JHVEPhoto

It’s been a little over 10 months since I wrote my bullish piece on Discover Financial Services (NYSE:DFS), and in that time, the shares have returned about 7.8% against a loss of 8.7% for the S&P 500. A stronger, wiser man than me would not take this opportunity to brag, and bask in the warm glow of self congratulation. My regulars know of my odious tendency to brag, so I’ll indulge in it. I’m feeling good about this trade, but I’m left with the question of what to do now. The company has obviously reported earnings since, so I thought I’d review the name to see if it makes sense to buy more, hold, or take my winnings and run. After all, a stock trading at $118 is, by definition, a more risky investment than that same stock when it’s trading at $111. I’ll review the aforementioned earnings, and will compare those to the valuation. Additionally, the three January 2023 puts with a strike of $80 that I sold when I last reviewed the name have just expired, and I am absolutely giddy to write about how that trade worked out. This company has come back on my radar because my puts have just expired. Additionally, though, I’m growing worried about credit card default rates. I may be fretting needlessly, but I don’t like the look of this chart. I don’t know about you, but I see a very definite uptick in delinquencies recently.

I’m absolutely obsessed with making your reading experience as pleasant as possible. One of the ways I try to make things as nice for you as possible is to offer up a “thesis statement” paragraph at the beginning of each of my articles, which gives you the “gist” of my thinking up front. In this way, you can understand my thinking relatively quickly, while insulating yourself from my sometimes tiresome style. You’re welcome. Anyway, I think the financial results here have been fine. My problem is that the shares are not objectively cheap, and that’s enough to drive me away at the moment. I am worried about the state of the economy, and I think the January 2023 rally has gotten ahead of itself. For that reason, I’ll be taking profits here. Also, I’ve done very well on my deep out of the money put options here, including a batch that has just expired some weeks ago. My recent experience with them indicates the potential deep out of the money puts has for generating great risk adjusted returns. The problem is that the premia on offer aren’t sufficient to justify the exercise, so I’m inclined to sit on the sidelines until the shares drop in price from here. Deep out of the money puts still come with some risk, so it’s troubling to me that they’re yielding over 210 basis points less than the U.S. Treasury Bill.

Financial Snapshot

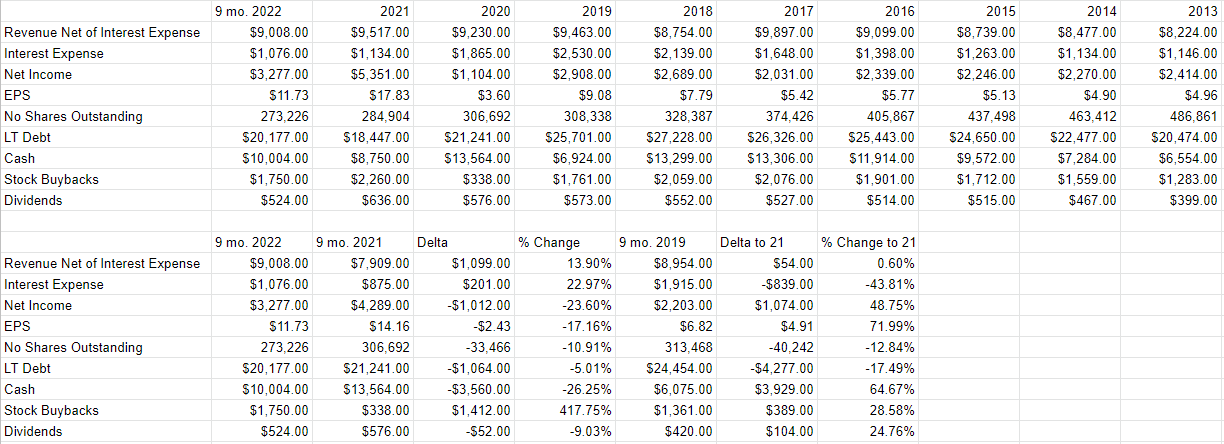

I think the financial history here has been generally good over the past year. Specifically, revenue for the first nine months of 2022 was up fully 13% relative to 2021. Net income was lower by $1 billion, but that was mostly a function of unrealised gains swinging from $562 million to the good in 2021 to a loss of $394 million in 2022. I don’t like the drop in net income, but I understand it as being driven by this dynamic. When compared to the pre-pandemic period, the financial results are also quite good. Although revenue is only marginally higher than it was in 2019, net income is up by about $1.07 billion, or 49%.

Additionally, the capital structure has improved, with long term debt down by about $1 billion, and now cash on hand represents fully 49.6% of outstanding debt. Thus, I don’t foresee a credit or solvency crisis here anytime soon. Given the above, and in spite of my ongoing fears of emerging credit issues in the economy, I’d be happy to buy more of this stock at the right price.

Discover Financial Financials (Discover Financial investor relations)

The Stock

As my regular readers know, I’ve talked myself out of some profitable trades with words like “at the right price.” In response to this criticism, I’d point out that I’m of the view that it’s better to miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product or service. The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future interest rates, the health of the economy, and so on. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. A reasonable sounding, if counterfactual, argument can be made to suggest that my Discover Financial investment would have done even better had the market not dropped since I bought last March. In any case, I’m of the view that the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. I absolutely hate to sound like I’m bragging about it, but this is exactly how I generated a very decent return on my Discover investment over the past year. The market was overly pessimistic, and I took advantage of that. I don’t want to be too repetitive, but in my view this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

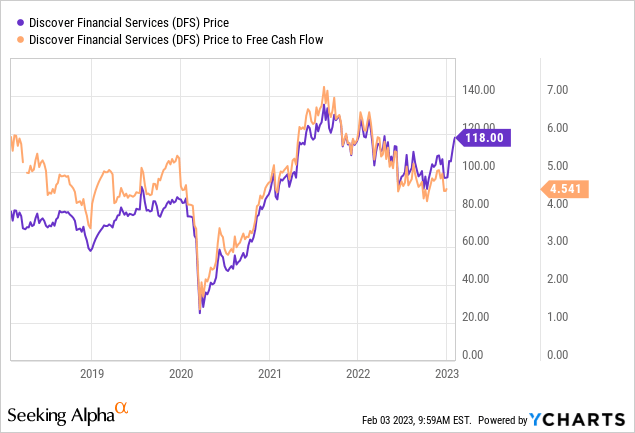

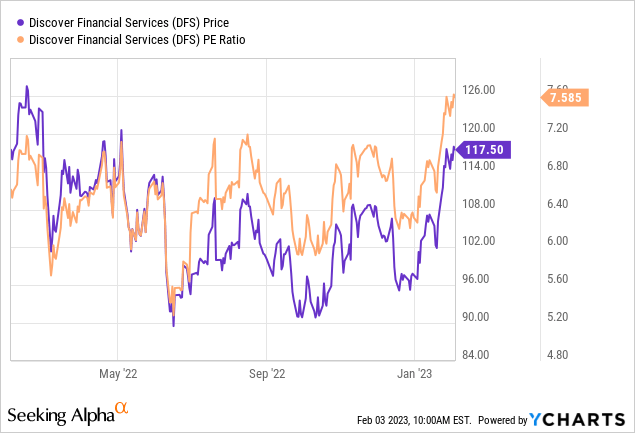

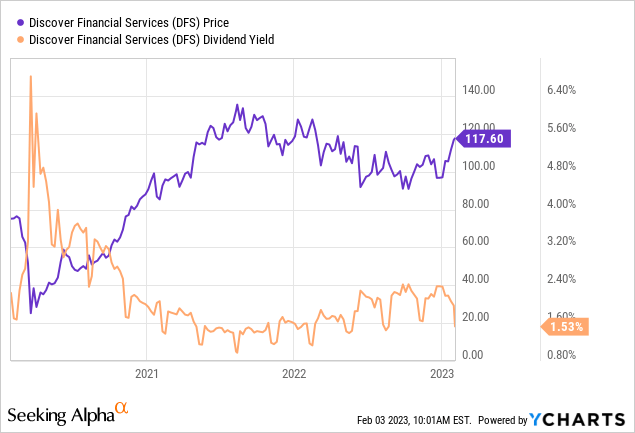

As my regulars know, I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you don’t have your copy of “Doyle’s Almanac of 2022 Trades” in front of you, I turned bullish on this stock when it was trading at a price to free cash flow of 5.833. The problem is that there’s no more free cash flow, so I need to rely on other valuation measures. I note that the market is paying more for $1 of earnings than it has at any time over the past year. This is troublesome in my view. It’s also concerning to me that the dividend yield is on the low end, and is currently yielding about 200 basis points less than the 10-year Treasury Bond.

One more thing my regulars know is that I want to try to understand what the crowd is currently “assuming” about the future of a given company, and in order to do this, I rely on the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of grade 10 algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Discover Financial Services at the moment suggests the market is assuming that this company will grow profits at a rate of about 1% from here. In my view, that is a pretty pessimistic forecast. This puts me on the horns of a dilemma. An argument could be made to suggest that the shares are inexpensive, and another could be made to suggest that they’re expensive, given that they’re yielding much less than the rather less risky 10-Year Treasury. Given that I’m in the mood to preserve capital, I’m going to take my chips off the table at this point. I may regret this move, as there’s a chance that the market price will rise from here. In my experience, though, what the market giveth, the market can very quickly taketh awayeth.

Options Update

My regular readers know that I’m also a big fan of selling deep out of the money put options. Way back in late March of last year, I sold three of the January 2023 Discover Financial puts with a strike of $80 for $5 each. These were 27% out of the money at the time, and they very recently expired worthless. Thus, my returns on this investment have been enhanced nicely. More importantly, in my view, the risk on these returns was much lower than it was on the stock. Some might suggest that I “drone on” about this point, but I gotta be me. I want to get across the idea that investing is not just about maximizing investment returns. It’s about maximizing risk adjusted investment returns. Deep out of the money put options are a great way to do this.

Although I like this strategy very much, obviously, I think, like with everything in investing, “there’s a time and a place.” Unfortunately, it’s not the right time at the moment, as the premia on offer are too thin to justify the exercise. “The juice isn’t worth the squeeze” as some might say. For instance, the January 2024 Discover Financial puts with a strike of $80 are currently bid at only $2.10. This represents a yield of about 2.6%, or about 210 basis points lower than the 1-year Treasury Bill. Although I like short puts a great deal, I’m going to have to sit on the sidelines at this point, and wait for any weakness in the shares before selling more of them.