Art Wager

Taylor Morrison Home Corporation (NYSE:TMHC) operates as a homebuilder in several states over the United States. The company has achieved extraordinarily good financials during the pandemic, but earnings have begun falling off in recent quarters with a very significant earnings drop in the most recent Q3 quarterly report. Even though the earnings are falling, I don’t see that investors should worry too much about the current price – the price already reflects a falling earnings level.

The Company & Stock

Taylor Morrison operates as a homebuilder in the United States. The company builds homes in Arizona, California, Colorado, Florida, Georgia, Nevada, North Carolina, Oregon, Texas, and Washington mostly around well-populated areas, mostly building single-home suburban buildings. In addition, Taylor Morrison provides financing for its customers.

Taylor Morrison’s stock has performed very well in the past five years as the company’s earnings have skyrocketed. In the period, the stock has appreciated at a CAGR of 21.3%:

Five-Year Stock Chart (Seeking Alpha)

Financials

A Long-Term View

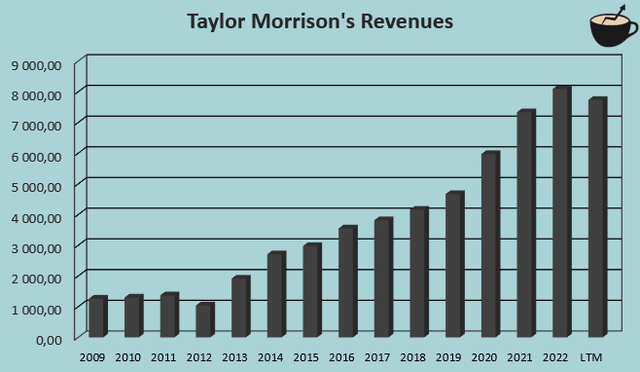

On a long-term basis, Taylor Morrison has achieved a good amount of growth. The company has achieved a compounded annual growth rate of 14.1% from 2009 to trailing figures as of Q3/2023 as a result of a great organic performance as well as select cash acquisitions in the period:

Author’s Calculation Using TIKR Data

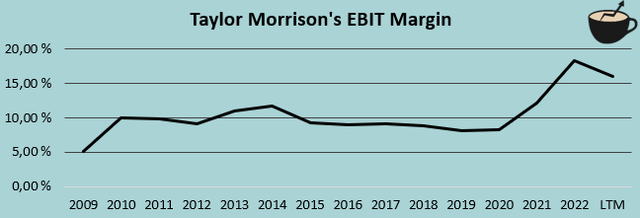

On a long-term basis, Taylor Morrison’s EBIT margin has been mostly quite stable. Excluding the pandemic-related market from 2020 to 2023 and the great financial crisis’ weakened 2009 margins, Taylor Morrison has achieved an average EBIT margin of 9.6% from 2010 to 2019. The current trailing EBIT margin still remains at a figure of 15.7%, significantly above the company’s long-term average:

Author’s Calculation Using TIKR Data

Reported Q3 Results

As can be seen in the long-term graphs, Taylor Morrison’s figures have begun to decline in 2023 so far. The company reported its Q3 earnings on the 25th of October, showing a significantly deteriorating earnings level from the previous year’s figures. Taylor Morrison’s revenues decreased by -17.6% year-over-year to $1.68 billion. The company’s EBIT fell by -45.1% to $226 million as the company’s gross margin fell significantly along with the sales level. The third quarter came in significantly worse than Q2 – in the second quarter, Taylor Morrison’s EBIT only decreased by -16.4%. Taylor Morrison also foresees a weak Q4 with homebuilding revenues of $1.81 billion, representing a year-over-year sales decrease of -19.2%.

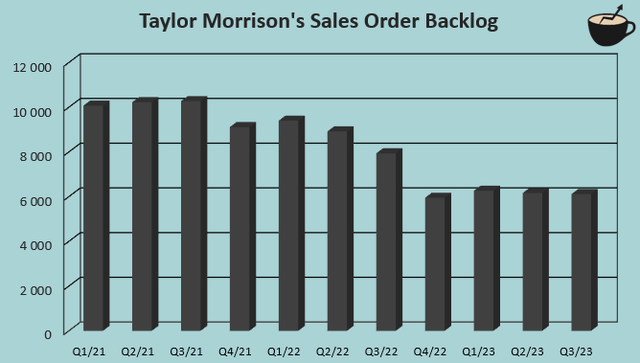

The company’s order backlog has somewhat stabilized during the past couple of quarters at a current backlog order number of 6118. The figure is down massively from a 2021 high of 10273 units. I believe that the company could still face tough quarters in 2024 as well, but the earnings level should start to stabilize at some point.

Author’s Calculation Using Q3 Presentation Data

Valuation

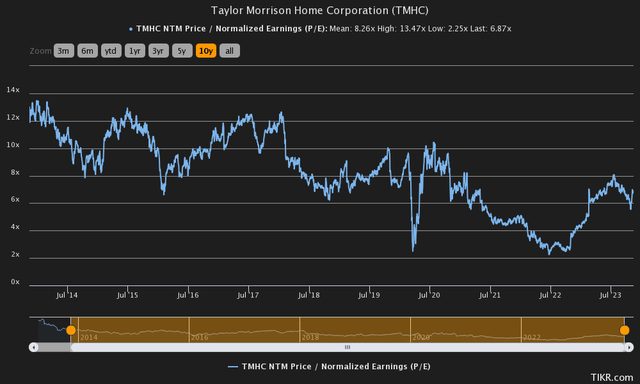

Taylor Morrison trades at quite a low forward P/E ratio – currently, the multiple stands at 6.9, below the company’s already quite low ten-year average of 8.3:

Historical Forward P/E (TIKR)

As Taylor Morrison’s operations are highly cyclical in nature, and the company’s earnings have been extraordinarily high in recent years, I believe that a more thorough examination needs to be done. In my usual manner, I constructed a discounted cash flow model to estimate a rough fair value for the stock.

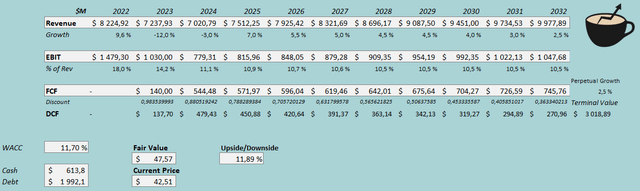

I believe that Taylor Morrison’s earnings are due for a correction, as the P/E ratio seems to estimate. In the DCF model, I estimate the company’s sales to remain challenging in 2023 and 2024 after an extraordinary earnings level – for 2023, I estimate sales decreases of -12%, and a slight further decrease of -3% in 2024. At some point, the company should start to recover back into a good level of growth as the company has a good long-term growth history – I estimate a growth of 7% for 2025, which falls in slow steps into a perpetual growth rate of 2.5%. Altogether, the revenues represent a CAGR of 4.5% from 2024 to 2032 as the company operates under more normal market conditions.

In addition to challenges in sales, I believe that Taylor Morrison’s margins should normalize back to a level that’s more in line with the company’s long-term history. I estimate the margin to fall from a 2023 estimated EBIT margin of 14.2% eventually into a stable EBIT margin level of 10.5% – the estimate represents a scenario where the achieved higher margins in recent years are mostly a result of an odd market, which I see as likely. The EBIT margin of 10.5% still leaves a good earnings level – as told earlier, Taylor Morrison’s EBIT margin from 2010 to 2019 has been lower at 9.6% on average.

The mentioned estimates along with a weighted average cost of capital of 11.70% craft the following DCF model with a fair value estimate of $47.57, around 12% above the stock price at the time of writing:

DCF Model (Author’s Calculation)

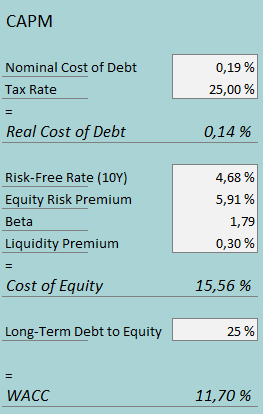

The used weighted average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In the past twelve months, Taylor Morrison’s interest expenses add up to $3.9 million – typical to homebuilders, Taylor Morrison capitalizes almost all of its interest expenses, making the interest row really low. With the company’s current amount of interest-bearing debt, Taylor Morrison’s interest rate comes up to 0.19%. As the interest expenses are already included in the EBIT figure, I use the low estimate in my model – the DCF model cash flows already include the overwhelming majority of the company’s debt-related expenses. Taylor Morrison uses debt quite well, and I estimate a long-term debt-to-equity ratio of 25%.

On the cost of equity side, I use the United States’ 10-year bond yield of 4.68% as the risk-free rate. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest estimate for the United States, made in July. Yahoo Finance estimates Taylor Morrison’s beta at a figure of 1.79, a high figure that’s quite typical for homebuilders. Finally, I add a small liquidity premium of 0.3%, crafting a cost of equity of 15.56% and a WACC of 11.70%.

Takeaway

As Taylor Morrison’s market conditions seem to normalize and remain partly challenging due to a weak macroeconomic state, the company’s earnings have begun to come back down from an extraordinarily high level. The stock price already seems to price in the earnings fall – my DCF model estimates a slight upside for the stock, even though the model estimates a significant further drop in earnings. The DCF model also estimates a long-term EBIT margin of 10.5%, when Taylor Morrison’s most recent quarterly margin was higher at 13.5% – if my assumption about a further margin fall into a historical level proves to be wrong, the stock could have a significant upside. Before the company demonstrates such a performance, though, I have a hold rating.