(Bloomberg) — European stocks climbed, bolstered by signs China’s stimulus measures are seeping through into the economy, and wagers that global interest rates are approaching a peak.

Most Read from Bloomberg

The Stoxx 600 gauge rose 0.4%, paring some earlier gains. Sectors leading the advance included mining as as rallying metals prices lifted shares including Rio Tinto Plc, Glencore Plc and Anglo American Plc. A gauge of consumer goods stocks, deriving a chunk of its sales from China, also climbed.

Energy shares were steady, as oil prices eased after earlier hitting their highest levels since November on expectations of supply cuts from the OPEC+ producers group.

Among individual movers, Danish drugmaker Novo Nordisk A/S rose to a new record high, having just become Europe’s most valuable firm. Carmaker Mercedes Benz Group AG added more than 1% after unveiling a new, longer-range electric vehicle.

US markets will be shut Monday for the Labor Day holiday, but futures advanced after the S&P 500 Index posted its best week since June.

Market sentiment got a boost from Friday’s US jobs report that showed a steadily cooling labor market, offering the Federal Reserve room to pause rate increases this month. Markets built on those gains after news of a weekend surge in home sales in two of China’s biggest cities, an early sign that government efforts to cushion a record housing slowdown is helping.

Shanghai and Beijing are seen benefiting the most from authorities’ announcement on Thursday that lowered down-payment thresholds across the nation. The Hang Seng index jumped more than 3% Monday before paring gains, while a Bloomberg gauge of Chinese developers jumped as much as 8.7%.

“We have been looking for more significant property rescue measures for some time to shore up sentiment and consumer confidence,” UBS Global Wealth Management Chief Investment Officer Mark Haefele said. “This now appears to be materializing in a more convincing way.”

Oil prices steadied, with WTI crude flat around $85. per barrel, after climbing last week on Russia’s announcement that it will extend export curbs. Saudi Arabia — which along with Moscow sets the tone at the OPEC+ alliance — is widely expected by traders to follow suit by pushing its voluntary curbs into October.

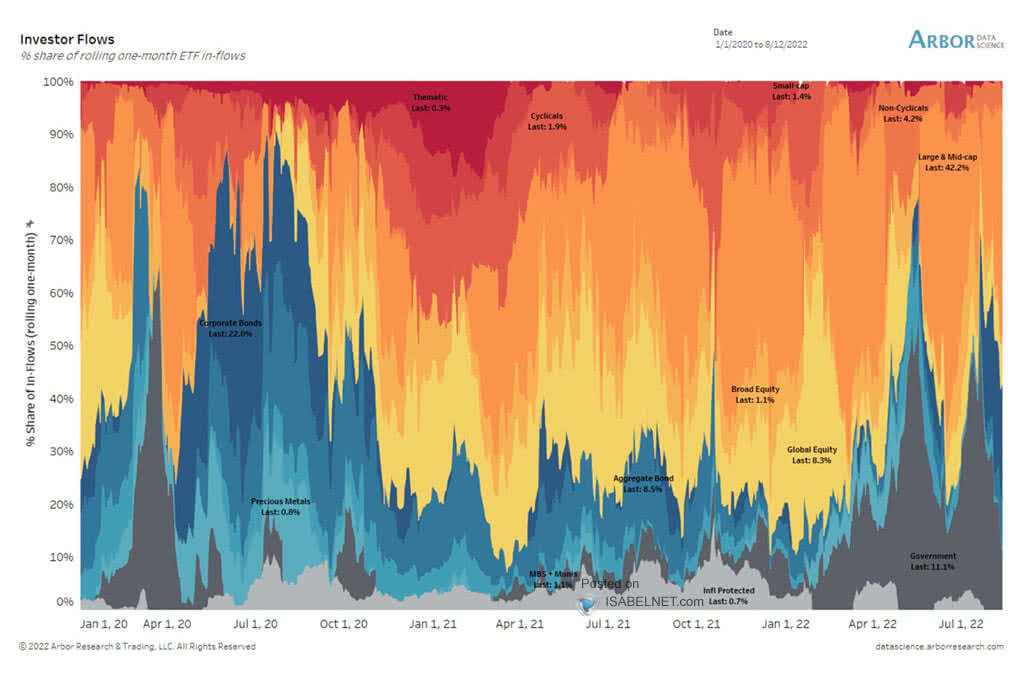

Bond yields inched higher in the euro zone, with rate-setters seemingly divided on whether policy needs to be tightened further this month, given above-forecast inflation and sluggish growth. In the US, many bond investors see the Fed’s 18-month tightening cycle as finally ending, bets that were reinforced after last week’s jobs data.

“The incoming data supports our view of a ‘softish’ landing for the US economy,” Haefele of UBS said.

At the same time, this year’s US stock market rally is strong enough to withstand another leg higher for bond yields, according to the latest Markets Live Pulse survey.

Central banks in Australia and Canada are expected to keep interest rates unchanged this week.

Key events this week:

Labor Day holiday in US and Canada, Monday

ECB President Christine Lagarde makes speech at seminar organized by the European Economics & Financial Center, Monday

Australia current account, rate decision, Tuesday

Japan household spending, Tuesday

China Caixin services PMI, Tuesday

Eurozone S&P Global Eurozone Services PMI, PPI, Tuesday

US factory orders, Tuesday

ECB President Christine Lagarde chairs panel focused on central banks and international sanctions at ECB Legal Conference, Tuesday

Australia GDP, Wednesday

Eurozone retail sales, Wednesday

Germany factory orders, Wednesday

US trade, Wednesday

Canada rate decision, Wednesday

Bank of England Governor Andrew Bailey testifies to the UK parliament’s Treasury Select Committee, Wednesday

Federal Reserve issues Beige Book economic survey, Wednesday

Boston Fed President Susan Collins speaks on the economy at New England Council, Wednesday

China trade, forex reserves, Thursday

Eurozone GDP, Thursday

US initial jobless claims, Thursday

Bank of Canada Governor Tiff Macklem to speak on the Economic Progress Report, Thursday

New York Fed President John Williams participates in moderated discussion at the Bloomberg Market Forum, Thursday

Atlanta Fed President Raphael Bostic speaks on economic outlook at Broward College, Thursday

Japan GDP, Friday

France industrial production, Friday

Germany CPI, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.4% as of 1:27 p.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.2%

The MSCI Asia Pacific Index rose 1.1%

The MSCI Emerging Markets Index rose 1.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.0799

The Japanese yen fell 0.1% to 146.41 per dollar

The offshore yuan was little changed at 7.2717 per dollar

The British pound rose 0.3% to $1.2624

Cryptocurrencies

Bitcoin fell 0.7% to $25,860.94

Ether fell 0.7% to $1,631.36

Bonds

The yield on 10-year Treasuries was little changed at 4.18%

Germany’s 10-year yield advanced two basis points to 2.57%

Britain’s 10-year yield advanced one basis point to 4.44%

Commodities

This story was produced with the assistance of Bloomberg Automation.

–With assistance from John Cheng and Tassia Sipahutar.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.