A standard characteristic of most low-income international locations is a authorities that collects little tax income and gives few public items. The literature on state capability and growth argues that the shortcoming to gather taxes effectively is on the coronary heart of why low-income international locations are as poor as they’re (Besley and Persson 2009). This analysis means that the trail to financial development for low-income international locations could start with investing within the authorities’s capability to gather tax revenues (Albers et al. 2020), in order to supply productivity-enhancing public items. A number of theories argue that know-how investments by tax administrations are central to development in authorities dimension, together with attributable to effectivity enhancements within the assortment course of (Brennan and Buchanan 1980, Becker and Mulligan 2003, Cowen 2021). Fan et al. (2018) present a latest research in China on computerised VAT.

On this context, our new analysis (Dzansi et al. 2022) gives descriptive and experimental proof on the function of know-how in bettering authorities tax capability. The setting is native governments in Ghana, which oversee assortment of property taxes however gather little or no in follow (Authorities of Ghana 2014). The know-how in query consists of a geospatial database of properties embedded into an digital pill with GPS capabilities. Comparable applied sciences have seen a major improve in adoption in creating international locations over the previous decade (Fish and Prichard 2017).

To gauge the potential for know-how to alleviate capability constraints, we first carried out a census of native governments. We carried out the census within the autumn of2017 in collaboration with a number of nationwide ministries and all 216 native governments within the nation. The goal of the census was to gather knowledge on each related dimension of the native tax assortment system in every native authorities. Three fundamental units of respondents have been interviewed: native authorities officers, domestically elected meeting members, and residents. Along with the survey knowledge, we digitised and harmonised administrative data to measure all sources of native tax assortment and all sorts of public expenditure in every district.

The census knowledge highlighted how poor infrastructure for gathering taxes – with restricted avenue naming and property addressing – shapes assortment practices in most areas. Almost all payments are hand-delivered by collectors to taxpayers, and collectors sometimes go to particular person taxpayers a number of occasions earlier than gathering (in the event that they gather in any respect). Nearly all of tax funds are made in money and paid on to income collectors. Not surprisingly, authorities officers cite ‘leakages’ by tax collectors as a major constraint on their revenues. On this difficult context, 17% of native governments have chosen to undertake know-how to help with tax assortment, within the type of a income administration software program and digital databases of properties. We discover that this minority of native governments which selected to put money into know-how have considerably higher outcomes at each stage within the tax assortment course of. Particularly, they ship extra payments, gather extra revenues, and have decrease non-payment charges than do governments with out know-how.

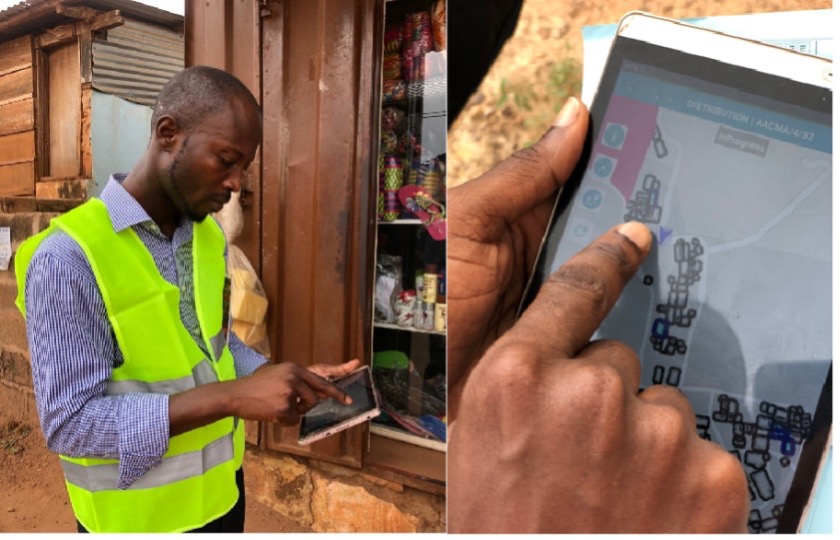

The tight empirical hyperlink between know-how use and tax assortment outcomes within the cross-section of native governments naturally invitations questions concerning the route of causality. To deal with this difficulty, we partnered with one massive municipal authorities in Ghana and a non-public know-how agency to randomise the usage of its know-how throughout the authorities’s jurisdiction. Particularly, we randomised the usage of a brand new income assortment software program and geospatial database of properties on the degree of a income collector. Within the experiment, each remedy and management collectors got a stack of round 135 payments of comparable worth in a randomly assigned space and tasked with gathering as a lot income as doable in six weeks. The remedy group was given an digital pill that makes use of the geospatial knowledge to make finding households simpler (see Determine 1). In any other case, the 2 teams of collectors, and their assigned areas, have been observationally related.

Determine 1

Notes: This graph reveals the common quantity of property taxes collected by income collector, individually by day of the intervention and remedy task.

Income collectors that use the brand new know-how delivered 27% extra payments than the management collectors by the tip of the research. We view this end result as reflecting the mechanical benefit that the know-how gives in finding taxpayers extra effectively in an setting with scant property addressing. The time collection of cumulative payments delivered in each teams reveals a concave sample, as collectors shift emphasis over time from delivering payments to following up with the households that have been already served a invoice in an effort to gather fee from them. Income collections have been 103% greater among the many collectors assigned to the know-how group, on common, implying a a lot bigger impact on income collections than on payments delivered. Furthermore, we discover that the remedy impact on collections grows over time, resulting in a rising common impact on the quantity collected per invoice delivered via the course of the experiment (Determine 2).

Determine 2

Notes: These pictures present the navigational help offered within the pill that’s utilized by income collectors within the remedy group.

We discover a number of potential hypotheses for why the remedy impact on collections is a lot bigger than the remedy impact on invoice deliveries. One easy story is that households have totally different attitudes towards fee when visited by collectors who present up with the know-how than by ‘established order’ collectors with out the know-how. But households in remedy and management areas surveyed proper after the experiment report statistically related ranges of perceived integrity and talent to implement tax funds amongst native authorities officers. A second speculation is that the know-how helps cut back leakages – for instance, within the type of funds made by households however diverted by income collectors earlier than reaching the native authorities’s coffers. Nonetheless, a number of sorts of family survey questions concerning the preponderance of bribe funds level to modestly extra – moderately than much less – bribe exercise in remedy areas than in management areas.

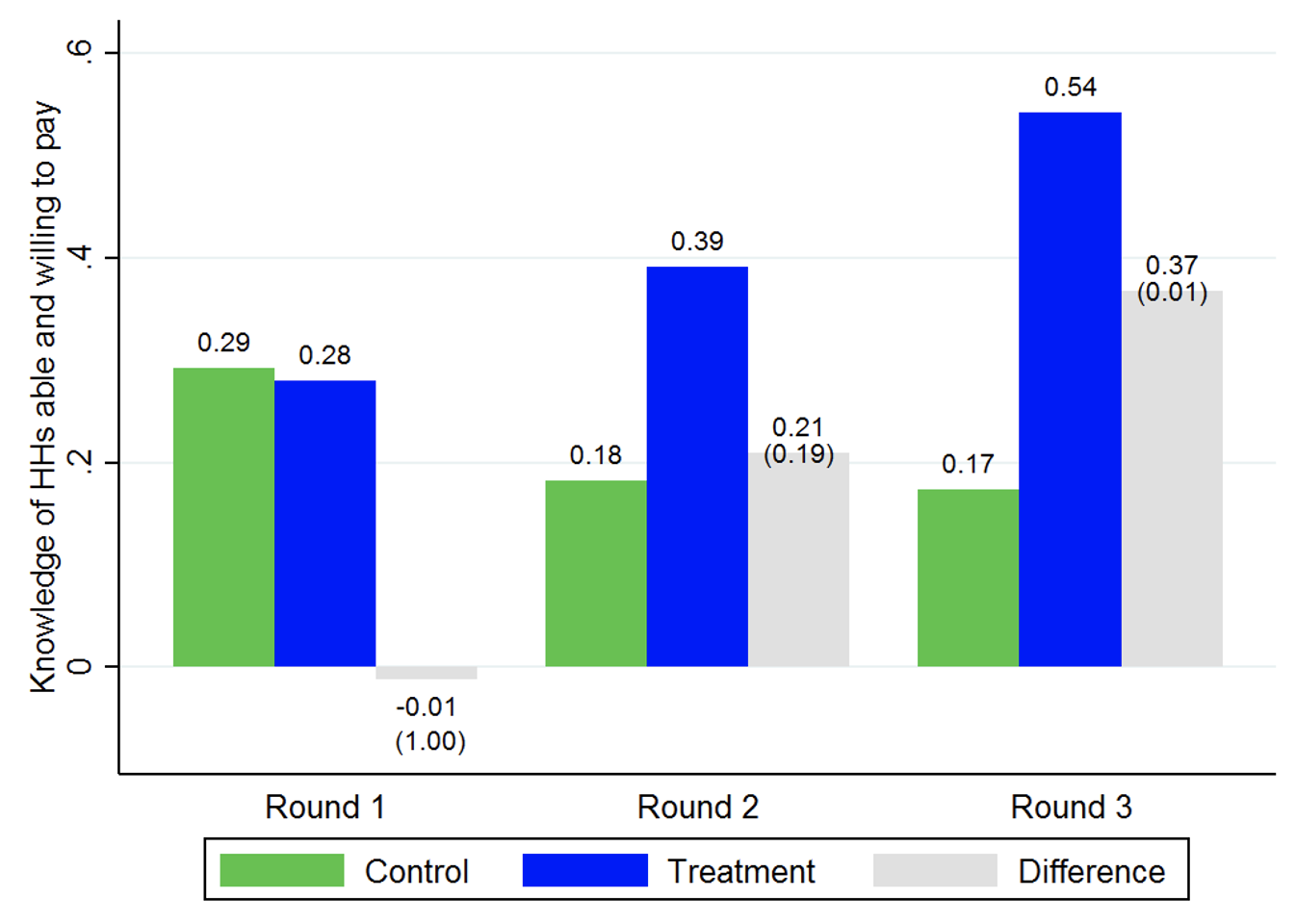

We argue that the probably mechanism is that the know-how permits collectors to find out about – and focus their scarce time on – households which might be probably to make tax funds. Utilizing surveys of collector behaviour and methods, we present that remedy collectors over time report having higher information of particular person households’ propensity to pay and focus extra on gathering from households which might be extra capable of pay, higher conscious of taxpaying duties, and extra glad with native public items (Determine 3). Importantly, none of those family traits would have been identified to the collectors at the beginning of the research interval. The implication is that know-how allowed collectors to be taught, via repeat visits (or longer visits), about family traits which might be in any other case tough to watch. In step with this concept, we doc that households with higher liquidity and better earnings – that are unobservable to the collectors ex ante – usually tend to be focused by the remedy group than management group. We formalise this differential studying mechanism in a easy dynamic Beckerian time use mannequin wherein forward-looking income collectors maximise cumulative income collections topic to a time constraint every interval.

Determine 3

Notes: This graph reveals the extent to which collectors know the place the households are positioned which might be extra capable of pay property taxes, individually by survey wave (baseline, midline, endline) and remedy task. The gray bar measures the distinction in information between the remedy and the management

Improved studying via know-how has necessary distributional impacts. The elevated details about family earnings gathered by the remedy collectors, and the following focusing on of high-income households, makes the native tax system extra progressive. Particularly, know-how will increase tax funds as a share of taxes due within the high quartiles of the income-asset distribution, however leaves tax funds unchanged within the backside quartile. Nonetheless, elevated data seems to be a double-edged sword, as know-how additionally will increase the incidence of bribes, with results concentrated within the backside quartile. Extra analyses counsel remedy collectors additionally find out about, and subsequently goal, these households which might be extra prepared to have interaction in bribes. That is according to our most well-liked rationalization about how know-how facilitates studying about which households usually tend to make tax funds.

Our experimental findings on know-how funding make clear the guarantees and pitfalls of utilizing know-how to construct tax capability, and the societal desirability should steadiness the constructive and progressive tax results in opposition to the regressive bribe results. Our outcomes counsel that the constructive results of know-how on tax outcomes are solely partly because of the presence itself of digital units embedded with geo-spatial knowledge. Expertise allowed collectors to beat studying constraints within the area (on this case, stemming from navigational challenges) which restricted their capability to construct details about taxpayers’ propensity to pay. Our findings subsequently relate to papers which present how pre-existing data sources from third events might be leveraged to enhance assortment (Kleven et al. 2011, Pomeranz 2015, Naritomi 2019, Balan et al. 2022). Most prior research place third-party data on the coronary heart of governments’ informational capability (Gordon and Li 2009, Kleven et al. 2016); our work reveals how, in settings the place such data sources are largely non-existent, the state can nonetheless strengthen its informational capability by immediately constructing details about taxpayers’ propensity to pay.

References

Albers, T, M Jerven and M Suesse (2020), “On the event of fiscal capability: New insights from African knowledge”, Vox.EU.org, 22 November.

Balan, P, A Bergeron, G Tourek and J L Weigel (2022), “Native Elites as State Capability: How Metropolis Chiefs Use Native Data to Improve Tax Compliance within the D.R. Congo”, American Financial Evaluation 112(3): 762-97.

Becker, G and C Mulligan (2003), “Deadweight Prices and the Measurement of Authorities”, The Journal of Legislation and Economics 46(2): 293-340.

Besley, T and T Persson (2009), “The Origins of State Capability: Property Rights, Taxation, and Politics”, American Financial Evaluation 99(4): 1218-44.

Brennan, G and J Buchanan (1980), The Energy to Tax, Cambridge College Press.

Cowen, T (2021), “Does Expertise Drive the Development of Authorities?”, in Essays on Authorities Development, Springer.

Dzansi, J, A Jensen, D Lagakos and H Telli (2022), “Expertise and Native State Capability: Proof from Ghana”, NBER Working Paper 29923.

Fan, H, Y Liu, N Qian and J Wen (2018), “The dynamic results of computerized VAT invoices on Chinese language manufacturing companies”, VoxEU.org, 29 July.

Gordon, R and W Li (2009), “Tax Buildings in Growing International locations: Many Puzzles and a Potential Clarification”, Journal of Public Economics 93(7-8): 855-866.

Authorities of Ghana (2014), “Internally Generated Income Technique and Pointers: Maximizing Internally Generated Income Potentials for Improved Native Degree Service Supply”, Ghana, Ministry of Finance.

Fish, P and W Prichard (2017), “Strengthening IT Techniques for Property Tax Reform”, African Property Tax Initiative Transient.

Kleven, H J, M B Knudsen, C T Kreiner, S Pedersen and E Saez (2011), “Unwilling or Unable to Cheat? Proof from a Tax Audit Experiment in Denmark”, Econometrica 79(3): 651-692.

Naritomi, J (2019), “Shoppers as Tax Auditors,” American Financial Evaluation 109(9): 3031-72.

Pomeranz, D (2015), “No Taxation with out Data: Deterrence and Self-enforcement within the Worth Added Tax”, American Financial Evaluation 105(8): 2539-69.