The inventory market is fairly scary lately, isn’t it?

Anybody who’s bullish on shares… or thinks they’re low-cost and value shopping for, retains getting wrecked. It’s not fully their fault; the continuous interventions by “somebody” hold making it seem as if there are actual patrons within the markets.

Yesterday confirmed us that there aren’t.

The S&P 500 got here charging out of the gate yesterday… however gave up a lot of the positive factors round midday. If it weren’t for 2 OBVIOUS manipulations by “somebody” which I’ve highlighted within the chart beneath, the market would have closed DOWN on the day.

That is the issue with blatant manipulation: it really works within the short-term, however does nothing to repair the first downside with the markets… specifically that costs are usually not at ranges at which REAL patrons wish to purchase.

One technique to get round this problem is to concentrate on long-term charts.

By specializing in what shares are doing in weekly or month-to-month phrases, you may tune out a lot of the “noise” brought on by interventions that solely final just a few hours and even minutes.

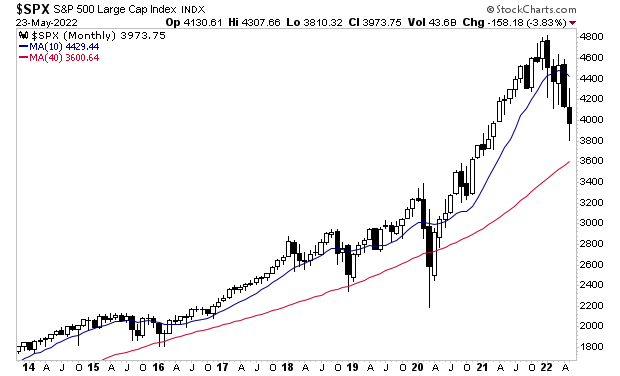

Here’s a month-to-month chart of the S&P 500. As you may see, the market has taken out its 10-month transferring common (blue line). Because the final eight years have proven, any time shares do that, they find yourself dropping to a minimum of the 40-month transferring common (purple line).

What’s REALLY scary about this chart is the truth that the final FOUR occasions this occurred, the Fed stopped the collapse by easing financial circumstances.

This time across the Fed CANNOT ease financial coverage.

Why?

As a result of financial easing unleashed the very factor what triggered the collapse within the first place: inflation. Extra easing will solely make the scenario worse!

Put merely, the Fed is NOT coming to the rescue this time. Shares might very effectively break beneath that purple line and wipe out years of positive factors.

The time to organize is NOW earlier than it hits.