Peach_iStock

The stock market, led by the Dow, is going parabolic as it inflates on helium forced into the financial system by the Fed. The bubble has become more manic and all-encompassing than the late 1990s dot.com/tech bubble, which was led by the Nasdaq. This time around the Dow is leading the pack and has become irrationally exuberant.

While this could become even more insane to the upside, the sentiment and level of speculative activity are back to levels historically indicative of a top. Wednesday’s (December 20th) sudden, sharp reversal in the stock market is likely a warning shot – tremors before a bigger earthquake. Retail trading accounted for 30% of the total trading volume on Friday, compared to the 30-day average of 10%. Volume in sub-$1 stocks is surging, reflecting an extreme degree of risk-taking. But it’s not just the penny stocks. The meme stocks like CVNA and SNAP are going parabolic.

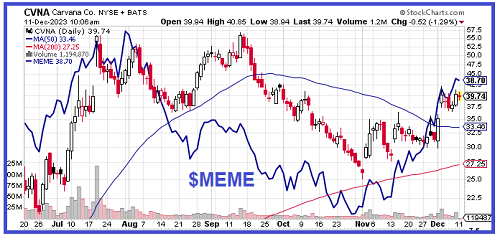

A long-time subscriber asked me how I explain the big move higher in CVNA because it’s pretty clear CVNA will eventually have to file for bankruptcy. I asked him to look at this chart to tell me:

The chart plots CVNA (candlesticks) vs the MEME stock ETF (MEME) (blue line). Note the strong correlation between MEME and CVNA. In fact, what does it say about CVNA that it has been underperforming MEME in the move higher that began in early November. Every retail idiot trading in this market is chasing the worst garbage stocks higher. Most of the stocks in MEME have a very high short interest. Most will be bankrupt within the next three years.

Long positioning by CTAs is at its most extreme level in at least eight years. Extreme long or short positioning by CTAs is a highly reliable contrarian indicator. The VIX is at its lowest level since mid-January 2020. Also, the weekly survey by the Association of American Individual Investors (high net worth, retail) shows that bullish sentiment jumped up to 51.3% through Wednesday, its highest level since July 19th. At 19.3%, the percentage of bears is at its lowest over that same period.

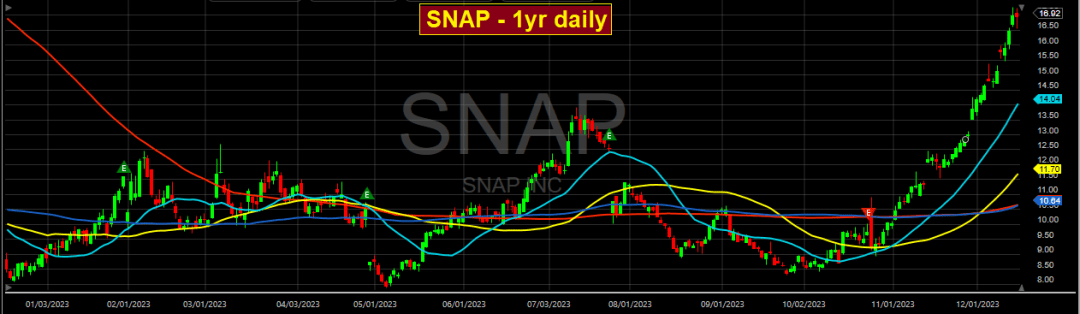

No one can say for certain when this madness will reverse. But we can say for certain that it will, and when it does, the ensuing sell-off will likely be brutal. Though I took a beating over the last three weeks in my put portfolio and closed out most of the positions. I continue to hold January CVNA $50 puts, AN January $125 and $130 puts, NVDA March $435 puts and TSLA April $220 puts. In addition, on Friday I started a position in IWM (Russell 2000 ETF) late December $195 puts. Earlier in the week I started buying late January SNAP $16.5 puts. Take a look at SNAP’s chart [next page] to understand why. Oh, I also hold January GDDY $100 puts.

C’mon, man. For its Q3, SNAP’s operations lost $380 million. Through 9 months, it’s incurred a $1.14 billion operating loss. The only reason this Company is still in business is that the capital markets have enabled it to raise over $4.8 billion via convertible bonds between 2019 and 2022. It did not issue any debt in 2023. But the only thing keeping SNAP from going out of business is the $3.4 billion in cash it had at the end of Q3 2023.

The stock gapped up on November 14th when it was reported that SNAP signed a deal with AMZN that enables AMZN to run ads on SNAP which lets SNAP users shop on AMZN and check out without exiting the SNAP app. The economic terms connected to the agreement were not disclosed, which means that the terms do not directly generate revenues from the agreement for SNAP. In terms of the financial benefit of this deal for SNAP, the only thing I could dig up after scouring articles and reports is that the deal might increase average user time on the SNAP app which might enable SNAP to charge higher advertising rates.

In my opinion, SNAP is worth no more than the value per share of the cash on its balance sheet, which will deplete over time. Currently, it has $2.42/share in cash. At some point, I plan to increase my capital commitment to SNAP puts beyond the January $15.50 puts I have now.

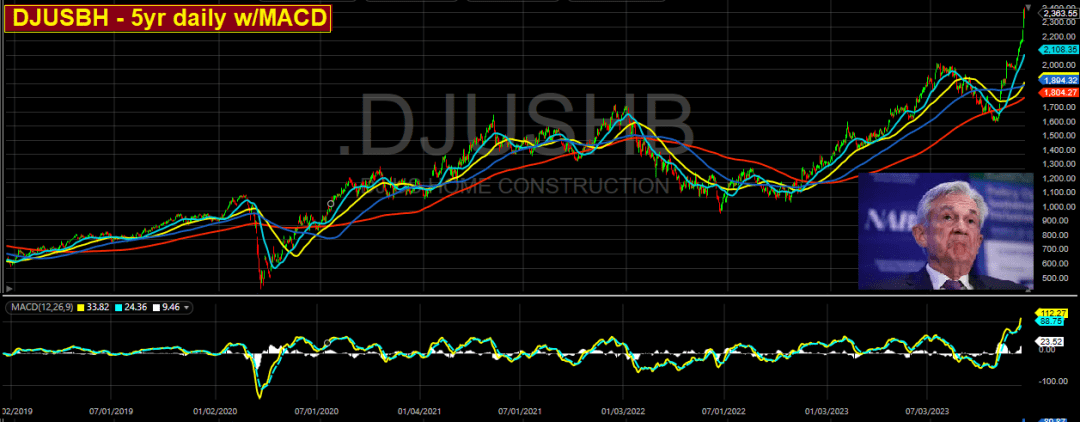

Housing market update – The homebuilder and home construction stocks have gone absolutely parabolic:

The Dow Jones Home Construction Index has soared 17% since the end of November. The MACD momentum indicator is by far at its most overbought reading in the history of the index (2000).

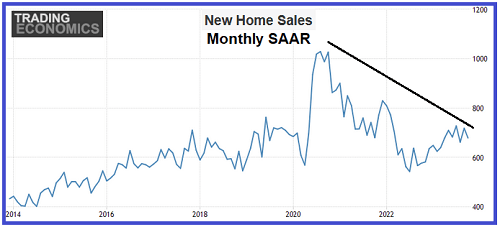

But while the homebuilders have been increasing deliveries via the use of heavy price discounts and other incentives, they are not reporting record levels of revenues and profitability. And the contract value of their order backlogs is plummeting. And here’s the 10-year picture of the monthly seasonal adjusted annualized rate for new home sales:

While new home sales bounced after declining for nearly two years, overall, the rate of new home sales has been in a steep downtrend since late 2020. In other words, the differential between the market cap of the homebuilders and their profitability may be at the widest in stock market history. The DJUSHB is 2.4x higher than it was at the peak of the early 2000s housing bubble while the SAAR peaked at over 700k back then compared to the current SAAR of 679k. I believe that reality will hit the stock market hard in 2024 accompanied by a swift sell-off in the homebuilder stocks.

Lennar (LEN – $149) reported its FY Q4 and full-year numbers on Thursday after the close. Despite “beating” revenue and EPS consensus, as well as the expected FY Q1 2024 forecast, the stock dropped 3.6% Friday. This is because it was apparent to the market that LEN sacrificed margins by cutting prices and offering fat incentives.

While Q4 revenues rose YoY 7.9%, operating income rose just 4.8%. Ordinarily, in a healthy operating environment, homebuilders would benefit from economies of scale and operating income would rise percentage-wise more than revenues. But the ASP declined 8.7%. This does not include incentives like rate buy-down loans and architectural upgrades.

LEN’s share price has soared 42% since the end of October. I would be an idiot if I didn’t admit that I wish I had bought calls 7 weeks ago. But the increase in market cap is not in any way remotely justified by fundamentals.

The value of LEN’s backlog, despite a 4.3% increase in new unit orders, plunged 24%. The ratio of LEN’s market cap to the value of the backlog is 6.4. A year ago, this ratio was 2.98. This illustrates the degree to which LEN’s market value has become completely unhinged from reality.

While the builders enjoyed a bounce in sales during 2023 thanks to rate buy-down gimmicks as well as other tweaks to mortgage terms that lower the cost for the first two years, with the “savings” added to the back-end cost of the mortgage, plus huge price, and upgrade incentives, I have no doubt that homebuilders face a tough 2024.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.