Boarding1Now/iStock Editorial via Getty Images

It’s been just under 3 months since I bought CSX Corporation (NASDAQ:CSX) ahead of its Q3 earnings report. Since then, the shares have returned about 8.3% against a gain of about 2.5% for the S&P 500. The company has posted earnings since, obviously, so I thought I’d check back with the company. Additionally, shares trading at $31 are definitionally a more risky investment than those same shares when they were trading at $28.70. So, I need to review the name to see if it makes sense to buy more, hold, or sell my stake. Additionally, I am short 10 puts which are about to expire, and I’m champing at the bit to write about those, as they’ve done well.

Welcome to the “thesis statement” portion of the article. This is for those people who want a bit more of a taste than what they can get with bullet points and titles, but don’t want to suffer through an entire meal. I fully understand. I will be taking my CSX chips off the table today, as I’m more interested in capital preservation at the moment than I am about trying to squeeze out a few more points of return. While the financial performance has been fine in 2022, I’m growing worried about the level of indebtedness. Additionally, the shares are somewhat optimistically priced at the moment. For that reason, I can’t recommend holding the shares. Just because I don’t want to remain long the stock doesn’t mean there’s nothing to be done here. Although I’m already short some very profitable puts at the moment, if you’re new to this party, I think you could do well selling puts here. Just because the shares aren’t attractively priced at the moment, doesn’t mean they’d not be a great investment at the right price. Given that, I would recommend selling the June puts with a strike price of $25. I think this is a “win-win” trade because the investor will either collect the premium or will be obliged to buy this great company at a P/E of ~13 times.

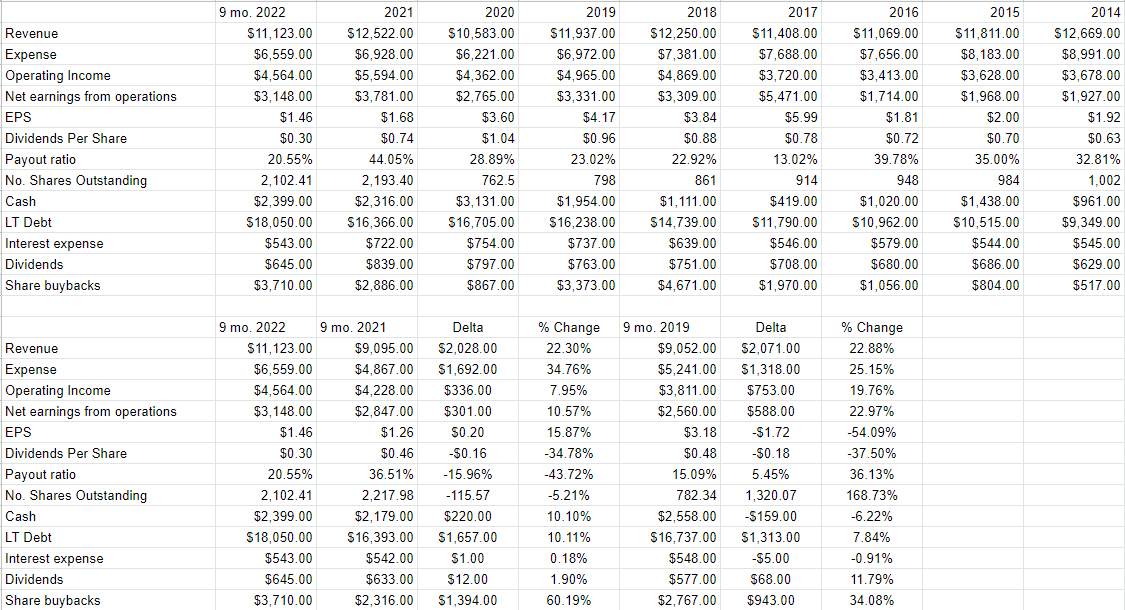

Financial Snapshot

When I last reviewed this company, I made reference to the fact that 2022 had at that point been quite good for the company. The trend continued into the next quarter, with revenue and net income higher by 22.3%, and 10.6% respectively from the prior period. Since 2021 was such an odd year, I think it worthwhile to compare the first nine months of 2022 with the same period in 2019. By that comparison, things look even better. Revenue and net income during the first nine months of 2022 were higher than 2019 by 22.9%, and 23% respectively. The financial performance during the first nine months of 2022 was quite good in my estimation.

It’s not all sunshine and lollipops at CSX, though. The capital structure has deteriorated fairly significantly over the past few years in my view. Although the cash hoard has expanded by about $220 million, or 10% over the past year, long term debt today is about $1.66 billion higher today than it was this time last year. That’s troublesome in my view, as higher levels of leverage eventually translate into higher levels of risk.

That written, I think the dividend remains well covered here, with a payout ratio of only 21%. For that reason, I’d be happy to add to my position in this company at the right price.

CSX Financials (CSX investor relations)

The Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits selling transportation services, while the stock is a speculative instrument that gets traded around based on long-term expectations about the business. Given that the financial statement valuation of the business is “backward-looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two.

Additionally, this stock, like all stocks, can be affected by changes in the overall market. The crowd may change its views about the desirability of “stocks” as an asset class, and that will impact individual stocks to some degree. Let me flesh this idea out a bit by using this investment as an example. My shares of CSX have risen about 8% since I turned bullish just under 3 months ago, against a gain of about 2.5% for the S&P 500. It’s impossible to prove the case definitively, but I’m of the view that some portion of the gain can be attributed to the general updraft in stock prices since I published my article. It’s impossible to put arithmetic precision to this idea, but I’m of the view that at least a portion of the upswing in CSX’s price should be attributed to the returns on the overall market.

So, to sum up, the business chugs along, while the stock bounces up and down based on the crowd’s ever-changing views about the future. The crowd is capricious, because the shares are much more volatile than anything that happens at the actual business. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. I like to buy stocks when the crowd is particularly down in the dumps about a given stock, because those expectations are easier to beat.

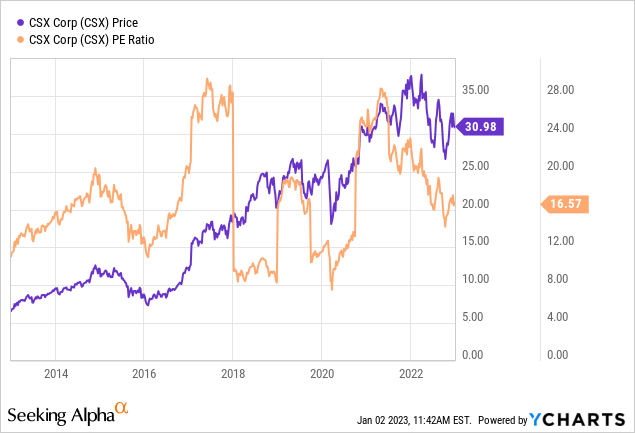

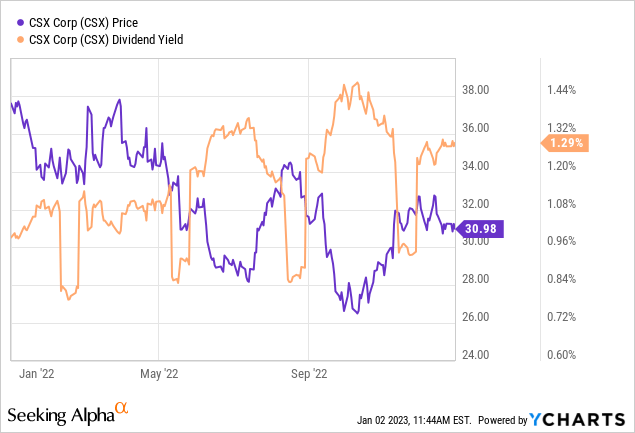

Another way of writing “down in the dumps about a given stock” is “cheap.” I like to buy cheap stocks because they tend to have more upside potential than downside. This is because much of the bad news has been wrung out of price. As my regulars know, I measure the cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the relationship of price to some measure of economic value, like sales, earnings, and the like. I like to see a stock trading at a discount to both its own history and the overall market. When last we met CSX, the shares were trading at a P/E of about 15.8, and sported a dividend yield of about 1.4%. They are now about 4.7% more expensive, and the dividend yield is about 8% lower per the following:

One more thing my regulars know is that I want to try to understand what the crowd is currently “assuming” about the future of a given company, and in order to do this, I rely on the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to CSX at the moment suggests the market is assuming that this company will grow profits at a rate of about 5% from here. In my view, that is a pretty optimistic forecast, even for a company with the moat that this one has. Given that I’m in the mood to preserve capital, I’m going to take my chips off the table at this point.

Options As Alternative

Just because I’ll be out of the stock doesn’t mean that there’s nothing to be done here. While I don’t like the stock at current prices, I’d be very happy to buy back in at the right price. Rather than sit around and wait for a correction that may never come, I’d rather sell put options at reasonable strike prices. The reason for this is that I think a short put is a “win-win” trade.

While I’m currently short CSX puts with strikes of $27.50, $25, and $22, so I won’t be selling more puts at the moment, but if you’re new to this party, I think there are great alternatives to stock ownership at current prices. Were I not already exposed to an irresponsibly large number of puts I’d sell the June CSX put with a strike of $25, which are currently bid at $.50. I consider this a “win-win” trade because one of two things will happen with these shares over the next six months. Either the shares won’t drop 20%, at which point the investor collects this premium and moves on. Alternatively, the shares may fall dramatically in price, in which case the investor will be “forced” to buy this company with its huge moat at the equivalent of a PE of about 13.3. Either outcome is great in my view. I’ll be making a similar trade after the 3rd Friday of this month when my options expire.

Welcome to the portion of the article where I get to remind readers about the risk of options trading. While I characterise these as “win-win” trades, this trade, like all others, comes with risk. I consider the risks associated with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, I would be very happy to buy much more CSX at $25, so I’d only sell puts at that strike at the moment. I would never advocate that people simply sell puts with the highest premia. In my view, that strategy would lead to disastrous results. So, dear reader, only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

Also, understand that put options are generally less liquid than stocks. That means that if you need to exit a position in a pinch, there’s a good chance that you will take a relatively large loss, given the large gap between bid and ask prices. While that’s less of a problem with CSX options, the bid-ask spread can be a “spicy meatball”, so you likely don’t want to ever be in a position where you’re forced to buy puts back. Thus, I would urge you to treat most options as though they were of the European variety, meaning that they can’t be traded until expiration.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on the upside. To use this trade as an example, let’s assume that some executive recognises that they’re bereft of new ideas decides to shake things up by putting in an offer to buy CSX. This will drive the shares higher. Obviously, in that happy circumstance, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upsides in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some more hopeful souls. Thankfully for me, my expectations have been so diminished by a life of trading that this isn’t really an emotional hardship for me.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me more than a few times over the years. While it always works out well because my strike prices are usually “screaming buys”, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. So, I can make a reasonable argument that CSX would be a steal at a net price of $24.50, but if the shares drop to $20, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

If you understand these risks and can tolerate them, I would recommend that you sell puts in lieu of buying shares. The return may be lower, but in my experience, this game isn’t about trying to capture maximum returns. It’s about trying to capture maximum risk-adjusted returns, and a deep out of the money put is a far less risky proposition than the stock in my view.