Milko

Maintaining a Buy Rating for Structure Therapeutics Following the Positive Clinical Data Readout of GSBR-1290

In the fast-evolving world of therapeutics, Structure Therapeutics (NASDAQ:GPCR) has positioned itself as a front-runner in obesity management and type 2 diabetes (T2D) treatment. Recently, the company’s oral small molecule GLP-1, GSBR-1290, has shown promising results in recent Phase 1b studies, providing reason for optimism and the continuation of our buy rating. This thesis delves into the details of the recent clinical data readout, focusing on the efficacy, safety, and future prospects of GSBR-1290.

Please read our previous article for a more detailed analysis of the company’s platform and our thesis around the clinical readout.

Efficacy of GSBR-1290 in the Ph1b Study

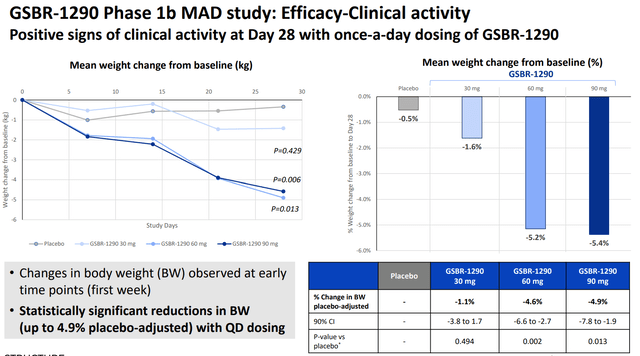

The recent Phase 1b data for GSBR-1290 revealed a remarkable pbo-adjusted weight loss of up to 4.9% at week 4. This was not only a positive surprise but also surpassed the benchmark set by competitor Eli Lilly’s (LLY) orforglipron. To put this into perspective, achieving approximately 5% pbo-adjusted weight loss at week four is noteworthy, given that the same percentage is typically set as a benchmark for a 12-week weight loss. This places GSBR-1290 at a vantage point and offers it an edge over contemporaneous market options.

Stat sig body weight reduction (Company IR deck)

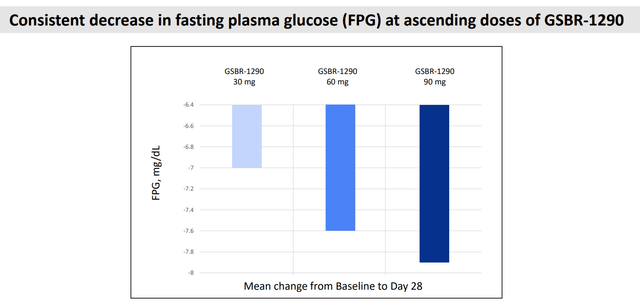

Additionally, we highlight that GSBR-1290 demonstrated a consistent decrease in fasting plasma glucose across ascending doses. This highlights its potential efficacy not just for weight management but also for glucose control, paving the way for its use in type 2 diabetes (T2D) patients, which is a highly attractive segment for a GLP-1.

Phase 1b: Fasting glucose level (Company IR deck)

Safety and Tolerability Profile

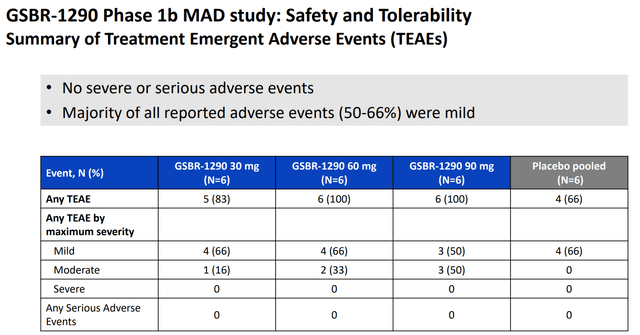

A major highlight of the study was the absence of any treatment discontinuation due to adverse events (AEs) and serious adverse events, which are usually considered red flags for early-stage clinical data readout. While there were some gastrointestinal side effects, like nausea, vomiting, diarrhea, and constipation, the majority of these AEs were mild in nature and presented no serious adverse events (SAEs).

AE summary (Company IR deck)

A nuanced understanding of the GI tolerability issues is essential. The company has previously indicated that dosing optimization could further enhance GI tolerability. This suggests that the current side effect profile can be improved upon, making the drug more patient-friendly.

Furthermore, the observed increase in heart rate, although consistent with other GLP-1 analogs, did not lead to any problematic symptoms. This aligns GSBR-1290’s profile with that of other drugs in its class, consolidating its safety profile.

The Way Forward: Addressing Delays and Data Omission

We believe the delay in Ph2a 12W obesity cohort data, which now pushes the expected results to 1H 2024, is admittedly a setback. This delay stems from a data omission issue, where weight loss data wasn’t collected for 24 out of 40 participants at the 12W mark. However, we believe the company’s agility in addressing this by enrolling replacement participants is commendable and do not believe that to be a meaningful overhang for the stock moving forward. More importantly, this delay isn’t drug-related, meaning the intrinsic value and potential of GSBR-1290 remain unhampered in our view. Furthermore, we believe the company’s decision to initiate two Phase 2b studies for GSBR-1290 during the second half of 2024 indicates their confidence in the drug’s profile and its promising future market potential moving forward.

Risks

Investing in Structure Therapeutics, as with any pharmaceutical entity, comes with its own set of risks. Firstly, the company’s pipeline hinges significantly on the success of GSBR-1290, and any unforeseen adverse outcomes or regulatory hurdles could negatively impact the stock’s value. The recent delay in Ph2a 12W obesity cohort data, though not drug-related, underscores the unpredictability associated with clinical trials and the possibility of further delays or data omissions. Moreover, the competitive landscape of obesity and T2D treatments means GSBR-1290 needs to continually demonstrate superior efficacy and safety profiles against existing and upcoming drugs. Additionally, the company’s financial health, regulatory changes, patent protections, and the global economic environment can all influence the stock’s performance.

Conclusion

In light of the impressive recent clinical data readout, the efficacy and safety profile of GSBR-1290, coupled with Structure Therapeutics’ commitment to navigate through clinical challenges, we reaffirm our speculative buy rating. The drug’s potential in addressing obesity and its promise in T2D treatment underscores its value in the current therapeutic landscape, especially considering T2D and obesity are major determinants of health in the US (the biggest biopharmaceutical market in the world). As we await further data, especially from the upcoming Phase 2a diabetes cohort expected in 4Q23, our conviction remains steadfast. Structure Therapeutics, with GSBR-1290, is well poised to make significant strides in the medical arena. Furthermore, the robust cash runway of $224m (by the end of Q2 2023) is almost three years of cash runway for the company considering the company’s $71M TTM cash burn, which gives us a high degree of comfort as the potential risk of dilution through public raise is low at this point.