RapidEye

Investment Thesis

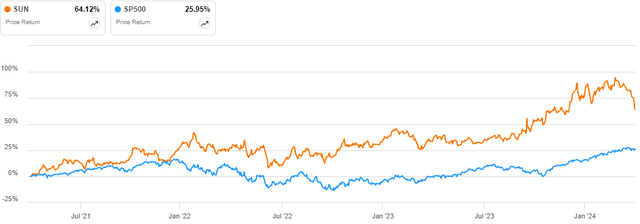

Sunoco LP Common Units (NYSE:SUN) has been on a bullish trajectory gaining about 64.12% over the last three years outperforming the S&P 500 by a margin of about 38%.

Seeking Alpha

Despite the solid upward trend, this stock has been experiencing a pullback over the last month but based on technical analysis the pullback is about to end and a trend reverse to the dominant bullish trend is imminent. I am bullish on this stock in the long term due to its stable business model and strategic growth. Given these factors, I rate this stock a buy because it is undervalued, and its dividend is attractive not forgetting the company’s good financial health.

Business Model & Strategic Growth

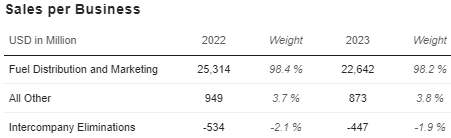

Sunoco together with its subsidiaries retails and distributes motor fuels in the US to about 10,000 customers including convenience stores, commercial customers, and independent dealers in more than 40 states in the US. The company operates through two major segments whose details can be found here. Below is the revenue contribution per segment with the fuel distribution and marketing segment being the core business segment accounting for more than 98% of total revenue for 2022 and 2023 FYs.

Market Screener

The company’s business model stability and strategic growth stem from its strong distribution network and strategic acquisitions. SUN operates a vast network of fuel stations and convenience stores a sector which is essential even during economic fluctuations because people and goods must transit. To be precise, the company serves about 10,000 customers as earlier mentioned, and it owns and operates 42 product terminals. Most interestingly, it is North America’s largest transmix processor. Due to its diversity, SUN was able to distribute over 8 billion gallons in 2023.

Given this diversity, this company has a stable business model which provides stable cash flow, something I believe is essential in maintaining its financial health. To support my assertion on the stability of this model and its consistency in cash flow generation; I draw your attention to the company’s operating cash flow, which has been increasing consistently since 2018, growing from a negative value of $26 million in 2018 to $600 million in 2023. In my opinion, this business model is not only stable but also resilient given the different challenges there have been, ranging from Covid-19 to geopolitical wars. For this stability and resilience, I am confident in the company’s future performance, and therefore my bullish stance firmly stands.

Besides the stable business model, SUN has made a smart strategic move with its recent acquisition of NuStar Energy in a deal valued at about $7.3 billion. This is a transformative deal that is aimed at expanding Sunoco’s footprint and diversifying its portfolio. Based on this acquisition, I find several strategic rationales and synergies that back my bullish outlook of this stock. Firstly, I expect this move to increase stability. It is without a doubt that the acquisition will diversify Sunoco by adding scale and leveraging the benefits of vertical integration. In terms of scale, SUN will benefit from NuStar’s extensive pipeline of about 9,500 miles and 63 terminal networks which will bolster its supply chain capabilities hence enhancing its model stability and potentially improving its cash flow generation.

Additionally, I will mention two of the potential benefits of vertical integration that SUN may enjoy from this acquisition. The first one is mitigating regulatory risk. Through an integrated structure, Sunoco can easily overcome the effects of regulatory changes by controlling more stages of the supply chain than it would be if they were standalone entities.

The second benefit would be efficient resource allocation. Through upstream and downstream integration, Sunoco can reduce operating costs such as negotiation costs, and costs related to managing separate operations therefore achieving an increased operational efficiency. These examples are just representatives of the many benefits of vertical integration.

Alongside these benefits of the integration, the acquisition comes along with a positive financial outlook. To begin with, it is immediately accretive with over 10% accretion to distributable cash flow per LP unit by the third year following its closure which is expected to be in the Second quarter of 2024. Further, it is accepted that there will be at least $150 million of run-rate synergies by the 3rd year after the closure of the deal. In terms of financial savings, the acquisition is anticipated to raise about $50 million per year of additional cash flow from refinancing a high-cost floating-rate capital.

Based on this background, I believe this is a good deal because, besides the many synergies ranging from financial to operational synergies, the deal will diversify Sunoco’s business model even further translating to more revenue streams which bodes well for its future cash flow generation, and financial health in general. In a nutshell, this deal could be a strategic move that will enhance SUN’s market position and financial health something I expect the market to reward with a higher valuation. Upon the completion of the deal, I expect investor confidence to be boosted thus attracting more interest in this stock something I believe will trigger a high valuation for this stock. All these factors point to a bullish outlook which aligns with my investment thesis.

Dividend And Financial Health

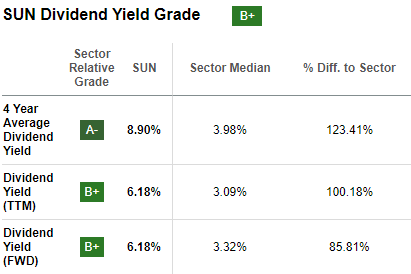

One of the attractive attributes of SUN is its dividend. First off, the company has paid dividends for 11 consecutive years, compared to the sector’s average of 3 years. Further, its dividend 10-year CAGR of 6.21% is way above the sector median of 1.13%. This not only makes SUN a reliable income payer but also a reputable one. To make it more interesting, its dividend yield is very appealing based on a 4-year average, trailing yield and even forward yield.

Seeking Alpha

Based on this background, I believe SUN is a good dividend stock given its lucrative yield, reliability, and reputation. However, considering that the company has a payout ratio of 92.53%, I believe the possibilities of short-term dividend growth are limited and therefore I believe this company will maintain its current dividend at least until the full completion of the NuStar acquisition whereby I expect the dividend to grow once the full synergies of the acquisitions are realized. That notwithstanding, at its current level, I still find it an attractive policy because it is way better than the sector average, especially considering its yield.

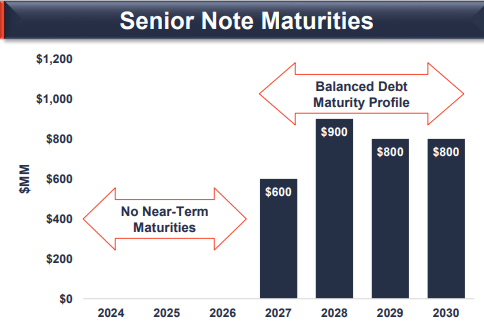

Another attractive attribute of SUN is its strong financial health. Although the company’s financial performance has been turbulent something which can be attributed to the market volatility, the overall trend shows a lot of resilience. With a 3-year revenue CAGR of 29.14% and a 3-year EPS CAGR of 31.37%, I believe the company’s strength in the sector is apparent. In addition, the company’s balance sheet and strategic decision solidifies its financial health. First off, SUN has total assets of $6.8 billion and a total debt of $4.11 billion. This reflects the company’s foundation and ability to leverage assets for future growth. Additionally, its total assets can cover its total debt by about 2x which is a safe position. Further, with a revolving credit facility of about $1.1 billion, the company has ample liquidity which offers them a lot of financial flexibility. Again, with an EBITDA of $815 million and interest expenses of $220 million, the company has an interest coverage ratio of about 4x which demonstrates its ability to cover its obligations. Most importantly, the company has no major debt maturities before 2026 and its maturities beyond 2026 are very balanced nullifying chances of default or a major financial burden in one single year.

SUN 2023 December Presentation

In summary, SUN has solid financial health, which I believe when coupled with its strategic acquisition positions this company for sustainable future growth. For this reason, I believe the market sentiments will improve because strong financials coupled with strong growth potential often lead to bullish market sentiments, thus pushing the stock price higher.

A Secure Future: Another Reason To Be Optimistic

While the company’s business model and acquisition are reasons enough to stake in this stock, I am also moved by its secure future. Firstly, the company has maintained a stable portfolio through its discipline when it comes to expenses which I find a core competence something I believe will contribute to long-term ratable income and margin stability. To be specific on its financial discipline, in 2019 SUN had total operating expenses of $623 million which was 93.7% of its adjusted EBITDA of $$665. This has improved to an adjusted EBITDA of $964 million in 2023 and total operating expenses of $737 million representing 76.5% of its adjusted EBITDA.

What inspires confidence in me is its future financial security. To secure its future, SUN has 7-to-10-year supply contracts with a retention rate of more than 90% which translates to high ratable volumes. In my view, this shows strong customer loyalty and a consistent revenue stream for the company. With such high retention long-term contracts, SUN is offered a predictable cash flow and a much reduced volatility associated with the fuel market something which alludes to a safe future. Most importantly, the contracts entail pass-through pricing mechanisms and cost-plus agreements which offer strong margin protection.

Additionally, Sunoco has an advantaged retail footprint in Hawaii where it operates almost 80 retail convenience store locations. This market offers SUN a competitive edge due to its isolated location and the constant demand for fuel. The advantages of Hawaii are the high volumes of tourism which ensure steady demand for fuel as well as the low competition due to the isolated location of the state. With this advantageous location, SUN is better positioned to exploit this market for its future success and growth.

Lastly, the company enjoys an exclusive presence along the NJ Turnpike which is one of the most traveled highways in the US. Its exclusivity in the region is marked by its ability to adjust fuel prices up to 3x in a week. The strategic position grants Sunoco the ability to cater to high volumes of travelers consequently providing a steady revenue stream and reinforcing its diverse market presence.

In summary, by striking a balance between the need for stable income streams with growth opportunities, SUN is creating a portfolio that can weather market fluctuations while leveraging growth opportunities. This strategy is enabling the company to have a secure financial future.

Valuation and Technical Take

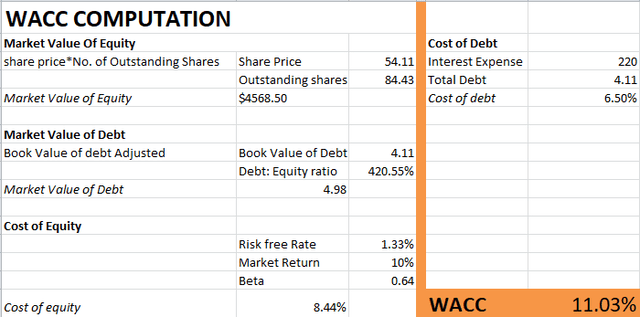

From a valuation perspective, SUN is significantly undervalued. This is based on my DCF model estimation. In my calculation, I assumed a growth rate of 10% which is conservative considering the company’s 5-year unlevered FCF CAGR of 18.6%. I used a conservative value to ensure the estimation is not over-ambitious. I also assumed a discount rate of 11% which is the company’s WACC based on my computation as shown below.

Author

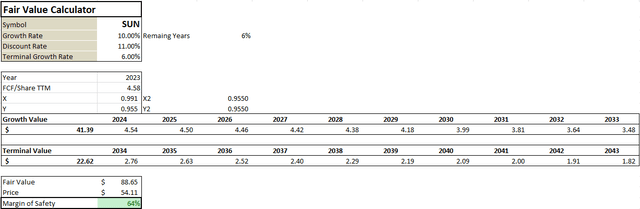

Given these assumptions and using the trailing FCF/share of $4.58 as my base case, below is my model output.

Author

Based on my estimation, SUN has a fair value of $88.65 which marks an upside potential of about 64%. To support my estimation, it also falls within range when I extrapolate the price assuming the forward PE of 8.79 and the projected EPS of $9.83 by 2029 which are independent estimates of Seeking Alpha. I adopted these independent estimates to evaluate how my estimated fair price compares to independent analysis. Using these inputs, I arrive at a potential price of $86.41 which is within range with my model estimation.

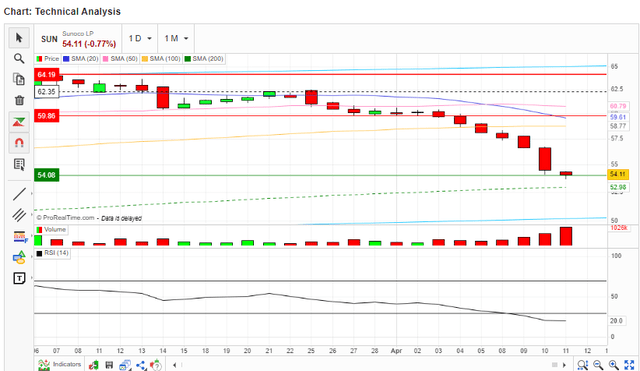

With these projections, let’s look at the price chart to make an informed decision. Looking at the price chart, this stock has been on an upward trajectory, but over the last month, this trend has been halted, and the stock moved downwards. From my observation, the current downward trend has been a pullback and not a dominant bearish trend. Looking at my analysis below, the pullback has hit its support zone, where I expect it to reverse and the bullish dominance to continue.

TradingView

To support my expectation of a trend reversal, I have considered the one-month analysis of the stock’s RSI, and it is apparent that this stock has been oversold in the last month and so it is about to reverse to a bullish trajectory. The RSI is currently at 20, which is way below the oversold region of 30, and therefore I expect the bulls to take charge.

Market Screener

In my view, the current pullback was a move by cautious investors to close some profits, especially considering that the stock has soared over the last 5 years, gaining about 76%. For this reason, potential investors should capitalize on the opportunity to enjoy the double-digit, as exhibited by my fair value estimation.

Risks

Although I am bullish on this stock, potential investors should be aware of the potential risk of investing here. One of the major risks of investing in SUN is its status of being a Master Limited Partnership [MLP]. Although MLPs offer tax benefits and high dividend yields, they are characterized by more complicated tax reporting requirements, which can be a deterrent to individual investors due to the likelihood of higher tax preparation costs. In addition, being an MLP, it is heavily involved in the distribution of fuel. This implies that changes in wholesale prices can impact its margins significantly. Although this risk is mitigated by the long-term contracts mentioned earlier, investors should keep a keen eye on any potential contract breaches or breakdowns because that could have a material impact on the company’s financial health.

Conclusion

In conclusion, SUN is a good investment opportunity for both dividend and value investors. It has a stable business model and strategic growth, which bodes well for its future growth. For investors interested in the energy market, Sunoco offers a promising avenue to fuel their investment portfolio’s growth.