Pgiam/iStock by way of Getty Photographs

Tarsus Pharma (NASDAQ:TARS) has an authorised drug for a mite infestation eye illness referred to as Demodex blepharitis and a number of late-stage belongings in its pipeline. Its key molecule is known as lotilaner, an antiparasitic broadly utilized in veterinary drugs for the therapy of ticks, mites and different infestations. It is out there in oral pill kinds and is understood to be efficient in animals. Tarsus has 3 product candidates, all of that are numerous formulations of lotilaner, developed in a type appropriate for human use.

Final 12 months, once I lined it, I stated that whereas the corporate had good knowledge and good execution, the market potential of the goal indication was unclear.

Nonetheless, in line with their most up-to-date annual report, an estimated 25 million Individuals endure from DB, and XDEMVY is the primary and solely FDA-approved therapy for Demodex blepharitis and “is taken into account the definitive normal of care.”

That is a big goal market. In my article, I had famous – and offered some proof of – how tea tree oil or TTO could be an efficient and cheap therapy for the demodex infestation. An optometrist who learn my article stated that TTO just isn’t solely not efficient, however it may be dangerous to our meibomian glands, which produce a lipid-rich substance referred to as meibum, which performs an important position in sustaining the well being of the eyes. The examine this consumer referred to was a 2022 Harvard + Beijing examine, hyperlink right here, which stated:

T4O, even at ranges 10-fold to 100-fold decrease than demodicidal concentrations, is poisonous to HMGECs in vitro.

T40 is one other title for the TTO extract. This examine did say that T40 was efficient as a demodicide. Nevertheless it simply wasn’t secure in vitro. Whereas this examine, being non-human, just isn’t conclusive, I consider the burden of proof is low right here, and we’re not in search of “conclusive.” A security concern is sufficient for an unapproved drugs to lose towards an authorised and efficient drug.

Going again to TARS, the inventory is up 65% proper now from final 12 months, and at one time was up 3x. The market has clearly sided with the corporate on this one.

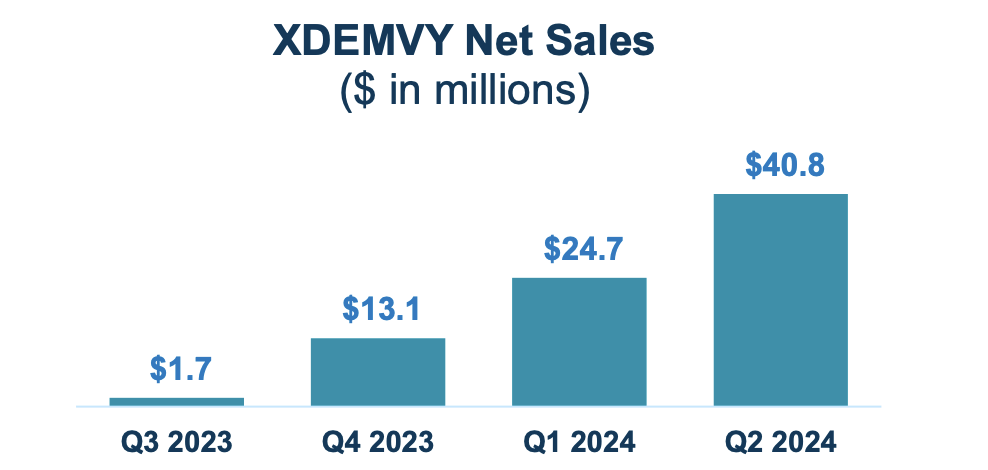

As for his or her income figures, they’ve accomplished very properly. Right here’s the chart:

Company Presentation

The corporate sees a $1bn alternative within the preliminary addressable phase alone. They estimate 1.5 million US sufferers already recognized with DB, and one other 1.2 million, 2.2 million and a pair of.3 million sufferers with Dry Eye Illness, Cataract and Contact lens respectively who even have DB. Collectively, this constitutes a >7M market, and the corporate values it at greater than $1bn.

Remainder of the pipeline

The identical molecule, TP-03, is in a section 2 trial in Meibomian gland illness (MGD’). It is also in trials in China for DB in partnership with LianBio (LIAN), though the way forward for that is unsure, see 10-Okay, web page 27. A second formulation, TP-04, is in section 2 focusing on rosacea. A 3rd formulation, TP-05, is in section 2 focusing on Lyme illness.

Lyme illness is a bacterial illness brought on by the chunk of contaminated deer ticks. In February, TARS printed constructive proof of idea knowledge from this examine. As the corporate stated, ticks wanted to be connected to the pores and skin for 36 hours earlier than the illness may very well be transmitted. So the corporate evaluated TP-05’s capacity to kill ticks inside 24 hours of their being connected to the pores and skin. Because it turned out, 97% of the ticks died inside 24 hours on the greater dose, whereas solely 5% died from placebo. This impact was retained for a complete month, which suggests the drugs can handle your tick chunk issues throughout a complete tick season.

In response to the corporate, “Over 30 million Individuals are thought of to be at excessive or reasonable threat of contracting Lyme illness, and there are roughly 300,000 – 400,000 circumstances within the U.S. every year.” Lyme illness is often handled with antibiotics. Clearly, this occurs after the illness happens and is detected. TP-05 seems to be preventive as a result of it kills not the Lyme illness micro organism however the vector itself, earlier than it could possibly trigger an an infection. That’s doubtlessly a really enticing addition to the therapeutic armamentarium.

Coming to TP-03 in MGD, roughly 30-40 million Individuals have this illness that’s brought on by the infestation of one other sort of demodex mite and should trigger everlasting harm to the tear glands. MGD has no authorised pharmacologic therapies. In a section 2 trial accomplished late final 12 months, TP-03 demonstrated “a statistically vital enchancment in two goal measures of the illness and was properly tolerated following therapy for 12 weeks with TP-03.” The corporate is pursuing regulatory discussions with the FDA.

TP-04, an aqueous gel formulation of lotilaner, has been examined in rosacea and located to be secure and efficient.

Friends/Competitors

There are a number of authorised and rising therapy choices for demodex-related illnesses. In MGD, Bausch + Lomb and Novaliq supply NOVO3, which was authorised in Could 2024 to deal with dry eye illness (DED) related to Meibomian gland dysfunction. The molecule was authorised following section 3 trials that met all major and secondary endpoints.

AZR-MD-001, a program from Azura Ophthalmics, is in section 3 scientific trials focusing on MGD. Final 12 months, the molecule met co-primary endpoints in a randomized section 2 scientific trial. Azura, a privately held firm, additionally has different packages in demodex associated illnesses.

Financials

TARS has a market cap of $977mn and a money steadiness of $323mn. Revenues have been $40.8 million. Analysis and growth (R&D) bills have been $12.3 million whereas promoting, normal and administrative (SG&A) bills have been $58.8 million. These SG&A bills, the corporate says, have been simply $20.3 million for a similar interval in 2023. The rise, they are saying, was “due primarily to $11.0 million of compensation-related expense (together with non-cash stock-based compensation), $13.8 million of economic and market analysis prices associated to the industrial launch of XDEMVY, and $13.6 million of elevated IT, authorized, skilled and different company bills.”

I need to say that the corporate may wish to be extra cautious with their rising bills.

Taking these bills as they’re, and extrapolating, they’ve a money runway of 4 or 5 quarters. Nonetheless, as gross sales improve, the extra money will definitely add to their money runway.

Patent state of affairs

The first concern for this firm is its mental property. Lotilaner, the important thing molecule, was authorised by the FDA for veterinary use in 2017 underneath the model title Credelio. It was developed by Elanco Animal Well being (ELAN), a number one firm in animal healthcare.

Tarsus licensed IP associated to Lotilaner from Elanco in 2019. In case you learn the 10-Okay, beginning at web page 25, you will notice that the phrases of the license are extraordinarily lenient. Elanco has apparently gifted them this molecule for human formulation at throwaway costs. Evaluate the milestone funds TARS has made or will make to Elanco (lower than $10mn complete, plus one other $75mn in future gross sales associated milestones) for what seems to be a $1 billion molecule, with what they’re getting from LianBio for his or her China partnership ($82mn upfront plus milestone and one other $30mn approx), and you may be amazed.

The related patents are legitimate until 2032 or so. The corporate has not disclosed which patents are legitimate until what 12 months, however has solely given the extent; which is kind of normal observe.

Dangers

Like I’ve indicated, the patent state of affairs is one thing of a threat. Their core patent pertains to lotilaner, and this has been licensed from Elanco for a small sum. Furthermore, the patent property is held just for one other 6-8 years, which limits their market alternative.

One other threat is the sudden spurt in G&A bills because the approval, which appears to be loads for an organization of this measurement. Though there isn’t any rule, as such, it has been my expertise that firms spend extra on R&D than on SG&A. Right here, R&D has stayed roughly fastened at round $12mn for over a 12 months, whereas SG&A has considerably elevated.

There’s additionally some competitors in a few of the goal indications, notably MGD, which must be thought of.

Backside line

TARS has a market cap of ~$1bn and a goal market additionally valued at $1bn. That is a sexy ratio. They’ve upcoming catalysts and powerful knowledge within the packages they’re pursuing. There are some dangers that I simply mentioned, however general I feel TARS is an efficient wager at present costs with a two-year window.