Joe Raedle

T-Mobile US, Inc. (NASDAQ:TMUS) is one of the leading telco operators in the US market, together with AT&T (T) and Verizon (VZ). Notably, the company is known for its 5G prowess, as it moved ahead of its keen competitors, taking the 5G leadership mantle against AT&T and Verizon. The company prides itself on its “un-carrier” approach, aiming to disrupt the traditional carrier model.

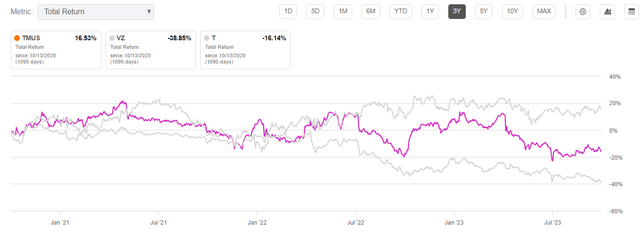

TMUS Vs. Peers (3Y total return %) (Seeking Alpha)

As such, I’m not surprised that the market has rewarded TMUS holders well over the past three years, as TMUS significantly outperformed its leading telco peers.

Furthermore, the company’s second-quarter or FQ2 earnings release in late July 2023 showed that its postpaid net adds and churn metrics have continued to outperform. As such, T-Mobile has fended off the competitive threat from cable operators such as Charter (CHTR) and Comcast (CMCSA), who have been encroaching on the turf of the telco players.

Management remains steadfast in its commitment to achieve its $16B to $18B in free cash flow or FCF outlook. The company’s recently announced $19B shareholder return authorization (shares repurchase and dividends) has likely assured investors that the company’s growth profile remains on track. Moreover, its adjusted EBITDA leverage ratio is expected to remain below its 2.5x target ratio over the next two years. Hence, I believe it sets up the company well to pursue growth opportunities, notwithstanding the high-interest rate regime that has battered rate-sensitive companies.

T-Mobile is scheduled to report its FQ3 earnings release on October 25. With TMUS holding close to its September 2023 highs at the $146 level, I assessed that investors have remained confident. Management’s robust capital allocation framework suggests that its shares are undervalued, underpinning investors’ confidence. The market has likely assessed that T-Mobile is expected to continue posting strong net-adds growth through the second half of 2023, continuing its solid performance in the first half.

Analysts’ estimates suggest that T-Mobile’s adjusted EBITDA margin is expected to continue improving through FY25, reaching 40% from this year’s estimated 37.4%. As such, the bullish thesis on TMUS should continue to see robust buying support on steep pullbacks if the company continues to execute well.

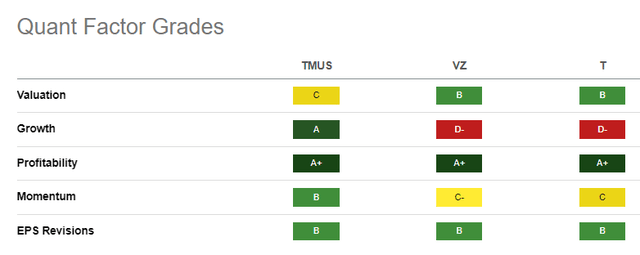

TMUS Vs. Peers Quant Grades (Seeking Alpha)

Given its outperformance, I’m not surprised that TMUS is priced at a premium against its leading telco rivals. However, with a best-in-class “A” growth grade, I gleaned that its “C” valuation grade suggests it isn’t aggressively valued. Even though Verizon and AT&T also boast sector-leading “A+” profitability grades, it’s clear that T-Mobile’s solid growth potential has kept investors onside, which can be assessed by its robust long-term uptrend.

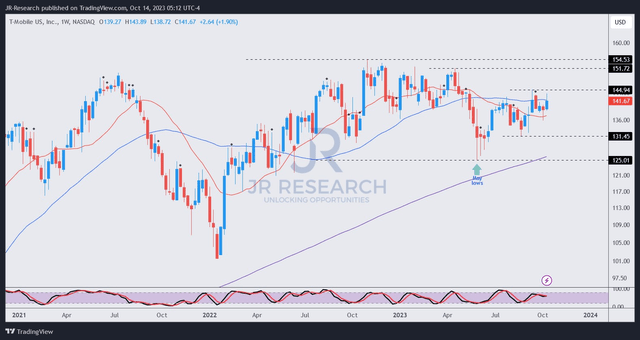

TMUS price chart (weekly) (TradingView)

I also gleaned that TMUS buyers returned with conviction at its May 2023 lows ($125 level) and helped stem a further slide. It has helped TMUS recover constructively toward its September highs at the $145 level.

However, that resistance zone has proved frustrating for buyers anticipating further upward momentum, which has since stalled.

Despite that, I don’t anticipate TMUS falling back toward its May lows, given the company’s solid execution and solid operating performance on its 5G leadership. As such, investors should consider the solid uptrend bias in TMUS to buy on steep pullbacks confidently.

Rating: Initiate Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!