increase the economic dependency of many states on Beijing.

“The BRI served multiple purposes,” says Yunnan Chen, a researcher at ODI, a public affairs think-tank. “It was seen as China’s offer of public goods to the world and particularly to the developing world by providing infrastructure finance.”

An upsurge in financial distress over recent years in several BRI recipient countries has obliged Beijing to fork out huge sums for bailouts. This has raised the question of whether Beijing, in spite of all its rhetoric praising the BRI, is in fact quietly rethinking the whole scheme.

“There has clearly been a pull back as well as a greater risk aversion by China’s policy banks and China’s policy insurer,” says Chen. “I don’t think this means an end to the BRI as a narrative. But the rhetoric has shifted already. We are seeing more mentions of small and beautiful projects . . . [and] a green BRI that is more sustainable.”

The example of Pakistan — the biggest national recipient of BRI funding — is illustrative of the successes, failures and governance shortcomings that are hampering China’s ambitions to lead the developing world, analysts said.

New data compiled for the Financial Times by Janes, the defence intelligence company, shows that 40 per cent of the projects in the China-Pakistan Economic Corridor (CPEC) — lionised in July by Xi as “an important flagship” for the entire BRI — have run into troubles including corruption, cost overruns, funding shortfalls or adverse environmental impacts.

Of these troubled projects, at least 20 per cent have been delayed indefinitely or cancelled outright, the Janes data shows. The biggest projects have tended to be the worst hit, with about half of the highway and hydropower schemes encountering difficulties and all of the railway and mining undertakings similarly running into trouble, according to Janes.

At the outset, an infusion of Chinese loans to build infrastructure seemed to promise a new future for one of Asia’s most impoverished countries. Projects like the $1bn Thar coal power plant and 13 other energy schemes helped alleviate crippling power shortages. New motorways boosted commerce between cities. Fibre-optic cables brought modern communications to mountain towns.

“In some senses, it was an absolute game changer,” says Bilal Gilani, executive director of Gallup Pakistan, a consultancy. He added that China was bringing in almost as much foreign investment into energy alone than “what Pakistan received as FDI in total in various sectors in 25 years prior to CPEC”.

Hussain, the Pakistani senator, goes further, saying infrastructure on this scale was inconceivable in the country prior to BRI. “The only two projects which we have successfully done with a certain sustainability, with a certain perseverance, with a certain determination — one was the nuclear bomb . . . and the second is CPEC.”

But overall, the $62bn programme agreed between Beijing and Islamabad in 2015 has fallen far short of its vision, analysts say. The ambition that new infrastructure would help turn Pakistan into a global manufacturing hub has yet to be realised, for instance.

“[We hoped] to get some Chinese companies to invest in Pakistan, in our special economic zones and then to export,” says a former Pakistani official, who declined to be identified. “That never took place. It’s OK to borrow money and build infrastructure, but it’s more difficult to bring investors into our zones to make stuff and sell it.”

This lack of follow through from Chinese private companies has arguably been CPEC’s biggest shortcoming. Analysts say that few Chinese businesses have shown an interest in setting up factories there, depriving the Pakistani government of the foreign currency earnings needed to service its non-rupee borrowings.

Hussain argues this is not necessarily the fault of CPEC. “Sometimes our people, and our bureaucracy, our officialdom or our policymakers become lazy and they feel they have a sense of entitlement,” he says.

Whatever the cause, the outcome is that Pakistan is now home to what Gilani calls a “graveyard of economic zones” whose “plots are empty”. The share of manufacturing in the country’s GDP has stagnated at around 13 per cent since CPEC started.

Grand strategic imperatives have also foundered on cold reality. A crucial early motivation behind CPEC was China’s dream of building a viable overland route to the Arabian Sea, allowing it to trade with the Middle East and Africa without traversing the US-patrolled Strait of Malacca.

But the plan took insufficient account of violent militant groups. Successive attacks on Chinese engineers — the most recent taking place in August — have added security headwinds to a $10bn plan to revamp Pakistan’s decrepit railways. The $300mn Gwadar port, the proposed outlet for Chinese trucking convoys, sits largely unused mainly because of security fears along the highway that serves it.

Meanwhile, Pakistan’s foreign debts have nearly doubled since 2015 to $100bn last year, with Chinese lenders collectively the largest creditors at around $30bn, according to the IMF. Islamabad spends around half of the country’s revenues on servicing foreign debt, according to campaign group Debt Justice, and needed a $3bn loan from the IMF in June to avoid defaulting amid an acute financial crisis.

For the BRI as a whole, the report card is somewhat more positive than in Pakistan. Out of a total $966bn in BRI transactions between 2013 and mid-2023 — a category that includes all the construction projects as well as investments by Chinese companies in 152 countries — some 10 per cent of transactions are classified as “troubled”, according to data from the American Enterprise Institute, a Washington-based think-tank.

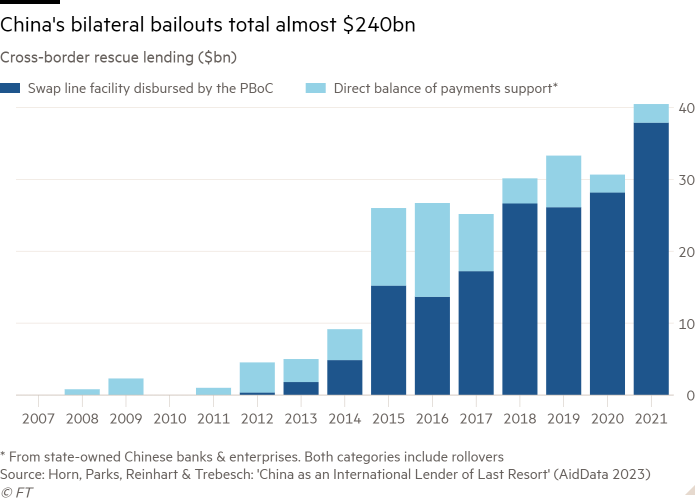

Where projects have run into trouble, Beijing has often felt obliged to step in as a “lender of last resort” to prevent BRI countries from crashing into debt crises.

Between 2019 and the end of 2021, Beijing granted $104bn in rescue loans — a figure almost as large as China’s bailout lending worldwide in the previous two decades, according to a study by AidData, the World Bank, Harvard Kennedy School and Kiel Institute for the World Economy.

All of these problems have prompted a fundamental rethink of how BRI operates, but its original geostrategic rationale remains very much intact. At the forum in Beijing, Xi pledged $100bn for more BRI projects.

In a bid to further expand BRI’s influence, Xi announced that the programme would also be broadened to increase scientific exchanges and co-operation and even “institutional building”. This would cover areas not traditionally regarded as China’s strengths such as taxation, finance and anti-corruption.

“What we stand against are unilateral sanctions, economic coercion and decoupling and supply chain disruption,” Xi said at the opening of the forum, a clear swipe at recent policy decisions by the US and the EU in areas such as semiconductors.

What comes next

A sea change now lies ahead for the BRI, according to David Landry, assistant professor of political economy at Duke Kunshan University in Suzhou, as Beijing takes lessons from the failures that have besmirched Xi’s grand scheme in recent years.

“China remained willing to keep backing strategic partners such as Pakistan but in the future smaller, less important countries from Beijing’s perspective would receive far less BRI funding,” he says.

Chen Yongjun, professor at the School of Business of Renmin University, says that the time has now come for a new emphasis. Over the next decade, he believes, the BRI will place more emphasis on green development, public health and the digital economy.

“The overall aim is for shared development and the creation of a new world order and global system,” Chen adds.

He expects this will involve China championing the causes of Xi’s “three global initiatives” — the Global Development Initiative, the Global Security Initiative and the Global Civilisation Initiative. These amount to a blueprint for an alternative world order to challenge the US-led system that has prevailed since the end of the second world war.

Initially at least, these initiatives are focused on aid and have a strong poverty-reduction angle, a contrast with the infrastructure-heavy approach adopted by the BRI. At the forum, Communist party leaders from the president down repeatedly spoke about the initiatives to their guests, even launching a new one on artificial intelligence.

The next 10 years offer China a chance to leverage its leadership in sectors such as electric vehicles and solar panels to make BRI greener, says Tom Xiaojun Wang, founder of People of Asia for Climate Solutions, an non-governmental organisation based in the Philippines.

It is time for China to “take that leadership [in green technology] to develop standards which would include environmental issues, and social and cultural issues”, he adds.

Wang describes a project he is working on in the Philippines in which Chinese companies supply solar panels to villages to put on top of their buildings. Such smaller schemes provide a direct benefit to the poor and are in line with the move away from mega power projects, he says.

But while China feels its way towards a new future for the BRI, the amount of rescue lending required by existing BRI recipient countries is set to remain high, analysts say. In Pakistan, for instance, Beijing has rolled over as much as $5.7bn of loans that came due over the past two years, according to Hussain.

Its recent financial troubles have made it more difficult for Pakistan to attract large-scale investment funding from other sources. So for all its challenges, Hussain says the CPEC is still the country’s best hope.

“In fact it’s the only game in town, to be very frank, in terms of investment on that size, speed and scale.”