Marina_Skoropadskaya

Proudly owning high-quality dividend progress shares is a good technique for long-term minded traders with a very long time horizon. The power to place your cash to work and permit compounding to happen is an underutilized and underappreciated technique.

As a dividend investor, you usually pay attention to the most recent dividend enhance you see from a inventory you personal, rightfully so as a result of it’s moderately thrilling to know you’ll be getting paid extra within the subsequent 12 months primarily for doing nothing however investing within the inventory.

Dividend will increase are one factor, however steady and constant dividend progress is totally completely different. That is the place Dividend Aristocrats come into play. A Dividend Aristocrat is an organization that has elevated its dividend for 25 or extra CONSECUTIVE years.

Nonetheless, a constant dividend enhance is simply a part of the story, as previous efficiency doesn’t assure something sooner or later. As such, we nonetheless have to carry out our due diligence.

Dividend Aristocrats as a complete have been treading water on this downturn now we have seen within the higher indexes. The ProShares S&P 500 Dividend Aristocrats ETF (NOBL) is down 10% on the 12 months whereas the S&P 500 (SPY) is down over 20%.

In in the present day’s article, we’ll take a more in-depth have a look at a Dividend Aristocrat with a quick rising dividend.

A Overwhelmed Down Dividend Development Inventory

T. Rowe Value (NASDAQ:TROW) is the Dividend Aristocrat we will probably be taking a look at in the present day. TROW is a US Funding Administration firm that has an array of various monetary choices. Consider issues like 401(ok) choices, investor administration, in addition to advisory providers.

On the completion of the corporate’s Q1, TROW had $1.55 trillion in belongings underneath administration, or AUM. TROW earns a administration payment or advisory payment based mostly on their AUM, in order you may think about, because the account values of their traders fall with the market, so does the corporate’s administration payment income.

The autumn within the markets has been a serious a part of the story, as TROW shares have fallen 40% on the 12 months. When the pandemic hit and the federal government was printing cash left and proper, the inflow of latest retail traders was enormous, which vastly benefitted an organization like TROW.

That has all modified now because the Federal Reserve has gone from a close to zero price atmosphere and including cash to the provision to a financial tightening coverage the place they’re lowering the cash provide whereas growing rates of interest. The newest hike of 75 foundation factors was the most important one in 28 years.

This has in flip put stress on equities, however this isn’t the intent nor the priority of the Federal Reserve. The Fed is doing this so as to battle the report excessive inflation now we have been seeing, through which these insurance policies will battle to fight that, which is able to contain slowing the economic system.

With equities falling, many of those new traders haven’t skilled a bull market or actual recession of their lifetime. The 2020 “recession” was the quickest on report and fueled by a worldwide pandemic, however we’re pointing in direction of an everyday recession within the months forward, assuming it has not already begun.

This has led to large withdrawals from traders out of their investing accounts, negatively impacting an organization like T Rowe Value.

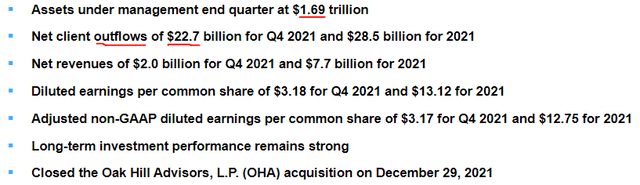

Here’s a have a look at the corporate’s This fall outcomes through which we see AUM of $1.69 trillion. Nonetheless, that is actually when the ache started for the corporate. As you may see on the slide under, the corporate noticed internet consumer outflows (cash being taken off their platform) of $22.7 billion in This fall alone, practically 80% of your entire outflows for the 12 months got here in that quarter alone.

TROW This fall 8K

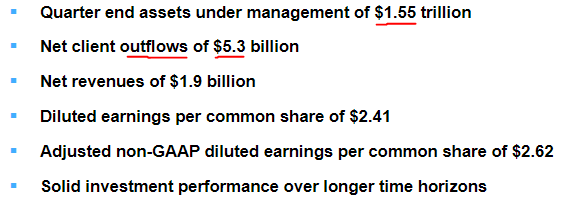

Bear in mind, decrease AUM means much less cash they will accumulate on administration charges. Quick ahead to Q1 2022, and we see AUM has fallen $140 billion and the outflows continued, albeit at a slower tempo, with $5.3 billion in money outflows.

TROW Q1 2022

Extra Ache Possible Forward

So the place does the corporate go from right here? Effectively, a lot of that will probably be predicated on the economic system and the higher inventory market.

Many economists are predicting a recession starting within the early components of 2023, however some consider it might have already begun. The strikes within the inventory market point out that traders are starting to cost this in, however this subsequent earnings season we’re about to embark on will probably be very telling.

We’re more likely to see corporations start to report the ache they’re seeing and revise their earnings estimates decrease, which is able to then result in analyst worth cuts that might add gasoline to the fireplace, sending the higher market decrease.

Extra ache out there means extra bother for an organization like TROW, which makes me consider the inventory may go decrease. Nonetheless, I’m seeking to layer into my place of TROW as a result of issues may change on a whim. You would get a Fed that reverses course (unlikely anytime quickly), or a stop hearth within the Russia/Ukraine Battle, or a slew of different issues that might ship this market increased on a dime.

Making an attempt to time the market is a tough factor to do.

Investor Takeaway

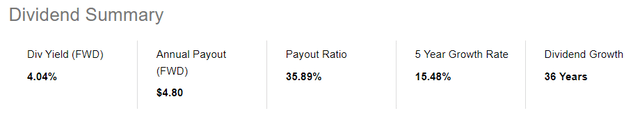

TROW is a good firm that may return with a vengeance. They’ve a fantastic dividend observe report that may reward you whilst you wait. The corporate has elevated their dividend for 36 years and counting. Over the previous 5 years, the corporate has a dividend progress price of 15.48%.

Searching for Alpha

Along with a powerful dividend progress observe report, you may acquire shares in the present day and earn an incredible dividend yield over 4%. That is the best yield you may have seen from the corporate.

You might be getting a high-yield, sturdy dividend progress, and constant dividend progress. Lastly, you’re getting a dividend that’s properly coated and prime for future dividend progress. The corporate at the moment has a payout ratio of solely 35%.

Undoubtedly check out T. Rowe Value so as to add on any pullbacks out there.