High earners relocate for decrease taxes – however merely reducing earnings tax charges won’t be a profitable technique

Isabel Z. Martínez 10 Might 2022

Within the aftermath of the worldwide monetary disaster, and in gentle of rising inequality in lots of international locations of the world, considerations about high earners and super-rich people relocating for tax causes have grown. Many international locations are nervous about shedding vital fractions of their tax base to low tax areas, and tax havens have come below scrutiny.

Over the previous years, financial analysis has made essential contributions, displaying that high earners certainly relocate throughout borders for tax causes. This has been discovered to be the case particularly for professionals dealing with a worldwide labour market like soccer gamers (Kleven et al. 2011, 2013), star scientists (Akcigit et al. 2015, 2016), or internationally cell high-skilled professionals (Kleven et al. 2013, 2014).

However tax havens should not solely a phenomenon within the worldwide panorama; they typically additionally exist inside international locations which have a fiscally decentralised construction. And as relocating inside a rustic is often more cost effective than transferring throughout nationwide borders, high earners are usually much more delicate to tax variations, as for instance Moretti and Wilson (2017, 2022) present for the US, or Schmidheiny and Slotwinski (2018) for Switzerland (see Kleven et al. 2019 for a abstract of the literature).

But whereas ample proof exists that reducing taxes is an efficient means to draw high earners, it’s not at all times clear how and whether or not this pays off for the jurisdictions that decrease their tax charges.

In current work (Martínez 2022), I examine a tax lower by the small Swiss canton of Obwalden, situated in central Switzerland. The objective explicitly was to draw high-income taxpayers, and this was to be achieved via the introduction of a regressive earnings and wealth tax schedule. In 2006, Obwalden modified its tax code and launched falling marginal tax charges for incomes past 300,000 Swiss francs (CHF). This corresponded roughly to the earnings threshold of the highest 1% of Swiss taxpayers. The introduction of the regressive scheme implied that for a single taxpayer with taxable earnings of 500,000 CHF (approx. 512,000 CHF gross earnings), the statutory common cantonal earnings tax fee fell from 17.9% to 14% after the reform. For an in any other case similar taxpayer with taxable earnings of 300,000 CHF (approx. 312,000 CHF gross earnings), the typical tax fee in distinction solely fell from 17.6% to 16.6%, as illustrated in Determine 1. (Notice that the full tax load would additional embody the federal earnings tax, which, nevertheless, is uniform throughout the canton and doesn’t have an effect on transferring selections.) On account of its regressive nature, the reform was repelled by the Federal Courtroom. In response to the court docket ruling, in 2008 the canton launched a flat fee tax, which lowered the tax load for high earners even additional.

Determine 1 Statutory earnings and wealth tax charges after totally different cantonal tax reforms

Since in Switzerland earnings and taxation is residence primarily based, it was enough for taxpayers to maneuver to Obwalden to reap the benefits of the low tax charges. Moreover, the Swiss tax system doesn’t distinguish between earnings from labour or capital. As I proven within the paper, this reform due to this fact launched a pointy, sizable, and really salient lower in marginal and common tax charges. I due to this fact exploit variation over time, throughout cantons, and throughout totally different teams of taxpayers to establish the pull impact of this pro-rich tax coverage in Obwalden.

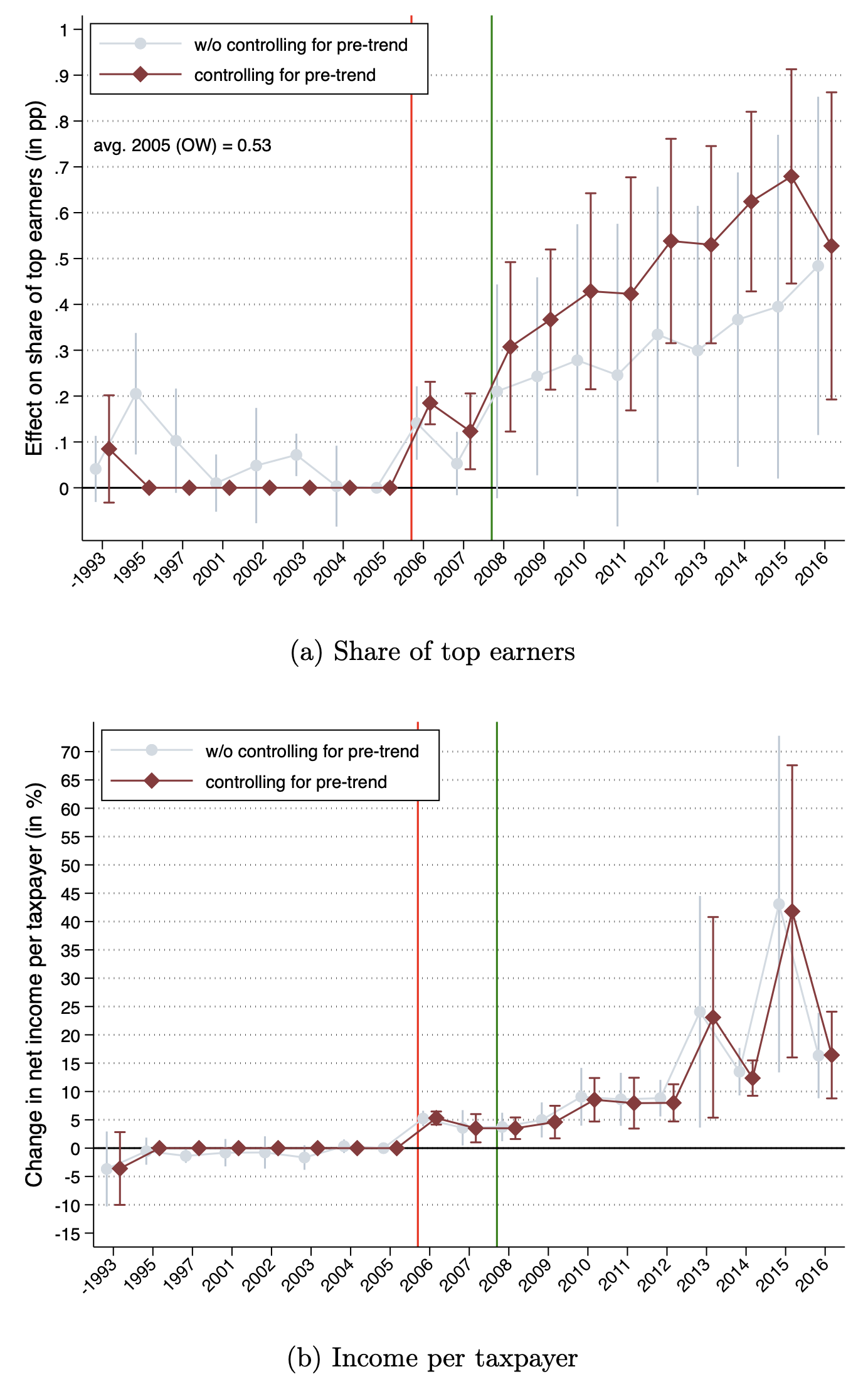

Utilizing federal earnings tax information, I first analyse (i) the inhabitants share of high-income taxpayers residing in a canton, and (ii) internet earnings per taxpayer in Obwalden compared to different cantons in a difference-in-differences setting. Outcomes from the corresponding occasion research (proven in Determine 2) point out that the reform had the supposed impact: by 2016, the share of high-income taxpayers in Obwalden had grown by 0.53 share factors relative to different cantons. This is a rise of 100% in comparison with Obwalden’s preliminary share of high earners. Web earnings per taxpayer had risen by 17%.

Determine 2 Occasion examine estimates of the impact on Obwalden’s tax base

To acquire a comparable measure of the results of tax fee modifications, economists sometimes compute the elasticity with respect to the net-of-average-tax fee (i.e., one minus the typical tax fee). This fee signifies the share of pay {that a} taxpayer takes residence after paying taxes.

I discover a big elasticity of in-migration within the 5 years after the reform. A 1% enhance within the net-of-average-tax fee elevated the influx of high earners by as much as 7.2%. These transferring responses have been fast and flattened out considerably over time. The extra exactly recognized elasticity of the inventory of high-income taxpayers residing within the canton (which additionally accounts for residents who stayed however would in any other case have moved elsewhere), lies within the vary of 1.5–2. In that respect, the reform was successful.

The important reader could also be sceptical about such giant behavioural responses to taxation. Nevertheless, these elasticities should be understood throughout the institutional context (Kleven et al. 2019). 4 elements assist to elucidate the massive responses:

1. Elasticities are bigger in settings with out restrictions with respect to career, earnings supply, nationality, or origin to reap the benefits of decrease taxes in one other jurisdiction. On this regard, Switzerland comes near a Tiebout (1956) mannequin world, the place folks vote with their toes.

2. The extremely debated tax modifications have been giant and salient, making it extra probably that individuals truly thought-about transferring for tax causes.

3. Switzerland is a small nation on the coronary heart of Europe. Transferring distances and therefore the prices of transferring are low.

4. The canton of Obwalden began out from a state of affairs with only a few high earners transferring to or residing within the canton. The relative modifications have been due to this fact giant for such a small jurisdiction. That is additionally why principle, actually, predicts that small jurisdictions will on common profit from participating in tax competitors whereas giant jurisdictions will lose.

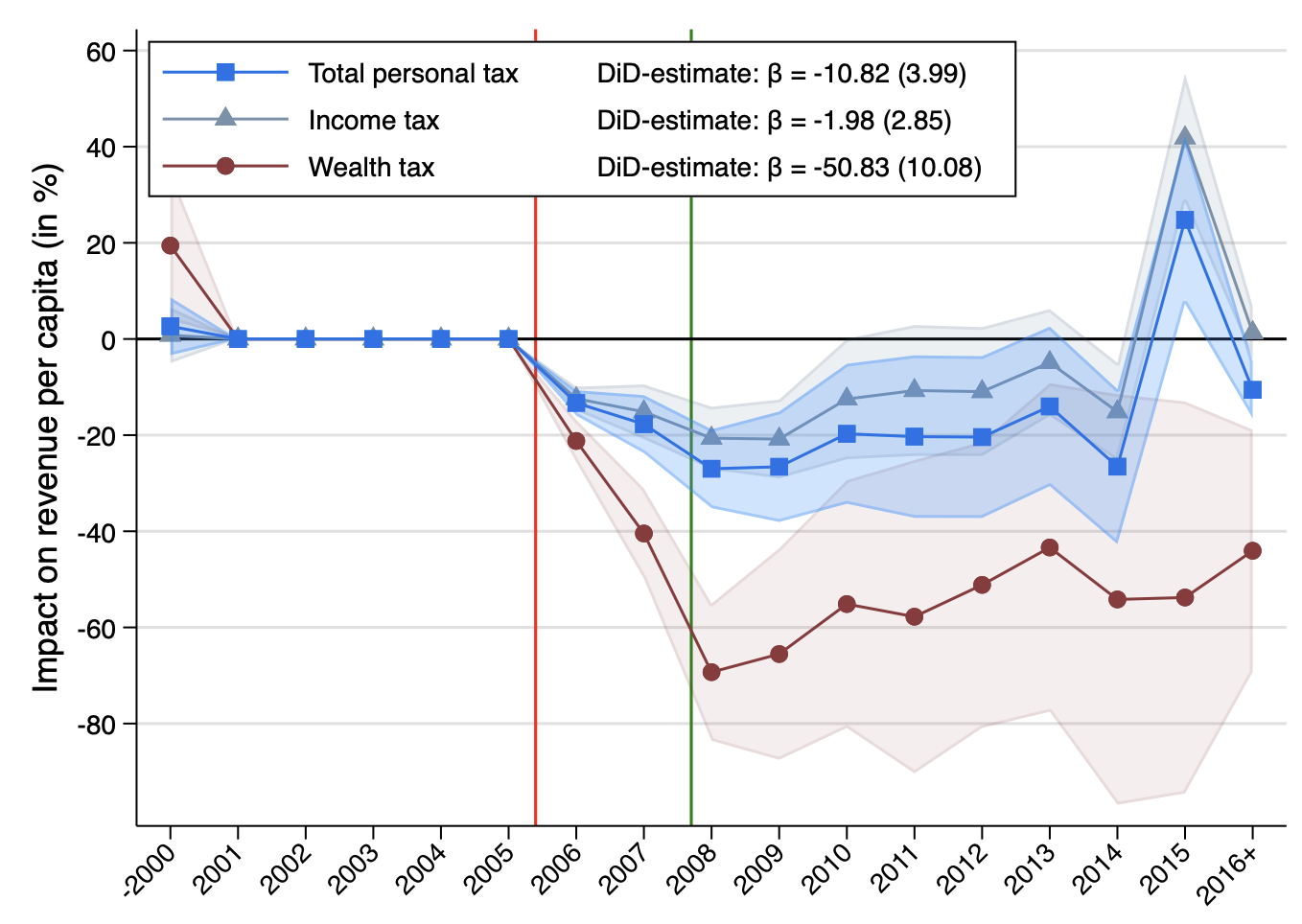

However moreover having extra high-income earners residing within the canton, how a lot did Obwalden actually acquire? Occasion examine estimates evaluating the cantonal tax income in Obwalden with the income in different cantons (Determine 3) present that the reform didn’t enhance income. (That is even even though the opposite cantons serving as a management group on this quasi-experimental setting have been barely negatively handled, since Obwalden attracted taxpayers from them due to its aggressive tax technique.) True, Obwalden’s complete tax income rose over time, however private tax income in different cantons rose much more compared.1 That is due to this fact additionally a story about what the fitting counterfactual is when evaluating a coverage. In the same vein, Agrawal and Foremny (2019) discover that whereas tax differentials in Spain did result in migratory responses, they weren’t sufficient to compensate the mechanical income losses that come up from reducing the tax charges.

Determine 3 Distinction-in-difference estimates of cantonal tax income

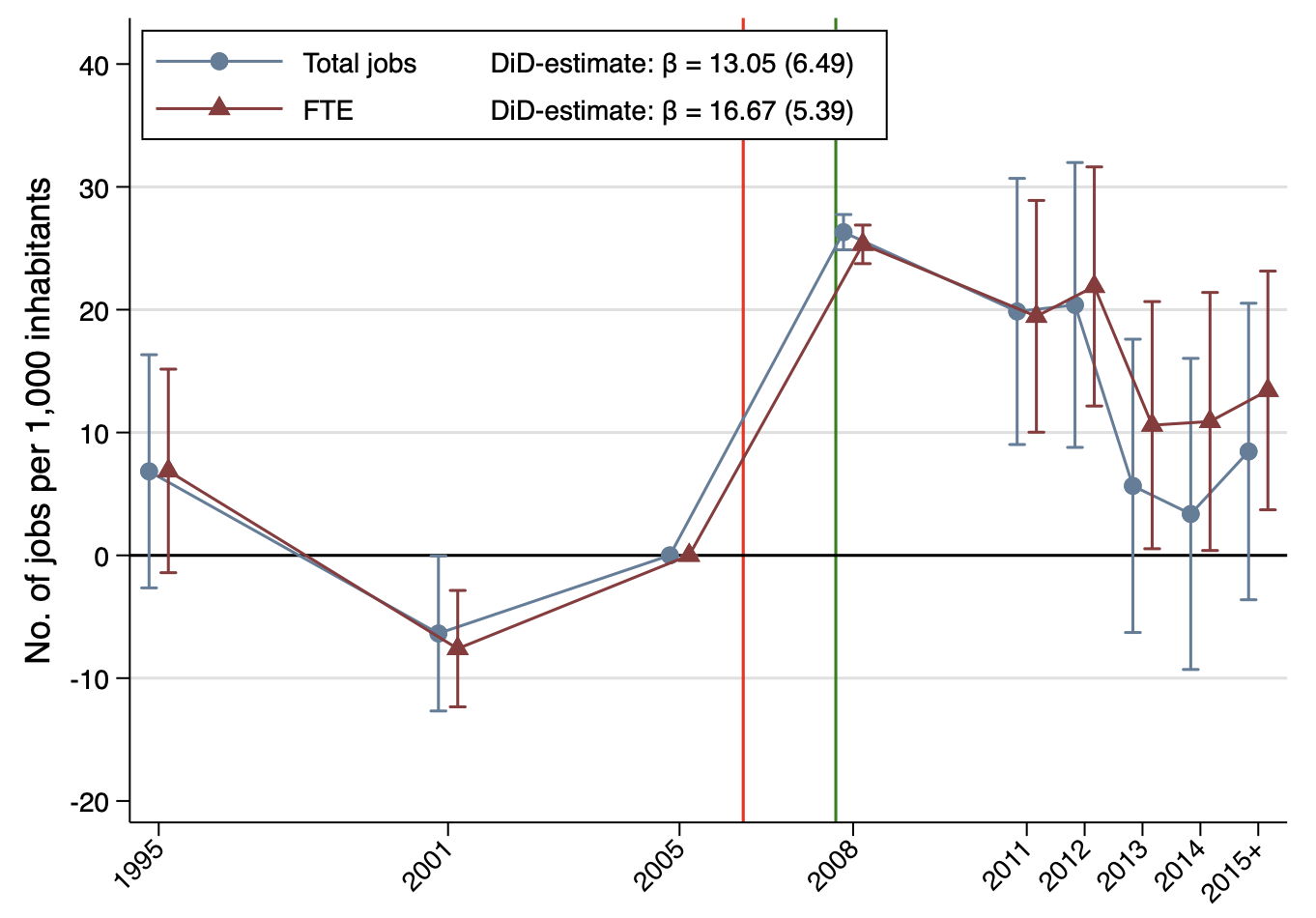

The place does this go away us? Attracting high-skilled high earners might need optimistic spillovers to the native financial system. However that is the case when tax coverage is focused and mixed with trade insurance policies. Moretti and Wilson (2017) discover that decrease high marginal tax charges entice star scientists to US states – together with engaging company earnings taxes and funding tax credit, that are particularly related for industries with excessive R&D bills. Within the case of Obwalden, I discover that native employment elevated: between 2005 and 2008, the variety of full-time equal (FTE) jobs rose by 11%, in comparison with a 4.3% enhance in all Switzerland over the identical interval. That is much more exceptional as the full variety of FTE jobs had been fixed in Obwalden between 1995 and 2005. Distinction-in-difference estimates indicate a rise within the variety of jobs per capita of two.3%, and of 4% for the variety of FTE jobs per capita. The corresponding occasion research are proven in Determine 4. Nevertheless, these will increase might not be solely because of the private earnings tax reform: in 2006, Obwalden additionally considerably diminished its company tax charges to a uniform fee of 6.6%, the bottom within the nation on the time. It’s sadly not attainable to disentangle the results of the 2 reforms. But once more, this implies that reducing private earnings tax charges alone might not be enough to take residence substantial beneficial properties from the tax competitors recreation.

Determine 4 Occasion examine of complete jobs and full-time equal jobs per capita in Obwalden

References

Agrawal, D R and D Foremny (2019), “Relocation of the Wealthy: Migration in Response to High Tax Price Adjustments from Spanish Reforms”, Evaluation of Economics and Statistics 101(2): 214-232.

Akcigit, U, S Baslandze and S Stantcheva (2015), “The consequences of high tax charges on celebrity inventors”, VoxEU.org, 26 April.

Akcigit, U, S Baslandze and S Stantcheva (2016), “Taxation and the worldwide mobility of inventors”, American Financial Evaluation 106(10): 2930-2981.

Kleven, H, C Landais, M Munoz and S Stantcheva (2019), “Taxation and migration: Proof and coverage implications”, Journal of Financial Views 34(2): 119-142.

Kleven, H J, C Landais and E Saez (2011), “Taxation and worldwide migration of superstars: Proof from the European soccer market”, VoxEU.org, 6 January.

Kleven, H J, C Landais and E Saez (2013), “Taxation and worldwide migration of superstars: Proof from the ecu soccer market”, American Financial Evaluation 103(5): 1892-1924.

Kleven, H J, C Landais, E Saez and E A Schultz (2013), “Migration and wage results of taxing high earners: Proof from the foreigners’ tax scheme in Denmark”, VoxEU.org, 17 September.

Kleven, H J, C Landais, E Saez and E A Schultz (2014), “Migration and wage results of taxing high earners: proof from the foreigner tax scheme in Denmark”, Quarterly Journal of Economics 129(1): 333-378.

Martínez, I Z (2022), “Mobility responses to the institution of a residential tax haven: Proof from Switzerland”, Journal of City Economics 129(103441).

Moretti, E and D J Wilson (2017), “The impact of state taxes on the geographical location of high earners: Proof from star scientists”, American Financial Evaluation 107(7): 1858-1903.

Moretti, E and D J Wilson (2022), “Taxing billionaires: Property taxes and the geographical location of the ultra-wealthy”, American Financial Journal: Financial Coverage, forthcoming.

Schmidheiny, Okay and M Slotwinski (2018), “Tax-induced mobility: Proof from a foreigners’ tax scheme in Switzerland”, Journal of Public Economics 167: 293-324

Tiebout, C M (1956), “A pure principle of native expenditures”, Journal of Political Economic system 64(5): 416-424.

Endnotes

1 To make issues worse, over time Obwalden additional misplaced income from the nationwide fiscal equalisation scheme, which redistributes income from wealthy cantons with a big tax base to poor cantons with a small tax base in per capita phrases. Because of its success in rising its tax base, Obwalden has moved from a internet beneficiary to a internet contributor to the equalisation scheme.