da-kuk/E+ through Getty Pictures

It’s been about 40 months since I wrote my “keep away from the inventory” piece on Cara Therapeutics (NASDAQ:CARA) and since that point, the shares are down about 33% towards a acquire of about 66% for the S&P 500. That underperformance, pushed by some unwelcome take a look at outcomes, has me intrigued. Because the firm only recently launched monetary statements, I believed I’d evaluation the title but once more to find out whether or not it’s value investing or not. I’ll make this willpower by trying on the monetary historical past right here, and by trying on the inventory as a factor distinct from the underlying enterprise. Lastly, in my earlier missive on this title, I analogized this inventory to a lottery ticket, suggesting it will be a lot better for traders who insisted on staying lengthy to purchase calls, somewhat than shares. I need to write about how that commerce labored out, and need to supply up one other, related commerce. Because the tune says, “I gotta be me”, and I can’t not write concerning the threat decreasing, yield enhancing potential of inventory choices. You might discover my incessant want to put in writing about choices to be tedious. I encourage your indulgence, as a result of it’s one of many least damaging of my many habits.

It’s the twenty first of March, which means that it’s the primary day again after St. Patrick’s Day celebrations, and I’ll confess that I’m nonetheless a bit shaky. For that purpose, I need to get my ideas down on digital paper as succinctly as potential so I can begin nursing myself again to my model of “well being.” I’ll leap proper to the purpose on this thesis assertion. Aside from a fairly robust capital construction, I feel the monetary efficiency right here is pretty unhealthy. The corporate has been worthwhile in solely one of many previous 9 years, and house owners have been diluted massively. Moreover, plainly staff are doing a lot better than house owners, which isn’t preferrred for my part, because the latter tackle far more threat. That stated, the inventory in all fairness cheap, and for that purpose I’ll be taking a (speculative) bullish place right here. In spite of everything, in shares equivalent to this, the previous is much much less related. I’ll be expressing most of this bullish thesis through name choices. In my opinion, that is the wisest path as a result of they provide many of the return “flavour” with far much less threat “energy.” I additionally like name choices as a result of they oblige traders to evaluation and take a look at their funding theses way more incessantly than they in any other case may. So, particularly, I’ll be shopping for 300 shares and can put in an order to purchase 10 of the January 2023 calls with a strike of $12.50.

Monetary Snapshot

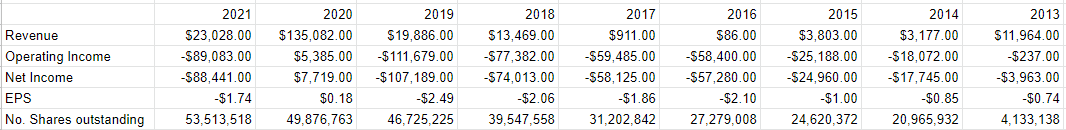

I perceive that many traders who purchase this form of enterprise don’t pay as a lot consideration to minutiae as money movement, and profitability. I do, although, so I’d beg your indulgence as I evaluation the monetary historical past right here. In my opinion, there’s not a lot to love right here. Each the highest and backside traces appear inconsistent. The corporate has been worthwhile one 12 months in 9, and in that 12 months, the margin was fairly skinny at 5.7%. On the identical time, the share rely has grown at a watch popping CAGR of ~33% over the previous 9 years, so traders are getting much less with every share purchased.

It’s not all darkish and stormy at Cara, although. The capital construction is extremely robust for my part. Specifically, the corporate at present has about $167 million in money and marketable securities, and complete liabilities are sitting round $19.5 million. Because the firm suffered a lack of ~$88 million in 2021, holding all else fixed, they’ve sufficient money available to fund one other two years or so. Moreover, the 84 staff on the agency took down $20.785 million in inventory based mostly compensation through the newest 12 months, so at the very least traders can take some comfort in realizing that at the very least staff are handled properly.

Cara Therapeutics Monetary Historical past (Cara Therapeutics Investor Relations)

The Inventory

The monetary historical past right here could also be troubled, however traders are clearly extra sooner or later than previously. That is why I need to spend a while trying on the inventory as a factor distinct from the underlying enterprise. The return you make from the funding, from this doubtlessly nice future, is basically a perform of the worth paid for that. In different phrases, there’s a powerful damaging relationship between the worth paid for a given inventory, and the following returns on it. I might proceed to drone on, and attempt to show this level theoretically, however the place’s the enjoyable in that? I’ll use Cara itself to display the purpose. The corporate launched earnings at first of March, so little or no has occurred on the enterprise between then and now.

If traders purchased instantly after earnings, they’re up about 14.5% as of now. Had somebody purchased the inventory on the eleventh, to select a date completely at random, they’re down about 3% since. Just about nothing occurred on the enterprise throughout this brief time span, and definitely not sufficient to warrant a 17.5% swing in returns. The comparatively excessive variance in efficiency in such a short while comes down fully to cost paid. That is why I strive, although don’t all the time succeed, to keep away from overpaying for a inventory, and demand on shopping for low-cost.

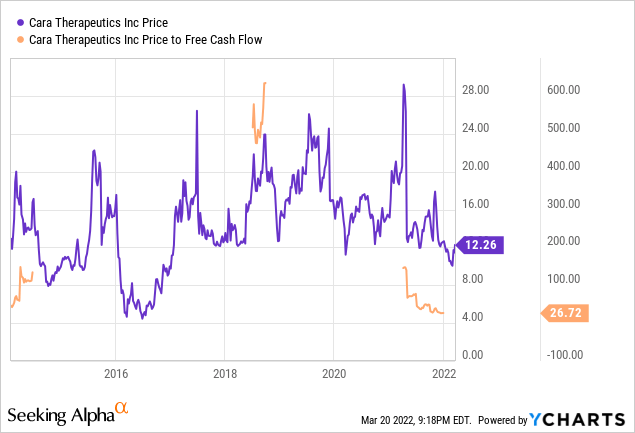

Because the individuals who learn my stuff repeatedly for some purpose know, I measure the cheapness, or not, of a inventory in a couple of methods, starting from the easy to the extra complicated. On the easy facet, I take a look at the ratio of worth to some measure of financial worth, like earnings, free money movement, e-book worth and the like. To bolster what I wrote above, there’s a powerful damaging relationship between worth paid and subsequent returns, so I need to see an organization buying and selling at a reduction to each the general market, and the inventory’s personal historical past. In case it’s not entrance of thoughts for you, expensive readers, in my earlier missive on Cara, I really useful avoiding the shares as a result of the worth to free money was egregiously excessive, properly north of 1,000. Issues have improved fairly considerably since then, per the next:

Supply: YCharts

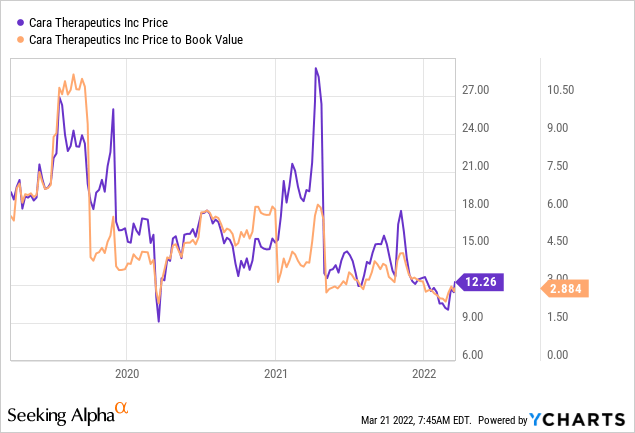

As well as, we see that the worth to e-book has improved fairly dramatically over the previous whereas, per the next:

Supply: YCharts

Admittedly these valuations could also be much less related for a “lottery ticket” inventory equivalent to this one due to the concept that the previous could also be far much less related than the long run. In spite of everything, the market might obtain a optimistic shock with the AD KORSUVA section III trial, which might possible trigger a bounce within the inventory. The previous would not’ actually give us any perception into this. That stated, the valuation displays the chance of success or failure in medical trails. If the market is properly pessimistic, the potential upside is much larger. The valuation is the one means by which we will measure the extent of optimism or pessimism within the shares, thus the ratios are related for my part.

My common victims know that I measure the optimism or pessimism implied by the inventory worth through the use of the work of Professor Stephen Penman and his e-book “Accounting for Worth.” On this e-book, Penman walks traders via how they’ll apply the magic of highschool algebra to a regular finance components to be able to work out what the market is “considering” a couple of given firm’s future progress. This includes isolating the “g” (progress) variable in a reasonably normal finance components. Making use of this method to Cara Therapeutics in the intervening time suggests the market is assuming that this firm will develop at a price of lower than 1% in perpetuity. I think about this to be a properly pessimistic forecast, and so for that purpose, I’m keen to take an explicitly bullish place within the shares.

Choices As An Different

In my earlier missive on this title, I really useful that traders who wished to specific a bullish thesis achieve this through name choices, in an article with the very authentic title “Cara Therapeutics: Swap to Calls.” In that article, I steered it will be higher for traders to purchase the Might 2019 name with a strike of $20 for $3.10 than to hold on to the shares that had been at the moment buying and selling for ~$18 per share. These calls expired nugatory, which is clearly not an excellent end result, however that efficiency is “much less unhealthy” than the efficiency of the inventory over time. In an organization equivalent to this, with such an unpredictable future, “much less unhealthy” is typically the most effective we will hope for.

With that in thoughts, I’d advocate shopping for the January 2023 calls with a strike of $12.50. These are at present requested at $3.80, which I think about to be a bit wealthy, so I’ll put in a very good til cancelled order to purchase at $2.50. If the shares really rise in worth over the following 10 months, the investor will seize a lot of the upside, with far much less capital in danger. If the shares languish right here, the calls will expire nugatory, however for my part, that’s a “much less unhealthy” end result.

I feel there’s one different level value making about my “calls in lieu of shares” technique. This can be one thing for biotech traders to contemplate. If a name expires nugatory, you’ve got the power to “re-up” by shopping for one other name, whereas nonetheless risking much less capital than you’d when you owned the shares. This makes the commerce much less dangerous by definition. Should you’re bullish on the title, or really feel {that a} buyout could also be within the playing cards, you’ll be able to stick with it this technique for years. That is nice as a result of it reduces capital threat, however there’s one other, extra refined profit that we should always think about. When a name expires nugatory, the investor is compelled to rethink the funding. In my opinion, that is an inherently optimistic train. After I was a stockbroker a few years in the past, I’d often meet a brand new shopper who owned a so-called “canine” of a inventory. They could have bought it a few years prior, however they only “knew” that it was going to come back again. Ultimately. Some day. In the meantime, the capital languished, and the chance price of the place grew. This self delusion isn’t potential with name choices. They expire, and it’s emotionally painful once they expire nugatory, however they protect capital they usually impose a extra frequent have to rethink funding choices. That is why I nonetheless advocate calls in lieu of shares for individuals who insist on staying lengthy right here. It’s how I’m going to specific most of my very own bullishness on this title.

Conclusion

I don’t have a crystal ball, and subsequently can’t predict how the gentle to reasonable astopic dermatitis trials are going to go. Neither do any of you. That is why I characterize shares equivalent to this as “lottery tickets.” Whereas I think about the inventory to be an unpredictable factor, I’m keen to take a small inventory place. Most of my bullish perspective will come within the type of name choices, although. Since I think about shares like Cara to be such unpredictable issues, I need to threat as little capital as potential, and I feel name choices are preferrred devices to specific this view. They offer traders many of the return “flavour” with far much less threat “energy.” For people who find themselves lengthy, I’d advocate a small inventory place, and the choices commerce I like to recommend above.