In the past week the Benchmark indices, Sensex and Nifty 50 declined 0.7 per cent each respectively. Most of the sectoral indices ended in red. BSE Realty declined the most by 4.3 per cent followed by BSE PSU -1.8 per cent, BSE Bankex -1.7 per cent. BSE IT and BSE Teck gained 3 per cent and 2.1 per cent respectively.

Among the BSE 500 stocks, the top gainers with fundamental news driving the shares were Indian Railway Finance Corporation (IRFC), KSB Limited and India Bulls Housing Finance Limited.

IRFC

The stock of IRFC returned 18 per cent for the week ending on August 4,2023. The highest single day gain of the stock (12.5 per cent) was on August 3,2023 amidst the market buzz that Indian railways plans to procure 60,000 wagons in July-September quarter worth ₹25,000 crore. This Capex plan will benefit companies like RVNL, IRCON, RailTel etc. These companies will require additional funds to meet such huge orderbook requirements and therefore, IRFC is expected to do good.

Indian Railway Finance Corporation (IRFC) was set up on 12th December 1986 as the dedicated financing arm of the Indian Railways for mobilizing funds from domestic as well as overseas capital markets. IRFC is a Schedule ‘A’ Public Sector Enterprise under the administrative control of the Ministry of Railways, Govt. of India. It is also registered as Systemically Important Non–Deposit taking Non-Banking Financial Company (NBFC – ND-SI) and Infrastructure Finance Company (NBFC- IFC) with Reserve Bank of India (RBI).

The trailing 12 months PE of the company is 9.29 times whereas the price to book ratio of the company is 1.29 times.

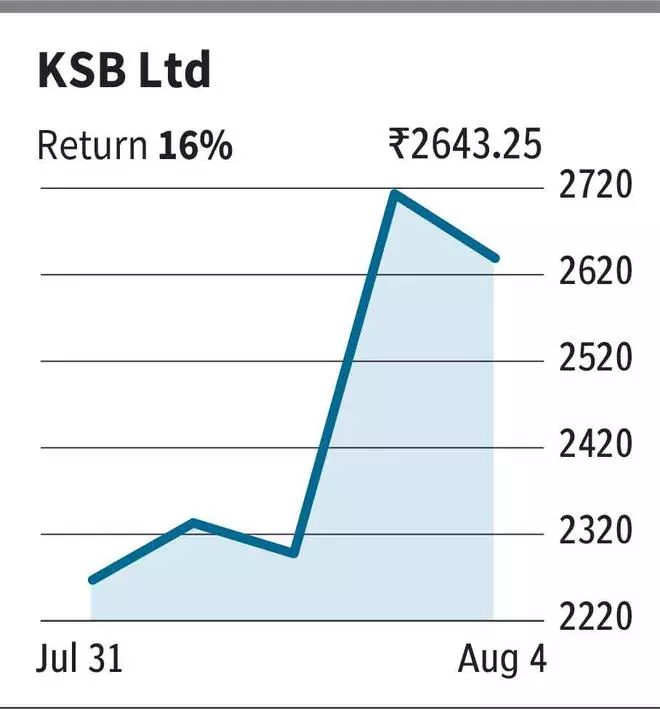

KSB Ltd

KSB is a pump and valves company which gave returns of 16 per cent for the week ending on August 4,2023. The highest single day gain of the stock (18 per cent) was on August 3,2023. The main reason for the rally in the stock was the positive June 2023 quarter results. The company registered revenue growth of 27 per cent YoY in June 2023 quarter to ₹591.3 crore. The net profit of the company also grew 29 per cent YoY to ₹62.8 crore.

The trailing 12 months PE of the company is 50.35 times whereas the price to book ratio of the company is 8.05 times.

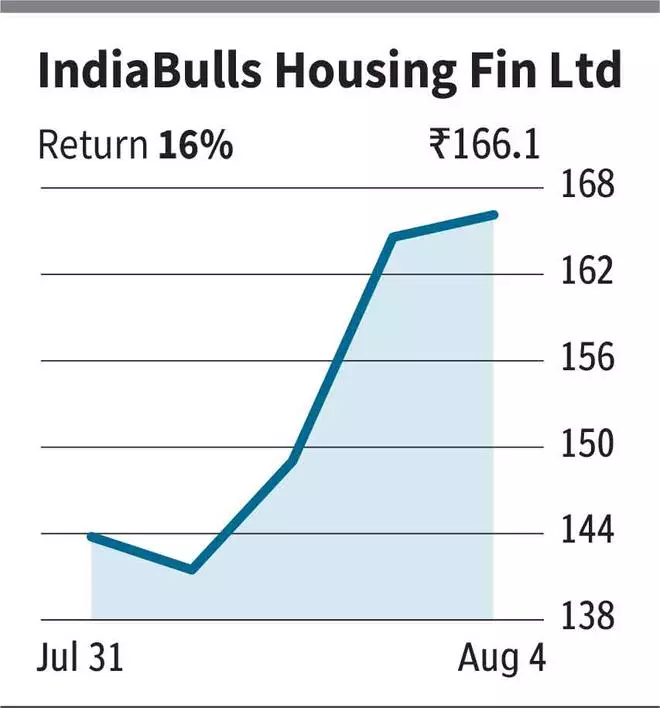

Indiabulls Housing finance Ltd

The stock of Indiabulls housing finance returned 16 per cent for the week ending on August 4,2023. The highest single day gain of the stock (16.3 per cent) was on August 3,2023. The main reason for the rally in the stock seems to be the outcome of its board meeting on July 28,2023 where it decided to raise funds through NCDs and announcement of final dividend. With this the company has resumed dividend payment after a gap of two years. The company in its board meeting approved to raise funds through issue of NCDs amounting to ₹ 35,000 Crore with an intent to grow its loan book

The trailing 12 months PE of the company is 6.95 times whereas the price to book ratio of the company is 0.45 times.