JHVEPhoto

Telenor (OTCQX:TELNY) offers a high-dividend yield, but this is more the result of poor dividend sustainability than being an income opportunity, thus investors should avoid its shares.

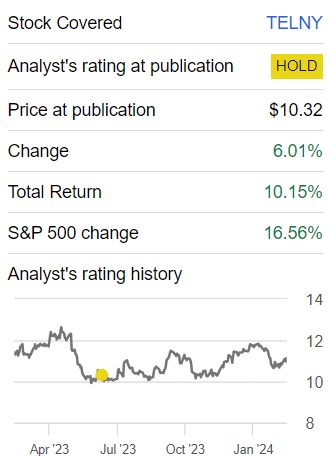

As I’ve covered in a previous article, Telenor offers an attractive dividend yield, but its dividend sustainability is questionable, and therefore it’s not a great income pick within the European telecom sector. As shown in the next graph, Telenor’s share price is up by some 10% since my last article, underperforming the market during the same time frame.

Article performance (Seeking Alpha)

As the company has recently released its financial figures related to 2023, I think it’s now a good time to analyze its most recent financial performance and update its investment case, to see if its income appeal has improved or not for long-term income investors.

Earnings Analysis and Dividend

Telenor has reported moderate growth during the last year, which is a positive outcome compared to other European telecom companies. This was supported both by its Scandinavian operations and its business in Asia, showing that Telenor has enjoyed positive operating momentum across the group.

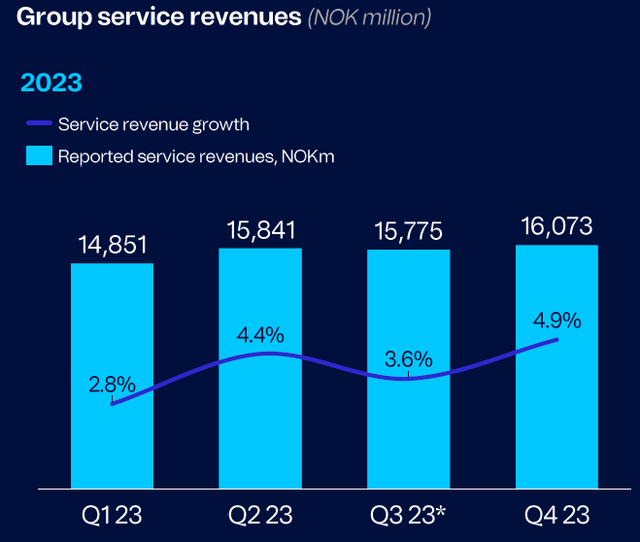

Its total revenues amounted to $7.6 billion in 2023, an increase of 4.7% YoY, supported by organic service revenue growth of 4% compared to the previous year. Its service revenue was $5.9 billion in the year, accounting for some 78% of total revenue, being therefore key for the company’s growth over the long term.

Service revenue (Telenor)

This positive backdrop was supported by price increases across the Nordic markets, leading to mobile revenue growth close to 5% throughout the year, while in Asia it reported strong growth in Bangladesh, but a more challenging operating environment in Pakistan. Nevertheless, while Telenor has lost customers in the country, it was able to increase by some 15% YoY its average revenue per user (ARPU) in 2023, thus its strategy seems to be more focused on profitability rather than growth in Pakistan, which seems a sensible move over the long term.

Regarding its operational expenses, Telenor reported an increase of 6.4% YoY to $2.55 billion, impacted negatively by higher energy costs and inflationary pressures, which were offset to some extent by the company’s restructuring efforts in its Nordic operations. Despite this significant increase in annual costs, Telenor’s EBITDA increased by 2.8% YoY to $3.3 billion, representing an EBITDA margin of 43%, which compares quite well with its European peers which usually have margins between 30-40%. This is justified by the company’s leading position across relatively concentrated markets, which leads to better pricing power than in other markets where the leading players have smaller market shares than Telenor has across the Nordic markets.

Its net profit for the year was $1.3 billion, a much lower figure than compared to 2022 (about $4 billion), as Telenor deconsolidated its Malaysia and Thailand operations and made impairments of $800 million related to some investments, namely in True Corporation, while on an adjusted basis its net income was practically flat compared to the previous year. Its reported earnings were $0.94 per share in 2023, compared to more than $3 per share in the previous year.

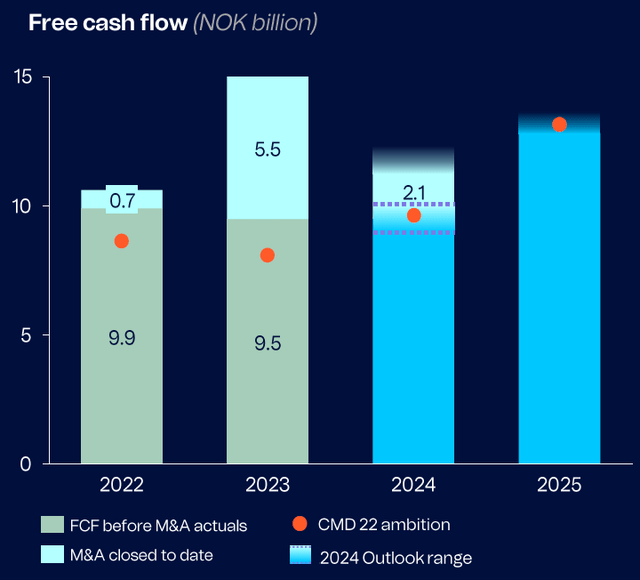

Regarding its free cash flow generation, it was $905 million in the year on an organic basis, slightly below the level reached in the previous year, but its free cash flow was boosted by its deal to sell 30% of its fibre network in Norway. This increased its free cash flow generation by more than $500 million, to some $1.4 billion in 2023, while in the next few years it expects to improve its free cash flow generation by higher contributions from its equity investments, some smaller M&A operations, and lower capex intensity.

Free cash flow (Telenor)

Regarding its balance sheet, Telenor’s position is good compared to its peers, given that its net debt-to-EBITDA ratio was 2.2x at the end of 2023, a smaller leverage position than other European telecom companies, which usually have rations between 2.5x-3x. This means that Telenor does not need to retain much earnings in the near future, enabling it to distribute a good part of its earnings to shareholders.

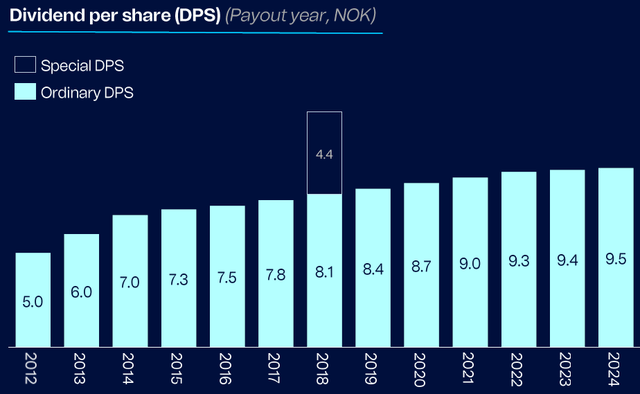

This has been its strategy over the past few years, taking into account that Telenor has delivered a growing dividend over the past decade, a trend that is expected to continue in 2024. Indeed, the company already announced an interim dividend of NOK 5 per share ($0.48 per share) to be paid next May, and a final dividend of NOK 4.50 per share ($0.43 per share) to be paid next October. This means its annual dividend related to 2023 earnings will be NOK 9 per share ($0.86 per share), a small increase of 1.1% from the previous year.

Dividend (Telenor)

While Telenor’s dividend history is quite good and gives a sense of safety, this is not exactly the case given that Telenor’s dividend payout ratio is 91%. This is a very high payout level, which is a warning sign of questionable dividend sustainability.

Furthermore, based on cash flow coverage, the situation is not much different given that its free cash flow of $900 million does not cover its close to $1.3 billion in dividend outflows. Telenor was able to boost its free cash flow in 2023 to $1.4 billion by selling a stake in its fibre network, but on a recurring basis its business is not generating enough cash to cover dividend payments, a poor sign of dividend sustainability over the long term.

Despite that, Telenor management is clearly committed to deliver a growing dividend over the long term, a profile that cannot be separated from the fact that its largest shareholder is the Norwegian state, with a stake of nearly 54%.

To some extent, its dividend policy is also a political decision to return cash for the largest shareholder, which means Telenor is likely to maintain a strategy to sell assets or increase debt to maintain its dividend policy, even though the dividend is not likely to be covered by organic cash flow generation in the coming years.

Due to this backdrop, it’s not surprising to see that Telenor is currently offering a high-dividend yield of about 8.1%, as the market is likely also concerned about its dividend sustainability over the long term. Despite that, the street is currently forecasting a flat dividend over the next couple of years, and some dividend growth in 2026, thus a dividend cut doesn’t seem to be expected in the medium term.

Conclusion

Telenor has an interesting business profile, due to its leading position across the Nordic markets and exposure to growth markets in Asia, which has enabled it to report positive operating momentum over the past few quarters.

While it offers a very high-dividend yield, its dividend sustainability is questionable over the long term because it’s not covered by free cash flow, making it a risky income play. On top of that, its shares are currently trading at 15.4x forward earnings, at a premium to its peers and its own history, this I think is better to avoid Telenor for the time being.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.