New markets require new approaches and tactics. Experts and industry leaders take the stage at Inman Connect New York in January to help navigate the market shift — and prepare for the next one. Meet the moment and join us. Register here.

Technology makes it easier than ever for homebuyers to compare rates with different lenders before taking out a mortgage, but a surprisingly high percentage doesn’t bother, according to surveys by Fannie Mae and Zillow Home Loans.

Shopping around can save thousands of dollars, but about one-third of prospective homebuyers only get a quote from one lender — a number that’s hardly changed over time, according to eight years of data from Fannie Mae’s National Housing Survey.

One in three homebuyers don’t shop for a mortgage

Source: Fannie Mae analysis of National Housing Survey data

Zillow Home Loans found that, on average, consumers put more time into researching car purchases and vacations than they do mortgages. Prospective homebuyers spend about as much time researching a new TV as they do mortgage lenders, Zillow’s survey found.

Because rates and terms can vary by lender, researchers at Freddie Mac have estimated that borrowers can save an average of $1,500 over the life of the loan by getting one additional rate quote and an average of about $3,000 if they get five quotes.

Widely used technology, such as mortgage product and pricing engines make it easy for borrowers to get custom rates from multiple lenders, and credit bureaus won’t penalize borrowers who rate shop within a focused period of 30-45 days.

So why do homebuyers seem to be so lazy about shopping around for the best deal?

Fannie Mae found that 39 percent of recent homebuyers who only received one quote said they felt most comfortable with the lender to which they applied. Another 29 percent said they were satisfied with the first quote they received.

“Homebuyers, especially first-time homebuyers, may feel overwhelmed with the complexity of comparing the many components that make up mortgage costs, including interest rate, closing costs, and points across different mortgage offers,” Fannie Mae researchers said. “Behaviorally, consumers might prefer to make a quick decision and opt to go with their first mortgage quote.”

But that doesn’t explain why one-third of more experienced repeat homebuyers also only got one quote.

“Their rationalization for only getting one mortgage quote may be different – perhaps some repeat buyers may feel confident that they received the best deal from a lender they trust, or perhaps they’re less price sensitive,” Fannie Mae researchers speculated. “More behavioral research likely needs to be done to explain why repeat homebuyers seek mortgage quotes with approximately the same frequency as first-time homebuyers.”

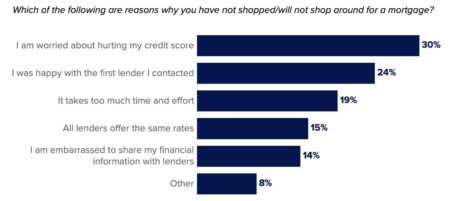

Reasons given for not shopping

Source: Zillow Home Loans survey

Zillow Home Loans’ survey of prospective homebuyers found that among those who had no plans to shop, 30 percent were worried that getting multiple quotes would hurt their credit score and 15 percent thought all lenders offer the same rates.

Neither of those beliefs is true, and the 19 percent who said “it takes too much time and effort” to compare rates may not be aware that many lenders and mortgage marketplaces can provide personalized rate quotes in minutes. The Consumer Financial Protection Bureau also offers a mortgage rate exploration tool powered by Informa Research Services, which collects the data directly from lenders.

Further innovation “to simplify the process by which consumers can compare mortgage quotes would help a substantial portion of homebuyers make better, more informed decisions,” Fannie Mae researchers said.

Zillow Home Loans’s survey was conducted online by The Harris Poll from Aug. 29-31, reaching 3,082 adults including 1,104 who were looking to buy a home in the next two years. The survey found 72 percent of prospective buyers hadn’t shopped for a mortgage and didn’t plan to do so, and that nearly half (46 percent) of prospective buyers who submitted applications for mortgage pre-approval only submitted one application.

“Home buyers should take the time necessary to make an educated decision on their mortgage,” said Zillow Home Loans Vice President Libby Cooper in a statement. “It’s often the largest financial decision someone makes.”

Homebuyers who get multiple quotes are “significantly more likely” to try to negotiate costs like their interest rate, origination fees, insurance and appraisal fees, Fannie Mae’s research shows.

A higher percentage of Hispanic homebuyers reported negotiating more costs, including mortgage rate and discount points than white or Black homebuyers, Fannie Mae said. Higher-income homebuyers were also more likely to report negotiating mortgage-related costs than lower-income homebuyers.

But hardly anyone shops for title and settlement services after receiving their lender’s closing cost estimate, with Fannie Mae finding 91 percent of homebuyers happy to go along with whatever their lender or Realtor recommends.

“Title companies, therefore, may experience very little competition from a cost perspective, particularly after they become a company that is frequently recommended by agents and lenders,” Fannie Mae researchers concluded.

The CFPB recommends that borrowers use their loan estimate to identify services they can shop for. Lenders are required to provide a list of companies that provide such services.

“Lenders or real estate agents might recommend providers they have a relationship with, but those providers might not offer the best deal,” the CFPB warns. “You can often save money by shopping around for closing services.”

For borrowers putting less than 20 percent down, shopping for private mortgage insurance could also save money.

Polly, a technology provider for mortgage capital markets, can serve up quotes from the nation’s six biggest private mortgage insurers within its product and pricing engine, helping borrowers assess their options and streamlining the mortgage insurance process for lenders.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter