By Peter Tchir of Academy Securities

The Fed Dot Plod

All of a sudden everyone seems to be elevating the variety of Fed cuts this 12 months and early subsequent 12 months. No doubt Friday’s job report was Weak with Few Redeeming Qualities. Whereas we argued that the Fed SHOULD have lower on the July assembly, there are a number of the explanation why the market could also be getting forward of itself when it comes to charge cuts and bond yields.

In any case, whereas final weekend’s title of Child Pool Closed for “Upkeep” could also be much more acceptable this weekend (clearly one thing is happening that markets don’t like), we’re going with the Fed Dot Plod, as a result of the Fed is now probably going to plod alongside slower than what the market priced in by the top of the week.

It’s considerably awkward to be bearish on the financial system, whereas anticipating the Fed to now disappoint, however we predict there may be proof to help it.

Jobs and the Fed

In response to Google developments, the “Sahm Rule” immediately attracted a whole lot of consideration. Powell even needed to reply a query about it in the course of the press convention. It is sensible that it will entice consideration, however let’s do not forget that it’s a “rule” solely on the planet of economics. Wherever else it will be conjecture, based mostly on logic, which has been helpful prior to now. Nevertheless, I’m sufficiently old to recollect when inverted curves have been a great rule of thumb to foretell recessions.

In any case, whereas Friday’s job report was not good, it’s questionable how a lot anybody information level will change the Fed’s view.

ADP, which got here out Wednesday forward of the FOMC announcement and press convention, got here in at 122k jobs. Headline NFP got here in at 114k jobs (even with 97k for the non-public sector). Since ADP modified its methodology to extra precisely predict NFP we must always assume that the Fed at the very least had an inkling that the report could be weak. As a aspect be aware, I want ADP saved their outdated methodology of attempting to trace what number of jobs have been created or misplaced based mostly on their distinctive information set as a result of I believe that it higher served market individuals.

We despatched out a fast be aware put up JOLTs that the Give up Fee was at 2.1, tied with final month for the bottom since Covid and worse than the two.2 common that we had in 2019. The Hires Fee was solely 3.4, the worst since Covid, and beneath the three.9 common in 2019. JOLTs was not robust. The “job openings” appeared okay, however we have now issues that it doesn’t do a great job of catching “ghost” jobs, “fishing” expeditions, and even these jobs that used to exist, however nobody has bothered to take away them from the job websites. The fee plan for a lot of websites/firms doesn’t create the inducement to take away job postings the way in which it used to with conventional/quaint approaches.

Whereas ISM employment was abysmal, what occurred to the entire individuals who as not too long ago as final month have been fast to level out manufacturing is simply a small a part of the financial system?

The case that the Fed ought to have anticipated weak point, even with comparatively little “new” info since Chair Powell informed the world that the labor market was in fine condition, appears at the very least considerably convincing.

Let’s not overlook that he repeatedly informed us that the Fed is not going to react to a single piece of knowledge.

Now, let’s transfer to the extra attention-grabbing, curious, and bizarre a part of this report – the willingness to consider in dangerous information.

The Willingness to Imagine in Dangerous Knowledge

The theme of “rubbish in, rubbish out” is a recurring subject in T-Experiences. What’s extremely regarding, from my perspective, is the willingness to take information that is perhaps questionable and use it to make coverage (or longer-term selections). For buying and selling, regardless of the quantity is, it would transfer markets. Nevertheless, and this hurts my head, that is partially as a result of we all know coverage makers take a look at the information as is, which lets algos unfastened to commerce on it. It is just over time that actuality hits and selections made based mostly on dangerous (or questionable) information change into obvious.

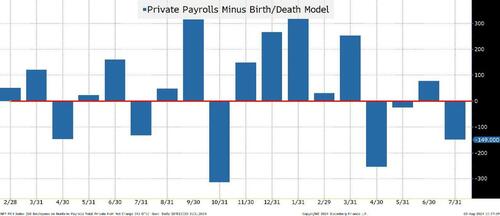

Right here we look at non-public payrolls versus the variety of jobs purportedly created (the start/demise mannequin). From January 2011 till February 2020 (simply earlier than Covid hit), we see comparatively few situations the place the variety of jobs created by the mannequin was higher than the variety of jobs reported (seems as unfavorable numbers on this chart).

It occurred 19 occasions out of 111 information factors (17%). The common for this era was 124k. Although you’ll be able to see that since 2016 the frequency has elevated, which we proceed to affiliate with the rise of the “gig” financial system creating many extra “self-employed” folks.

One thing appears to have occurred since February 2022. Sure the information is cherry-picked, however it’s fairly placing, and really completely different than something we have now seen prior to now decade throughout “regular” occasions (the Covid shocks make a large number of a whole lot of the information).

Since February 2023, 33% of the reviews could be unfavorable for personal jobs if it wasn’t for the start/demise mannequin. The common variety of non-public sector jobs (taking out the start/demise adjustment) dropped from 124k to 44k.

57% of all YTD jobs are statistical fakes, thanks solely to the Beginning/Dying adjustment pic.twitter.com/utYosI0k7S

— zerohedge (@zerohedge) August 2, 2024

I’m not arguing that the start/demise mannequin is sensible, however what I’m arguing is that it has change into a disproportionately giant contributor to the entire variety of non-public sector jobs.

Possibly it is sensible, or possibly the mannequin hasn’t been correctly calibrated to take care of work at home, the GIG financial system, or the shift from being workers to establishing LLCs, and so forth.

Whereas the Fed (and particularly the media) appears glad to take the NFP reviews on full religion and credit score, coloration me skeptical.

Only a fast be aware on “revisions.”

“2-month whole revisions” should have essentially the most up to date info because it offers extra time for survey responses to reach. In response to the BLS Survey Response Charges, the response charges stay low (I used to be targeted on employment, although CPI housing additionally caught my eye). Once more, what’s the “fudge issue” and the way good is the BLS at it?

When 2-month web revisions (a bit overstated, I believe resulting from double counting), we’ve had 14 of the final 18 months revised downward. That appears statistically unlikely. It additionally exhibits a slightly important variety of whole downward revisions.

The place I’m popping out on the roles information:

Preliminary, headline numbers – American Exceptionalism.

Wanting into particulars, analyzing developments on revisions, information “plugs,” and estimations – American “meh-ism.”

Within the U.S. you don’t convict somebody of against the law if there’s a “cheap doubt” so why would we make coverage on information that, at the very least for me, additionally creates a “cheap doubt”?

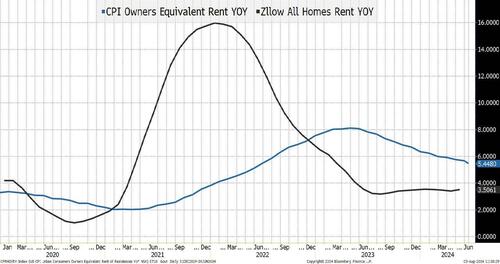

Talking of crimes, which information set do you consider? The CPI Homeowners’ Equal Lease or Zillow’s?

This chart appears to spotlight a couple of issues:

- The Fed was gradual to hike as a result of they have been utilizing information that was not capturing the transfer in rents! It’s virtually unimaginable to consider that anybody studying this report didn’t face this problem instantly, or with household or associates! Rents have been skyrocketing in 2021 whereas we have been nonetheless launched into QE.

- The “ache” the common particular person felt round inflation, which appears to point out up in sentiment surveys, appears to replicate the Zillow sample higher than the OER sample. Throughout the board, folks appeared to expertise a a lot larger degree of inflation in comparison with what really made it into the official information.

- Now, the OER is “catching up,” and we appear (at the very least to some extent) to be letting what is probably going a quantity larger than actuality have an effect on CPI – and in flip coverage.

Why we discuss CPI, the place shelter has a relative significance of 36%, with such apparent flaws, is past me! Supposedly, OER, at one time made sense, and was the very best we may do (we additionally used to need to lace up sneakers), however does it make any sense at present?

At Academy, we regularly focus on the danger of combating the final warfare, and not solely does the Fed appear to be combating the final warfare, however they’re additionally combating it with dangerous intel!

Ought to Versus Will

Clearly, we’re within the camp of they need to lower! That they need to have lower! That they’re behind the curve! So why are we hesitant to hitch the gang anticipating the Fed to immediately speed up their cuts?

The Fed, the media, and lots of others have been snug with taking information at face worth. So, why would they begin digging into this in additional element now?

The Fed has informed us, in no unsure phrases, that no single information level will outline coverage. They weren’t keen to chop on Wednesday and there actually hasn’t been that a lot “new” information.

The Fed (or at the very least sufficient influential members) has been so frightened of a resurgence in inflation that it appears tough to consider that they are going to do an about face and even panic any time quickly.

At this level, I do agree that enacting the Fed “Put” would set off inflation. Whereas I believe we’re seeing inflation come underneath management, and a few areas are even experiencing deflation, if the Fed does something that appears or smells like they’re desperate to embrace the Fed Put, we’d probably see inflation – beginning with danger property. They’re caught between a rock and a tough place when it comes to with the ability to be aggressive.

Nobody desires to confess they have been incorrect (clearly, I’ve to revise my goal on 10-year yields, as what seemed good 6 buying and selling days in the past, is not sensible now). That applies to the Fed as effectively. They only had their greatest stage. Fed audio system at the moment are on the circuit after the 2-day assembly, adopted by a 45-minute press convention. How do you again off these selections and phrases, when, for all intents and functions, nothing a lot has modified?

I’m fairly actually scared about how politicized any determination they make would possibly change into. It gained’t be a political determination on their half, however I believe a 50-bps lower in September would gas rage on social media which may spill into the actual world. Possibly I’m overestimating how strongly some segments of the inhabitants may be made to really feel a couple of charge lower when it comes to serving to or harming their candidate, however I’ve moved to trepidation (if not concern) on this danger.

Possibly we’ll get extra cuts (sooner), however the market received forward of itself.

Liquidity, De-Risking, Vol Promoting, and Extra

I’m getting uninterested in writing, and you’re in all probability getting uninterested in studying, and we’ve lined these earlier than, so we will probably be transient:

Liquidity. The world of algo-driven “fake” liquidity is being examined virtually every day (in each instructions) and it’s not going to get higher. Lack of liquidity works in each instructions – simply take a look at Wednesday’s inventory surge.

De-Risking. The ETFs I’m monitoring most intently confirmed blended outcomes early within the week, however moved in the direction of “shopping for the dip” because the week went on. XLK, QQQ, TQQQ, SQQQ, NVDL, and ARKK pointed to some danger taking and positively didn’t scream “capitulation.” That will result in a bounce, however I stay satisfied that the worst isn’t behind us.

Selecting up nickels in entrance of a steam curler. That may be a well mannered method of claiming considered one of my favourite Wall Road phrases – “Eat like a mouse, poop like an elephant.” Vol promoting has change into “de riguer“ on this market. Any self-respecting RIA has their shoppers promoting vol – instantly, through funds/ETFs specializing in these trades, and even, maybe unwittingly, in leveraged ETFs. Many write places as a result of “if the inventory will get there, you need to personal it in any case.” My view stays that what they actually imply is “if the inventory will get there, for no good purpose, you need to personal it” as most of the time value drops are related to unfavorable information that make what was at one time a great and apparent value a bit extra harmful. Additionally, it helps should you weren’t absolutely invested and didn’t write too many places, in any other case you would possibly must promote slightly than purchase.

The Japanese Yen. The power there may be sparking a whole lot of chatter in regards to the “unwind of carry trades” the place traders borrowed cheaply in depreciating yen to purchase different property. I’m by no means too certain how large or actual that danger is, however with the JPY appreciating virtually 10% in lower than a month it’s one thing to observe.

Faux passive. When indices, from slender to broad, change into closely concentrated in a handful of shares, your instinct on “passive” is prone to be incorrect. Promoting stress (which we’ve seen much less of than I’d have anticipated given the strikes) will hit the large leaders. Since momentum has been the very best issue, that leaves us open for extra promoting. Similar to inflows went disproportionately to a handful of firms enhancing their narrative, outflows can even hit them, by way of no fault of their very own, aside from the success of their shares. Hopefully, inventory pickers will win right here! Since June thirtieth, the S&P 500 equal weight index is up 1.5% whereas the common (market cap weight) index is down 2%.

Backside Line

The Fed will probably be extra “plodding” than what the market has priced in.

U.S. 2s vs 10s is the least inverted since June 2022. Proceed to search for “normalization” because the Fed can management the entrance finish, however not a lot on the again finish.

Whereas we had been in search of weaker financial information, I used to be shocked (painfully) by how shortly 10s moved and received beneath 3.8% to complete the week. I’m extremely bearish, at the very least for a commerce right here, as I can’t discover a purpose (in something I take a look at) to carry my vary beneath 4% – 4.2%. I must modify to the case that whereas we’ve been snug interested by a slowing financial system and decrease inflation, it was not as extensively held as we thought.

Shares. We proceed to suppose that we have now not seen the underside and that we’ll be decrease sooner or later in August than we’re at present (can’t low cost a potential bounce once more from right here, however am ready for decrease ranges to purchase this market). On the Nasdaq 100 the present goal is 17,500. Just under the 200-day transferring common, the place we’d count on help, although that’s nonetheless above the April nineteenth low of 17,000. If something, the danger of breaching that is still excessive. The S&P 500 is a bit trickier as it’s nonetheless above the 100-day transferring common, however 5,000 looks like a great goal (the 200-day transferring common and the April lows).

Purchase power right here on the current weak point. Sure, the financial system is slowing. There are an increasing number of questions on whether or not AI, Knowledge Facilities, and so forth., and all the pieces related to it (energy for instance) received forward of itself, however geopolitical danger is extraordinarily excessive and something we see on that entrance will result in provide shocks for power.

Credit score. Ought to outperform, however it would begin transferring far more in step with equities because the fairness transfer is beginning to replicate extra than simply valuation issues. Credit score spreads have been effectively protected in opposition to valuation issues however is not going to be as protected as we transfer into “bumpy” touchdown issues. Decrease Treasury yields gained’t assist spreads, and we must always see a a lot bigger than anticipated August calendar develop to benefit from the transfer in all-in yields.

Holy recession, Batman! We’ve been on the aspect extra involved in regards to the financial system for a while now. It felt like we have been swimming upstream at occasions, and Wednesday’s inventory surge felt like we have been swimming in a child pool “closed for upkeep.” Then immediately recession is on the tip of everybody’s tongue! Deservedly so, however wow, did that occur quick!

Good luck, as this summer time is popping extra turbulent slightly than much less turbulent!