A UnitedHealth Group health insurance card is seen in a wallet, Oct.14, 2019.

Lucy Nicholson | Reuters

Check out the companies making headlines in midday trading.

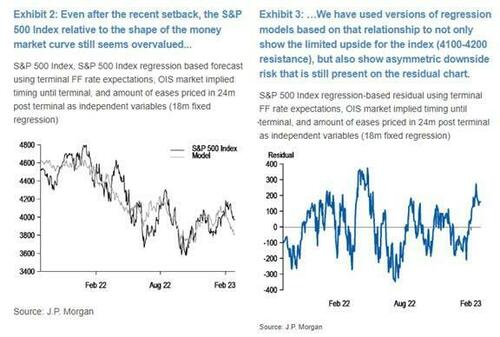

JPMorgan Chase — Shares fell slightly even after the bank reported stronger-than-expected results for the second quarter, as it benefited from higher interest rates and better-than-expected bond trading.

Wells Fargo — Wells Fargo shares rose slightly after the Wall Street firm topped second-quarter expectations. The bank also said it anticipates higher-than-expected net interest income this year.

UnitedHealth — The health-care giant popped nearly 7% after topping expectations for the second quarter on both the top and bottom lines. UnitedHealth also upped the lower end of its full-year guidance. Other health-care stocks rose in sympathy, with Cigna and Elevance Health last up more than 4% each.

Citigroup — Shares of the New York-based lender fell 2% even after the firm reported second-quarter earnings and revenue that topped expectations. Despite the beat, Citi’s revenue fell 1% from a year ago as the decline in markets and investment banking businesses weighed on its results.

JetBlue Airways, American Airlines — JetBlue Airways and American Airlines slid more than 2% each in midday trading. The two airlines are no longer selling seats on each other’s flights after Thursday, following a court ruling in May that they end their more than two-year partnership.

Microsoft — The software stock rose about 2% after UBS upgraded it to a buy rating, saying its artificial intelligence opportunity and recent underperformance make it too attractive to ignore.

AT&T — The telecommunications stock sank nearly 5% after JPMorgan downgraded it to neutral from overweight, citing competition concerns. The Wall Street firm also said AT&T’s exposure to cable may limit the upside for shares.

State Street — Shares slumped 9.5% after the financial giant’s second-quarter revenue of $3.11 billion missed analyst estimates of $3.14 billion, per Refinitiv. However, State Street beat on earnings, reporting earnings per share of $2.17, versus the $2.10 expected by analysts.

Blackrock — Shares of the asset manager lost 2% after reporting second-quarter results. Earnings topped Wall Street’s expectations, but net inflows came up short and showed a decline.

Alcoa — The aluminum stock fell 4.9% following a downgrade to neutral from overweight by JPMorgan. The firm said the stock could struggle as the price for the metal faces downward pressure.

Progressive — Progressive shares lost 1.5% after Wells Fargo downgraded the insurance company to equal weight from overweight, citing growth concerns.

Eli Lilly — The pharmaceutical stock rose 3% in midday trading. Eli Lilly said it plans to acquire privately held obesity drug maker Versanis for $1.9 billion.

— CNBC’s Yun Li, Alex Harring, Sarah Min and Michelle Fox contributed reporting.