SDI Productions/E+ by way of Getty Photos

Funding thesis

Talkspace (NASDAQ:TALK) has gained robust momentum in its enterprise following latest partnerships with Medicare, in addition to initiatives for teenagers and colleges. These developments have considerably expanded the buyer base that has entry to Talkspace’s companies. I foresee a promising outlook for the corporate, with income progress anticipated to surpass 21% subsequent 12 months, with adjusted EBITDA reaching $19 million. Primarily based on my estimates, shares are valued at an EV/FY25 adjusted EBITDA a number of of 9.7. I discover its valuation to be very engaging, regardless of dangers of elevated competitors and gross margin strain. Moreover, the corporate’s massive web money place and its potential as an acquisition goal, assist mitigate draw back threat, creating an interesting risk-reward profile. Consequently, I price TALK inventory a Purchase.

Monetary highlights and my expectations for what’s forward

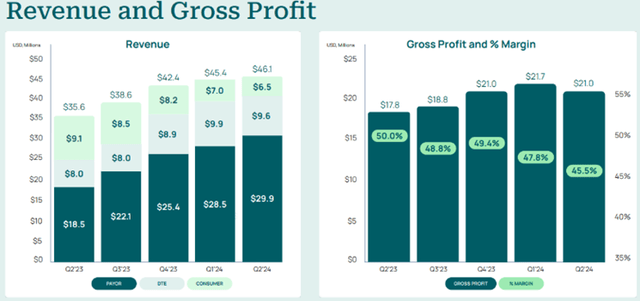

Q2 Investor presentation

Income in Q2 was up 29% 12 months over 12 months to $46.1 million, as proven above. Payor and Direct to Enterprise (DTE) section revenues grew 62% and 20% 12 months over 12 months respectively, whereas the Direct to Shopper (DTC) section noticed a decline of 28%. The decline within the DTC section aligns with administration’s technique of prioritizing the Payor and DTE segments over the Shopper enterprise. These tendencies are contributing to a headwind on gross margins, which have been declining however are anticipated to stabilize at present ranges. Administration’s steerage of $190 million in total income for this 12 months implies 27% year-over-year progress, which suggests an 8% improve in income for the second half of 2024 in comparison with the primary half. Trying forward, I anticipate this robust progress to proceed and forecast subsequent 12 months’s progress to be 21%, with income reaching $230 million and gross margins staying at round 43%. One of many key elements driving future progress is the expectation for the inhabitants lined to develop considerably from 145 million on the finish of final quarter, to above 200 million subsequent 12 months, as described by Talkspace’s CEO when he acknowledged:

Trying ahead, we anticipate including a number of new Blues plans and regional plans by the year-end. We anticipate that throughout the subsequent 12 months, practically 200 million individuals, virtually two-thirds of the American public may have entry to Talkspace via their medical health insurance.

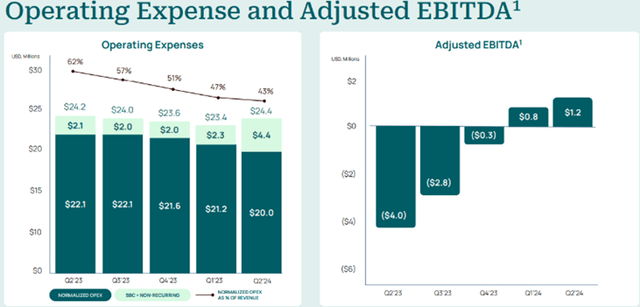

Q2 Investor presentation

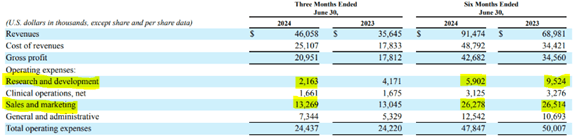

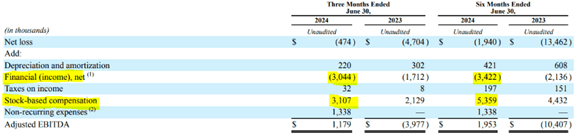

As proven above, normalized working bills have declined sharply as a share of total income. This, along with the stable income progress in latest quarters, has led to the corporate being worthwhile on an adjusted EBITDA foundation for the final two quarters. Administration’s steerage requires adjusted EBITDA to be $6 million this 12 months, representing a margin of three%. Trying forward, I anticipate normalized working bills excluding stock-based compensation (SBC) to stay at round $20 million per quarter heading into subsequent 12 months. As proven from the extract beneath, the expense reductions up to now have been pushed by lowering gross sales and advertising and marketing and R&D spend. I don’t see this pattern persevering with, provided that the corporate wants to keep up advertising and marketing spend to be able to inform shoppers relating to the supply of Talkspace’s companies beneath totally different healthcare plans.

Q2 Monetary report

In keeping with these expectations, I anticipate adjusted EBITDA of $19 million in 2025, translating to a margin barely above 8%. The corporate continues to generate curiosity revenue from its substantial money reserves, as highlighted beneath. Given the minimal capital expenditures required for its enterprise, adjusted EBITDA serves as a dependable measure of FCF era. Nevertheless, SBC stays notably excessive at round $10 million yearly. Traders ought to monitor this intently to make sure that future returns are usually not considerably diluted. Administration is actively using its $110 million money place to repurchase shares, including $25 million to the buyback program final quarter, along with the $15 million introduced earlier this 12 months.

Q2 Monetary report

TALK inventory valuation

On the present share worth of $1.75, the corporate has a market capitalization of $294 million. With a web money place of $110 million, the enterprise worth stands at $184 million. Primarily based on administration’s steerage of $190 million in income and $6 million in adjusted EBITDA, shares are valued at EV/Income and EV/Adjusted EBITDA multiples of 0.97 and 30.7 respectively. Based on my estimates for 2025 of $230 million in income and $19 million in adjusted EBITDA, the valuation turns into significantly cheaper with EV/Income and EV/Adjusted EBITDA multiples falling to 0.8 and 9.7, respectively.

A lot of its business friends comparable to Teladoc (TDOC) and American Nicely (AMWL) proceed to battle to display worthwhile progress. American Nicely stays unprofitable, whereas Teladoc shares at present commerce at EV/Income and EV/Adjusted EBITDA multiples of 0.66 and 5, with practically flat year-over-year progress anticipated for subsequent 12 months. Given my outlook for Talkspace, I contemplate it to be very attractively valued. Moreover, Talkspace’s concentrate on psychological well being, which is a rising and more and more vital space of care, makes it a compelling acquisition goal for bigger healthcare suppliers seeking to broaden their telehealth companies. Along with its massive money steadiness, this could assist mitigate vital draw back threat for the shares at their present degree.

Dangers to contemplate

Competitors

For my part, the largest threat dealing with the corporate is the risk from elevated competitors. Not solely does Talkspace deal with quite a few rivals within the psychological well being sector, however main healthcare suppliers are additionally more and more integrating telehealth companies, doubtlessly together with psychological well being care, into their choices. Till now, Talkspace has managed to keep up a number one market place largely on account of its well-recognized model.

Margin strain

As the corporate companions with bigger well being plans, it’s experiencing ongoing strain on its gross margins. Traders ought to intently monitor this metric to make sure that it doesn’t adversely impression total profitability.

Financial Downturn

The corporate’s DTC enterprise is more likely to be affected by any financial downturn, although it contributes solely a smaller portion of total income. Moreover, the corporate’s payor section requires shoppers to make a copayment on the time of service, which might additionally face challenges in a weak financial setting.

Purchase TALK inventory

Regardless of the outlined dangers, I discover the present share worth to be extremely engaging given the corporate’s promising progress prospects and bettering margins. I like to recommend that traders capitalize on the current share worth weak spot to ascertain an extended place within the firm.