lcva2

Dear readers/subscribers,

It’s been around 1.5-2 months since I last wrote about Teleperformance (OTCPK:TLPFY). You might wonder why I, after such short a time, am suddenly writing more articles on the company. The answer to that is relatively simple – the thesis has grown stronger, and the current upside definitely warrants your attention.

Because seen from a conservative perspective, the upside for Teleperformance at this particular time is one of the highest conservative upsides with over 2% yield I see in the entire market, with the company’s credit ratings included in the consideration.

Let’s look at what we have going for us here.

Teleperformance – The upside is even higher at this point

So, one of the largest companies in call centers and related technologies is currently definitely on sale. The company is one of the highest-quality businesses in this entire segment based on profitability and returns. It works in the “Business Services” segment, a highly competitive segment, and being that it’s in something like Call centers, this is not exactly a high-margin industry, to begin with.

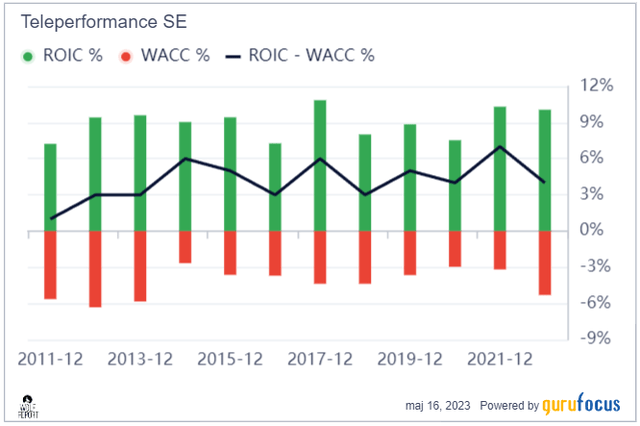

7-9% net margin is what you can expect from this segment, double-digits and you’re an outperformer. Teleperformance is around 8%, with operating margins of around 12%, and gross margins of about 32.7%. The company is a well-oiled machine, not only in turning top-line sales into net income but also in terms of profitability and making sure that its investments generate good returns. Over the past decade, the company has always had consistently profitable ROIC net of WACC, and the company’s top and bottom line metrics have been growing.

Teleperformance ROIC/WACC (GuruFocus)

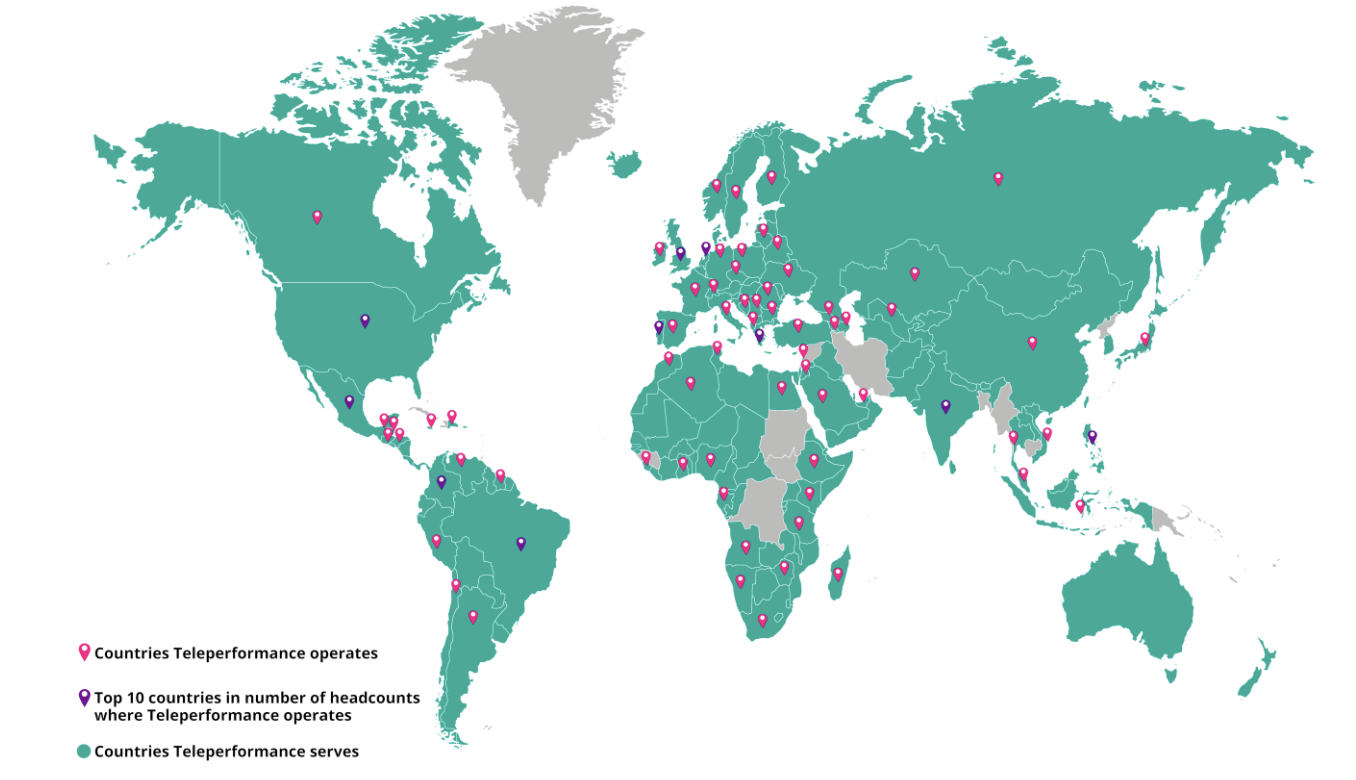

While debt has been increasing, the company has been effectively managing its overall M&A and expanding its business. It now has a very appealing split as of 2022A, with 32.9% NA; 32.6% EMEA, 20.3% LATAM, and 14.3% Specialized services.

In a relatively short amount of time, Teleperformance dropped a fair bit, over 20%. That’s also why when I enter new positions, I generally size up slowly – things might drop, and I like averaging out. It means that despite this drop, since having an average up, I’m about at negative 6% ROR for my position, which isn’t worrying to me, since I believe the company to be qualitative.

Why the drop, though?

It started with an announced M&A of Majorel, which caused the share price to drop a corresponding amount in relation to the announcement. We also had some indicators of the 1Q23 results. Majorel first, in accordance with the info below.

Paris, April 26, 2023 – Teleperformance, a global leader in digital business services, today announced its proposed voluntary cash and share offer for all shares in Majorel (the “Shares”). Teleperformance offers €30 per share for a total consideration of €3bn. The Majorel shareholders can also elect to receive Teleperformance shares at an exchange ratio of 0,1382 Teleperformance share for each Majorel share, up to a maximum of €1bn in Teleperformance shares.

Therefore, the initial drop of about €30/share was not at all strange. In addition, the 1Q23 results we do have, revenue specifically, saw an increase of 8.6% YoY excluding COVID-19 contracts, 1.9% on an LFL basis, and 2.2% on an as-reported basis. This came from solid organic growth from the company’s diversified basis, including activities in social media, finservices, travel, and with government agencies.

Teleperformance IR

The company also managed sustained growth in its NA-based offshoring activities, delivering sustained margin improvements. China reopening was another positive for the company, and the impacts from the various COVID-19 contracts ending are getting lower and lower as some of these start winding down. For 1Q, the current impact was now less than €150M for the quarter.

Based on the company’s strong 1Q23, Teleperformance revised its overall targets. These targets now include:

- LFL Rev growth, excluding COVID-19, of 8-10% on an annual basis, and including COVID-19, around 7%, illustrating the later-year wind down of these contracts.

- EBITDA margin improvements to record levels of around 16% or above, which is a 30 bps+ improvement on a previous level.

- The company wants to further target more M&As capable of generating further value as things move forward.

So, all in all, I see that first period as pretty much a confirmation of what I already knew to be a positive outlook for this excellent company. The environment is uncertain, and there are some factors that could send this the wrong way, that’s for sure. Volatility is in this company’s blood – the 48% negative 1-year RoR is proof enough of that.

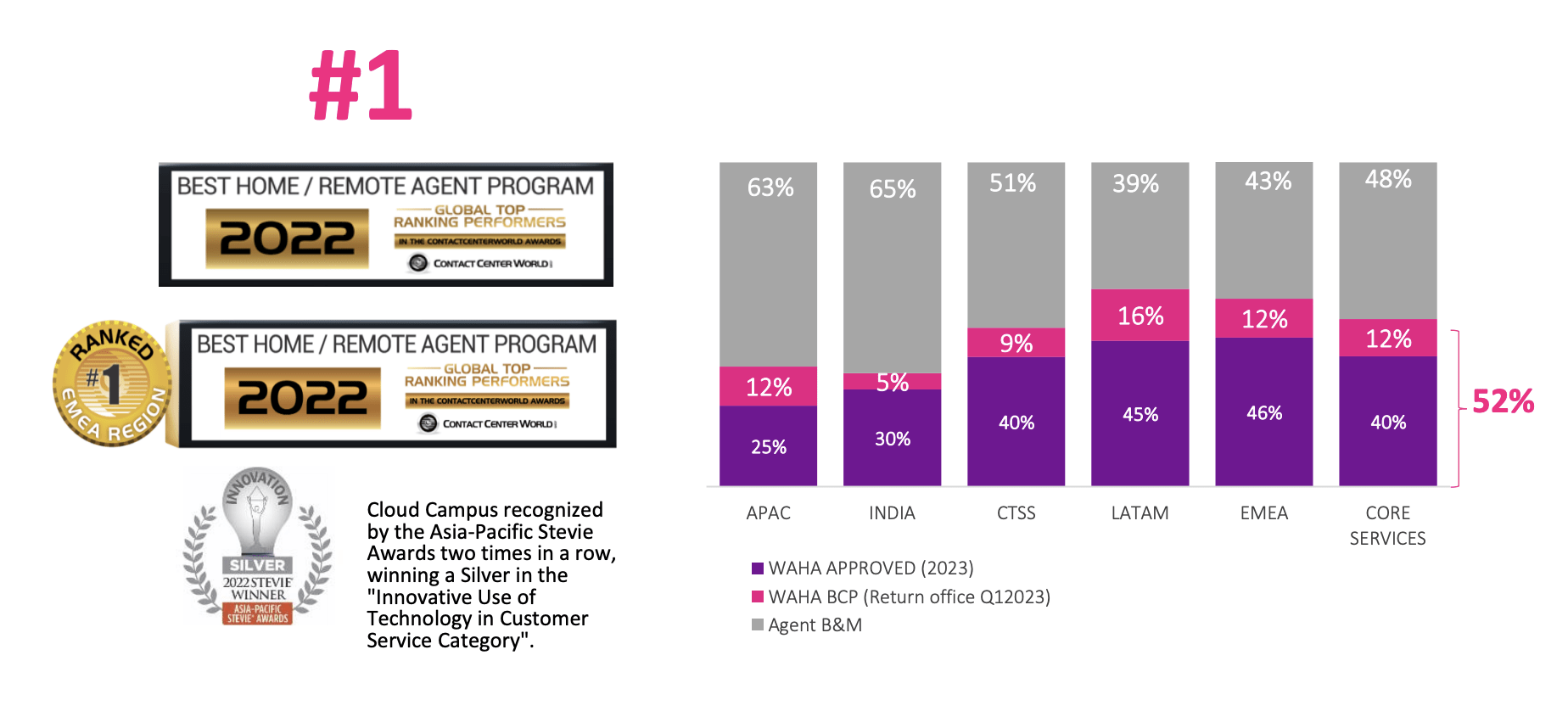

However, the company has also dropped that much without really any underlying reason as far as earnings, forecasts, or actual trends go. The company is a capable market leader, and much of the upside or dominance isn’t really up for debate – in particular as far as satisfaction on the customer/agent side.

Teleperformance IR

The company’s clients are, as you might expect, across multiple industries. Some major sectors include Airlines, Hospitality, OTA, Cruise, and Car rental industries. While it’s accurate to describe TP primarily as a “core” services business, such as call centers, based on an 85.7% revenue portion from this segment for 2022, the company also generates over €1.2B in revenues from specialized services – and this mix on an overall level is one of the attracting factors to this company that I can see.

As I mentioned in my premiere piece on Teleperformance – you shouldn’t touch this business unless you’re in it for the long haul. By this, I mean that the company may not materialize its upside for 2-5 years – but when it does, I believe that it will do so with a vengeance, bringing with it returns of potential in the 150-300% RoR range.

The yield isn’t great, but at 2%+ it’s not terrible either. I know plenty of companies that are often described as acceptable dividend stocks that have below 3% in overall yield. Given that it’s a once-a-year payout though, I wouldn’t expect significant dividends on a continual basis here – it’s more along the line of a once-a-year paying bond.

The real upside is in the capital appreciation potential – not in seeing Teleperformance as an income investment.

Teleperformance – The upside could be massive, and you should be paying attention

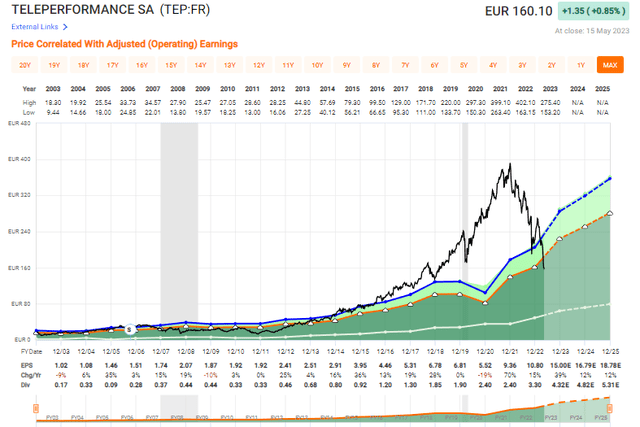

The fact that Teleperformance is a company that’s gone high, only to drop back down “too far” should be evident by looking at a single graph.

Teleperformance Valuation (F.A.S.T. Graphs)

This is a visual representation of what can be seen by looking at historical P/E ranges as well. What’s happened over the past few years, especially after COVID-19, is that the company’s position in the online infrastructure has been overestimated, and inflated. People have been expecting this company to never turn down again.

Everything turns down – even this company. And that’s what we’re seeing here. That’s why the company in terms of valuations, hasn’t been this cheap for almost a decade. And that, dear readers, is why I am starting to “pound the table” for Teleperformance as an investment.

The relatively simple fact is that even estimating Teleperformance at a growth rate with a 15x P/E, the forecasted numbers give us an upside potential of close to 25% per year, or 75%+ until 2025E. And that is by forecasting a company that is expected to grow EPS by an annual rate of 18% at a 15x P/E.

You could do that, and you could still beat the market. But the real magic happens when you start estimating the company at multiples that would actually be fair in relation to where the company is expected to grow. At that point, we start getting some very different numbers.

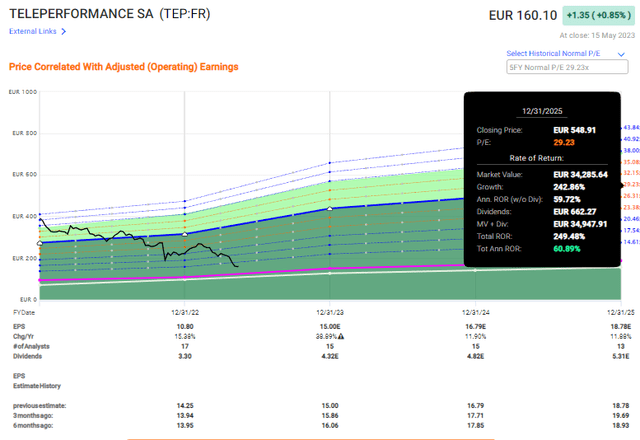

Teleperformance Upside (F.A.S.T. Graphs)

That dear readers, is full normalization potential. That’s 250% in less than 3 years, and while it may be exuberant to expect that sort of level, please note that on a historical basis, it’s not outside the realm of possibility for this business. In fact, it’s entirely possible that this is what we may see. The difference between the two scenarios is massive – double in P/E in the latter one, obviously. My point is that even if you were to forecast Teleperformance at 10x P/E, you’re still walking away with potentially market-beating 8.5% returns on a current forecast basis.

And there are not many companies out there that offer this to you.

The company also has a proven track record of value creation over time and is one of the most well-diversified communications companies I have ever encountered. Based on this, you shouldn’t view improvements or beating this forecast as unlikely either. Analysts don’t miss on this company either – not often. A 2-year forward basis with a 20% MoE sees analysts hitting the mark of 91% if you include beats by the company. That’s a good statistic, and one I believe we can actually “bank” on.

As I mentioned in my last article – there are peers, but none are close to as interesting as Teleperformance. Those peers include businesses such as Telus (TU), Concentrix (CNXC), Atento (ATTO), Sykes, TTEC (TTEC), and Webhelp – none come close to matching Teleperformance as an investment at this time.

The company remains significantly undervalued on the basis of other investors as well. Current average S&P Global targets give us an average of €307, based on a low of €146 and a high of €380/share, giving us an upside of 91.9% with 13 out of 16 analysts at either a “BUY” or an equivalent outperform rating.

Conclusively, the upside is now even higher – 250% – and I don’t see any fundamental or forecast-related reason why the company would be underperforming.

Based on this, I give this a continued “BUY”, with a massive upside.

Thesis

- Teleperformance is a superb company in the call center and general business service outsourcing field. I consider the company to be one of the finest around, and due to a combination of fundamental strength and excellent upside, to be a “buy” here.

- The “buy” is stated based on a conservative target share price of €275/share – and by giving it that target, I’m 10-20% lower than the average analyst, due to my always discounting conservatively. However, I believe this company has the very real potential to outperform.

- For that reason, I recently bought shares, and I’m about to buy more.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.