z1b

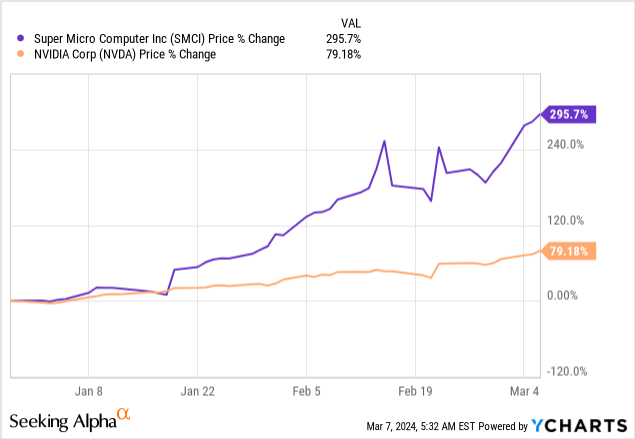

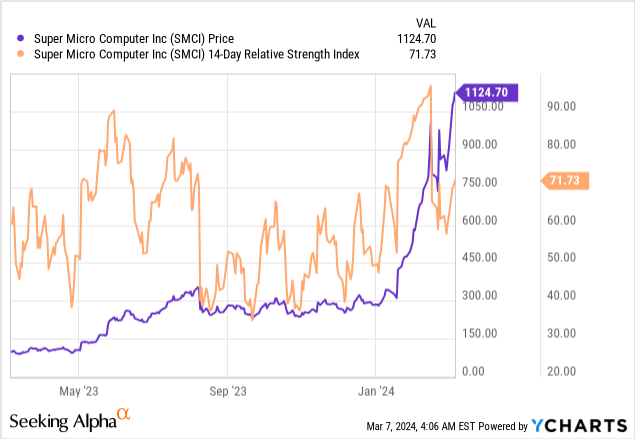

Shares of Super Micro Computer (NASDAQ:SMCI) have been on a tear this year, soaring 296% since the start of the year on strong growth results shown in the company’s FQ2’24 earnings card and surging investor interest in a company that is benefiting from the AI revolution. Super Micro Computer even out-performed Nvidia (NVDA) YTD and the company has just been included in the S&P 500 stock market index. While the IT solutions and server company has seen significant top line and earnings growth in the last year, I believe shares are likely overvalued as they trade at 6X the average P/E in the last three years. They are also overbought based off of RSI which represents correction risks and indicates that recent gains have been chiefly driven by FOMO-buyers. Although SMCI clearly has a lot of growth potential related to the mainstreaming of AI applications, I would caution against buying Super Micro Computer at the current valuation level!

Mainstreaming of AI has been an accelerant for Super Micro’s server business growth

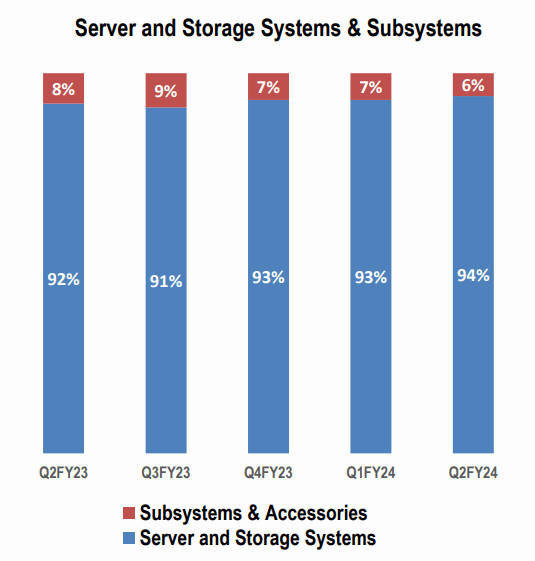

Super Micro provides IT solutions and builds server and storage systems for data centers. The company is providing server systems for a whole range of industries such as data centers, cloud, and edge computing. Server and storage systems, optimized to accommodate AI applications, have seen soaring demand lately which benefits Super Micro’s core product offering. Servers and storage systems represented 94% of Super Micro’s revenue mix.

Super Micro

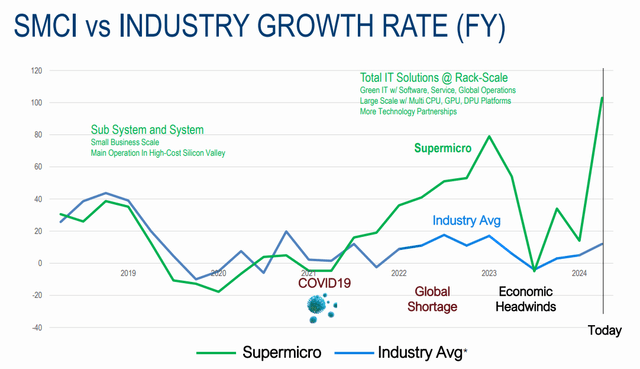

The main catalyst that Super Micro is seeing in its business is the mainstreaming of artificial intelligence applications, which is boosting the company’s AI-optimized server products, a core product that has emerged as a revenue driver for the company in the last year. This accelerating demand for AI-optimized servers has allowed the company to grow five times faster than the industry in the last year.

Super Micro

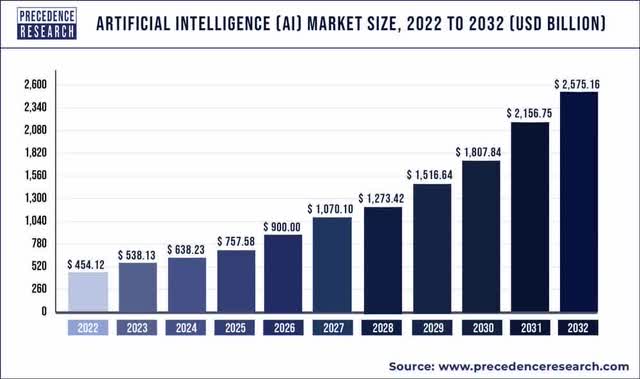

The market potential for AI computing solutions is obviously only growing. With more companies using artificial intelligence products in their businesses to capture cost-savings, scale their IT transformations and provide better and faster service to customers, companies operating in the AI realm are looking at impressive growth prospects, both in the short and in the long term.

Precedence Research projects that the size of the global artificial intelligence market is going to increase by a factor of 4.8X between 2023 and 2032. This implies an artificial intelligence market size of approximately $2.6T by 2032 which calculates to an annual average market expansion rate of almost 20% (Source). Companies like Super Micro and Nvidia, to name just two, are at the very center of this AI revolution.

Precedence Research

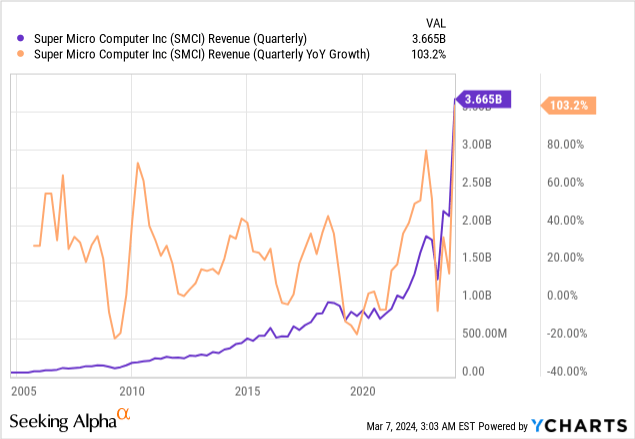

Super Micro’s has seen a significant acceleration of its top line growth most recently: the company’s revenue base doubled in its second fiscal quarter (the quarter ended December 31, 2023). Super Micro generated $3.7B in revenues in the most recent quarter, showing 103% year over year growth due to accelerating demand for AI servers. Demand is also much stronger than the company’s forecast for FQ2’24 indicated: Super Micro originally expected only $2.7-2.9B in revenues for the last year. Going forward, demand for server systems is unlikely to slow given the massive AI tailwind which in turn represents a growth opportunity for Super Micro’s core product.

These revenue achievements square with Nvidia’s results for the most recent quarter on which the company’s CEO, Jensen Huang, commented as the company seeing a “tipping point” in AI adoption. I discussed Nvidia’s revenue trajectory in my work: Lessons Learned From My Worst Call Ever (Rating Upgrade).

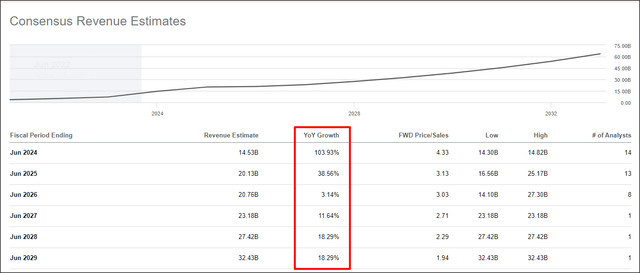

The outlook for revenue growth remains favorable with the consensus estimate currently calling for a doubling of Super Micro’s revenue base on a full-year basis. However, the company’s top line growth rate is set to normalize next year and the average annual revenue growth rate in the next five years is set to drop to 17% annually which is much closer to the AI market expansion rate.

Seeking Alpha

What I don’t like about Super Micro: weak gross profit margin trend

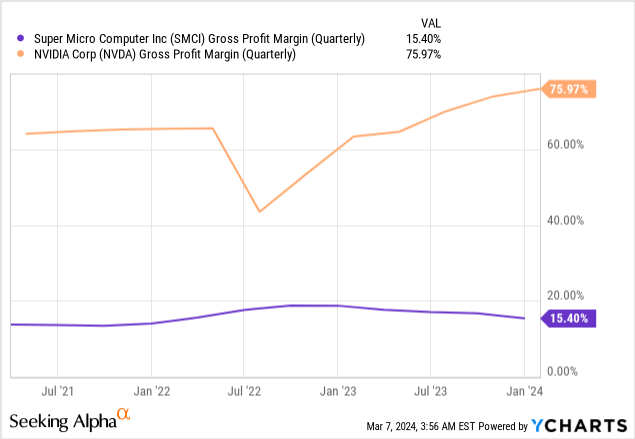

While the market outlook, the expanding size of the AI pie and Super Micro’s AI-supportive server systems are favorable developments, the firm’s margin situation does not look nearly as good… at least not when compared to Nvidia.

Nvidia’s gross profit margin as of the latest quarter was 76% which was almost five times higher than Super Micro’s gross margin of 15%. Additionally, Nvidia was able to translate its soaring revenue base into significant gross profit margin expansion in the last year (+12.7 PP Y/Y) while Super Micro’s gross profit margins declined in every single quarter (-3.3 PP Y/Y).

The reason for this is that Nvidia has gotten an early start with its H100 GPU that is being used to run AI applications which translated to significant pricing strength. Nvidia can charge top dollar for its GPUs and a general shortage of AI GPUs has only further established Nvidia as a market leader in this segment. From a gross margin point of view, I believe Super Micro leaves much to be desired…

S&P 500 index inclusion

SMCI made news after it was announced that the company is going to be included in the S&P 500 index, which many investors follow closely. S&P 500 index inclusion is typically a positive catalyst for shares due to their higher visibility for investors.

Super Micro’s sentiment and valuation

Shares of Super Micro have soared this year and are now overbought based off of the Relative Strength Index as well. The RSI (currently at 71.73) indicates that Super Micro is widely overbought right now which could foreshadow at least a minor correction to the downside in the near future.

Much more interesting than the technical profile is the valuation setup for Super Micro. Unfortunately, the recent price surge has completely decoupled Super Micro’s current earnings multiplier from the company’s past valuation averages.

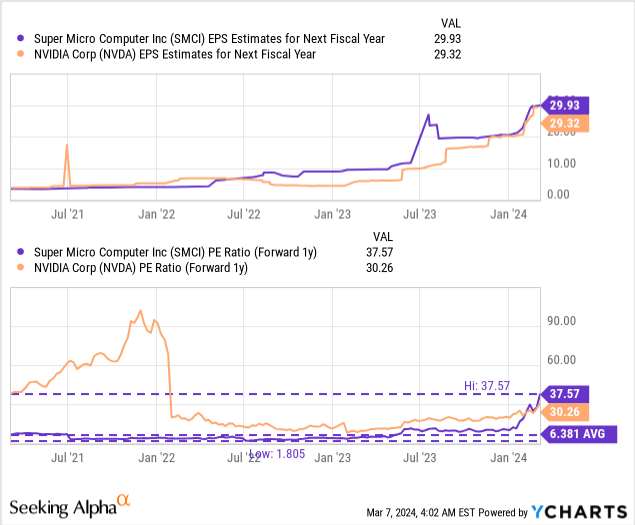

Super Micro’s valuation now also exceeds Nvidia’s valuation, although Nvidia has significantly higher gross margins and stronger incremental earnings potential as a result. Super Micro and Nvidia have about the same amount of per-share earnings expected for FY 2025, but SMCI is 24% more expensive than Nvidia, from a multiplier point of view.

Nvidia trades at 30.3X forward earnings compared to a P/E ratio of 37.6X for Super Micro. However, the overvaluation of SMCI becomes more apparent in the context of the company’s historical P/E: in the last three years, SMCI traded at an average P/E ratio of only 6.4X. The FY 2025 P/E ratio is nearly 5.9 times higher than the 3-year average P/E, indicating at Super Micro’s valuation is at least driven by speculation and hope for quick gains. I stated in my Nvidia article that a 25X P/E ratio may be more reasonable for Nvidia which I also happen to believe applies to Super Micro. A 25X “fair value P/E” implies a fair value of $750 at which I point I may consider buying into SMCI.

Risks with Super Micro

Obviously, the valuation is a big risk for the technology company. AI applications are growing and so is the demand for AI servers and GPUs, but at nearly 6 times the average P/E ratio in the last three years, investors are at risk of falling into a FOMO (fear-of-missing-out) trap. I believe the two biggest commercial risks for Super Micro at this point are slowing growth in the important AI server market and a continuation of the weaker margin trend. What would change my mind about SMCI is if the company saw gross margin expansion and if it maintained its top line momentum beyond FY 2024.

Closing thoughts

Super Micro’s shares have soared by almost 300% since January and while many seem to believe the rally will continue after the company has been included in the widely-followed S&P 500 index, my opinion is that investors are stepping into a FOMO trap and should pay attention to the company’s valuation.

With shares trading at 37X forward earnings, it seems to me that the firm’s growth is more than fully valued and shares are obviously at risk of profit taking. SMCI appears significantly overvalued in a historical context, but also relative to Nvidia which is significantly more profitable than Super Micro. While I don’t recommend to short Super Micro based off of its stretched valuation and overbought RSI status, I definitely would call for caution here. While the business does have momentum, a consolidation would likely offer investors a much better entry point into Super Micro!