RiverNorthPhotography

Introduction

My primary investment vehicle is my dividend growth portfolio. It consists of ~80 securities with a long track record of dividend increases. I constantly look for fresh additions to my portfolio, return to my previous investments, and examine whether I should add to them. The current volatility in the financial sector allows me to try and capitalize on more attractive prices.

The volatility in the financial sector may be an attractive entry point for dividend growth investors. This is true, especially for T. Rowe Price Group (NASDAQ:TROW). The financial industry is suffering from a highly negative sentiment following the collapse of Silicon Valley Bank. Much more resilient banks have seen their share price decline, and other segments in the sector also suffered. T. Rowe is down 23% over the last twelve months, and it is time to revisit this dividend aristocrat.

T. Rowe will be analyzed using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

T. Rowe Price Group provides investment management services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed-income mutual funds. The firm invests in public equity and fixed-income markets across the globe. It employs fundamental and quantitative analysis with a bottom-up approach. The firm utilizes in-house and external research to make its investments. It uses socially responsible investing focusing on environmental, social, and governance issues. It makes investments in late-stage venture capital transactions and usually invests between $3 million and $5 million.

Fundamentals

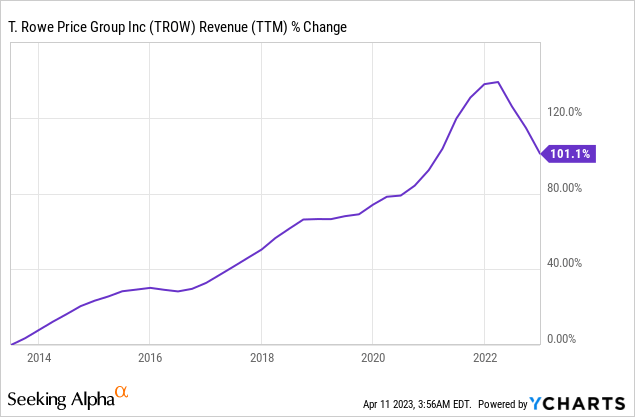

Revenues are up 100% over the last decade. The revenue increases are capital inflows into the funds together with capital appreciation due to strong investment and performance and the favorable stock market in general. The company relies on growing its AUM (assets under management) to increase sales. The current AUM stands at $1.31T. In the future, as seen on Seeking Alpha, the analyst consensus expects T. Rowe to show zero sales growth in the medium term as the economy slows down.

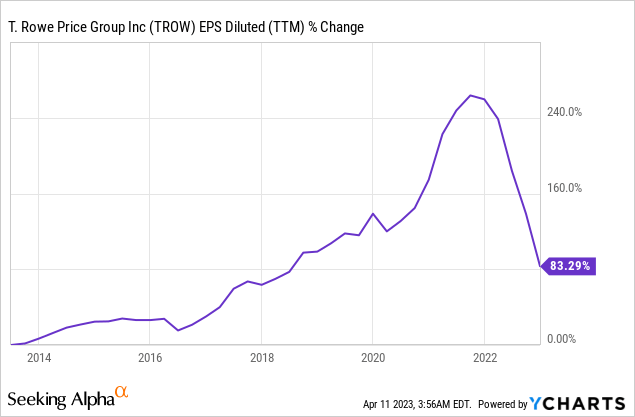

The EPS (earnings per share) has been growing much faster but declined faster when the stock market performance declined. This is due to the high beta, as T. Rowe as an asset manager, is highly sensitive towards market fluctuations as it shrinks its AUM and causes outflows which shrink the AUM further. T. Rowe supports EPS growth with cost-cutting and buybacks and will enjoy increasing EPS as the stock market and the economy recover. In the future, as seen on Seeking Alpha, the analyst consensus expects T. Rowe to suffer from a 2% annual decline in EPS in the medium term. The slide is expected in 2023 and is followed by recovery afterward.

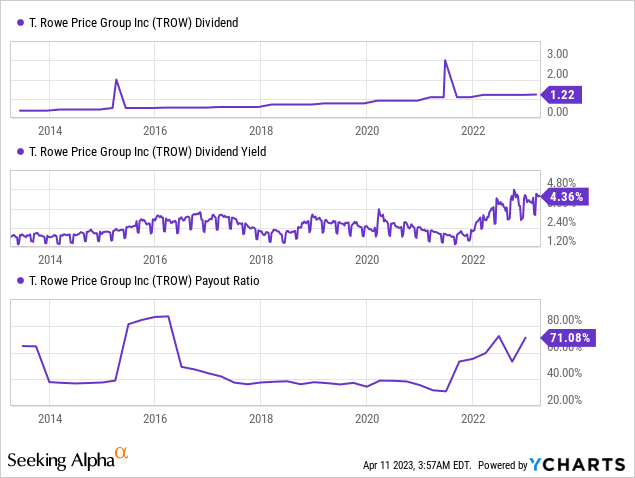

The company is a dividend aristocrat that has been raising its dividend annually for 36 years. It means that the company continued to increase the dividend despite high inflation in the 1980s and market crashes during the dot com bubble and the financial crisis of 2008. The current yield is attractive at 4.4% and seems safe despite the increasing payout ratio, as the company kept that wiggle room for that occasion.

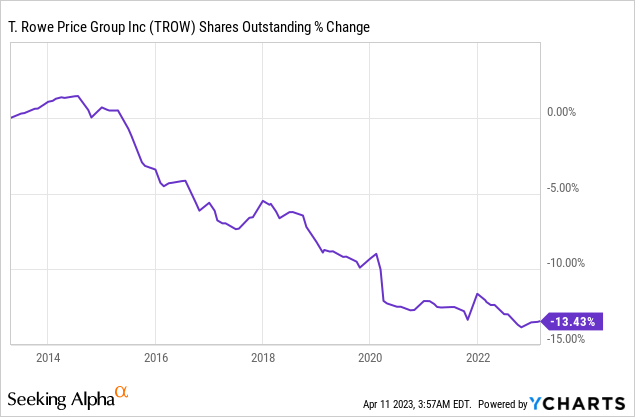

In addition to dividends, the company returns capital to shareholders via buybacks. Buybacks support EPS growth as they lower the number of outstanding shares. Over the last decade, outstanding shares decreased by 13%. Buybacks are highly effective when the share price is low and the valuation is attractive. Therefore, the current buyback plans exercised by the board should support future growth when markets recover.

Valuation

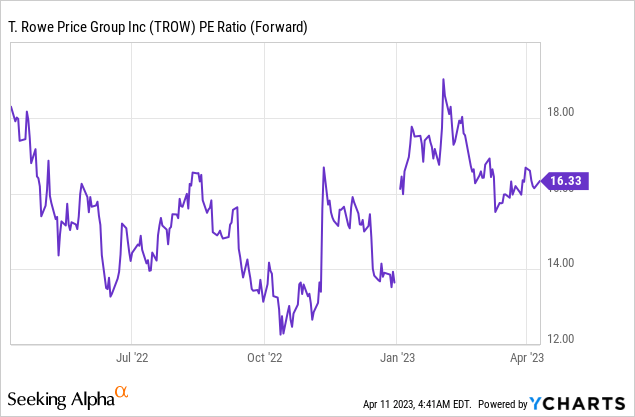

The company’s current P/E (price to earnings) ratio stands at 16.33 when considering the forecasted EPS for 2023. This figure is expected to be the lowest in the cycle as analysts expect EPS to grow in 2024. Paying 16 times earnings for a company with significant growth over the years and a decent dividend yield makes sense to me. As seen in the graph below, the valuation aligns with the valuation over the past twelve months.

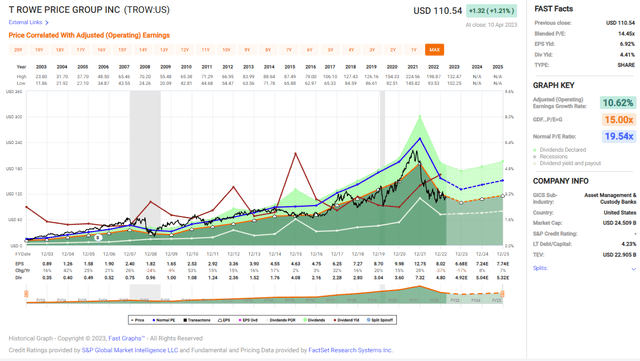

The graph below from Fastgraphs shows that the company’s current valuation is decent compared to the average valuation of the company. Over the last two decades, the average P/E ratio was 19.54, while the current is 16.3. However, during these decades, the company also enjoyed an average annual increase of 10.6% in its EPS. The current EPS forecast is for a decline in 2023, followed by slower growth. Therefore, the current discount is justified yet may be a good long-term entry point.

Fastgraphs

To conclude, T. Rowe has been one of the most resilient asset managers over the last three and a half decades. The company has enjoyed consistent sales growth and increased AUM, resulting in higher EPS and dividends. Investors in T. Rowe can now acquire more shares in what I believe to be a fair valuation as the company trades for a discount compared to its average P/E ratio.

Opportunities

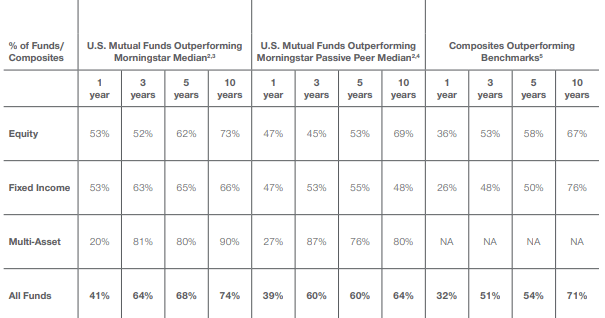

The company’s high performance is the most significant growth opportunity. T. Rowe Price Group is marketing great products to its clients. According to the company, over 70% of its funds outperform the benchmarks and the Morningstar median. Its ability to deliver significant returns with great advice to its clients and tailoring suitable portfolios to each need propels the company as we advance.

T. Rowe 2022 Annual Report

International expansion is another growth opportunity for the company. The company has excellent financial products, and selling them globally makes sense. Investors across the globe can enjoy steady returns with the company’s advisory services. The company has 17 offices outside the United States and has room to grow in growing markets like China and its new and developing upper-middle class.

T. Rowe Website

In addition to the geographical expansion, the company is also expanding its product offerings. The company has acquired Oak Hill Advisors, a leading alternative credit manager. It will help T. Rowe grow beyond traded securities and into alternative investments. In addition, T. Rowe has an outstanding balance sheet with zero net debt which will allow the company to acquire more peers in the future as companies suffer from a declining valuation.

Risks

Market conditions have a significant impact on the assets under management for the company. As interest rates rise and recession fears mount, investors may become more cautious, leading to a decline in the assets managed by T. Rowe Price. Moreover, the assets it already manages may shrink in value. Therefore, T. Rowe may face lower revenues and profits, impacting the share price.

Secondly, T. Rowe Price’s earnings per share are sensitive to market fluctuations, meaning the company has a high beta. It means that the company’s share price is likely to be more volatile than the broader market, both on the upside and the downside. The share price will suffer significant declines during market downturns. Therefore, this investment opportunity is not for the faint of heart. Investors should expect a bumpy ride as the economy seeks direction and the market together.

Moreover, the rise of passive investing has been a significant trend lately, with BlackRock (BLK) leading the way. As more investors turn to passive strategies, T. Rowe Price could see a decline in assets under management and sales. This could harm the company’s profitability and ability to gain new investors. If the trend toward passive investing continues, T. Rowe Price may need to adapt its business model to remain competitive.

Conclusions

T. Rowe Price Group is a great company. The company has excellent fundamentals with a history of growth across the board. It has a fortified balance sheet with zero net debt and trades for a fair valuation. In addition, the company is also enjoying some tremendous long-term opportunities as it expands its products and geographically.

However, there are some significant risks, especially in the short term, for investors in the company. The current business environment is challenging, and there is high uncertainty. Therefore, I believe that the shares are a HOLD until the economy stabilizes and we have a lower level of uncertainty towards additional rate hikes and a possible recession.

This is a downgrade from a year ago when I rated the company a BUY. Despite being at the same price roughly, I believe that shares are a HOLD today due to the higher probability for the risks to materialize. On the other hand, if the company’s price drops even more towards a P/E ratio of 12-13, the company may be interesting despite the uncertainty, as the future potential will be worth the elevated risk.