nicoletaionescu/iStock by way of Getty Pictures

Walmart’s (WMT) earnings appeared to defy most skeptics of the economic system. Opposite to many expectations, Walmart topped Q2 estimates and raised its FY25 outlook. Its internet gross sales and working revenue have been the best in two years. This ignited a broad-based rally within the retail sector with Goal (NYSE:TGT) being a key beneficiary, however I don’t suppose this was justified. The best way I see it, some names are being benefitted whereas many different corporations (NKE, LULU, HD and so forth.) really feel the ache of a weak shopper. Customers are bargain-hunting, and Goal might not be a beneficiary. I price Goal as a Promote.

Goal just isn’t Walmart

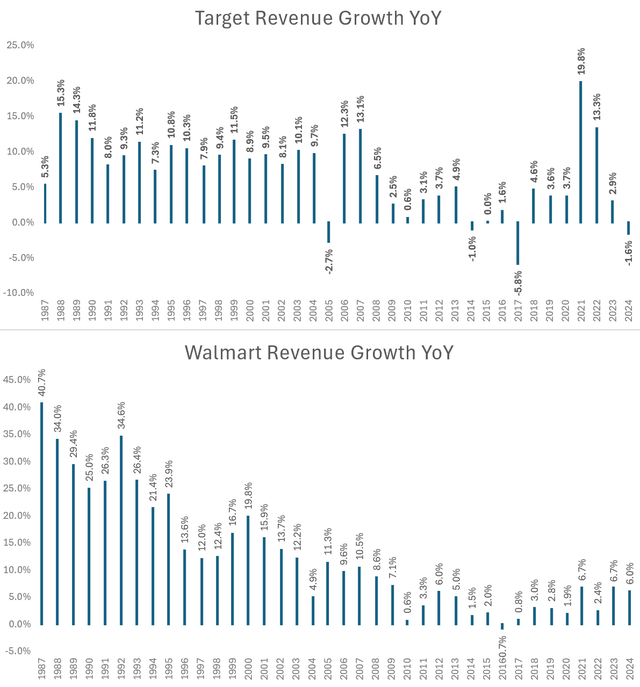

The paths taken by two of the largest retailers should not fully the identical. Walmart has seen a extra regular development in its fortunes whereas a collection of missteps have marked Goal. That is to say that Goal’s revenues might not be as resilient, and it will be incorrect to suppose that Walmart’s rising tide will elevate Goal’s boat.

Writer generated from Firm knowledge

Over time the dip in Goal’s financials throughout totally different years might be attributed to a number of causes.

- Competitors from Walmart affected Goal’s market share and gross sales development as Walmart’s aggressive pricing methods attracted extra price-sensitive shoppers.

- A large knowledge breach that compromised the non-public data of thousands and thousands of consumers. The repercussions of this breach prolonged into 2014, eroding shopper belief and resulting in a decline in gross sales as prospects have been cautious of buying at Goal.

- Whereas Walmart has been in a position to broaden and is well-established in Canada, Goal’s try and broaden into Canada confronted vital challenges, together with provide chain points and a failure to resonate with Canadian shoppers. These difficulties led to monetary losses and in the end Goal’s choice to exit the Canadian market in 2015.

- Most not too long ago, excessive inflation and a slowing economic system have affected price-conscious prospects who’ve decreased spending on discretionary gadgets disproportionately affecting Goal which makes up a good portion of Goal’s merchandise.

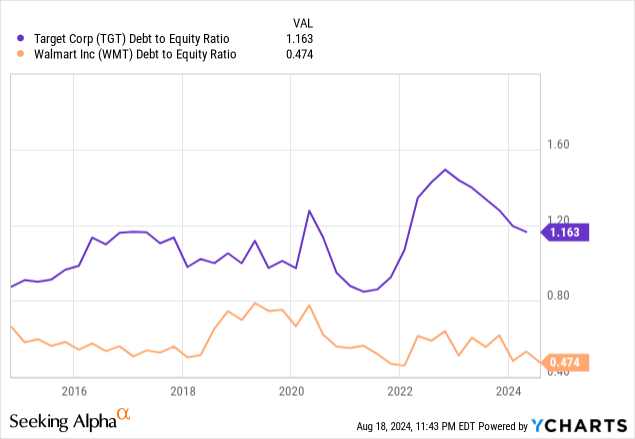

Lastly, the fates of their steadiness sheet has additionally developed otherwise. Walmart debt to fairness is down general, whereas Goal’s has all the time been a lot greater than Walmart and is up greater than it was a decade in the past (So even within the face of a collective downturn for the complete business Walmart has a lot greater steadiness sheet flexibility than Goal)

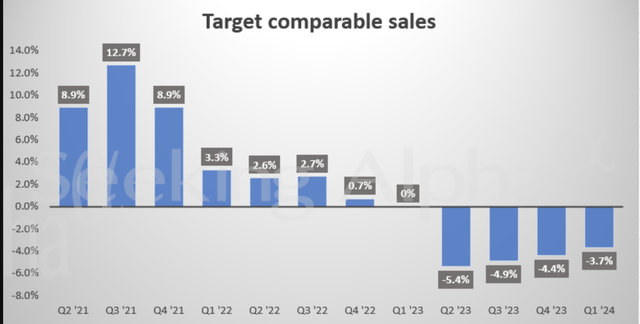

Goal’s upcoming Q2 earnings

SA

For Goal Company, it would not be stunning to see one other down quarter after seeing 4 consecutive quarters of declining development. Moreover, for the fiscal yr the variety of up revisions is 6 for EPS, whereas the variety of down revisions is nineteen. For revenues there are 20 down revisions versus 7 up revisions. Of their first quarter earnings name, the administration maintained that they’re cautious of close to time period outlook and count on discretionary traits stay beneath stress. Nonetheless, for the quarter they’re anticipating to lastly get away of unfavorable topline development and broaden their revenue price.

Within the second quarter, we’re planning for a comparable gross sales improve within the 0% to 2% vary. Whereas that is under the expansion price we might count on to ship over time, it displays a continued cautious method to our close to time period outlook, which has served us properly in current quarters. On the underside line in Q2, we’re guiding to a spread of $1.95 to $2.35. The midpoint of this EPS vary represents a development price of roughly 20% over final yr as we proceed to construct on the revenue price enlargement we have seen over the previous few quarters.

– Michael Fiddelke – EVP, COO and CFO

Deciphering from Walmart’s Q2 Earnings name

So whereas Walmart’s outcomes have been optimistic information for its inventory, I’m struggling to go together with the market narrative that the patron is powerful and it’s a optimistic for all retail shares. If something Goal can be extra affected by this pattern when you begin digging into Walmart’s earnings name.

- E-commerce gross sales have been the largest contributor to earnings and likewise noticed a discount in supply value per order bettering gross margins

- The corporate has highlighted using Gen AI for elevated effectivity and development behind on-line gross sales

- Groceries, accounting for about 60% of Walmart’s U.S. gross sales, have been a key consider serving to the retailer improve its market share and appeal to buyers from varied revenue ranges.

- The corporate’s concentrate on being a low-cost vendor led to decreased costs on 7,200 gadgets with a 35% improve within the variety of rollbacks on meals gadgets

- Worldwide gross sales rose 8.3% led by huge positive aspects in Mexico and China.

Goal’s e-commerce gross sales suffered final yr and it continued this yr primarily attributable to its concentrate on discretionary gadgets which shoppers have in the reduction of on whereas Walmart has been in a position to make up for that because of the power of their grocery deliveries. Whereas Gen AI could have a major affect on its operations, the jury continues to be out on its efficacy and/or how lengthy it takes Goal to make it efficient sufficient in its operations. Goal just isn’t a low-cost vendor and though it has been decreasing costs for its gadgets to be higher aggressive with Walmart, I’m uncertain of the margins as its operations might not be optimized sufficient to compete within the low-cost section. Lastly, Goal is simply current within the U.S. so no worldwide market alternatives to learn from.

Making an attempt to foretell the financial future by Walmart’s outcomes may current a skewed image. It was a extremely robust quarter for Walmart, however I don’t essentially suppose that’s an excellent factor for the economic system. Individuals are searching for worth, and as a substitute of going to Goal, Kroger or wherever else they store, they’re now going to Walmart for at the very least a portion of their purchases

– Steven Shemesh, Retail analyst at RBC Capital Markets

Goal’s Valuation and Dangers to this thesis

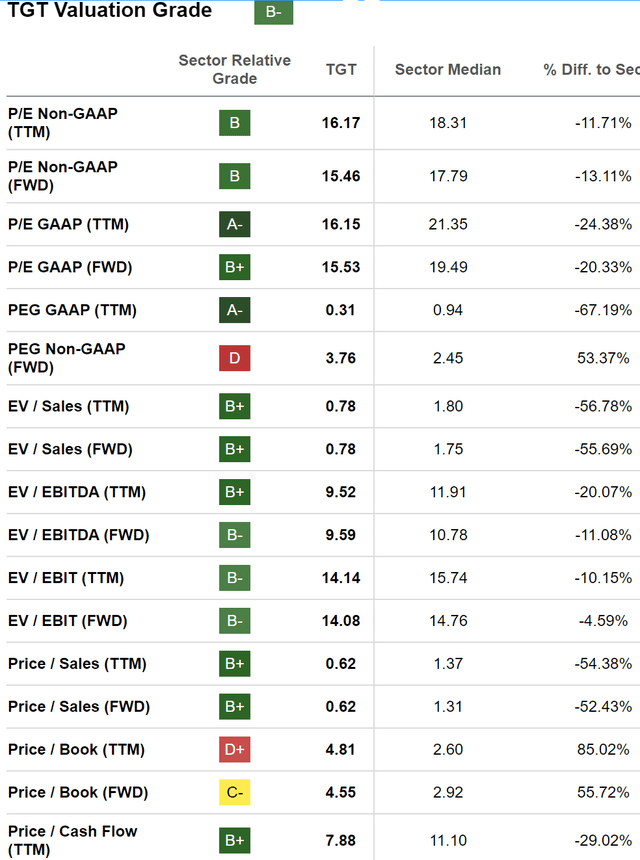

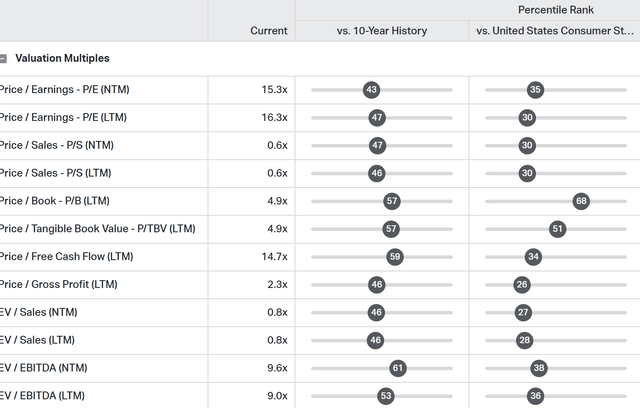

A legitimate danger to a Promote ranking can be Goal’s valuation. At the moment, Goal firm trades at 15 occasions earnings and with an elevated outlook on its earnings, its ahead a number of is 15.5x. Its EV/EBITDA and its money flows are additionally buying and selling at a reduction to the sector.

SA

This exhibits that the market could have discounted a nasty quick time period future already into its inventory worth. Taking a look at its percentile rank in opposition to its personal ten yr historical past and in opposition to the Client staples sector, it’s clear that greater than 50% of the time the multiples have been buying and selling greater than the current values.

Goal’s valuation percentile rank (Koyfin)

So any excellent news (nonetheless slight it might be) could assist the quick time period upside motion in its inventory worth. However I’d personally view a rally from right here as an opportunity to promote until the quick time period uncertainty within the economic system adjustments. There is sufficient to make a case for unsure market. Together with shaky geopolitics on a number of fronts, warnings indicators have come within the type of a weakening labor market, the Convention Board’s Main Financial Index (LEI) on a downward pattern, and the best bank card account delinquency in additional than a decade. All in all, I’m skeptical of the Walmart pushed rally.